Quarterly Publication - July 2016

International Portfolio Update - July 2016

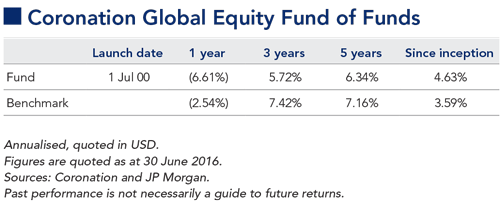

The fund advanced 1.4% over the quarter, ahead of the benchmark return of 1.0%. This brings the rolling 12-month performance to -6.6% against the benchmark return of -2.5%.

North America was the best performing region, rising 2.4% (in US dollar terms), while Europe performed the worst, declining 2.3% (in US dollar terms). Japan advanced by 3.6% and Asia Pacific ex-Japan declined 0.7% (both in US dollar terms). The fund’s regional positioning had a negative impact on performance during the quarter.

Among the global sectors, energy (+9.7%) and healthcare (+5.2%) generated the highest returns, while utilities (+3.3%) and materials (+3.2%) also delivered strong returns over the quarter. The worst-performing sectors were consumer discretionary (-4.5%), financials (-3.0%) and information technology (-2.9%). On a look-through basis, the fund was negatively impacted by an underweight position in energy, consumer staples and utilities, and an overweight position in the consumer discretionary and information technology sectors.

The majority of the fund’s underlying managers performed very well over the quarter, allowing the overall portfolio to finish ahead of the index.

Contrarius Global Equity has had a very strong quarter, benefiting from positions in commodity-related holdings, most notably gold, which performed well over the three-month period. Kinross Gold (+43.8%), IAMGold (+87.3%) and Fortescue Metals (+37.2%) are examples of strong investment performances.

Coronation Global Emerging Markets also generated strong alpha this quarter, benefiting from mergers and acquisitions activity in the Brazilian for-profit education space, most notably Kroton (+19.6%). Strong returns from Naspers (+8.7%), Yes Bank (+29.2%) and Tata Motors (+20.1%) also drove performance over the period.

Eminence and Viking delivered similar returns for the quarter. Viking benefited from commodity-related exposure with positions such as Southwestern Energy (+55.9%), Cabot Oil & Gas (+13.4%) and Range Resources (+33.3%). Positions in Amazon (+20.6%), Envision Healthcare (+24.4%) and Eli Lilly (+10.4%) also added value. A significant contributor to performance for Eminence was its large position in LinkedIn (+65.5%). The fund also benefited from strong returns from Zynga Inc (+9.2%), CalAtlantic Group (+10.0%) and Intercontinental Group (+9.2%).

After a sustained period of strong performance, Lansdowne Developed Markets saw a steep decline over the quarter. This was largely driven by its positions in consumer discretionary stocks including Nike (-9.9%), L Brands (-22.8%) and Apple (-11.8%). Lloyds Bank (-18.1%), a long-term winner for the fund over a number of years, was a victim of the UK’s referendum vote and detracted from performance over the quarter. Declines in share prices were also recorded by Delta Airlines (-25.0%), Visa (-2.9%) and MasterCard (-6.6%).

Egerton also suffered a negative return, again after a long period of substantial outperformance. Airline-related stocks were among the main detractors, including Ryanair (-20.1%), Southwest Airlines (-12.3%) and Airbus (-9.2%). Exposure to UK homebuilders, which were among the biggest victims of the referendum vote, also contributed to the negative performance, as did positions in Microsoft, Alphabet and Priceline.

We have recently reduced our exposure to Vulcan Value Partners following a disappointing run in performance. The fund declined over the quarter, following another disappointing performance by Fossil (-35.8%). It also held Visa and MasterCard, as well as Check Point Technology (-8.9%).

The economic uncertainty created by Brexit did not only affect the UK as ‘Project Fear’ predicted, but also rippled across the rest of Europe and the broader global economy. The result is widely expected to spark debates around membership in other EU countries at a time when the union is already dealing with major issues including Greece’s debt, a banking bailout in Italy and the ongoing migrant crisis.

The economic uncertainty associated with Brexit is sure to continue for a substantial period of time. The major central banks have stepped in to provide liquidity and stabilise the currency markets, and expectations for a rate hike in the US are moving out towards 2017. This should be supportive, but global growth is expected to slow. In combination with the prospect of electioneering in Europe and the US over the next two quarters, this will no doubt create some market volatility in the medium term.

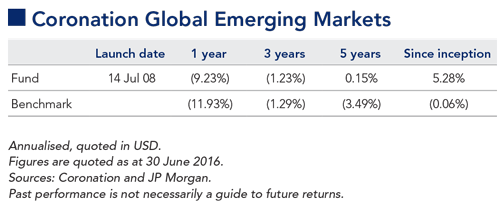

The GEM strategy returned 4.8% for the quarter, outperforming the benchmark by 4.1%. After a tough couple of quarters, there has been a marked improvement in the strategy’s shorter-term performance − one-year rolling alpha now sits at 2.7%, after negative numbers over the previous two to three quarters.

The quick turnaround illustrates why we dislike shorter-term measures of performance and instead prefer to look at longerterm returns, which we believe are more meaningful when analysing the capabilities of a manager. In this regard, the strategy’s alpha over periods of five years (3.6% per annum), seven years (3.5% per annum) and since inception (5.3% per annum) is strong, and within or above our long-term target of 3% to 4% per annum.

The biggest news for the strategy during the quarter came at the start of June when the largest Brazilian private sector education operator, Kroton Educacional, launched an offer to purchase the second-largest provider, Estácio Participações. At the time, the strategy’s position sizes in these two stocks amounted to 4.2% and 2.0% respectively. By the end of June, the market reaction to the deal took these positions to 5.5% and 3.5% respectively. We are very positive on the education sector in Brazil. During the course of 2015, we significantly increased the strategy’s position in Kroton (and introduced a holding in Estácio for the first time) as the shares tumbled following the government’s decision to reduce student aid. The two companies’ share prices more than halved during the course of the year.

In our view, the reduction in student loans has a small negative impact on our assessment of fair value for the two businesses. The share price reaction in both cases was excessive. Part of the overreaction was due to the wholesale aversion to Brazilian assets, which saw investors sell most Brazilian stocks regardless of their underlying business fundamentals. The material decline in the real against the US dollar meant that the portfolio impact of these share price declines was even more pronounced.

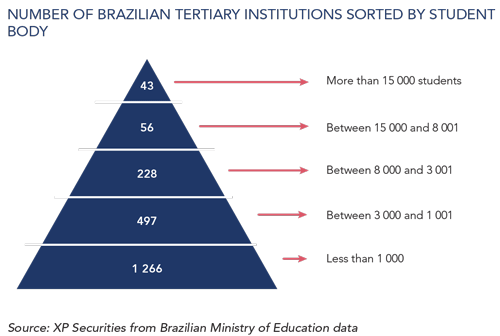

We have long argued the investment case for the Brazilian providers of private education. By some estimates there are over 2 000 private institutions in the country, the vast majority of which has less than 8 000 students (see the figure overleaf). As can be expected, the quality of the institutions’ offerings varies greatly, particularly since many of the private sector players only have a single campus with a few hundred students. This sort of fragmentation makes the market ripe for consolidation; education institutions have a large number of fixed central costs that can be diluted down across a larger student base. This became evident to private equity groups ten to 15 years ago and a few large groups emerged, some of which subsequently became listed entities.

Kroton and Estácio are two such examples, with Kroton resulting from a 2014 merger between the original Kroton and Anhanguera Educacional, the then no. 2 player in the market. In turn, the merger created a clear industry leader with a market share of approximately 15%. Thus, Kroton’s move to buy Estácio (7% market share) will further entrench its dominant position.

Prior to Kroton’s bid, Estácio’s share price had underperformed that of Kroton significantly this year – down 22% to end-May compared with Kroton, which was up 16% over the same period (both in local currency), resulting in a relative underperformance of 38%. In fact, Estácio is one of the few Brazilian stocks we cover that did not benefit from more positive Brazilian market sentiment in response to impeachment proceedings against the (currently suspended) President Dilma Rousseff. Kroton management seized the opportunity to bid for control of the company, offering just less than one Kroton share (0.977 to be exact) for every Estácio share held. The offer was in line with the ratio of the two firms’ share prices over the prior 30 days.

Not surprisingly, Estácio’s board felt this offer was opportunistic and undervalued their business significantly. In their view, the ratio of the two firms’ share prices had been closer to 1.5 times over the 23-month period since the merger of Kroton and Anhanguera, which Estácio believed was the more appropriate benchmark to reference any bid. With quite a large gap in expectations between the two parties, it was fairly possible for the deal to fall through. However, shareholders strongly favoured the two firms coming to an agreement and for the Estácio board not to risk the deal by demanding too high a price. The departure of the Estácio CEO and COO (who was previously the company CFO) during the negotiation period added to the urgency of finding a suitable solution. Two competing bids from a large Estácio shareholder (to take control) and from another smaller education group (to merge with Estácio) were not, in our view, worth serious consideration.

Coronation played a leading role in advocating the merits of the Kroton bid. We based our support solely on our view of the quality of management at the respective firms: we believe that Kroton’s management would be able to realise much more value from Estácio’s assets than the latter’s management (particularly after the aforementioned executive departures). Kroton also believed they could realise significant synergies upon merging with Estácio, which we estimate could be in the region of R$3 billion to R$4 billion in present value terms. At the time the bid was launched, Estácio’s market capitalisation was only R$3.5 billion, making this a great deal for Kroton shareholders, but less so for those in Estácio. We still believed, however, that the deal should be supported if Kroton made an appropriate revised offer. The difference in management quality should ultimately prove very beneficial to Estácio shareholders; receiving Kroton shares instead of cash means they should continue to benefit from the growth in the combined entity under Kroton management.

Kroton’s management has an exceptional track record, clearly demonstrated over recent years. At the end of 2011, the capitalisation of Kroton and Estácio was almost the same. Since then, and prior to the bid, Kroton’s market capitalisation has increased to more than five times that of Estácio. Even accounting for the Anhanguera acquisition, this is still a big divergence in performance. The compound annual return delivered to Kroton shareholders over the period has been 42.2% per annum compared to 14.7% per annum for Estácio – a difference of 27.5% per annum. The share price divergence has mirrored the difference in operational performance – in particular, our preferred metric of free cash flow (operating cash flow less capital investments), where Kroton has delivered six times the free cash flow of Estácio over the period. When Kroton bought Anhanguera in 2014, the two firms had EBITDA margins of 36% and 19% respectively. Today, the combined firm has EBITDA margins of 41%. Kroton targeted annual synergies of R$300 million by 2018 from the combined entity – by 2015 it had already realised almost R$400 million worth of synergies. It has exceeded targets by so much that the final synergies number was revised up to R$620 million by 2018. We believe the Kroton management team is capable of replicating its previous feat with Estácio’s assets. (In our view the company CEO, Rodrigo Galindo, is among the best we have ever come across in emerging markets.)

We lobbied hard for Estácio to negotiate with Kroton to reach a mutually acceptable deal. This included letters to the board of directors and chairman of Estácio’s board, as well as numerous conversations with various parties in which we outlined the importance of making the correct decision that will ultimately benefit shareholders most. After lobbying by Coronation and other shareholders to both parties, Kroton eventually increased its offer to 1.25 shares for every Estácio share, a 28% increase from the initial offer. Further negotiations first resulted in an improved offer of 1.281 Kroton shares, together with a special dividend to Estácio shareholders of R$0.55 per share, and later in a final offer with the same swap ratio and a dividend of R$1.37, which was accepted by the Estácio board. This takes the final offer to approximately 1.38 Kroton shares per Estácio share. At the time of writing, with Kroton’s share price having appreciated by around 26% since its first offer, Estácio’s shareholders will receive an effective premium of 67% to the pre-offer share price. We did not want to accept a cash offer − it would have meant that we do not participate to the same degree in the upside of the combined entity. As an all-share offer (aside from the special cash dividend), however, the offer has much more merit.

Assuming this deal is accepted by shareholders of both firms (and the regulators), we believe the combined entity will be in a unique position to truly capitalise on the continued growth and consolidation of the education sector in Brazil. Most of the smaller players make very little money as they lack scale (their costs are higher) and their degrees are less recognised than those of the national players (which means they cannot charge as much). Over time many of these players will close, allowing larger players (like Kroton) to really accelerate their organic expansion. Despite the recent share price appreciation, Kroton still trades on 12 times forward earnings, with several years of expected double-digit earnings growth ahead.

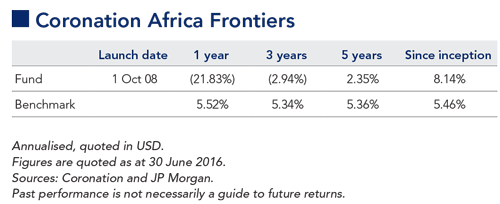

Over the past three months, volatility has remained a theme across the continent and this uncertainty saw the bulk of African stock exchanges close in negative territory for the period. In US dollars, Nigeria was down 17.2%, Egypt by 7.0% and Kenya by 5.4%, while Zimbabwe was up 3.5%. For the quarter, the fund declined by 2.2%, with the JSE All Africa 30 ex SA Index down 2.9% and the benchmark (3-month US dollar Libor + 5%) up 1.4%.

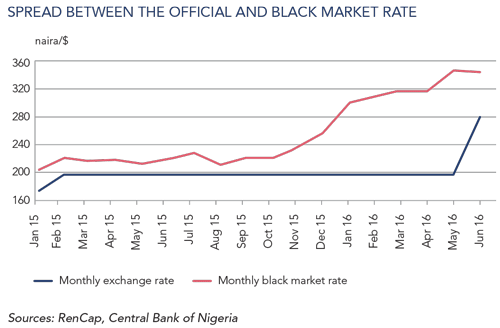

While Nigeria was down in US dollar terms, the market was up 17.0% in local currency (naira) terms over the same period. This was on the back of the Central Bank of Nigeria’s (CBN) decision to remove its exchange rate peg and allow the naira to devalue by around 30%. This decision came in late June, after more than a year during which the CBN stubbornly stuck to an unsustainable peg at N199 to the US dollar.

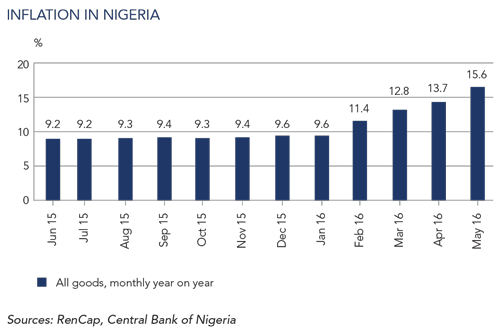

The widening spread between the official and parallel rate, double-digit inflation and US dollar shortages as witnessed during the quarter no doubt served as the proverbial straw that broke the camel’s back.

While the CBN maintains it has moved to a ‘flexible’ rate, the verdict is still out on whether the market functions in a way that allows the rate to fully reflect supply and demand dynamics: the CBN remains the only seller of dollars in the market, banks report variable experiences in filling their dollar orders, and the parallel market still exists and continues to quote a rate well above the current quoted price. In fairness though, we are but a few weeks into the new exchange rate regime.

We are certainly very pleased that the CBN has taken this first step in what is bound to be a painful adjustment process. The Buhari government now needs to address some of the country’s key shortcomings such as a lack of export diversification, its resulting dependence on oil and Nigeria’s growing trade and budget deficits. Despite the president’s good intentions to shelter the people of Nigeria from inflation (one of the key reasons Nigeria held on to the peg), in the short term we do not see any respite in this regard.

Pressure on consumer purchasing power is therefore likely to worsen and this has been the key driver behind our decision to decrease our exposure to consumer-facing businesses. While Nigerian Breweries remains one of the most attractive companies in our universe, we have reduced our position and also sold Guinness Nigeria. We have avoided companies like Nestlé Nigeria, Unilever Nigeria and Flour Mills of Nigeria.

The latter two businesses lack pricing power and while Nestlé Nigeria has pricing power, it holds significant US dollar-denominated debt. We have used the proceeds of our sales to buy stocks that we believe are likely to benefit most from the devaluation and that are least exposed to liabilities denominated in hard currency. Dangote Cement is one such stock. The company has been commissioning cement plants across the continent, which has resulted in an increase in US dollar revenues as a percentage of sales. Any devaluation will benefit Dangote Cement as its revenue from international operations (30% of total revenue) serves to cushion any rising import costs. We have also maintained a healthy exposure to Seplat Petroleum Development, which earns all of its revenue in US dollars and has a significant cost base priced in naira.

We are cognisant that the near-term environment in Nigeria will remain tough, but the decision by the CBN to move away from a fixed exchange rate regime is a very positive one. Over the medium to long term, Nigeria is one of the most attractive markets globally. We remain committed to our bottom-up, valuation-driven approach to stock picking which we believe allows us to take positions in high-quality companies that are undervalued by the market. Holding these positions through the cycle should provide outperformance to our clients over the long term.