Quarterly Publication - October 2017

Emerging Markets - October 2017

Over the years, we have repeatedly made the case for a direct allocation to emerging markets, as they are underrepresented in major global indices and under-researched by the world’s investors.

Through frequent crises and downswings, we encouraged investors not only to keep the faith, but also to look through the short-term news and focus on the long-term potential. At times, this may have been severely tested as currencies and commodities saw collapsing prices and political shocks wreak havoc on asset prices. We continue to emphasise that there are always investment opportunities present in emerging markets. Emerging market behaviour is far more inefficient than that of developed markets, creating ongoing mispricings from which an active, valuation-driven investor can benefit.

Since the most recent crisis, emerging markets have staged a strong and broad recovery, and the IMF now expects growth of 4.6% this year (and 4.9% in 2018) from these countries. In contrast, advanced economies are expected to expand by only 2.2% in 2017, before slowing down to 2% next year.

The road ahead will be bumpy and one should never expect that emerging market countries will not pose challenges to investors from time to time. Still, despite many daunting challenges, we do believe that the positive trajectory for these countries is growing ever clearer.

In the long run, emerging markets will continue to benefit from structural drivers that are simply not present in developed markets. With younger populations, formalising economies and vastly untapped consumption potential, emerging markets undeniably offer a higher rate of growth potential. An example is China, where only 55% to 60% of the population has access to the internet (compared to an average of 80% in developed markets). Hundreds of millions of consumers still need to be connected, holding massive potential for many consumer and internet companies. Also, while 90% of US households own at least one vehicle, only 6% of households in the Philippines own a car and 2% in Vietnam. In China, less than a fifth of households own their own car. This should provide a strong tailwind for growth in vehicle sales in emerging markets.

Similar structural growth stories are playing out across a number of emerging market industries. A growing consumer class and a strong shift from the informal to the formal sector are benefiting many companies. These include the Russian food retail sector where national retailers continue to profit from the move away from ‘mom and pop independents’ and open-air markets to branded chains. They also include Indian private sector banks that look to benefit from both a capture in market share from the poorer run state-owned counterparts that still control 70% of the banking sector and the increase in financial services penetration of the relatively underbanked population.

Our valuation approach aims to value these businesses based on what we expect them to earn over the long term. We then look to use any short-term pressure on the share price as a buying opportunity if prices fall significantly below our estimate of intrinsic value. In addition, despite the strong run in emerging markets as a grouping over the past 18 months, we still see many companies that are trading at very attractive upside to their long-term value.

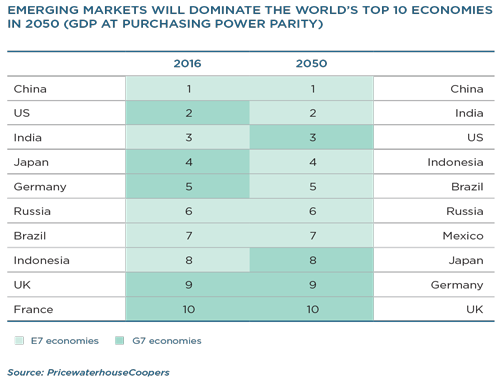

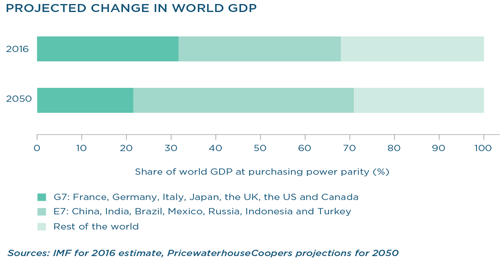

The strong supporting dynamics will drive emerging market growth for many years, and according to some projections, six of the world’s seven largest economies could be emerging markets by 2050. By then, Indonesia and Mexico are projected to be larger than Japan, Germany, the UK or France, while Turkey could overtake Italy.

Investors without emerging market exposure will fail to benefit from this massive economic shift. For those with a nervous disposition, we believe emerging markets are reaching scale and a level of maturity that bring with it a greater degree of predictability. So while the end of quantitative easing may have a negative impact on emerging markets, our base case is that emerging market economies today are far more robust and we would not expect a repeat of the ‘Volcker Shock’ when Latin American countries lost a decade of economic growth in reaction to sharp rate hikes in the US during 1979 to 1981. This time round, emerging markets are more resilient, with record-low inflation, flexible currencies and sheer size on their side. Their economies have matured; they are structurally much stronger and able to withstand volatility.

So the question shifts from ‘why emerging markets’ to ‘where in emerging markets’. The answer may be more difficult than you think:

A top-down only approach will not necessarily help you. The relationship between economic growth and equity returns has proven to be somewhat tenuous in emerging markets. Notwithstanding the positive economic drivers, we would emphasise that economic growth does not necessarily equal good investment returns, and in our experience, the countries with the rosiest outlooks do not necessarily offer the most attractive long-term investment opportunities.

Our emphasis is on stock selection rather than top-down geographic allocation or macro themes. Our own, unique research will determine what a share is worth (its fair value), and we will only invest if we think the current price is sufficiently below this level, thereby offering a significant margin of safety. This analysis is based on our own detailed modelling of all companies in our coverage list. This includes modelling revenue, cost and margins for at least five years out.

Our proprietary company research is supported by extensive first-hand scrutiny of potential holdings, including country visits and meetings with management, competitors, industry experts and other information sources.

Active management gets you the most benefit. We believe many of the best investments in emerging markets lie beyond the largest indices.

Notwithstanding the strong long-term emerging market investment case, global equity managers remain generally structurally underweight in emerging markets. For example, the MSCI All Country World index, the most important index for global markets, includes a much smaller emerging markets allocation than their share of global GDP would justify. This is because capital market development in these countries is not as evolved as their developed-market counterparts and many large emerging markets businesses have lower free floats than their peers in developed markets. When international investors do invest in emerging markets, it tends to be in a narrow universe of the biggest, most liquid names in the asset class.

Importantly, we do not believe the MSCI Emerging Markets Index is an appropriate reflection of all the value and investment opportunities in emerging markets. Many of the holdings in the index often are below-average businesses (particularly state-owned banks and energy groups), subject to significant state regulation. Often these companies are poor stewards of capital and exposed to cyclical earnings. We do not believe they represent the full opportunity set in emerging markets.

And just like any such index or by investing in an index fund, you would systematically own more overpriced stocks, sectors and countries and less of their underpriced counterparts. The importance of researching and selecting a portfolio of the best opportunities within emerging markets is even greater when the overall backdrop is challenging. You want to be confident that the investments in your portfolio are able to weather the storm and, in many cases, come out stronger on the other side. Accordingly, we build entirely clean-slate portfolios based on our assessment of the most compelling risk-adjusted investment opportunities in emerging markets. Our portfolios look very different to the index. In fact, we are comfortable taking decisive positions away from the benchmark when the investment case is compelling, as these positions are underpinned by convictions derived from our proprietary analysis.

We have identified many great businesses in fast-growing industries with small (or no) weightings in the index that have resulted in significant value creation for our clients over the years. This is evident in the performance of the Coronation Global Emerging Markets strategy which has delivered an annualised return of 6.7% (in US dollars, net of fees) since inception in 2008. The strategy has outperformed its benchmark (the MSCI Daily Total Return Net Emerging Markets USD) by 3.6% per annum, net of fees.

Given our expectation that all asset class returns may be lower going forward, exposure to these emerging market higher-growth opportunities, provided the right companies are bought at the right price, will remain vital.

The volatility of the MSCI Daily Total Return Net Emerging Markets USD (NDUEEGF Index) represented above may be materially different from that of the Global Emerging Markets Equity Strategy. In addition, the holdings in the accounts comprising the Strategy may differ significantly from the securities or components that comprise the MSCI Daily Total Return Net Emerging Markets USD (NDUEEGF Index). The MSCI Daily Total Return Net Emerging Markets USD (NDUEEGF Index) has not been selected to represent an appropriate benchmark to compare the Global Emerging Markets Equity Strategy’s performance, but rather is disclosed to allow for comparison of the Strategy’s performance to that of a well-known and widely recognised index.

United States - Institutional

United States - Institutional