Personal finance

Tax-free investing

- Tax-free investing should be on every investor's radar

- We’ve increased our range of tax-free fund options

- Tax free means just that – no income, dividends or capital gains tax

- Boost your investment by adopting a ‘first in, last out’ approach

A Tax-Free Investment (TFI) is one of the best ways for South Africans who have extra money to save outside of their retirement fund to build up a nest egg for the future. It’s why we encourage investors to take full advantage of their annual tax-free allowance every year.

And, from November, the total number of funds available within Coronation’s TFI offering will increase to 22.

You’ll now have tax-free access to not just the best value we are seeing in the SA equity market through the Coronation Top 20 and Equity funds, but also to attractive offshore opportunities via the rand-denominated Global Optimum Growth Feeder and Global Emerging Markets Flexible funds.

WHY MAKING THE MOST OF YOUR TAX-FREE ALLOWANCE IS MORE IMPORTANT THAN EVER

Something that living through a global health and economic crisis has taught us is not to take anything for granted. Many South Africans have suffered deep losses during this tough time and are concerned about the uncertainty that lies ahead. But one thing that can’t be taken away from us is how we respond in times of crisis.

Focusing on doing the best we can with what we have, and to plan ahead as best we can to secure our futures, is something we can all do to regain control of our lives. And investing tax free is an opportunity to do just that.

NOW IS THE TIME TO TAKE ADVANTAGE OF TAX-FREE INVESTING

The current tax year ends on 28 February 2022. So, you still have time to ensure that you take full advantage this year of the valuable perk offered to us by government to encourage us to save – an annual allowance of R36 000 that can be invested tax free.

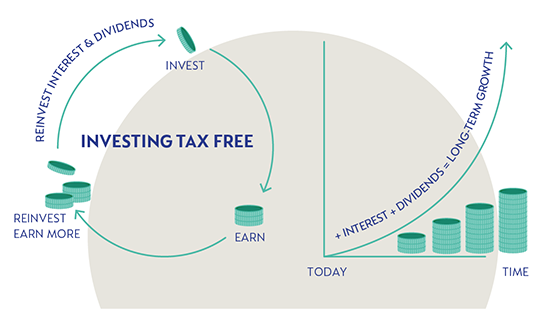

In your tax-free investment, you pay no income, dividend or capital gains tax on your investment gains, which boosts your realised investment return.

THINK ‘FIRST IN, LAST OUT’ WHEN IT COMES TO INVESTING TAX FREE

Start investing tax free early and stay the course to experience the full benefit.

We encourage tax-free investors to build up towards their lifetime limit as early as possible in their investment journey and then to keep that money invested for as long as possible as they build up to a healthy nest egg.

FIRST IN

If you have extra money outside of your retirement fund to invest for yourself or your children, first consider taking advantage of your annual tax-free allowance. By starting to invest tax free early, you give yourself the best opportunity to begin reaping the benefits of compound interest early on your investment journey.

Remember that when you invest tax free, you can withdraw your cash whenever you like, but you can’t put it back. All amounts invested count towards your annual (R36 000) and lifetime (R500 000) tax-free limits regardless of any withdrawals you make. In other words, you can’t ‘replace’ the money you withdraw with a new investment. So, we encourage you to start building up to that lifetime limit as early as possible to maximise the time it has to benefit from compound interest.

LAST OUT

A TFI is money that you ideally want to leave invested for as long as possible. The longer you leave your money invested tax free, the harder compounding will work for you. So, for example, if you are saving for short-term goals such as a holiday or a deposit on a car, do so separately and let your TFI simmer.

Investing over multiple decades, and leaving your money invested, also enable it to withstand the effects of short-term market volatility that is typical of the financial markets. Over the long term, the bumps smooth out and the overall trend is for your money to grow.

NOT YET A CORONATION TAX-FREE INVESTOR?

You can start investing with us via a monthly debit order from as little as R250, or you can make lump-sum investments from R5 000 to R36 000. If you have an existing tax-free savings account with a bank, you can switch it to a TFI at no cost.

To select the funds that suit your needs, speak to your financial adviser if you have one, or visit www.coronation.com and follow our simple online investment process. +

South Africa - Personal

South Africa - Personal