Quarterly Publication - July 2017

L BRANDS - July 2017

L Brands is a global retailer with a long history of success, a loyal customer base and a dominant brand in a compelling category of apparel retail. Its leading brand should be familiar to most as it is a name synonymous with lingerie globally – Victoria’s Secret. Besides Victoria’s Secret the company owns PINK (the younger sister brand to Victoria’s Secret), Bath & Body Works, La Senza and Henri Bendel.

Les Wexner founded the company in 1963 and today is the longest serving executive in the Fortune 500 at 55 years – even longer than Warren Buffett!

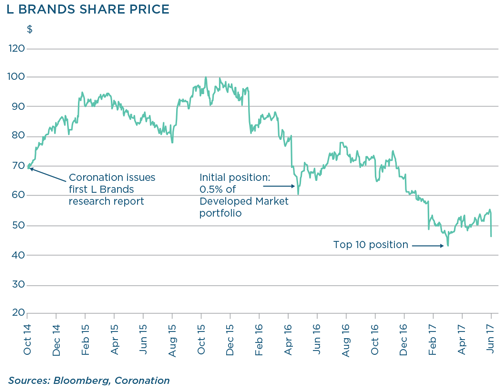

When we first did detailed work on L Brands we liked the fundamentals of the company, but there was insufficient margin of safety due to its high valuation. Accordingly, we originally chose not to own any shares. A series of subsequent short-term struggles at Victoria’s Secret caused the price to drop (50% from its peak at one stage), allowing us an opportunity to build a position. The fundamentals still remain attractive, but the share now trades for less than we think it is worth. We address the concerns and the investment case for L Brands in this article.

RECENT CONCERNS

We believe the struggles faced by Victoria’s Secret are short term in nature and do not affect the long-term attractiveness of the company. Firstly, Victoria’s Secret chose to cease selling swimwear, apparel and footwear in 2016 which, combined, accounted for $525 million (c. 7%) of revenue. These categories were deemed noncore, lower return and more seasonal, leading to increased markdown risk and pressure on margins. Freeing up store space that was used by these categories could also be utilised better with higher-return categories, for example sports and beauty.

Secondly, management decided to significantly reduce direct mail couponing and replace it with targeted category and product promotions instead. Although this has pressured near-term results, these strategic changes are beneficial to the sustainability of the brand and the long-term returns and earnings power of the company.

These changes also coincided with broad-based weakness in overall US retail sales, with multiple store closures (especially department stores) and the continued growth of online retail. The underlying narrative for any retailer with an extensive store base is not favourable and has led to further negative sentiment towards the retail sector as a whole. Having first owned shares in Amazon in 2011 we are fully aware of the threat online retail poses to traditional bricks-and-mortar shops. However, Victoria’s Secret has key attributes which differentiate it from other retailers. Firstly, it is focused primarily on lingerie, a category which is more attractive than general apparel due to the emotive nature of the product which engenders high customer loyalty and repeat purchases. This results in industryleading store productivity (on a sales per square foot basis), with 99% of stores generating positive free cash flow (after tax).

Furthermore, L Brands also enjoys significant lease protections¹ as its ‘destination’ stores drive traffic to malls. These protections create flexibility in what is typically a large fixed cost for most retailers. Victoria’s Secret also has aboveaverage ecommerce penetration (20% of domestic sales versus the industry average of 13%) and is therefore well placed to adapt to changing shopping habits and potentially capture market share as competitors close doors.

So while L Brands works through these headwinds (which impact near-term earnings), we believe the strengths of the business are as relevant today as when we first researched the company three years ago.

BRAND POWER

In a world where anyone can call up a product on a smartphone and where multiple brands are competing for a share of the consumer’s wallet, ownership of a compelling brand is vitally important to stay relevant and grow. In fact, it is almost impossible to place an explicit numerical value on it. This is something management clearly understands, given the growth of Victoria’s Secret into the dominant global lingerie brand over many years. The Victoria’s Secret Fashion Show, a springboard for many successful international models’ careers, is shown in nearly 200 countries and has generated 100 billion media impressions worldwide. It has a strong social media presence, with 27 million Facebook followers and 56 million Instagram followers, and is the market leader in the fragmented lingerie category, with market share of approximately 27% in the US.

PINK is the sister brand to Victoria’s Secret aimed at university-age women. The brand was created internally to address the younger consumer and has grown to a sizeable business with industry-leading productivity metrics (over $1 000 sales per square foot). PINK also has a strong social media presence, with 13.6 million Facebook followers and 7.2 million Instagram followers.

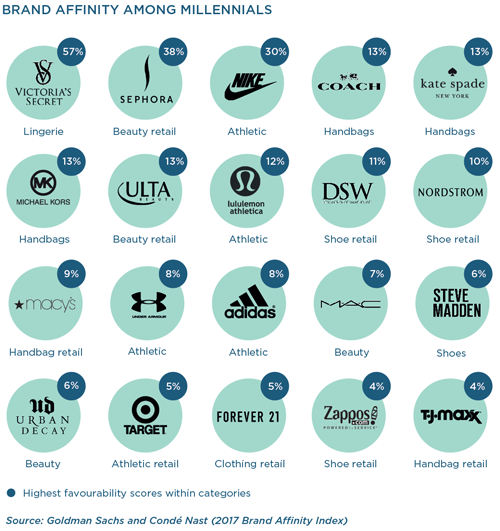

Recently Goldman Sachs, in partnership with Condé Nast, conducted a survey which focused on millennial female shoppers’ affinity for various brands. Victoria’s Secret was the clear leader in the lingerie space, more than eight times more favoured than the second-placed brand. Victoria’s Secret dominates its category more so than any other brand, beating Nike, lululemon, Coach and Michael Kors, to name a few. According to the survey, the millennial shopper controls over one quarter of dollars spent in fashion categories already and their spending will increase almost 40% in the coming 15 years due to rising disposable income. With its high brand affinity, Victoria’s Secret is well placed to capture a fair share of this increasing spend.

INTERNATIONAL POTENTIAL

L Brands has followed an approach unlike most other retailers with regard to its international expansion. While many retailers rapidly expanded through a combination of wholesale sales, franchise agreements and their own stores, L Brands focused first on succeeding in the North American market and building its brand premium. In 2016, international revenue only accounted for 3% of total revenue.

With a globally recognised brand portfolio (particularly Victoria’s Secret), there is clearly a significant international growth runway remaining. Its brand and customer experience remain the highest priority for management and as such the company has approached its expansion in a steady and measured way, ensuring that every store around the world meets strict standards (unusually for a retailer, it gives final approval on all store locations for franchise partners).

International growth is focused on a few key geographies – Europe, the Middle East and most recently (and importantly) China. China is a market with massive long-term potential, highlighted by the company’s decision to assume control from its former franchise partner and operate its own stores and ecommerce (in partnership with Alibaba). The opportunity is sizeable as China could be the same size as the US business in time. Victoria’s Secret is already well recognised in China and management intends to have the 2017 Fashion Show in Shanghai, confirming its commitment to the country. We believe that the international potential for L Brands is incredibly attractive and will be a revenue and earnings growth theme that plays out for many years.

MARGIN POTENTIAL

L Brands has multiple avenues for future operating margin improvement from 2016 levels.

The aforementioned strategic changes have depressed merchandise margins due to the need to discount product in order to clear it quickly. The new targeted promotional strategies should also result in fewer margin-dilutive promotions. For example, in the past, direct mailers were used to offer a free pair of underwear (no corresponding purchase required) and 40% of customers simply came into store to collect their free product with no additional purchase. Clearly, giving away products for nothing is very dilutive to margins.

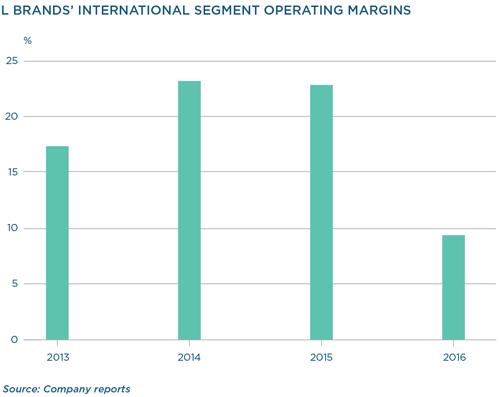

L Brands’ decision to enter and roll out stores in China with its own team also does not come without short-term costs. It has depressed margins in the international segment, which historically earned higher margins than the core company. However, as the Chinese business gains scale over time we expect margins to improve meaningfully from current levels.

CONCLUSION

L Brands owns world-class brands, with leading market positions in attractive categories. Although cyclical, the company has tremendous potential to grow as it expands internationally.

“Long ago, Ben Graham taught me that price is what you pay; value is what you get”, Warren Buffett wrote in a Berkshire Hathaway shareholder letter nearly a decade ago. “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.” As investors, much like consumers, we are constantly on the lookout for markdowns like these. But the skill lies in determining whether the headwinds the company faces are cyclical or structural, a once-off or a permanent (value-destroying) change. In our view, the challenges L Brands faces today are mostly temporary and short term. We believe L Brands is quality merchandise that has been temporarily marked down.

¹ Should the occupancy of a mall fall below a certain level or anchor tenants leave, L Brands’ rental costs drop and it is able to vacate on short notice with no financial penalty.

This article is for informational purposes and should not be taken as a recommendation to purchase any individual securities. The companies mentioned herein are currently held in Coronation managed strategies, however, Coronation closely monitors its positions and may make changes to investment strategies at any time. If a company’s underlying fundamentals or valuation measures change, Coronation will re-evaluate its position and may sell part or all of its position. There is no guarantee that, should market conditions repeat, the abovementioned companies will perform in the same way in the future. There is no guarantee that the opinions expressed herein will be valid beyond the date of this presentation. There can be no assurance that a strategy will continue to hold the same position in companies described herein.

United States - Institutional

United States - Institutional