Quarterly Publication - October 2016

Anheuser-Busch InBev - October 2016

'Non est potestas Super Terram quae Comparetur ei.' (There is no power on earth to be compared to him.)

A Latin quote from the Book of Job describing the mythical beast Leviathan (or behemoth). The quote was featured on the frontispiece of the original 1651 edition of Leviathan by Thomas Hobbes. Leviathan was a feared sea serpent or monster. In Hebrew it simply means ‘whale’.

Thursday 29 September marked a sad moment in South Africa’s corporate history. It was the last day of trading for SABMiller, which listed as the JSE’s first industrial company in 1897. Over the past 119 years, South African Breweries grew to become the world’s second-largest brewer, one of the top 100 companies listed in London and the second-biggest company on the JSE. Yet it was not too big to be acquired. In September 2015, Anheuser-Busch InBev (ABI), the world’s biggest beer company, made an audacious offer for SABMiller. The combination of (mostly) cash and shares, bumped up by several sweeteners to a final $112 billion, was accepted a year later. End of SABMiller. Fortunately for SA investors, ABI had to get the blessing of local regulatory authorities, one of the many hoops it had to jump through. It was clear early on that a JSE listing would go some way to smoothing that path. ABI duly became an inwardly-listed company in February this year. SA-based investors can thus still obtain exposure to the assets they once owned (and then some) through the shares of the acquirer. To many local investors, however, the ‘new’ company will feel big, foreign, unknown and a little scary, like the leviathan of legend. This note will do its best to demystify the beast.

Let us start with the people behind ABI. The company has its origins with three gentlemen named Jorge Paulo Lemann, Marcel Herrmann Telles and Carlos Alberto Sicupira. You probably know the story, but here is a recap. Lemann, Telles and Sicupira founded Banco Garantia, an avant garde investment bank, in Brazil in 1971, eventually selling it to Credit Suisse in 1998 for $675 million. They had identified beer as a great business and used their capital to buy the Brazilian brewery Brahma. In 1999 they merged it with another brewing company, Antarctica, to form Ambev, the biggest brewer in Brazil. This first big deal, done when Lemann was already 59 and with a heart attack under his belt, set them up for greater things. Within five years, and now under the leadership of Lemann’s protégé, Carlos Brito, Ambev was big enough to merge with Interbrew, a prestigious but sleepy Belgian brewer. The cost savings that the aggressive Brazilians were able to extract from Interbrew astounded the market. The stock of the combined firm, now called InBev, rose 40% in 2005 alone. In 2008, at the height of the global financial crisis, InBev made a controversial $46 billion bid for Anheuser-Busch, the US corporate doyen. To have raised such a sum given the global backdrop at the time was an unbelievable achievement. It worked and became the stuff of business legend, as recounted in many breathless books (Dethroning the King, by former Financial Times correspondent Julie MacIntosh among many others).

ABI was now the biggest brewer globally and owned Budweiser, the so-called ‘King of Beers’. Again, cost savings were significant. They were to do it twice more. In 2012, ABI bought the 50% in Mexican brewer Modelo that it did not already own, for $20 billion. To acquire SABMiller, it raised over $60 billion of bond finance. Following the deal, ABI – already a global behemoth – is now the biggest consumer product goods company in the world by profits (ahead of Procter & Gamble and Nestlé). In brewing terms, it makes almost five times the profits of the next global brewer, Heineken. Leviathan indeed.

Make money, and the world will conspire to call you a gentleman, said Oscar Wilde. In joint control of ABI through a voting pool arrangement (with the Belgian families who used to own Interbrew), the Ambev founders are now among the world’s most celebrated billionaires. How did they do it? Well, they are clearly very good dealmakers and financiers. But these are not asset strippers and paper merchants. They have improved the quality of the acquired businesses by simplifying them, scaling them up and removing costs. In almost all cases, the operating margins of acquired businesses have been increased by more than 10%. At the heart of this success lies a unique business culture (‘dream, people, culture’, in their words) which can be rendered as follows:

- ABI is very good at large-company basics like distribution, logistics, procurement and sales execution. Excellence, at scale, is powerful.

- Management structures are flat, allowing direct line of sight downward and feedback upward. Somehow they run businesses with fewer people than peer companies.

- Managers are heavily incentivised to reach outrageous stretch targets (the ‘dream’), the idea being that they are then challenged to find innovative ways to bridge the ‘expectation gap’ to a higher level of performance. Incentives are largely through shares, aligning the interests of managers and shareholders.

- Budgeting is brutal and goals are set from the top. ABI is synonymous with zero-based budgeting. They are cost demons who fly economy and stay in gritty bed-and-breakfasts. To get a new ballpoint pen, you have to hand in your old one. Really.

- Simplicity. They drive hard, but mostly at things that can move the needle. The focus is to get things 80% right, but not to sweat the small stuff (the 80% effort that brings the last 20% reward).

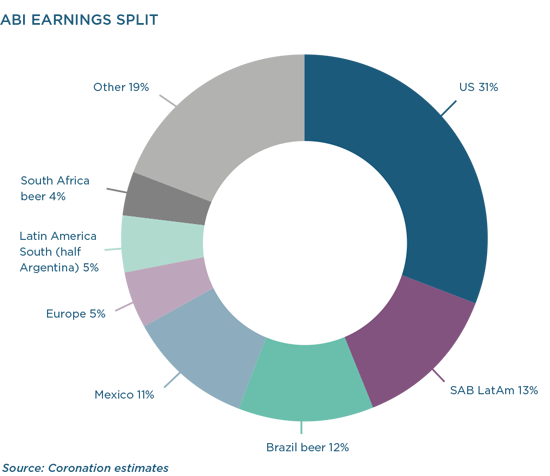

Enough of the history. What are investors in ABI getting? The following pie chart shows where the earnings come from.

A massive 77% of earnings comes from the Americas, 33% from North and 44% from South. ABI’s Latin American business is particularly powerful, and spread across 17 countries, with Brazil and Mexico prominent. The six ex-SAB countries add significant scale to this continental presence. At 9% (of which SA represents 4%), Africa still punches below its 30-country weight, but it offers both organic growth and the potential for mergers and acquisitions. To round off a truly global portfolio, Asia (China, Australia and South Korea) comes in at 9% and Europe (nine countries) at 5%. Some 56% of ABI is exposed to faster-growing emerging markets, climbing to an expected 66% by the end of our forecast period. With a solid 30% of earnings from the US, and diversified as ABI is across continents and currencies, currency exposure is actually quite modest. Looking at things in aggregate, ABI sells one in four beers consumed worldwide and earns between 45% and 50% of all the profits in global beer. For the SABMiller deal, it raised $60 billion in debt at a rate of 3.2%, with an average term of 13 years, a better rate than is available to some countries, including SA. Its prodigious financing capability is underpinned by an annual EBITDA (discretionary cash flow) of $25 billion. Market capitalisation is $260 billion, or R3.5 trillion. Leviathan.

How do you grow something that is already this big? There are many moving parts, but on the 80/20 principle, the things that will make the difference over the next five years are:

- $1.95 billion of synergies to come from re-sizing SABMiller’s (and the joint) cost base after the deal.

- ABI’s important US business is presently struggling. Market conditions are tough and some key brands, especially Bud Light, are underperforming. To fix this, sales and marketing expenditure is currently elevated. A normalisation of these factors will add to earnings growth from here.

- The strong growth in the acquired SABMiller LatAm businesses will continue, aided by margin enhancement from ABI’s logistics and efficiency initiatives.

- Mexico is turning into a brilliant market for ABI. A large, profitable duopoly with ABI in the lead role, it is growing strongly. Margins can still expand further.

- In China, ABI’s premium beers have found a sweet spot as an affordable luxury, while mainstream beer and fancy spirits have battled. Profitability will more than double over the next five years.

If we consider the income statement at a group-wide level, from the top down, revenue should grow close to 10% in dollars in the medium term. This comes from a combination of 3% to 4% volume growth, 3% to 4% annual growth in price/ mix and a bit of help from currency strength. The margins of a consumer staples company should rise gradually with greater scale and efficiency, taking growth in operating profit to over the 10% mark. Now add or subtract the effect of de-gearing (less interest as they lay off the acquisition debt), tax effects and gradual share buybacks, and one comfortably gets to 12% earnings growth. In dollars. Leviathan can indeed still grow.

We have here the opportunity to buy shares in a company with excellent, almost unbeatable fundamentals, one of the best in the world. It offers scale, market power, a strong balance sheet and a deep moat around the business, in the form of brands, relationships and market positions. Beer is a consumer staple with steady revenues, the portfolio effect takes care of currency and country issues, and growth is guaranteed through exposure to emerging markets. To round it off, there is the stewardship of awesome capital allocators who are shareholders alongside us. Perfection comes at a price, however. ABI is priced at around 19 times what it should earn in a normal year. And for now, before the cost savings are reflected in earnings, the one-year price earnings stands at a daunting 26 times. Even a few years ahead, the price earnings comes out at the higher end of the peer spectrum. Too rich? It may be for some. This share has looked expensive many times in the past and still did well for shareholders. Perhaps the problem is that the optionality from new deals cannot be accommodated in earnings forecasts. Or that natural conservatism means the forecast has upside.

Taking it all into account, I see a decent margin of safety between our valuation of the company and the actual share price of ABI, a stock SA investors should be willing to hold even if it were at fair value. Thus, it is not a buy or sell decision for me but rather how big the portfolio weighting should be. Most Coronation portfolios already have a sizeable position in ABI. It is likely to get bigger over time. Disregard Leviathan at thy peril.

This article is for informational purposes and should not be taken as a recommendation to purchase any individual securities. The companies mentioned herein are currently held in Coronation managed strategies, however, Coronation closely monitors its positions and may make changes to investment strategies at any time. If a company’s underlying fundamentals or valuation measures change, Coronation will re-evaluate its position and may sell part or all of its position. There is no guarantee that, should market conditions repeat, the abovementioned companies will perform in the same way in the future. There is no guarantee that the opinions expressed herein will be valid beyond the date of this presentation. There can be no assurance that a strategy will continue to hold the same position in companies described herein.