SA FLAGSHOP FUND UPDATE - April 2017

Our funds have emerged well from an extremely turbulent start to the year.

The FTSE/JSE All Share Index’s return of 3.8% for the first quarter (2.5% for the rolling 12-month period) belies the sharp sell-off in locally focused shares following the surprise cabinet reshuffle at the end of March. Domestic investors have also seen a currency shock and a surge in government bond yields in recent weeks in reaction to the political uncertainty.

We expect the domestic situation to deteriorate further, so we remain inclined to favour businesses operating outside of SA and will require a greater margin of safety before increasing positions in purely domestic businesses.

We do not believe that the decline in pure domestic stocks was large enough to adequately compensate investors for the deterioration in the macroeconomic environment and enhanced levels of risk. In aggregate, we think our portfolios are well positioned with an overweight position in rand hedge equities and limited exposure to domestic government bonds.

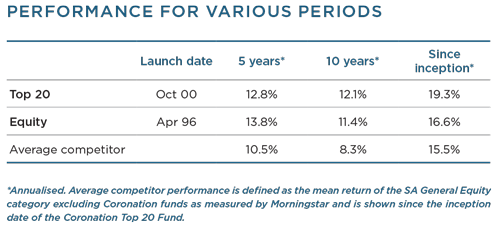

INVESTOR NEED: LONG-TERM GROWTH

Domestic general equity funds

Both our flagship equity funds have delivered a strong performance in a volatile environment. Rand hedge holdings, which we believe offer compelling stock-specific fundamentals, remain the cornerstone of these strategies. While Top 20 only invests in locally listed shares, the Equity Fund is close to its maximum 25% exposure to foreign shares.

Our rand hedge industrial holdings, such as Naspers, British American Tobacco and Mondi (which in particular continues to deliver a steady earnings growth profile and good cash generation) have had a solid start to the year, notwithstanding relative rand strength. Despite the political events, the rand ended the quarter 2.1% stronger (up 9.3% over the rolling 12 months). Although the rand has weakened since quarter-end, we believe it is still pricing in a relatively optimistic political and economic outcome.

Prices in the resource sector spiked towards quarter-end, with Northam Platinum (up 27%), Exxaro (up 32%) and Glencore (up 13%) gaining ground. Although we have taken profits in some of our resource holdings, we retain a healthy weighting in the sector. The platinum sector remains an interesting one. Although these equities have recovered strongly off their lows, they remain depressed. A stock like Impala still trades 87% off its peak at the top of the commodity market in 2008, and at a 50% discount to its book value. Platinum group metals markets are in deficit and the industry cannot survive at current prices. We think there are significant opportunities, should prices increase to a level sufficient to keep platinum miners in business. Northam is our key pick in the sector. It is a low-cost producer with less labour-intensive operations than its peers, and a strong balance sheet.

We increased exposure to MTN during the quarter. The share has halved from its peak a few years ago and sentiment is currently very negative. Although the risks inherent in regions such as Nigeria and Iran are high, we believe that the potential upside in the stock justifies our current weighting.

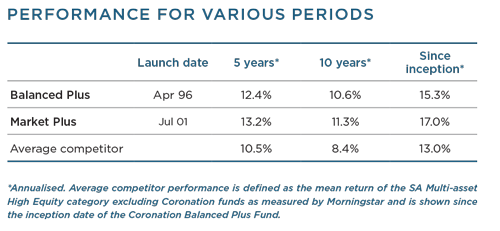

Multi-asset class funds

Our balanced funds performed well during the quarter but more importantly continue to outperform over the more meaningful periods shown above. Despite great uncertainty, locally and globally, the funds have a high allocation to growth assets (equity and listed property). These funds are managed to meet the needs of investors who still have decades to invest, where the biggest risk lies in inflation eroding real capital values over time. In aggregate, we think the funds are well positioned, with offshore exposure close to maximum levels, low holdings in domestic government bonds and local equities tilted towards businesses with offshore earnings streams.

Our global equity position, which includes an allocation to other emerging markets, has delivered a strong outperformance. Emerging markets sustained their rally into the new year, after a strong 2016. Our overall allocation to offshore assets is sitting close to its maximum, as we are very concerned about the risks in SA.

In our domestic exposure, our allocation to resource shares has contributed to performance. Our underweight position in companies that are sensitive to domestic interest rates and the local economy has also been beneficial, as these companies have been hit hard following the recent replacement of the finance minister.

Our property allocation includes domestic SA property holdings, UK property stocks listed on the JSE and some high-quality domestic counters. We consider UK listed property an exciting opportunity for the patient investor. Our largest holding is Intu, a portfolio of high-quality shopping centres. We expect the local property sector to show mid-single- digit growth in distributions over the medium term. Reasonable distribution growth, combined with an attractive initial yield (typically in the 8% to 10% region), should result in an attractive holding period return.

We have been very underweight government bonds for some time, and have maintained this position. Global bond markets remain very expensive due to central bank buying strategies. Locally, the market does not fully price in the risk of greater budget deficits in the event that economic growth weakens and potential political demands on the Treasury increase.

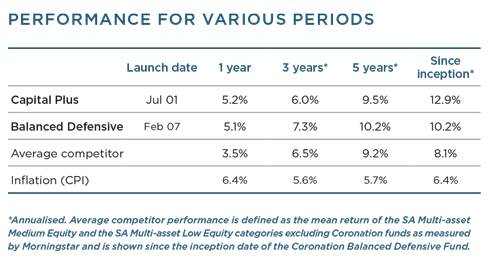

INVESTOR NEED: INCOME AND GROWTH

Multi-asset funds

Despite the volatility towards the end of the quarter, the funds protected capital well over the period. Disappointing returns relative to inflation over the past three years bear testimony to the tough investment environment in which real returns in the interest-bearing areas have been far lower than the historical trend. Sluggish economic growth has also limited the ability of domestic companies to grow profits, as reflected in the FTSE/JSE All Share Index trending sideways.

Given the well-diversified multi-asset nature of the strategies, we construct the portfolios to withstand unforeseen events. In the case of SA, the rand invariably acts as the biggest shock absorber and owning a high proportion of domestically listed companies that derive the bulk of their earnings from outside the country has again proven to be a prudent approach.

Global stock markets were generally strong, driven by expectations of positive policy changes by the Trump administration (such as lowering corporate taxes). However, the markets have in our view ignored the risks of tensions in the global economy as president Trump advocates protectionism through his ‘America First’ approach. We consequently decided to reduce our exposure to global risk assets somewhat by lightening both our developed and emerging market equity holdings. Still, we continue to hold close to the maximum allowable exposure to global assets. We have navigated uncertain periods before by steadfastly focusing on the tenets of our long-term, valuation-driven investment philosophy and, once again, we have seen it pay off in the most recent performance of our portfolios.

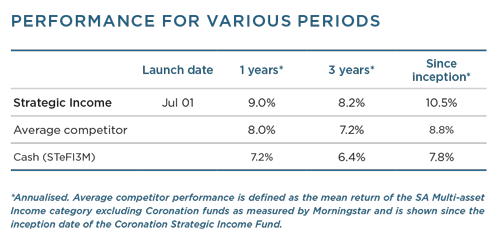

INVESTOR NEED: IMMEDIATE INCOME

Income fund

The fund comfortably met its objective of providing a better return than a traditional money market fund for investors with a time horizon between one and three years.

We remain vigilant of risks emanating from the dislocations between stretched valuations and the underlying fundamentals of the SA economy. However, we believe that the fund’s current positioning correctly reflects appropriate levels of caution. The fund’s yield of 9.1% continues to be attractive relative to its conservative duration risk. We continue to believe that this yield is an adequate proxy for expected fund performance over the next 12 months. As is evident, we remain cautious in our management of the fund. We continue to invest only in assets and instruments that we believe have the correct risk and term premium, to limit investor downside and enhance yield. For a detailed investment review of all our funds, please refer to our fact sheets and commentaries in the Funds & Products section of www.coronation.co.za.