Bond Outlook - July 2016

The SA bond and currency markets have had their fair share of bad weather in the past few years. The bond market has seen yields (as referenced by the 2026-maturing government bond) bottom out at 6.9% in May 2013 and sell off to a peak of 10.5% in December 2015 after the replacement of then finance minister Nhlanhla Nene. Benchmark yields have settled at around 9% for now. The downpour in the currency market has been worse, more a torrent or a flood than a shower. The rand bottomed at R6.50 to the dollar in May 2011, before depreciating sharply following the Marikana tragedy in mid-2012 to spike at R17.91 in January 2016. It was trading at R14.30 to the dollar at the time of writing.

The most important question for the fixed income market now is whether the worst of the storm is behind us. Was December 2015 the eye of the storm, and will the shock to inflation that followed start to recede? Or is there more to come? Importantly, is the first glimmer of a rainbow about to emerge as drought-related food inflation hits a peak in the next few months before possibly receding?

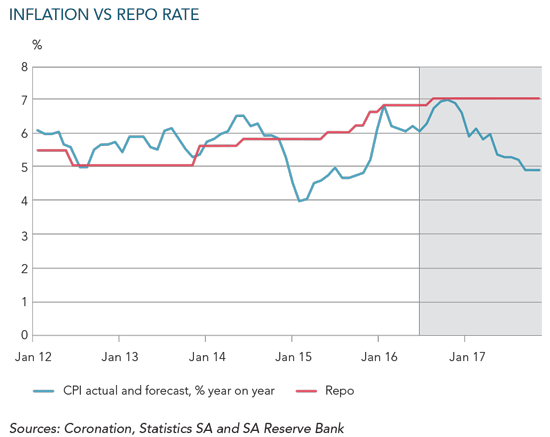

In response to the upside risk to inflation posed by the drought and the weaker currency, the Monetary Policy Committee (MPC) continued to raise the repo rate this year, with 75 basis points (bps) of rate increases up to May 2016. Since the start of the rate normalisation cycle in January 2014, the MPC has raised the repo rate by a cumulative 200 bps to its current level of 7%. Meanwhile, the economy has weakened significantly, with growth first slowing and then contracting by 0.6% year-on-year in the first quarter of 2016. Inflation is expected to peak in the fourth quarter of 2016, and already actual data have started to surprise to the downside. Could this imply that the SA Reserve Bank (SARB) has done enough? The answer has to be in a combination of the outlook for inflation, and then growth.

We think inflation is close to peaking. The most important driver of the recent rise in inflation is food prices. It is very unusual to have two consecutive years of high food prices – especially driven by high maize prices. Conditions invariably normalise as farmers overplant to take advantage of high prevailing prices; a year of high prices is usually followed by a bumper crop and high food stocks which spill over to the following years. However, given the reported severity of the drought and concerns that some farms may no longer be able to produce (due also to fire sales and long-term damage), there was a considerable risk to this view. Subsequently rain has been reported in key areas in May, and there is some solace that a ‘normal’ rainfall in August to September this year would be enough to generate a ‘normal’ yielding maize crop, and also that peripheral farms will be bought or rented and planted. This gives us comfort that a more traditional moderation in food prices may be expected next year.

There is also a growing concern that SA consumers are now really coming under pressure. There was an outright contraction in household consumption expenditure in the first quarter of 2016, which coincided with a drop in (albeit volatile) personal tax revenue in March and very weak underlying credit and vehicle sales data. A combination of high inflation in food staples (c. 29% year-on-year in the first quarter of 2016), very limited tax relief in February, job losses in the first quarter of 2016, slowing real income growth (especially in the public sector) and a broad unwillingness to spend among wealthier consumers, are all increasingly in play. This will challenge both growth and the ability of companies to hike prices.

Household spending is a key determinant of GDP growth. GDP contracted by 0.6% year-on-year in the first quarter of 2016, with household spending and fixed investment remaining weak and net exports a neutral contributor to growth. Government spending picked up a little, offsetting some of the weakness, but this is insufficient to boost overall activity this year.

Early indications for the second quarter are weak too. Corporate profitability is under significant pressure, employment contracted during the first quarter, and the only growth support may come from trade – although the recent Brexit vote could compromise UK demand for domestic exports. Certainly, the last SARB MPC statement highlighted greater concern for the growth outlook than at previous meetings. Structural impediments to growth persist. The labour market is inflexible and productivity is low, and investment in capacity has been hampered not only by poor global growth conditions, but also by unhelpful policy uncertainty. Domestic GDP is unlikely to grow by more than 0.5% this year, and perhaps by 1 % in 2017.

Taken together, this implies inflation is likely to be much lower in 12 to 18 months than it is now. What does that mean for the fixed interest investment cycle and the valuation of our long bonds?

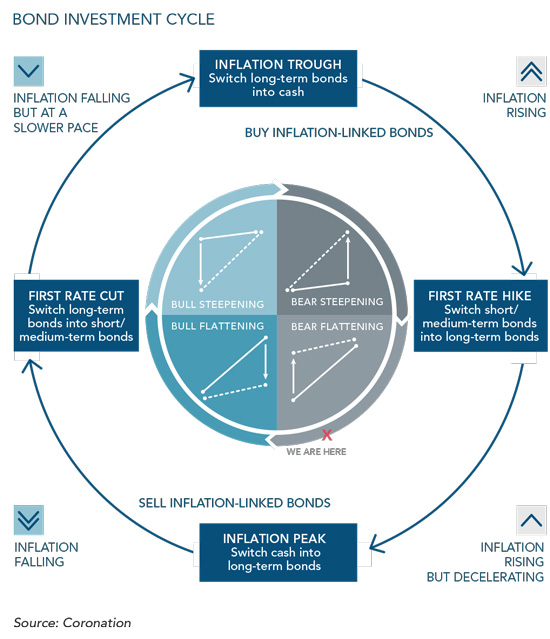

The following flowchart clearly indicates that as one moves towards the inflation peak, and in the process begin to discount the top of the rate cycle, that is the right time to begin accumulating long bonds and lengthening the duration in fixed interest portfolios. However, it is crucial to ensure that the fixed interest investment cycle argument is also supported by the underlying valuation of local bonds.

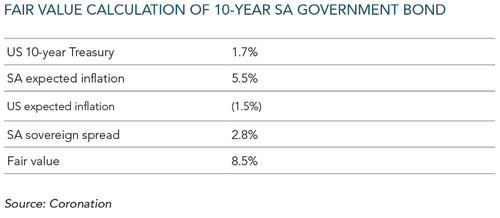

One of the methods we use to calculate a fair valuation for SA long bonds is to use the three fundamental components that determine the yield:

- A global long bond rate (we use the ten-year US treasury);

- We then add an expected inflation differential between the SA and US markets (basically, SA expected inflation minus US expected inflation); and

- Finally, the SA sovereign spread, which aims to capture the SA risk premium in the yield.

Our calculations point towards a fair value of 8.5% for the ten-year SA government bond, as detailed in the following table.

Currently, the SA ten-year government bond trades around 9%. Should yields start falling and the bond trades closer to the calculated fair value, it would offer a total return over a 12-month period of approximately 12%.

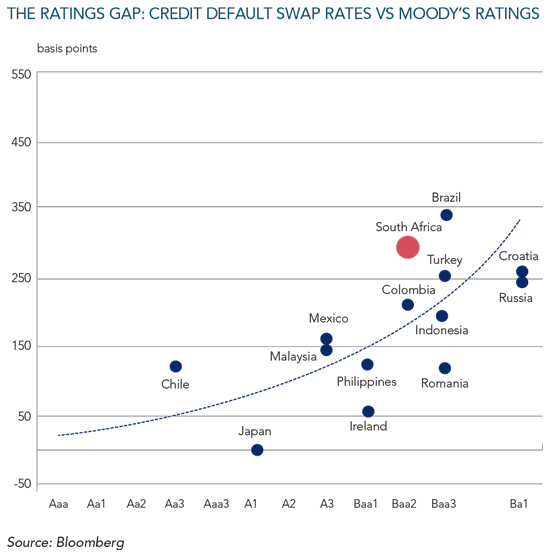

Another potential positive underpin of this valuation could come from the SA sovereign spread. The chart below shows that current valuations are discounting a ratings downgrade to junk status. Should SA manage to get another stay of execution from junk status in December, then there could be scope for that spread to tighten to be in line with the trading levels of an investment grade country.

In our valuation metrics, a significant risk is the possibility of a derating in US bond yields. The US ten-year bonds are currently trading at historically low levels, which may move back to more normal levels should the Federal Reserve increase the pace of the hiking cycle in the US.

In conclusion

Growth in SA has been generally disappointing following the global financial crisis, but despite this, inflation has remained relatively high, rising through 2015 and into this year. There is considerable uncertainty about how high headline inflation can climb. These stagflationary conditions have made policy setting very hard, and domestic political flux has not helped either.

The recent sharp deterioration in growth suggests that the economy may now simply be too weak to absorb much price pressure. Also, better conditions for grain planting may alleviate some of the stress from rising food inflation in the months ahead. Bar any unexpected political risk event, these circumstances should support a near-term peak in inflation and much better prospects for bond yields over the next 12 to 18 months.