Quarterly Publication - October 2017

Announcing fee cuts - October 2017

As your independent fund manager, we know that our primary job is to add value to the investments that you have entrusted to us. We do this through disciplined application of our long-term investment philosophy, by hiring the best investment professionals and by ensuring that we have a simple and needs-orientated fund range at a fee proportionate to the outcomes you receive. If we cannot produce top after-fees performance over meaningful periods, we will not remain worthy of your trust.

We also know that markets evolve and that client preferences change over time. As a result, we continuously review our fund positioning and the management fees we charge to ensure they remain competitive, fair and appropriate.

We conducted a major fee review in 2015 that affected most of our funds (see the July 2015 edition of Corospondent). The key aim then was to simplify and standardise our fee approach. We introduced pioneering performance-related fee structures for our equity-biased funds and fixed fees for all lower and moderate risk multi-asset funds.

These changes have already resulted in meaningful fee reductions over the past two years.

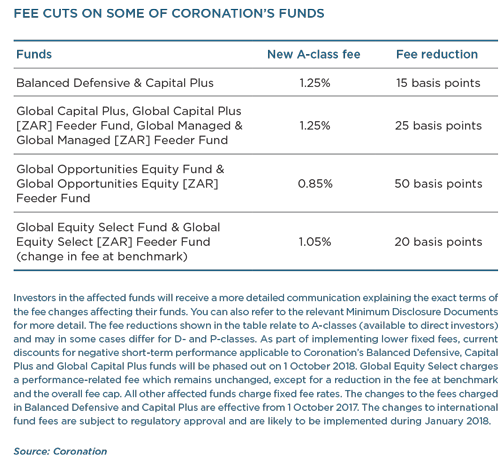

Following the reductions in 2015, we now announce further fee cuts to our income-and-growth and international funds, as indicated in the table opposite.

All our flagship multi-asset funds will charge the same fixed fee of 1.25% for direct retail investors. This is the fee currently charged by our largest fund, Coronation Balanced Plus.

Charging one fee rate regardless of risk budget or geographical focus makes it easier for investors to focus on optimising their long-term investment outcomes by remaining in the fund most appropriate to their needs.

Coronation has made significant progress in attracting allocations from large overseas investors, including leading international retirement funds. As our international business continues to grow, we can share some of the scale benefits with all clients through lower fund management and administration charges in our global funds.

We have also made changes to the way we disclose fees. From this month, we show both one- and three-year total expense ratios on our fact sheets, and provide more information on the component costs that make up fund expenses. Existing investors can also now obtain an effective annual cost disclosure for their specific fund selection via Coronation Online Services.

We have shown over the years, time and time again, that we value our investment track record far more than our profitability or our market share. Every decision we make is driven by the sincere desire to deliver the best possible investment outcome for our clients. The latest fee reductions should confirm this commitment.

South Africa - Personal

South Africa - Personal