Quarterly Publication - July 2016

MTN - July 2016

The last year has been a dramatic one for MTN. After more than a decade of growing to become the largest mobile operator in Africa and the Middle East, the company found itself facing a multitude of headwinds. The deteriorating economic environment in key markets such as SA and Nigeria started putting pressure on its organic growth. Also, the business had not invested adequately in its network and was slow to recognise the global trend in mobile usage away from voice and towards data. As a result, the company was losing market share to more agile competitors who had better network capacity. And then, in October 2015, news emerged that the company was being fined $5.2 billion for a delay in disconnecting subscribers who were improperly registered on MTN’s Nigerian network.

The magnitude of the fine was extraordinary by global standards, for any industry. Previously, the largest telecommunications fine was $1.3 billion, levied on Djezzy Telecom for breaching foreign exchange regulations in Algeria in 2012. In other industries, the largest fine given by the US Justice Department to an automotive manufacturer was $1.2 billion in 2014 to Toyota after a faulty accelerator mechanism led to 37 deaths. General Motors was fined $900 million for an ignition switch defect that caused 174 deaths. Earlier this year, a BHP Billiton and Vale joint venture negotiated a settlement of $1.1 billion over 15 years for compensation and repair costs following a dam disaster in Brazil that caused 17 fatalities.

Subscriber registration has been an ongoing process in Nigeria. The requirements are onerous (akin to the biometric capturing of individual details) and obtaining complete subscriber information in the absence of a national identity database is difficult. A new, more security-conscious political regime felt it was imperative to have a quick cleanout of unregistered subscribers in an effort to tackle terrorism. Mobile operators were given seven days to comply. According to the Nigerian regulator only MTN did not meet this deadline.

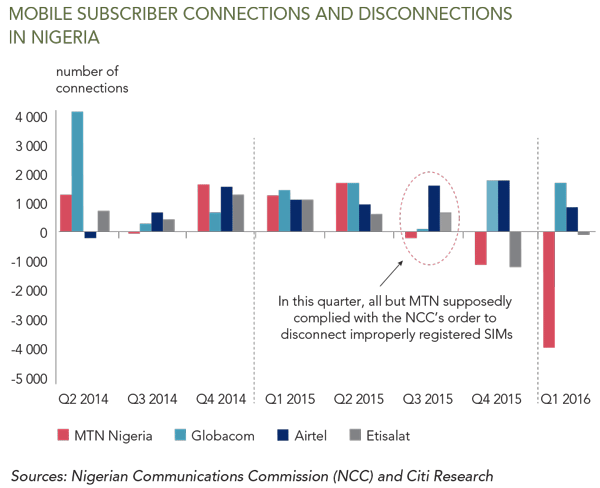

This assertion was not easy to confirm or dispute at the time. However, our channel checks with competitors and ex-employees, as well as analysis of the quarterly reported subscriber numbers published by the Nigerian regulators, seemed to suggest that MTN had been singled out. The official data (shown in the bar graph below) show that, in the third quarter of 2015, only MTN showed net subscriber disconnections. Every other operator (Globacom, Airtel and Etisalat) showed net additions – despite the regulatory requirement to disconnect unregistered users.

In addition to the fine, the Nigerian regulator also proceeded to suspend regulatory services to MTN. The suspension of these services effectively hamstrung MTN’s competitive position as it was not allowed to implement any promotions or new tariffs. This led to a direct loss of market share to competitors. The quantum of the fine and the suspension of services highlighted the extent to which the relationship between MTN and the Nigerian regulator had broken down.

The share price reaction to these events was swift and brutal. In the space of three months, the market wiped $10 billion off the market capitalisation of the company, almost twice the initial fine amount. News headlines from the Nigerian press were extremely negative, unofficial comments from the regulator were not encouraging and there was no consistency in the official communications on the fine. In December 2015, MTN was notified that the fine was reduced by 35%. Then, a day later, this was changed to 25%! Compounding the relentless newsflow was further macro pressure with poor Nigerian GDP growth and investors questioning the sustainability of a pegged exchange rate.

Although we held MTN in our portfolios when the fine was announced, it was an underweight position across most of our funds. While there was a lot of conflicting newsflow and confusion following the fine announcement, we thought that the share price presented an interesting investment opportunity. The market’s attention was focused only on Nigeria: the negative issues around the fine, the economy and the exchange rate. While it is a big market for MTN, its other key operations in Iran and Ghana were performing well and SA was staging a recovery after years of underperformance. All operations were generating good cash flow.

Also, the company was using the tough economic environment in Nigeria to deepen the moat around its business. Despite the tense regulatory relationship, MTN still managed to renew its mobile licence for a reasonable payment and received approvals to make spectrum acquisitions. With the growing demand for data services in Nigeria, this would expand MTN’s network capability and entrench its market leadership.

By March 2016, regulatory services were restored, allowing MTN to once again be competitive in the market from a pricing perspective.

MTN’s share price also posed very little downside from a valuation perspective. It had already more than discounted the full initial fine amount of $5.2 billion. The company had a fortress balance sheet with no net debt and was in a position to pay the full fine amount without the need to raise equity capital. Even after adjusting for the fine, the market’s rating of the business looked very cheap compared to a basket of emerging market telecommunication peers.

The shock of the fine had also prompted a deep introspection within MTN and a recognition by the board that some fundamental changes to the company’s culture and strategy were required. Chairman Phuthuma Nhleko stepped into the CEO role on an interim basis to implement some of these changes. The company made the decision to increase its capital expenditure programme in key markets. Fresh management and board skills were brought in to enhance governance, improve the culture and unlock efficiencies. Our previous experience has taught us that it is dangerous to underestimate the long-term benefits of a high-level change in direction, especially in a business that was not achieving its full potential.

With this long-term perspective in mind, we took the decision to increase our MTN position and moved to an overweight position in our funds. Our discussions with competitors and regulators, as well as with board and management members, solidified our view that regardless of the final amount to be paid to resolve the fine, the company was on the path to making fundamental business changes. None of this was reflected in the market price.

Towards the end of June 2016, the fine was settled at $1.7 billion, payable in instalments over three years. The present value of this fine is much lower at around $1 billion. Subsequent to that, the Central Bank of Nigeria announced a move away from the pegged currency towards a more flexible exchange rate regime. With this implemented, dollar availability has improved in the country and businesses should be able to extract cash from Nigeria. Finally, we saw the announcement of Rob Shuter as the new MTN group CEO. Shuter will be a positive appointment for MTN as he has financial experience from his time with Vodacom as financial director, as well as operational experience as CEO of Vodafone’s European cluster. We think he will bring good capital allocation skills and improved operational discipline to MTN. He is further supported by a strengthened board, which now also includes Paul Hanratty (formerly with the Old Mutual Group) and Stan Miller (from the US investment company Capital Group and executive chairman of MTS, a Russian mobile operator) among others.

It was not an easy or a comfortable decision to increase our position size in MTN. But the fear in the market granted us an opportunity to make an investment which would be to the long-term benefit of our clients. The resolution of these issues will bring about some short-term pain for the group, but the overall business fundamentals still look attractive. MTN has a market-leading footprint in key countries that is very difficult to replicate. While not immune to macro pressures, it has a relatively defensive business model. Data penetration across key markets is still at very low levels and growth will be supported by the increased availability and affordability of smartphones. Its balance sheet strength is not to be underestimated. In most markets, competitors are unable to match MTN’s level of capital spend on its network. The business is able to fund elevated capital expenditure, while still supporting a decent dividend yield.

All of these factors, along with improved management and board skills, will be a powerful combination that can deliver good long-term returns to the patient long-term investor.

This article is for informational purposes and should not be taken as a recommendation to purchase any individual securities. The companies mentioned herein are currently held in Coronation managed strategies, however, Coronation closely monitors its positions and may make changes to investment strategies at any time. If a company’s underlying fundamentals or valuation measures change, Coronation will re-evaluate its position and may sell part or all of its position. There is no guarantee that, should market conditions repeat, the abovementioned companies will perform in the same way in the future. There is no guarantee that the opinions expressed herein will be valid beyond the date of this presentation. There can be no assurance that a strategy will continue to hold the same position in companies described herein.

United States - Institutional

United States - Institutional