Quarterly Publication - July 2017

MOBILE MONEY IN FRONTIER MARKETS - July 2017

Certain brands are not only well known, they are so renowned that they have actually become generic terms for products. People will refer to any bandage as a Band- Aid, or will call a hot tub a Jacuzzi, irrespective of whether it was actually manufactured by these companies. Other brands have become verbs: you often hear people say, “I will Uber home”, and just think how frequently we use the phrase, “Let me Google it”.

When you visit Kenya you will find another brand that has become a verb – M-Pesa, the leading mobile money business in the country. “Should I just M-Pesa you the money?” is commonly heard and is evidence of a business that has become completely entrenched in the Kenyan economy. M-Pesa is owned by Safaricom, the leading mobile operator in Kenya. Safaricom recently became particularly relevant for South African investors when Vodacom announced in May 2017 that it will acquire a 35% stake in the company.

We have been following Safaricom closely since we participated in its listing in 2008. We have held this company in different sizes in our portfolio for many years, and as a result our Global Frontiers team, as well as many of our South Africa-focused analysts and portfolio managers, is very familiar with this business.

Typically it is our years of experience investing in South Africa that assist us in analysing companies in frontier markets, but in some cases, like with Safaricom, it is our experience in Kenya that helps us to better analyse an investment in South Africa.

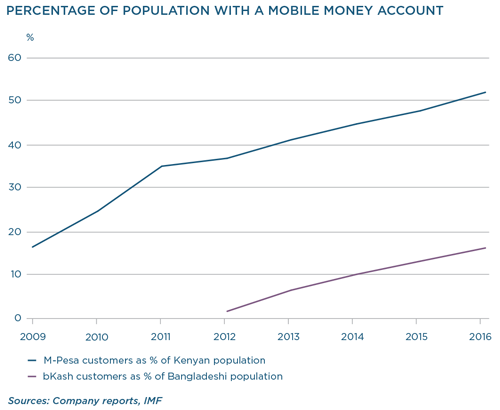

Safaricom’s telecommunication business is highly cash generative and offers attractive growth due to low mobile and data penetration in Kenya. The risk of aggressive price competition is also small due to the low profitability levels among its competitors and the fact that tariffs in Kenya are already among the lowest in Africa. In addition to these factors, what really excites us is the potential of M-Pesa, a business started in 2007 as a service to transfer money using your mobile phone. M-Pesa was specifically targeted at people without a bank account, evidenced by its first advertisement campaign with the simple slogan “Send money home”. The low banking penetration and supportive regulations, particularly at the time when M-Pesa was launched, resulted in a rapid uptake. M-Pesa now accounts for 27% of Safaricom’s revenue and has grown to 26 million customers, 19 million of whom were active in the past 30 days. This means that two out of every five Kenyans have used M-Pesa in the last month!

Today, M-Pesa is a phenomenal ecosystem with a strong moat of agents and satisfied customers, as well as large economies of scale. The velocity of money within M-Pesa is quite spectacular and continues to grow. In the most recent financial year alone, $18 billion was deposited into the system and $16 billion person-to-person (P2P) transfers were made using M-Pesa.

The evolution from P2P transfers to an integrated payments platform is only just beginning. Supermarkets now allow customers to use M-Pesa to pay for goods, businesses increasingly use M-Pesa for bulk payments such as wages and you can now even buy government bonds using M-Pesa. The profit margins of these new services are significantly higher than for P2P transfers where Safaricom has to pay an agent commission every time money is deposited or withdrawn from the ecosystem. There is significant potential to add more services to the platform as over 90% of transactions in the Kenyan economy are still done with physical cash. M-Pesa is increasingly looking like a payments network such as Visa or Mastercard, whose attractive economic fundamentals are well documented.

M-Pesa has already begun to disrupt the banking landscape in Kenya. We have argued for many years that the Kenyan banking industry is simply too profitable, leaving the door open for disruptive competitors such as M-Pesa. Although M-Pesa currently does not have intentions to become a fully-fledged bank, we view this as a natural progression over time. We estimate that deposits in the M-Pesa system have grown to such an extent that they eclipse the deposits of at least 26 of the 40 banks in Kenya. Currently Safaricom is not entitled to keep the interest earned on the float (the interest is paid to charities), but there is significant potential to mobilise these deposits should M-Pesa get a full banking licence. In addition, we would argue that the information it has on customer behaviour, based on their M-Pesa transaction history, means that Safaricom’s ability to do credit scoring must be well ahead of many of the banks.

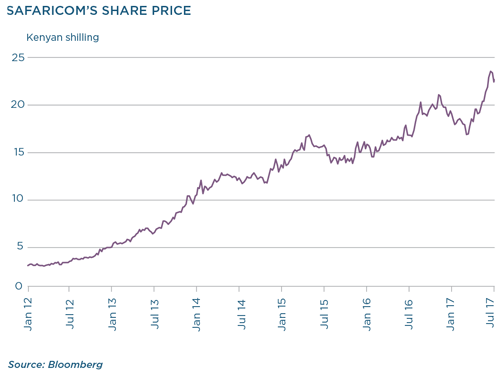

The following graph shows the share price performance of Safaricom over the past five years. During this period, the company often appeared to be expensive on near-term multiples, but by looking a number of years out and valuing the business based on what we believed to be a normalised earnings level, we continued to find the valuations attractive. We believe today is no different and that M-Pesa’s evolution over the coming years will continue to surprise investors.

Across frontier markets there are a number of countries that offer similar opportunities. The low banking penetration in countries like Mali and Pakistan offers the ideal environment for mobile money, while in Zimbabwe the tight liquidity environment acted as a boon for mobile money adoption. However, the investment opportunity we are most excited about is bKash in Bangladesh, another example of a brand that has become a verb.

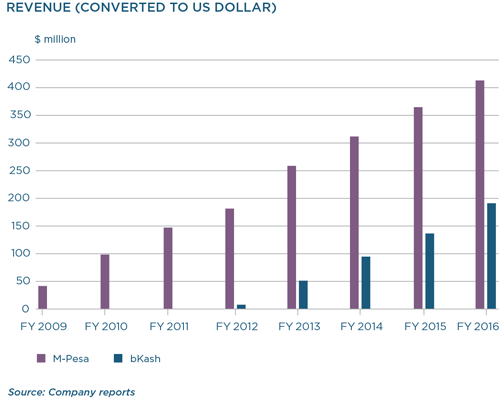

bKash has close to 80% market share of mobile money transactions in Bangladesh. The business is run by a management team with a lot of experience in mobile money and, similar to Kenya, Bangladesh has low banking penetration with supportive regulation, focused on financial inclusion in the country. We have seen that the network effect in a business like this is incredible, with the number of transactions growing exponentially as the number of users expands. This means that the strongest player usually just gets stronger and in this ‘winner takes all’ industry, bKash is extremely well positioned to capture the Bangladeshi mobile money market. We believe that bKash is today where M-Pesa was about four or five years ago, and if M-Pesa’s growth trajectory is anything to go by, bKash has enormous growth ahead of it.

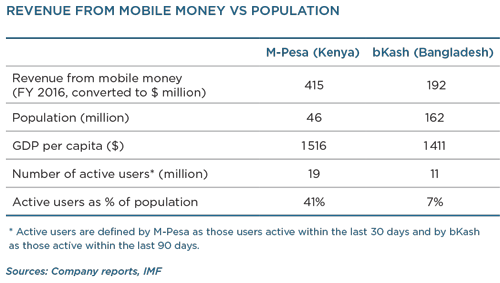

Firstly, bKash should experience strong revenue growth as the number of users and the transactions per user increase. The following table and graphs show that although Bangladesh’s population is almost four times the size of Kenya, its mobile money revenue is (still) significantly lower than that of M-Pesa, clearly highlighting the potential for bKash.

Secondly, the profit margin of bKash is still well below where it could be once this business reaches maturity. bKash is investing heavily to build its agent network and entrench its market position. This, as well as the fact that virtually all its transactions are still the traditional lower-margin P2P transfers, both point to significant growth in margins in the future. The gross profit margin of bKash has grown to 19% in 2016, but this is well below that of M-Pesa, which we estimate to be in excess of 50%. Over time, we see no reason why bKash cannot have similar gross profit margins as the business matures and new high-margin services are added to the bKash platform.

When it comes to net profit margins, bKash should be able to achieve margins well above that of M-Pesa, given that it is entitled to the interest earned on the float balance. If M-Pesa had this benefit, its profit margin would have been more than 10 percentage points higher. Many articles have been written on the benefits of a business which generates float, usually quoting Warren Buffett’s explanation that float is essentially free money which a business can use to invest. The bKash float has grown rapidly from $50 million in 2013 to over $200 million currently. The float has the potential to be a multiple of this balance in a few years’ time and, similar to M-Pesa, we believe the ability of this business to gather these cheap deposits is a major threat to banks.

Currently investors can get exposure to bKash through its listed parent, BRAC Bank. We expect that bKash will be unbundled from BRAC Bank at some point in the future – firstly to give investors direct exposure to this attractive business, but also to allow bKash even more freedom to pursue new products and services which will inevitably compete with its parent. Similar to Safaricom, we believe that while the BRAC Bank valuation might look stretched on near-term multiples, the share price does not yet fully reflect the growth potential and optionality inherent in the mobile money business. We believe this offers an attractive opportunity for long-term investors.

United States - Institutional

United States - Institutional