Quarterly Publication - April 2017

Factfile: Coronation Houseview Equity - April 2017

INCEPTION DATE

October 1993

PORTFOLIO MANAGERS

Karl Leinberger, Sarah-Jane Alexander and Adrian Zetler. Karl has managed the Coronation Houseview Equity Strategy since 2005. Sarah-Jane joined Coronation in 2008 and manages assets within the strategy. Adrian is co-manager and joined Coronation in 2009.

OVERVIEW

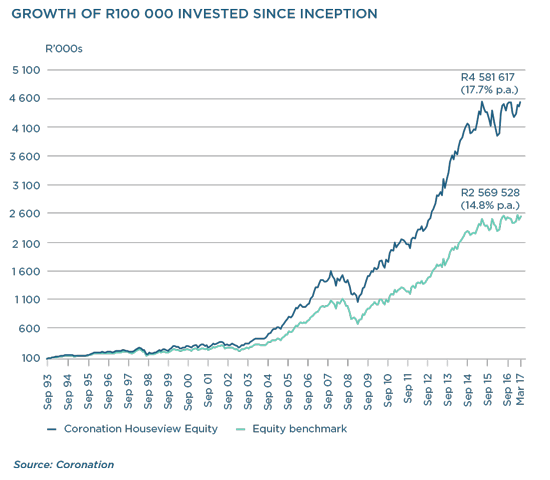

Coronation Houseview Equity is our flagship specialist South African equity strategy. Launched in 1993, it boasts a compelling track record of almost 24 years of material outperformance of the South African equity market. Having recently been re-opened to new investors after a five-year closure we are pleased that this offers more of our institutional clients the opportunity to share in this strong performance.

MANDATE

Coronation Houseview Equity represents our best investment view for an equity mandate. The portfolio is constructed on a clean-slate basis with no reference to a benchmark. As such, we seek to identify the most compelling risk-adjusted returns in the South African market with the aim of outperforming the equity market over meaningful periods (defined as at least five years). Our aim is to replicate the outperformance of the market that this strategy has achieved historically.

PORTFOLIO CONSTRUCTION

Coronation is a long-term, valuation-driven investment house. Our aim is to identify mispriced assets trading at discounts to their long-term underlying value (fair value) through extensive proprietary research. Coronation Houseview Equity comprises the strongest conviction ideas from our research process – and therefore our view of the most undervalued listed shares in South Africa, given our long investment horizon.

We do not define risk as volatility, tracking error or divergence from a benchmark but rather as the probability of a permanent loss of capital. Across all of our mandates, we consistently aim to construct robust, antifragile strategies that are sufficiently diversified across our highest conviction investment ideas. We believe that a diversified portfolio of undervalued assets is the best protection an investor has in an uncertain world.

COMPELLING TRACK RECORD

Coronation Houseview Equity has delivered a return of 17.7% per annum since inception almost a quarter of a century ago, outperforming its benchmark by 2.9% per annum during this time. This track record has been produced during various market cycles and periods of unprecedented macro volatility.

A defining feature is the consistency and persistency of the long-term alpha produced, unusual by local and global standards. We believe this is the result of a disciplined focus on investing only in businesses that are trading at a discount to our assessment of their real long-term value.

* The performance shown here is for informational purposes only and is meant to demonstrate the performance of Coronation’s longest running strategy. The Houseview Equity Strategy is not marketed to US investors and the performance shown here is not indicative of performance that would have been achieved in any other Coronation strategy, including those marketed to US investors. Investors should carefully review the materials and disclosures for the strategies they are interested in. The performance shown is gross of fees. Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. The volatility of the FTSE/ JSE Africa Capped All Share Index (CAPI) represented above may be materially dierent from that of the Houseview Equity Strategy. In addition, the holdings in the accounts comprising the Houseview Equity Strategy may dier significantly from the securities that comprise CAPI. The CAPI has not been selected to represent an appropriate benchmark to compare the Houseview Equity Strategy’s performance, but rather is disclosed to allow for comparison of the strategy’s performance to that of a well-known and widely recognized index. The CAPI is constructed in the same way as the JSE All Share Index but constituents with a weight larger than 10% are capped at 10% at each quarterly review.

United States - Institutional

United States - Institutional