“Financial success is a soft skill. How you behave is more important than what you know.“ – Morgan Housel, author of The Psychology of Money

To set the tone for the start of the new decade, we asked our Personal Investments team to share their top investment insights. Herewith the second instalment, to complement the first 10 tips shared in the January edition of Corospondent.

Live below your means – Petronella Nkobe

Don’t spend more than you earn. As simple as it sounds, it’s easy to fall into the trap of relying on your credit cards to acquire the ‘finer things’ in life, maintain a desired lifestyle or to keep up appearances. Spending less doesn't mean you can't enjoy life, and trading immediate pleasures for the sake of long-term gains brings its own rewards. The rule of thumb is to save at least 10% of your income – if your monthly income is R10 000, your monthly savings should therefore be at least R1 000.

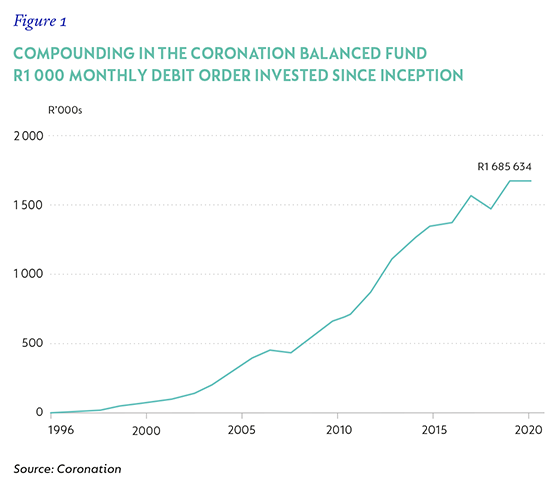

If you had invested R1 000 per month into the Coronation Balanced Plus Fund since its launch in April 1996, your investment would now be worth nearly R1.7 million, as shown in Figure 1. This is the outcome of an annualised return of 12.4% earned for 24.5 years. The earlier you start, the better, as the compounded growth over time is what makes living below your means so worthwhile. Give it a try; you will be surprised how hard your money and investments can work for you.

Set aside an emergency fund and keep separate investment accounts for different goals – Ndapwa Kwedhi

How resilient is your current investment plan to financial emergencies? Many investors struggle to realise their goals when they are derailed by unforeseen expenses. You can prepare for contingencies by maintaining an emergency fund and preserving your safety net savings in a conservative investment vehicle. The Coronation Strategic Income Fund is liquid and easily accessible on ‘rainy days’. How much to keep in your emergency fund will depend on your lifestyle and circumstances, but three to six months of your regular expense budget is a good starting point.

You can further enhance your investment outcomes by keeping separate accounts for your different financial goals. This creates a clearer sense of direction, as it enables you to track progress for each goal and makes it a little harder to access money earmarked for a specific purpose. Although the ultimate objective of investing remains to maximise returns within your unique set of constraints, maintaining separate goal-based investment accounts ensures that the respective portfolios are invested optimally— each driven by a distinct set of objectives that are bound by their respective time horizons, making it easier to optimise risk and return levels.

Build your balance sheet: invest automatically and regularly – Liezel Greeff

“Little by little, a little becomes a lot” – Tanzanian proverb

It’s so much easier to stay disciplined with saving when it happens automatically. Investing R500 per month might require some tweaks to your budget initially, but once you get it going you will soon forget all about it, as it leaves your bank account before you get the chance to spend it on something you might not need.

By investing a smaller monthly amount more regularly, you are investing when the market goes up as well as when the market goes down, thereby averaging out the price of each unit, something we call rand cost averaging.

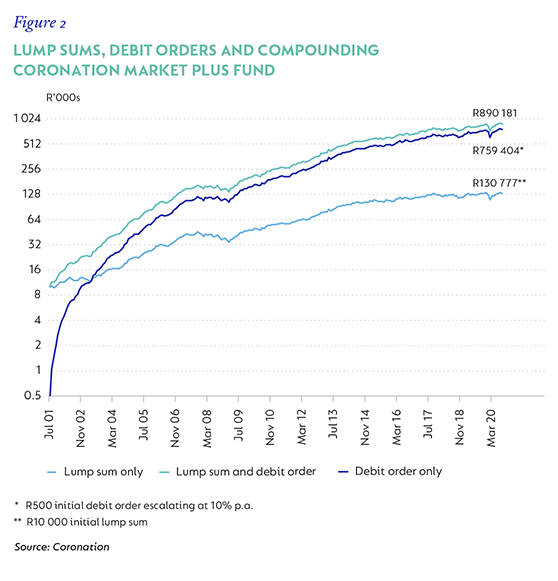

Monthly investments really start to make sense when you earn a return on your return made by the previous return – you get the point. Put in a fancier jacket, it’s called compound growth. It starts small and slowly, but once it picks up momentum, it’s quite a force. As Figure 2 shows, a picture is worth a thousand words. The moral of the story, you ask? What are you still waiting for?

Those annual tax-free contributions add up – Jasantha Mari

We all pay tax on our hard-earned money, and if we manage to save some of it, we again pay tax on the returns our savings produce. The only exceptions are retirement savings through, for example, retirement annuities (RAs) or tax-free investment accounts (TFIs). While RAs have attractive tax benefits, they come with limitations to how you can structure your investment portfolio.

TFIs have become increasingly popular since introduced by government five years ago to encourage saving without paying tax on income earned or on capital gains. Individuals can contribute up to R36 000 within a tax year without being penalised. Your lifetime contributions may not exceed R500 000 and that can be achieved in under 14 years. The added benefit of a TFI is that there are no investment restrictions as in the case of RAs.

In a recent study, using the actual returns produced by the Coronation Market Plus Fund since launch in 2001 and hypothetical tax-free contributions to get to the maximum R500 000 contribution as quickly as possible, we found that the TFI tax benefits increased the investment programme’s terminal value by 29% (from R2.1 million to R2.7 million).

So, why not start today by taking advantage of this opportunity? Find the right fund for you, start contributing and the benefits will continue to add up.

How much should I invest offshore? – Lerato Ried

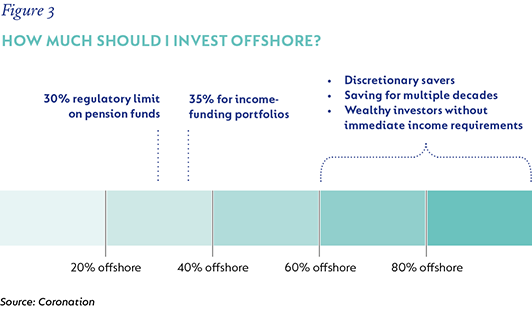

The short and maybe frustrating answer is that it depends. The appropriate allocation will differ for every person, because we all have different return expectations, risk parameters, spending profiles and time horizons. Although research has shown that all investors should aim to have a minimum of 25% of their investment portfolio offshore, your answer may be very different. The best way to optimise exposure is to consult with a credible financial adviser who will be able to do a comprehensive assessment.

However, there are general guidelines that you can follow:

- If the purpose of your investment portfolio is to draw an income from it, especially if the income rate is more than 5%, you should generally aim to have no more than 35% direct offshore exposure in your portfolio.

- Long-term investors who will not be using their investment to supplement their immediate income can invest up to 100% of their portfolio offshore, depending on their risk appetite and financial goals.

Do not move the goal posts too often – Frederick Greeff

Clear goal setting (your personal investment goalposts) is the first and arguably most important step in the investment planning process. If you do not know what you want to achieve with your hard-earned money, you won’t be able to choose the right investment strategy.

To use a simple analogy: if you plan to explore our beautiful continent on a 4x4 trip to Botswana, you need to match the ‘vehicle’ to the goal – a Toyota Corolla simply won’t do the job given the need. You’ll need a Fortuner with 4x4 capabilities, or better yet, a rugged Land Cruiser, otherwise you’ll just get stuck in the sand. The same is true for reaching your investment destination. The bottom line – choosing the right investment strategy upfront is key, and then sticking to it is just as critical, even when markets take a turn for the worse. If you move the goalposts halfway through the journey and change your investment strategy, you risk interrupting the powerful effect of compounding that is firmly embedded within your investment portfolio.

Think carefully about your personal circumstances and preferences when setting you goalposts. Commit to targeting that investment goal and then stick to the investment strategy that is tailored to help you reach it. Simple, but not easy. This will largely determine your investment outcome. Coronation has a range of flagship funds that is designed to reach most investor targets. To assist you in making the right investment choice, visit our fund centre and select the need that best suits your current circumstances.

Your retirement crib sheet – Christo Lineveldt

No function can fully solve the complex equation of retirement, but there are three key numbers to keep in mind when considering your retirement plan: 75, 5 and 15.

- 75%: how much of your final annual salary you will likely need to replace at retirement to maintain your lifestyle.

- 5%: the generally accepted maximum annual initial drawdown rate that a well-constructed retirement portfolio can sustainably accommodate over two or more decades.

- 15x: the multiple of your final annual salary required at retirement given the 75% replacement ratio and 5% maximum annual drawdown.

- 15%: the recommended minimum portion of your pre-tax income that should be set aside for retirement throughout your working life to make the above numbers achievable.

It goes without saying that the above is a simple guideline and that we recommend consulting a qualified financial adviser for a tailored retirement plan.

Successful investors make many mistakes along the way – Jared Williams

Not all heroes wear capes. Mine is a fiery Scot with a penchant for black zip-up cardigans, chewing gum and ‘the hairdryer treatment’. A serial winner who is widely regarded as the most successful football manager ever – Sir Alex Ferguson. Is it surprising, then, that Fergie only won just under 60% of his 1 500 games during an illustrious 27-year spell managing Manchester United? For every three matches where he got his tactics right, there were two games where one of the greatest managers of sporting talent did not succeed.

“Losing is a powerful management tool so long as it does not become a habit.” – Alex Ferguson

Like a football manager erring when selecting the 11 players to start a match, investors will inevitably make mistakes in their investment decisions. Perhaps you picked the wrong manager or, borrowing a football term, scored an own goal by attempting to time the market and it moved against you. A disciplined investor endeavours not to repeat their mistakes, but also knows they are unavoidable.

Ferguson averaged just one Manager of the Month award per season. Over short periods, his teams were not always the best, but over the course of the season they almost inevitably won the title. The key to his team’s success is accredited, in his words, to the “consistent application of discipline”.

Successful investors make mistakes often but with a disciplined approach to investing they learn and correct. Making just slightly more good decisions than bad ones compounds over time and can produce meaningful long-term outperformance.

Don’t chase the trend – Suzanne de Wet

At our core, humans are social beings. In times of stress and uncertainty (much like what we face today) people are afraid and it is human instinct to rely on our group to help us when we’re afraid. We make decisions that most of our friends, colleagues or family make because we feel safer together. This is known as ‘herd behaviour’ and can be defined as doing what others do, instead of using your own information to make decisions. In most aspects of life this is a useful strategy and has helped humans survive many ordeals. Unfortunately, this does not hold true for all aspects of life – especially not for your finances or investments.

There are at least two reasons why this behaviour is not recommended for decision-making when investing. First, we all have different circumstances. To make a thought-through financial decision, you must consider your own personal needs and not that of the herd. What are your current assets and liabilities? What is your risk profile? What is the goal of your investment? These are the questions you should build your strategy around.

Secondly, following the herd means you are likely to invest where the money already is, rather than where the best opportunities are. Investors often use past performance as their frame of reference (or, put differently, ‘what works right now’). This is how asset bubbles are created and only investing in what is already popular creates a high probability of capital loss.

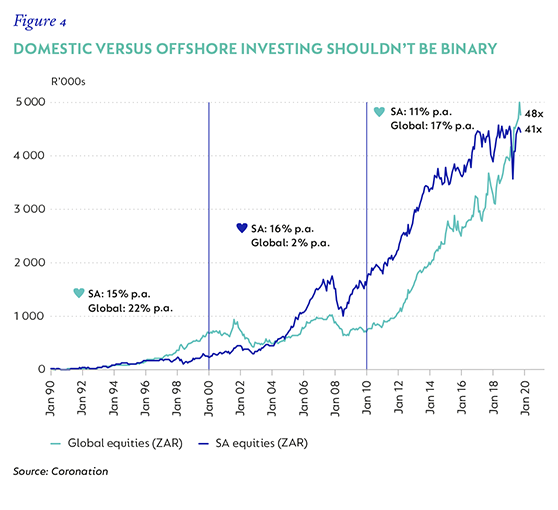

An example of herd behaviour is the desire of many local investors to move all their money offshore after the rand has depreciated in value. In 2001, after the rand depreciated by more than 60% in six months, South African investors flocked to offshore investments only to receive close to 0% return for the following 10 years. Over the same period, local equities had one of the best 10-year periods in history.

You don’t have to ignore all information out there, but try to develop an awareness of the factors you use when making your investment decisions. Avoid blindly following a trend ‘just because everyone else is doing it’. Try and frame your decisions correctly and don’t get carried away with good (or bad) past results; it’s only the future events that will count.

The key to successful investing can be summed up in just two words – asset allocation – Fred Grunewald

If there’s one thing that history teaches us, it’s that no one knows what the future may bring. The idea of ‘not putting all of your eggs in one basket’ is the essence of asset allocation, which involves identifying how your investment portfolio should be distributed between the various asset classes such as equities, bonds, commodities and cash. The objective of asset allocation is to optimise the mix of your investments into different asset classes to maximise the return of the investment portfolio while minimising the potential risk, based on your time horizon, risk tolerance and long-term investment goals.

History suggests that different asset classes perform better or worse depending on economic conditions, market forces, technological change and political developments. The goal of an asset allocation strategy is to ensure that you own a robust portfolio that can withstand many different outcomes. It makes sense for many investors to outsource these decisions by investing in an appropriately mandated multi-asset fund with the ability to hold a wide variety of assets. The long track record of the Coronation Optimum Growth Fund is testament to the success of this approach.

South Africa - Personal

South Africa - Personal