Quarterly Publication - October 2017

Avoid the post-retirement trap - October 2017

Investors in our income-and-growth funds (Coronation Capital Plus and Coronation Balanced Defensive) may feel unhappy with their recent returns, due to a confluence of factors.

First, the markets have until recently been going nowhere. Equities, bonds and cash have barely beaten inflation over the three years to end-September. Further, with the three asset classes having delivered similar returns (roughly 7% per year) over this period, investors were not compensated for taking on additional risk.

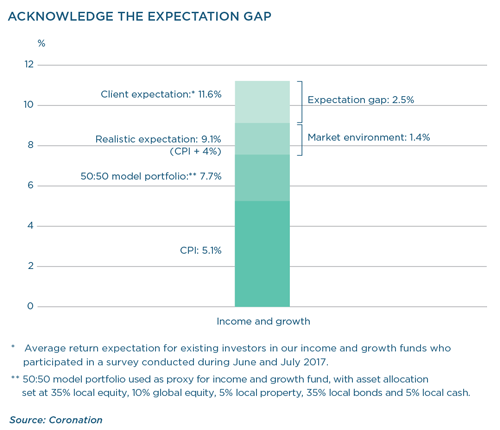

This has resulted in a subdued performance over the recent years, which may have been experienced as particularly painful due to an additional factor: unrealistic expectations. Notwithstanding forewarnings from ourselves and other investment managers, many investors did not expect the sharp slowdown in market returns over the past three years. In fact, a recent client survey showed that the return expectations for these funds remain on the high side.

The survey found that the average expectation of an 11.6% annual return for income-and-growth funds are almost similar to the 12.4% expected for long-term growth funds – an unrealistic assumption given that income-and-growth funds take on significantly lower risk. In our view, a more realistic return expectation for our absolute return funds is CPI plus 4% (in the case of Capital Plus) and CPI plus 3% (in the case of Balanced Defensive). Unfortunately, in the recent past this was a near-impossible target to achieve, given the mediocre returns delivered by the underlying building blocks.

In reaction, many frustrated investors across the industry have moved their savings away from income-and-growth funds which have exposure to shares (equities). An estimated R20 billion has been withdrawn over the past year, and a lot of the money has ended up in more conservative options, including managed income funds and cash deposits.

After all, why take on more risk by investing in shares if you can get the same level of return from lower-risk options? Recent performance provides part of the answer: markets rally when you least expect it. At the time of writing, the 7% average return from equities over three years mentioned earlier has morphed into 10.4% per year, while cash and bonds are still at 7% per annum.

Conservative investors need some exposure to growth assets to be able to maintain their spending power through retirement. Ultimately, we strongly believe that the key risk that more conservative income-and-growth investors need to avoid – counterintuitively – is not taking on enough risk.

Also, we see better days ahead for shares. We are more upbeat about domestic equities than we were three years ago when the market was expensive. There are many SA businesses for which the expected returns going forward look better than they have for quite some time. Most of that has to do with the fact that the base is so low.

If our macroeconomic outlook improves just a little bit, and companies are able to improve their topline only by a small margin, one can easily expect to see a decent improvement in earnings.

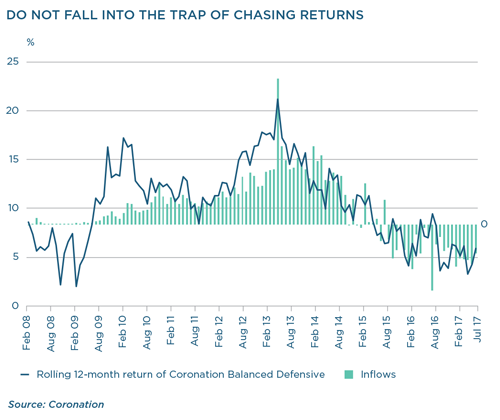

Further, investors should avoid falling into the trap of chasing returns, as is clear from the graph below. Investors tend to commit capital when returns have been good and withdraw after they experienced a tougher time. We do not believe this to be an appropriate investment strategy for long-term investors. Ultimately, one requires the patience to look beyond any short-term pain and avoid locking in any losses by selling low and buying high.

INVESTMENT LIMITS AND BENCHMARK CHANGES

To ensure we maximise investment outcomes for our clients in Balanced Defensive and Capital Plus, we are making incremental changes to their risk budgets.

This will bring these funds’ ability to take risk in line with the limits applicable to their existing fund classification categories, while still allowing the retention of their dual objectives (delivering real growth over time while preserving capital over the shorter term). We believe these changes will further enhance client outcomes over time.

The funds’ ability to invest in growth assets (defined as equity, listed property and commodity holdings) will increase. For Balanced Defensive, its risk budget will increase from 40% to 50% and for Capital Plus from 60% to 70%.

The maximum effective equity exposures will remain at 40% for Balanced Defensive and 60% for Capital Plus to ensure the funds remain compliant with the equity limits applicable to the SA – Multi-Asset – Low Equity and Medium Equity categories respectively. This change in strategic asset allocation limits will become effective on 1 November 2017.

In line with increasing the risk budget for Capital Plus, we will also be changing its dual objective from a 12-month capital preservation target to an 18-month capital preservation target. The primary objective of outperforming CPI plus 4% over the long term will remain unchanged. Capital Plus remains in our view the appropriate portfolio to fund an income drawdown programme over an extended period of time.

To better reflect the difference in positioning between the two funds, the benchmark for Balanced Defensive will be changed to CPI plus 3% from Cash plus 3% (with cash returns measured using the Short Term Fixed Interest Three-Month Index). Both Capital Plus and Balanced Defensive are clean-slate funds focused on producing real returns, and it therefore remains appropriate to measure long-term outcomes against an inflation target. Using the same base metric for both income-and-growth funds makes positioning easier to understand and more clearly communicates return expectations.