Taking stock of your portfolio - January 2017

We know that you invest with us to contribute to a more financially secure future for you and your family. It is easier to get there if you have clearly defined objectives. If you are uncertain whether your goals and financial plan make sense, we suggest that you consult an independent financial adviser. Meanwhile, we provide some practical suggestions that we think are relevant in the current environment.

CONTINUE TO MAKE REGULAR CONTRIBUTIONS

Woody Allen once said that 80% of success is showing up. The investment equivalent of this maxim is to save on autopilot while basically forgetting that you have the money until you get to the end of your investment horizon (e.g. retirement). It is relatively easy to follow this approach:

- Invest via monthly debit order to automate the administration.

- Contribute to an investment vehicle that offers tax breaks, such as a retirement annuity (up to R350 000 per year) or tax-free investment (up to R30 000 per year), to minimise or eliminate tax leakage.

- Select a growth-orientated multi-asset fund such as Balanced Plus (for savings in a retirement vehicle) or Market Plus (for discretionary and tax-free investments) as your investment engine. These funds aim to optimise growth over long periods of time, and by investing in them you grant us a wide enough mandate to alter portfolio allocations over time as market conditions change.

COPING IN A LOWER-RETURN ENVIRONMENT

We report elsewhere in this Corospondent that the most important growth asset classes underperformed inflation in 2016. This may make you wonder whether remaining committed to your investment strategy is worth it. However, it may be easier to do so if you keep the following in mind:

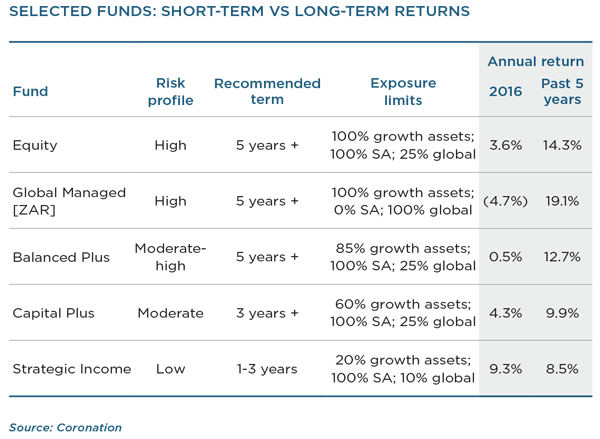

- While the immediacy of recent returns makes for an easy mental shortcut, remember that it is returns over the lifetime of your investment that matter. It is more useful to lengthen your time horizon in tough times than to shorten it. Consider the table overleaf, showing returns for selected funds with different levels of exposure to growth assets. Based solely on 2016 performances, you may be tempted to conclude that it would be better to reduce risk. However, returns over the past five years more accurately reflect the expected outcomes for the different risk profiles.

- Weaker historical returns increase the likelihood of stronger future returns. The local equity market moved sideways in real terms over the past four years, while the earnings of the underlying companies have continued to grow. This means that valuation levels are more attractive today than they were four or five years ago, making it realistic to expect better returns over the next five to ten years.

We remain of the view that as long as you own a fund with an objective, time horizon and risk budget appropriate to your needs, it makes sense to stay the course in your existing investment.

INVESTORS DRAWING AN INCOME SHOULD CONSIDER MODERATING INCREASES IN 2017

More conservative multi-asset funds such as Capital Plus and Balanced Defensive returned 6% to 7% per annum over the past three years, compared to an expected outcome of somewhere in the 9% to 10% range. Lower returns present investors requiring a growing income from their portfolios with tough choices.

The key challenge to get right is to balance immediate spending requirements with future quality of life. Drawdown strategies are more sustainable when you are able to defer some of your spending to periods following better investment returns. If you are still in the first half of retirement, the prudent response in the current environment would be a moderation in the income withdrawal rate from your portfolio, potentially deferring this year’s increase in your drawdown rate. With inflation for 2017 expected to ease somewhat, investors may be in a better position to achieve this outcome. You can read more about retirement income trade-offs in the Corolab Investment Guide: The Income & Growth Challenge available in the Publications section of our website.

TAXES ARE LIKELY TO BE INCREASED FURTHER IN 2017

National Treasury is on record as again planning to increase taxes in the 2017/2018 tax year. Given political and competitive constraints, it is unlikely that the additional tax can be raised through increases in value-added tax or the company tax rate. While new and/or higher indirect taxes, closing loopholes and tightening the tax net may help, it is likely that the personal income tax system will bear a significant share of the load, as was the case in the preceding two budgets.

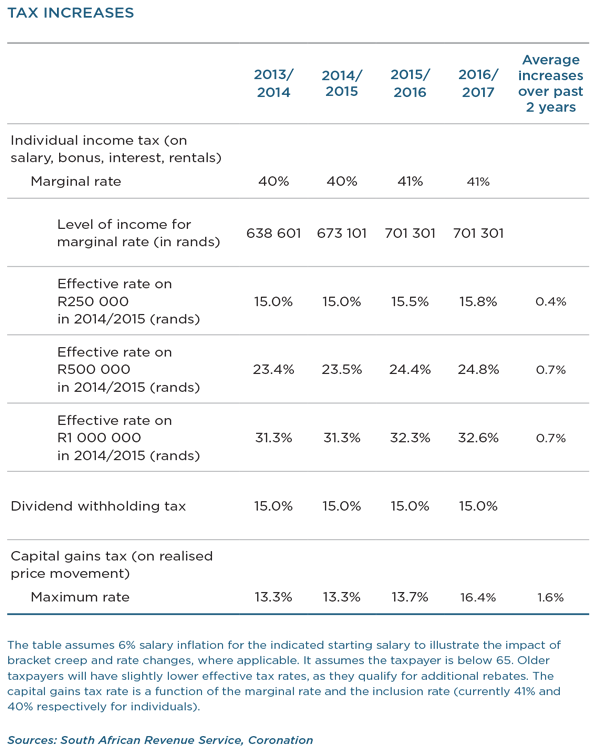

The table below shows how the effective rate of tax has changed over the last three years for different levels of taxable income. We can expect a similar increase across the income spectrum in the next tax year. It is also likely that very high income earners (taxable income above R1 million) may be impacted by a higher marginal rate. Judge Dennis Davis, the chair of a tax reform committee, has suggested that this rate may be 45%.

TAX ALLOWANCES FOR INVESTORS

As a reminder, investors qualify for the following investment-related tax breaks:

- Individuals pay a lower tax rate on capital gains (16.4%) and dividend income (15%) compared to interest, rental and salary income (41%). This means that investors not using tax-advantaged vehicles are, all other things being equal, better off holding equities in their portfolios than other assets.

- Tax-advantaged contribution to a tax-free investment of up to R30 000 per year. This is arguably the best tax break available to individual investors at the moment. While you use after-tax money to invest in a tax-free investment, all income and growth earned from the underlying funds are tax free, and all proceeds at the time of withdrawal will also be untaxed. Just do not over-contribute – contributions in excess of the annual R30 000 limit are taxed very punitively.

- Tax-advantaged contribution to retirement funds. You can contribute the lower of 27.5% of taxable income (excluding retirement benefits) or R350 000 annually to retirement funds, and deduct this amount from your taxable income in the year of contribution. Your capital and reinvested income will grow tax free as long as it remains in the retirement fund, and you will only pay tax on the way out when you start to withdraw from your retirement fund (at the then-prevailing tax rate).

- General interest exemption of R23 800 for investors under 65, and R34 500 for investors over 65. At the current yield of around 8% on funds such as Coronation Strategic Income and Coronation Money Market, this means that you can invest nearly R300 000 if you are under 65 and R430 000 if you are over 65 before starting to pay tax on interest earned.

- Annual capital gains exclusion of the first R40 000 gain. This exclusion makes it more efficient to stagger the realisation of capital gains over different tax years.

LAST CHANCE TO REGULARISE OFFSHORE HOLDINGS

All local residents are subject to exchange controls and paying local taxes on their worldwide income and assets. Offshore assets that are held without the necessary SA Revenue Service (SARS) and SA Reserve Bank approvals may subject the holder to criminal prosecution, while incurring additional foreign exchange and tax penalties if the authorities obtain information about these assets without the taxpayer’s assistance. Increased information sharing between international tax authorities, expected to be put in force later this year, makes this outcome more likely.

SARS announced a special voluntary disclosure programme, effective until 30 June 2017, which enables taxpayers to regularise their affairs by paying an effective tax rate of up to 20.5% of the value of the offshore assets irregularly held, in exchange for a waiving of prosecution. If you are in this position, regardless of the source of the offshore assets, you should obtain tax advice from a specialist to assist you with deciding on the right course of action.

By making sure that your portfolio continues to meet your investment needs, taking advantage of the tax breaks on offer and – above all – staying the course, you can ensure that you remain well on your way to achieve the financial future you are working towards.

We wish you all the best for 2017!

South Africa - Personal

South Africa - Personal