Quarterly Publication - April 2017

International portfolio update - April 2017

The fund advanced 7.3% against the benchmark return of 6.9%. This brings its rolling 12-month performance to 17.2% against the 15.0% returned by the MSCI All Country World Index.

The first quarter of 2017 was another good one for global asset returns, specifically equities. Emerging markets were particularly strong, supported by a declining US dollar. Developed markets also delivered healthy returns. Equity markets in the US continued to benefit from the Trump reflation trade early on in the quarter. However, president Trump’s failure to enact the Obamacare replacement bill saw markets ease during March on concerns about his ability to move forward on infrastructure and tax reform. Economists are, however, raising their growth forecasts for Western Europe and Asia, and with a probable return to growth of around 3% in the US, markets had a lot to be optimistic about.

The Pacific ex-Japan was the best performing region by a large margin, rising 11.8% (in US dollar terms). The weakest return came from North America, which rose 6.0%. Japan and Europe returned 7.0% and 7.6% respectively (both in US dollar terms). Emerging markets (up 11.5%) strongly outperformed developed markets (up 6.4%) in US dollar terms. The regional positioning had a small negative impact on the fund’s performance.

Among the global sectors, information technology (+9.3%), healthcare (+7.8%) and consumer staples (+5.9%) generated the best returns. The worst performing sectors were energy (-5.6%), telecoms (0.2%) and utilities (4.4%). On a look-through basis, the fund’s sector positioning had a positive impact on performance, principally its overweight position in information technology and underweight positions in energy, telecommunications and financials. Low exposure to healthcare had a small negative impact.

Egerton Capital returned 10.0% over the quarter and, given its weighting in the fund, made the largest contribution to performance over the period. Egerton’s performance benefited from its holdings in Tencent (+17.4%), Charter Communications (+13.7%), Airbus Group SE (+13.5%), Facebook (+23.5%) and S&P Global (+22.0%). The underlying manager also saw excellent returns from many of its holdings, with only a handful of detractors over the quarter.

Despite underperforming its own benchmark during the quarter, Coronation Global Emerging Markets made a strong contribution to the fund’s performance. Positions in Naspers (+14.9%), JD.com (+22.3%) and Heineken (12.0%) were among the key contributors, while Magnit (-13.5%) and Tata Motors (-1.2%) detracted slightly from performance.

Conatus Capital Management LP returned 8.3% for the quarter and therefore also generated positive alpha for the fund over the period. Its top performing holdings include Adidas (+18.7%), PTC Inc (+13.6%), Sony Corporation (+15.3%) and Activision Blizzard Inc. (+38.9%). Many of the manager’s middleweight stocks also performed quite well.

Positive contributions also came from Maverick Long Only and Viking Global. Both underlying managers comfortably outperformed the fund’s benchmark. Maverick benefited from its exposure to the IT sector, but its position in Sabre Corporation disappointed with a decline of 14.5% over the quarter. Viking, in turn, benefited from positions in Adidas, Facebook, JD.com and Netflix.

Detractors to performance over the period include Eminence, which marginally underperformed the index. The manager’s top positions − Autodesk (+16.8%) and Lennar Corp (+19.3%) − delivered strong returns over the quarter, but a number of its smaller positions were a drag on performance. These include Autonation (-13.1%) and Micro Strategy (-4.9%). Lansdowne Developed Markets also detracted somewhat from performance in this short period as its top positions moved in line with the market, thereby allowing the few stocks that did decline to have a far greater impact on overall performance.

The medium-term outlook points towards a modest upturn in global economic activity, led by the US and supported by continued momentum from China and India. Fears of a self-feeding disinflationary environment have also greatly receded. This should be supportive of base metals, which after the recent upswing in commodity prices, may add to input price pressure.

However, there are a number of uncertainties that could vex markets in the short term, such as Mr Trump’s strategy on taxation and global trade as well as the imminent Brexit negotiations. US equities are fully priced and compared to long-term averages could even be regarded as expensive, whereas Europe and emerging markets offer some value. Many fundamental demographic and social changes are currently unfolding and the ability to apply a calm perspective, coupled with good stock picking, should generate strong alpha.

The fund returned 10.2% for the quarter, handsomely outperforming its benchmark return of 6.9%. As we have often argued in the past, this short-term performance is purely incidental, given the vagaries of financial markets over shorter periods of time. Our 12-month lagging return of 23% has been materially above the index return of 15.0%. However, the most pleasing aspect is that, on a gross basis, we have now moved into positive alpha territory since the inception of the strategy.

Given the challenging start shortly after launch, we worked hard at overcoming this deficit, and are pleased to report that this milestone has been achieved. Incidentally, our developed market carve-out has outperformed its benchmark by more than 3% per annum since inception (gross), again confirming that our philosophy and process are generating the required results.

The highlight of our portfolio returns over the last quarter was SoftBank’s offer to acquire 100% of Fortress Investment Group (at the time a top five holding within the fund). The offer price represented a 60% premium to the undisturbed price, and while we think it still undervalues the stock by between 20% and 30%, we recognised that the majority of the equity is held by management, who were supportive of the transaction and intended to stay on as part of the larger group. As such, even though we were a material minority shareholder, we could not influence the transaction outcome, and hence liquidated the position to invest the proceeds in other promising opportunities. Fortress contributed just over 2% alpha over the quarter, and just less than 2.5% over the last year. Since inception of the strategy, Fortress’s contribution was a more modest 0.3%. We continue to believe that the alternative asset management sector offers interesting investment opportunities, and remain committed investors in stocks like Blackstone, Apollo, KKR & Co and Carlyle.

Other notable contributors to performance over the last year include Apollo, Estácio/Kroton (featured in previous commentaries), Amazon and Charter Communications. We had two material detractors in Limited Brands (discussed in more detail below) and TripAdvisor. In the case of TripAdvisor, we were again reminded about the importance of management and their ability to execute strategy that ultimately will be the largest determinant of success.

At the time of investing in TripAdvisor, we also invested in Priceline.com, the online travel agency that owns powerful platforms like Booking.com. While TripAdvisor and Priceline.com operate in the same sector, and therefore benefit from the same strong secular drivers, Priceline.com’s focus on driving simplicity and customer value has allowed them to significantly outperform TripAdvisor over the last few quarters, thereby creating exceptional value for shareholders. TripAdvisor, on the other hand, has been trying to migrate its business model to include other services and changed value propositions for its customers, in the process losing focus and making some operational mistakes. We are watching them carefully to see if they can ultimately monetise the strong brand and content that they are known for.

As equity markets continued to scale new heights, we have become more concerned about valuation levels. It is clear that markets have been giving Mr Trump the benefit of the doubt regarding his ability to reflate the economy and kick-start growth in the US, and ultimately across other regions of the world. We take a more sanguine approach in that we do not want to be paying for promises, especially coming from a volatile and inexperienced US administration. As such, we have bought some put options in the fund as protection (to a very limited extent) against exogenous shocks. These options, while cheap relative to history, still cost around 5% to 6% per annum for ‘at the money’ protection.

We also continued to look for value in the more defensively positioned sectors such as consumer staples. The world remains an uncertain place, and while we embrace taking risk when we believe the odds are tilted in our favour, we have become a little more circumspect in this regard.

INVESTMENT CASE FOR LIMITED BRANDS

Limited Brands is the owner of powerful brands like Victoria’s Secret and Bath & Body Works. When we initially bought the stock, the investment thesis focused on a continued opportunity for growth in the US for Bath & Body Works and, what we regarded as an outsized opportunity for Victoria’s Secret in China. Since then, the competitive landscape (for Victoria’s Secret) has intensified in the US, and coupled with continued pressure on footfall in conventional retail malls, investors have essentially given up on the company in terms of its ability to compete in its home market.

While short-term profits have been rebased downwards, we continued to add to our position, such that Limited Brands is now a top five position in the fund. We regard the brands as very powerful and relevant for future consumers, and still believe in the longer-term opportunity in China.

In the meantime, we are comfortable paying a price earnings multiple of 14 to 15 for the reduced profit base with continued strong cash generation. We expect our patience to be handsomely rewarded at some point in the future.

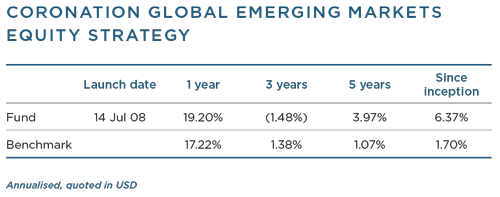

The strategy returned 10.2% for the quarter, which was 1.2% behind the index’s return of 11.4%. The biggest positive contributors over the period were JD.com (+22.2%, 0.45% contribution), Yes Bank (+39.6%, 0.37% contribution) and Naspers (+17.2%, 0.3% contribution). Three stocks detracted by 0.50% or more: Magnit (which declined by 13% and detracted by 0.9%), Kroton (which appreciated by 2%, but as this was well below the index return, itPao de resulted in a -0.5% attribution) and not owning Samsung Electronics (which detracted by 0.5%). The strategy is now approaching its nine-year track record and over this period has outperformed the market by 4.6% per annum. Over the past seven- and five-year periods, the fund has outperformed the market by 3.2% per annum and 2.9% per annum respectively.

In terms of portfolio activity over the quarter, we added one new position (a 1% holding in Norilsk Nickel) and sold out of five smaller positions (all less than 1%). We sold out of Richemont, Arcos Dorados and NetEase on the basis that all three reached our estimate of fair value for the respective stocks, with both Arcos Dorados and NetEase having appreciated by more than 100% over the past year. Sohu.com was sold as a result of our increasing concern about the long-term prospects for the video business, where they compete against three formidable players (Alibaba, Baidu and Tencent). Lastly, while still undervalued in our view, we sold out of Pão de Açúcar as a result of a reduced margin of safety due to a reduction in our fair value, given slower long-term top-line growth and lower long-term normal margins. Other selling activity of note include our halving of the fund’s position in Brilliance China (from 3% to 1.5% of fund) as the share moved closer to our fair value, having appreciated by 64% over the past year.

MMC Norilsk Nickel, the strategy’s new holding, is the number one nickel producer in the world (35% of revenue), the number one palladium producer in the world (palladium/platinum make up just over 30% of revenue) and a top ten global copper producer (25% of revenue). In our view, Norilsk’s ore body in Siberia is one of the best geological assets in the world. Norilsk’s nickel grades are, for example, 40% higher than the industry average, its copper grades 25% higher, and its palladium/platinum grades above the SA platinum miners’ average. This means that the revenue per ounce that Norilsk generates is far higher than most peers. As a result, margins are industry leading (EBITDA margins have averaged 50% over the past 10 years) as is the company’s free cash flow generation (Norilsk have converted 100% of earnings into free cash flow over the past 10 years). Norilsk trades on 10 times this year’s earnings with a 9% dividend yield. In addition, the prices of all three of its core commodities (nickel, palladium and copper) are currently trading below normal (marginal cost of production) levels and earnings are therefore below normal in our view. We have valued Norilsk on a low-multiple/high-discount rate to take into account the risks (a cyclical asset, based in Russia). This valuation still gives substantial upside, making the share attractive on a risk-adjusted expected return basis in our view.

In terms of other buying activity during the quarter, we added to the strategy’s Naspers position (the largest position, now 7.7% of strategy). Naspers’s core asset is its 33% stake in Tencent (the leading gaming/social network internet company in China) and today Naspers trades at a 15% discount to the market value of this Tencent stake. In addition, Naspers owns considerable other assets.

The two most notable assets include its online classified businesses in numerous emerging markets and its pay TV assets in SA and 40 other African countries. In our view, Tencent is a great asset that we would happily own. Naspers, however, effectively enables us to buy Tencent at a discount to the latter’s current market value, plus we get assets such as the online classified ads and pay TV for free. In addition, we have high regard for Naspers’s management team and believe that over time they will create value in the assets excluding Tencent. The upside to our fair value for Naspers is around 70%, making it extremely attractive in our view. At the end of the quarter, the fund had 5.5% combined exposure to the Indian financial services sector spread across the two private sector banks, Axis Bank and Yes Bank, as well as the country’s leading mortgage provider, the Housing Development Finance Corporation (HDFC). We have written before about why we like the private sector financials – in short, they are taking market share from their public sector counterparts in a market that is growing strongly due to low financial services penetration. We had been reducing the fund’s exposure to each of the names during the course of 2016 as their share prices appreciated and their associated margin of safety (to our fair value) declined. In November 2016, the Indian government announced an immediate end to the acceptance of all existing Rs500 and Rs1 000 notes as legal tender. The outstanding notes had to be deposited by year-end or expire worthless. This process was aimed at catching tax evaders and bringing more of the economy into the formal market, partly in preparation for a national sales tax planned for introduction in April 2017, but also because so much money had left the banking system after gold import restrictions were introduced as a foreign currency saving measure during the mini-crisis of 2013. Since these notes represented approximately 98% of monetary value outstanding, and there was no transition period, the disruption to the economy was immense.

The effect was compounded by insufficient availability of the new replacement notes, and with India being a predominantly cash economy there was a big crunch on consumer spending in the final quarter of last year. The combined effect of this hit sentiment toward the banking sector and most of the listed bank shares fell. We saw this as a buying opportunity − given that the long-term impact on the banking sector (and hence the long-term fair values of the individual banks) is limited − and increased the strategy’s positions accordingly.

Our view has largely been borne out by subsequent developments this year. In our recent interactions with the management teams of all three businesses it has become apparent that their franchises have actually been enhanced by the demonetisation events, despite the short-term pressure on the economy and hence lending demand. In the case of Axis and Yes Bank, the investment in building out retail branch infrastructure (and their ATM networks) in recent years has paid dividends sooner than would otherwise have been the case. Both saw a significant inflow of deposits, which is a lower cost source of funding, allowing them to increase their current and saving accounts ratio (as a percentage of total liabilities) at a faster rate than they have been able to historically. This is positive for long-term net interest margins and if maintained, should result in strong profit growth once lending volumes normalise.

The private sector banks are also better placed to respond to the pick-up in lending demand as their lending books have been less affected by the slowdown of the fourth quarter of 2016. For HDFC, the inability of all industry lenders to accept cash for mortgage payments has hurt the competition only because HDFC has not historically accepted cash.

Other developments in the housing finance industry underpin HDFC’s long-term prospects − in particular, the expansion of tax incentives for low-income housing, the easing of regulations related to raising of funding as well as better and more uniform regulation of housing developers themselves.

The weighted average upside to the portfolio at the end of March was just above 50%, which is in line with the long-term average. We continue to come across a number of potential new buys and the bigger challenge is deciding which positions to reduce or sell to make room for these potential new holdings. During the first quarter of 2017, we went on two research trips to Brazil as well as trips to India and Hong Kong. In the coming months members of the team will be going to China, Russia, Indonesia and Singapore.

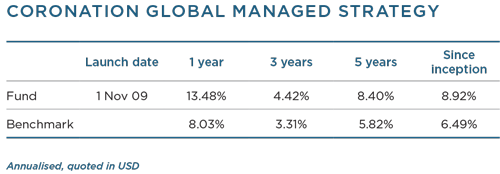

The strategy returned 6.6% over the three-month period, handsomely outperforming its benchmark return of 4.8%. Our 12-month lagging return of 13.5% has been materially above the benchmark return of 8.0%. In fact, we are now ahead of the benchmark over all meaningful periods and the strategy's annualised outperformance since inception stands at a pleasing 2.15% per annum. This number puts the fund comfortably in the top quintile of global funds with a similar mandate.

In the bond and equity markets, returns appear to have largely followed a pattern commensurate with asset risk. Therefore, the lower the credit rating, the better the return. This was illustrated by the fact that despite the US Federal Reserve (Fed) hiking interest rates in March, emerging market debt (in local currency) performed very strongly, producing a total return of 6.4%.

Additionally, returns were further boosted by the strength in emerging market currencies, with the Mexican peso, Russian rouble and Korean won rising between 8% and 10% against the US dollar over the quarter. Interestingly, despite a more hawkish Fed, US Treasury yields moved lower over the quarter, albeit only marginally. In the currency market, the clear trend during the quarter was that investors’ long-standing preference for the US dollar has declined, with the greenback underperforming every other major currency during the period. Global bonds returned 1.8% in US dollar terms over the quarter, but their 12-month lagging return remains a negative 1.9% due to the significant correction following the outcome of the US election in the fourth quarter of 2016.

Global listed property recovered somewhat after the post-election sell-off, although the asset class lagged equities by a significant margin. For the quarter, listed property returned 2.3%, marginally ahead of bonds. The asset class also performed slightly better than bonds over the last 12 months (up 1.9%), but much worse than equities (up 15.0%). Over three and five years, however, the returns from property and equities are very similar.

A very satisfying feature of the past quarter’s performance is that we have outperformed all the relevant benchmarks in the fund's respective asset class buckets. In hindsight, the fund's exposure to equities could have been higher, but within the asset class we comfortably outperformed the benchmark over both the quarter and the year. Our property holdings did well over the quarter, even though the 12-month numbers remain negative.

Credit performed well over both the quarter and the year, and our gold holdings added significant alpha to the fund over the last quarter. Over the longer term, similar comments can be made about our stock/instrument selection within equity and credit, while the property holdings performed well relative to bonds. The only negative over the quarter came from a poor return in the merger arbitrage bucket, which was impacted by continued uncertainty around the Rite Aid deal. We are monitoring the developments closely, but remain convinced that the potential returns outweigh the risks, and have added to this position.

The highlight of our equity returns over the last quarter was SoftBank’s offer to acquire 100% of Fortress Investment Group (at the time a top five equity holding within the fund). For more detail on this, and other notable contributors to equity performance, please refer to the Global Equity Strategy commentary.

We have started adding some exposure to US property stocks for the first time in a while. These stocks sold off significantly following the correction in long bond rates, and most of the retail real estate investment trusts (REITs) were punished during this quarter as investor concerns focused on the potential 'death' of the US mall (which we discuss in more detail in the section on Limited Brands below). While we concur that the internet will continue to gain market share at the expense of bricks-and-mortar retailers, our view differs from that of the market. In our opinion, the listed portfolios of US retail REITs comprise top-quality malls that should remain relevant to their tenants even in a more challenged world.

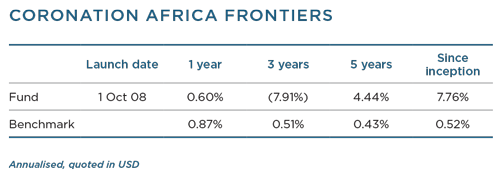

The fund returned 5.6% for the quarter, outperforming both its benchmark (3 Month USD Libor +5%), which was up 1.5%, and the Africa Top 30 ex-SA Index (up 0.61%). Performance was driven largely by Egypt (up 5.1%), while Kenya was virtually flat (+0.4%). Markets in Nigeria and Zimbabwe were down 4.7% and 3.9%, respectively.

Africa has been incredibly tough for investors over the past few years: for the period 1 January 2015 to 31 December 2016, the MSCI Africa ex-SA Index lost 31% of its value. Africa-only funds did not make it through this torrid time unscathed. Based on a review of the industry, we believe assets under management have halved in the past two years with a number of funds closing and only a dozen or so left with less than US$10 million per fund to manage. Together with performance deterioration and significant outflows, previously liquid markets such as Egypt and Nigeria dried up to around a tenth of the average daily trade seen at their peak.

It is during times such as these that one’s commitment to investing through the cycle is truly tested. But history has shown that this is also when long-term, valuation-driven investors find particularly attractive opportunities to buy stakes in high-quality businesses.

One such opportunity has been Egypt. Our country exposure at any one point in time is always a function of stock-specific attractiveness rather than a broad country overlay or target country exposure. However, we are particularly excited about the investment opportunities we are seeing on the Egyptian exchange. In previous commentaries we have discussed the devaluation of its currency and its benefits at length. Since the devaluation, the Egyptian market performed very well with the EGX100 up 22% to date. Egypt continued to benefit from increased investor interest during the quarter as foreign holdings of Egyptian government debt rose to around US$4 billion (versus US$300 million prior to the devaluation), and net equity purchases by foreigners total around US$700 million since the devaluation.

Egypt has been the largest position in the fund since September 2015 as a number of assets traded at very attractive valuations on the back of several years of headwinds in the form of political and social unrest, the collapse of tourism, concerns around terrorism and more recently, the currency and foreign exchange crisis. Despite the strong share price performance witnessed since the devaluation, we remain excited about a number of companies in Egypt: it is still early in the adjustment process put into motion in 2016, and while the operating environment has improved in terms of foreign exchange availability, company earnings are still well below our assessment of normal and businesses are still trading at very attractive multiples. In the short term, the positive policy decisions made by the government will no doubt continue to put pressure on consumers in the form of high inflation, coupled with lagged wage increases. However, in the medium term, we believe these policies will positively impact the economy and allow for growth, job creation, increased per capita income and improved welfare. Our preferred positions in Egypt are Eastern Tobacco, Egyptian International Pharmaceutical Industries Company and Commercial International Bank. We believe these companies have the ability to weather the short-term consumer pressure, benefit from the currency devaluation and, most importantly, have the ability to compound earnings over the long term.

Nigeria, on the other hand, continues to face significant issues, particularly with regard to its currency regime and businesses still finding it incredibly difficult to source foreign exchange. While the Central Bank of Nigeria (CBN) did remove the exchange rate peg in June 2016, allowing the currency to devalue to a level that is now roughly 60% above the pegged rate, equity prices have not responded as was the case in Egypt. As a result, many high-quality businesses now trade at values significantly below our estimate of fair value. However, due to the current foreign exchange shortages, we have low conviction on what the currency will do in the medium term and remain cautious in managing our exposure to this market. We prefer to hold companies that are better positioned to weather a devaluation and better able to navigate the constrained consumer environment. There were some positive developments in Nigeria over the quarter: data released for the fourth quarter of 2016 indicated that the current account is once again in surplus on the back of an increase in production numbers and a stronger oil price. Nigeria was the only major oil economy that went from running a large trade surplus to a deficit during 2015 and 2016 due to output stoppages. Furthermore, on 24 March, the CBN confirmed that gross foreign exchange reserves increased to US$30 billion, compared to lows of US$24 billion in October 2016. Another noteworthy development in recent weeks has been the narrowing of the spread between the parallel market and the official exchange rate due to the CBN pumping dollars into the system. The sustainability of this is of course questionable, and we continue to believe that what Nigeria needs is a transparent, flexible and functioning exchange rate regime that will allow companies to do business and restore investor confidence.

There are often days where the newsflow out of Africa paints a picture of impossible operating conditions, an unfavourable political environment, a constrained growth outlook and crippling government deficits, both internal and external. But we regularly make the point that financial markets typically turn when investors least expect them to and that when they do turn, they often do so very quickly. The fund has had a strong start to the year; however, we are mindful that there is still a long way to go and our commitment to clients remains intact: while staying mindful of potential volatility and risks, we will continue to diligently and rigorously analyse businesses from the bottom up and seek out exciting, long-term investment opportunities that are trading at attractive prices below what we believe to be their intrinsic value. It is this commitment to a process that has worked very well for Coronation over the past 24 years (across geographies, sectors and through cycles) that we believe has the potential to generate above-average returns for our clients over meaningful periods of time.

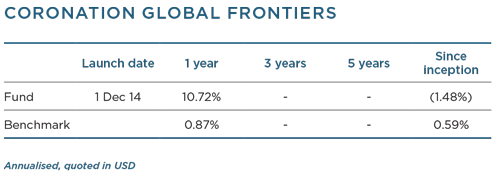

The fund returned 5.4% for the quarter compared to its benchmark (3 Month USD Libor +3.5%), which was up 1.1%. The MSCI Frontier Markets Index returned 9.1% over this period with its two largest constituents, Kuwait (19% of the index) and Argentina (16% of the index) up 12% and 33%, respectively. Argentinian performance was driven by a combination of green shoots in the economy and the potential for inclusion in the MSCI Emerging Markets Index. We do not benchmark the fund against the index, a feature we consider to be a defining characteristic of the fund

Other markets that performed strongly during the quarter include Vietnam (+8.4%), Bangladesh (+3.8%) and Jordan (+4.1%). Pakistan, which will be reclassified as an emerging market by the MSCI on 31 May 2017, was flat (+0.4%) and Sri Lanka was down 7.4%. In Sub-Saharan Africa our largest country exposure, Egypt, was up 5.1% over the quarter. Following the devaluation of its currency in November 2016, the Egyptian market has performed very well with the EGX100, up 22%. The resulting improved foreign exchange availability, coupled with a number of positive policy moves by the government, has seen Egypt continuing to benefit from increased investor interest during this quarter: foreign holdings of government debt rose to around US$4 billion versus US$300 million before the devaluation, net equity purchases by foreigners totalled around US$700 million since the devaluation, and the average daily value traded doubled in US dollar terms. Kenya was virtually flat (+0.4%) as the bulk of the sell-off witnessed in January was made up by gains in the larger companies on the exchange such as Safaricom. Markets in Nigeria and Zimbabwe were down 4.7% and 3.9%, respectively.

Two significant contributors to performance this quarter came from Bangladesh: Beximco Pharmaceuticals and BRAC Bank. BRAC Bank, which owns a stake in the largest mobile money player in the country, was up 33% over the quarter. It is currently the fund’s biggest position as we are particularly excited about the opportunity for mobile money in Bangladesh. With less than a third of the adult population in Bangladesh having access to bank accounts and around eight in every 10 people living in rural areas, mobile money has enormous potential to meet the basic financial needs of a large number of people. In the last seven years, we have closely followed M-Pesa, the Kenyan mobile money success story, and our learnings have been extremely useful in helping us understand the potential of bKash in Bangladesh. Compared to M-Pesa, we believe bKash is still in its infancy in terms of the number of customers, the range of products and profitability. bKash was started in 2011 and today has 80% market share, processing around 4 million transactions per day for its 30 million customers.

We believe that BRAC Bank presents an attractive investment opportunity too. Founded in 2001 with the explicit mandate to serve small and medium-sized enterprises and the unbanked population, BRAC Bank has the footprint and foundations in place to take advantage of Bangladesh’s strong real GDP growth, significant foreign direct investment, improved political stability and security conditions and robust domestic demand. A new CEO – known in the industry as quite the changemaker – has had a material influence on the strategy, processes, human capital and financial performance of the business over the past 12 months and we are confident that these changes will allow the bank to continue compounding earnings well into the future and delivering value to its shareholders.

We have strong conviction that our portfolio is filled with exciting investment ideas like BRAC Bank, Beximco Pharmaceuticals and Eastern Tobacco. The fund has had a strong start to the year; however, we are mindful that there is still a long way to go and our commitment to our clients remains intact: while staying mindful of potential volatility and risks, we will continue to diligently and rigorously analyse businesses from the bottom up and find exciting, long-term investment opportunities trading at attractive prices below what we believe to be their intrinsic value. It is this commitment to a process that has worked very well for Coronation over the past 24 years (across geographies, sectors and through cycles) that we believe has the potential to generate above-average returns for our clients over meaningful periods of time.

Global bond markets were relatively stable during the quarter following the large sell-off in the final months of 2016. Riskier asset classes continued to benefit from the broad upturn in global activity indicators, which saw corporate and emerging market bonds perform strongly. The perception that new US policy initiatives (such as infrastructure spending) may take longer than initially hoped saw the US dollar relinquish some of its strong gains. The currency ended up underperforming all the G10 currencies during the quarter. The fund had a strong quarter, up 3.21%, compared to the Barclays Aggregate Bond Index return of 1.76% for the same period.

After several months, the market still has more questions than answers about the Trump administration. However, one thing is clear: factions within the Republican Party mean policy implementation is not a given. The failure to repeal Obamacare will shift the focus back to fiscal and trade policies, but the chances of sweeping reform appear to be fading. Meanwhile, economic data suggest the US economy remains healthy, but a significant divergence exists between hard data (retail sales, capital spending) − that is less robust − and soft data (consumer sentiment and business expectations). In fact, the GDP forecasting model of the Federal Reserve Bank of Atlanta now estimates US growth to be below 1% in the first quarter (roughly 0.5% below market expectations).

Continued tightening in the labour market and evidence of rising wages were, however, sufficient for the Fed to raise the Fed funds rate by 0.25% in mid-March. More hawkish comments by Fed members in the run-up to the meeting led some to expect that the ‘dots’ would be revised higher. In the end, only the 2019 expectations were revised upwards by 0.125% to 3%. The market now prices a 50% chance of a further 0.25% hike in June and one and a half moves by year-end. The central projections by Fed officials remain considerably above those projected by the market beyond 2017. However, it is worth remembering that Fed policy can be reshaped considerably given that three vacancies on the board of governors will be coming due during 2017, as well as the Chair (Janet Yellen) and potentially the Vice Chair (Stanley Fischer) in 2018. After eight years, during which core personal consumption expenditures inflation has been below target for all of but four months, senior Fed economists recently published a paper reminding markets that the FOMC inflation goal is symmetrical (around 2%). The paper concluded that policy should allow for higher inflation than target during normal times. Clearly, this would have important implications for the setting of interest rates and how people perceive the merits of US inflation-linked bonds if voiced more openly by voting Fed members.

US 10-year yields ended the quarter at the low end of a relatively tight range (2.4% to 2.6%), with the curve flattening very slightly. Breakeven rates of inflation were also very stable around 2% with the correlation of longer breakevens and the oil price falling to almost nothing. On 15 March, the suspension of the previous debt ceiling (agreed to in October 2015) lapsed. For now, the Treasury has a few tricks up its sleeve to postpone the date on which it runs out of cash, but at some point in the next few months a further suspension will have to be agreed on by Congress, raising the prospect of a further political logjam. The latest long-term budgetary outlook (released by the Congressional Budget Office) projects US debt to rise from 77% of GDP to 150% of GDP over the next 30 years should nothing change. The debt ceiling debate also highlights the challenges of pushing through large infrastructure spending.

Subsequent to the changes to US money market regulation in October 2016, there has been increased demand for short-dated assets. The recently reduced issuance of US Treasury bills (as a result of the debt ceiling) has seen short-dated instruments trade at expensive levels, with swap spreads widening significantly at the short end. The richness of short-dated government bonds also lent demand to shorter-dated AAA-rated instruments, which tightened by between 10 basis points (bps) and 15 bps during the quarter. The fund increased its exposure to the US over the three-month period via the two-year and 10-year portion of the curve, while reducing its exposure to the long end.

Within Europe, both economic activity and inflation expectations have improved. The European Central Bank’s (ECB) March policy meeting came shortly after the release of February’s inflation data, which showed that inflation touched 2%. The ECB’s updated growth and inflation forecasts were both revised marginally higher in what was taken to be a hawkish signal by the market and the one-year forward rate one year from now jumped 0.2% as the prospect of rate rises in 2018 began to be discussed (as has the timing of scaling back quantitative easing). Since then, March’s inflation forecast has been released showing inflation back at 1.5% and it appears the ECB is seeking to calm the market. Having been wrong-footed by the outcome of the Brexit vote and US elections, the French elections remain a key focus for the market. Marine Le Pen’s chances appear slim, but until there is clarity, short-dated German bonds will continue to attract a safe-haven premium. French debt performed the worst during the quarter, while other peripheral debt (such as Italy) also struggled as problems in the banking system continue to cast a shadow. With the real yield on German 10-year bonds trading below -1% we see little reason to hold European government bonds.

Emerging market debt performed strongly during the quarter, both in hard currency terms (with the Emerging Market Bond Index [EMBI] spread narrowing from 3.65% to 3.28%) and in local currency terms (as local debt markets witnessed significant inflows). The fund added to its holdings in Mexico, which subsequently performed well (as bond yields tightened by 50 bps compared to US Treasuries) and the peso appreciated strongly against the US dollar (as Mr Trump’s anti-Mexico rhetoric moderated). The fund has since scaled back some of its exposure to the peso. In January, we sold our hard currency denominated Turkish bonds in favour of local currency bonds after further weakness in the lira. SA was among the best performing markets until mid-March when political risks once again emerged, sending bond yields 70 bps higher and the currency gave back the 10% it had gained. The fund had reduced some of its SA bond and currency exposure prior to the weakness. In frontier markets, the fund invested in Egyptian Treasury Bills (where interest rates and the currency are viewed as undervalued) and in Argentinian short-dated US dollar-denominated bonds

Corporate bonds (particularly those in the US) performed strongly during the quarter and were reflective of the positive sentiment in equity markets. Despite high levels of issuance, new deals have been well supported with very little new issuance premium. Lower-rated entities performed best, but a weaker oil price and outflows from high-yield funds have begun to see a more cautious tone emerge in the high-yield space. All of Mr Trump’s envisioned tax policies (whether a border adjustment tax, lower corporate tax rates or tax breaks on repatriated earnings) have important sectoral influences that the market will have to grapple with. Within Europe, the timing of any further reduction in asset purchases will be a key factor for the market. We remain cautious on valuations at current levels. The fund added some exposure in the form of Cromwell convertible bonds and tendered its holding in Old Mutual Tier 1 securities.

After strengthening in the wake of the US elections, the US dollar fell victim to extended expectations and weakened across all G10 currencies as well as a wide range of emerging market currencies. The currency’s weakness can be attributed to the following factors: Firstly, the fact that Mr Trump has not revealed greater detail about his plans for tax reform and infrastructure spending, prompting fears that the fiscal boost to the economy will be less than anticipated, disappointed investors to some extent. Secondly, economic activity in other regions surprised on the upside. The euro also derived support from a reduction in short speculative positions as the market reacted to the prospect of tighter monetary policy within Europe. Having been the weakest G10 currency since the US election, the yen was one of the best performing (up 4.5% versus the US dollar) over the quarter as the reflation trade unwound. The yen also benefited from a reduction in flows from Japanese investors into the international markets ahead of the Japanese year-end. The fund remains slightly overweight US dollars, but has been reducing its underweight in euros and yen, which we believe continue to be undervalued in fundamentals. The fund’s other key currency holdings are in Mexico, Turkey and Egypt.

The fund remains underweight duration, but has reduced this underweight by adding to its US exposure. The fund is also overweight a number of emerging markets where we believe currencies remain cheap. Our exposure to corporate bonds is relatively modest and we remain cautious given current valuations. There seems to be a sense in markets that we are entering a new reflationary phase and central banks will be able to unwind the exceptionally accommodative polices that have been in place for many years. Whether this proves to be the case holds the key to holding markets that will ultimately perform.

*All fund and index returns quoted in US dollar.