Quarterly Publication - October 2017

Growth and Inflation - October 2017

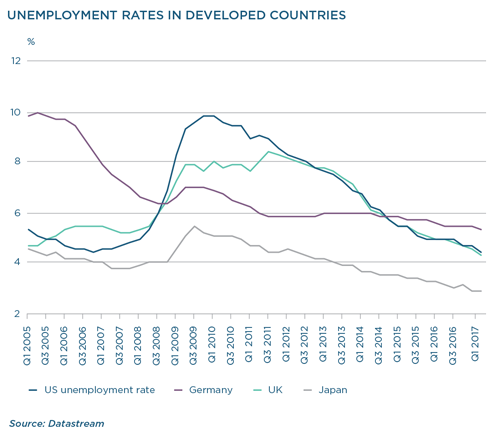

One of the most baffling themes this year has been the divergence of growth and inflation. Since mid-2016 there has been a good and surprisingly broad-based acceleration in GDP growth, but followed by a marked deceleration in accompanying inflation pressure from early 2017. This is particularly evident in key developed economies like the US, Germany and even Japan, where unemployment has reached historically low levels, but wage pressures are largely absent. This dynamic has put central banks in a difficult position – economic activity has recovered well; in fact, in some countries growth is running ahead of potential, but low inflation has limited scope for policy normalisation. In turn, this has created a very positive environment for emerging markets, with good support for commodity prices but low volatility. Accommodative developed market policy settings continued to be very supportive of risk appetite. This seems about to change.

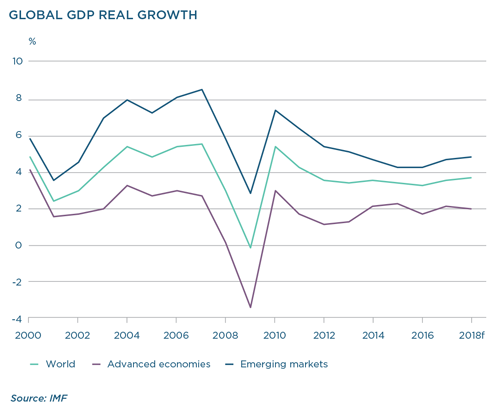

Global growth has been consistently revised higher this year. The latest IMF forecasts expect real output across the world to expand at a rate of 3.6% in 2017 and 3.7% in 2018. In April, the IMF was still expecting 3.5% and 3.6% respectively, and the improvement is distributed fairly equally between developed and emerging economies. There are good signs that growth will persist: in the US, GDP growth is set to be 2.2% in 2017 and 2.3% in 2018. Recent data support ongoing momentum, with unemployment at 4.2% in September and good indications that capital investment is picking up. In Europe, aggregate growth is forecast at 2.1%, from 1.8%, with unemployment at 9.1%, and strong growth expected from Germany in particular, although the whole region should contribute. In Japan, the recovery has been stronger than most expected, and here too momentum has been building. Growth is forecast for 1.5% this year and 0.7% next year. Only the UK, amid ongoing political and Brexit-related uncertainty, has suffered, and growth is expected to slow to 1.5% next year, from 1.7% in 2017.

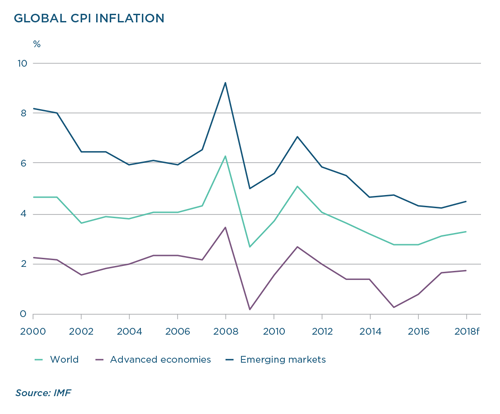

Despite strong growth momentum, global inflation remains low. The IMF forecasts global inflation at 3.1%, with developed economies at 1.7% this year and emerging markets at 4.2%. In the aftermath of the crisis, inflation was low globally because of deficient demand, excess capacity and collapsing commodity prices. Inflation averaged 3.6% from 2009 to 2015 (compared to 4.4% in the previous eight years, which included very high post-crisis inflation in key emerging markets). But in developed economies, it was much lower, at 1.2%, prompting more unorthodox monetary policy settings to ensure a deflation cycle did not take hold. From mid-2016, globally both growth and inflation started to accelerate, fuelled by the start of the current growth acceleration, and an associated improvement in commodity prices. But by early 2017, these paths diverged: global inflation was tracking 1.6% by mid-year, with growth 3.4%, throwing monetary policy into a quandary, especially at the Federal Reserve (Fed).

In part, the moderation in inflation was due to lower food and energy prices, and in some cases idiosyncratic factors like US telecommunications and healthcare pricing. But the biggest factor was very low wage growth, despite ongoing tightness in labour markets. Low wages have been a legacy of the financial crisis and the recession which followed. Labour market slack, underemployment, an increase in the number of pension-age workers in the labour force, low inflation expectations, more regulatory flexibility, automation and technological changes may also have contributed. Looking ahead it seems more likely than not that inflation will again accelerate. Cyclically, the disinflationary pressure of low food and fuel inflation has started normalising, and some of the (mostly US) data oddities are unlikely to be repeated. The key signpost is wage acceleration, and there is evidence that labour markets – globally – are becoming tight enough to see higher wages.

Signs of pricing power will certainly make the job of central banks easier. Even without it, most central banks in the developed world – with the notable exception of Japan – have signalled that they are moving closer to more normal policy settings. Policymakers can see their economies at or near full employment, with visibly good growth momentum. External risk has also diminished with the broader global growth recovery.

The Fed is ahead of the pack, having already raised the Fed Funds rate by 75 basis points (bps), and signalled to markets that it intends to start shrinking its balance sheet. The European Central Bank, whose job is a bit harder – not only because Euro area inflation is low but also because the growth recovery is less even and there is a legacy of high government debt and banking sector fragility in some countries – has said that it intends to slowly reduce its active quantitative easing programme from the end of 2017. The Bank of England is also in an uncomfortable position, with high inflation but low growth to contend with. It is expected to raise rates by 25 bps in November, but it is uncertain how much more may be to come. Despite the better-than-expected growth outcomes, the Bank of Japan will most likely wait for very good evidence of an overshoot of its 2% inflation target before throttling back its massive monetary stimulus.

What does this mean for emerging markets? The low inflation world has been a boon for emerging markets, with recovering global trade, higher commodity prices and accommodative monetary policy settings supporting growth while still fuelling demand for their ‘yielding’ assets. The biggest risk is that inflation in developed economies rises much faster than currently anticipated, forcing a stronger monetary policy response than expected. Higher developed economy yields and rising policy rates would undermine emerging currencies and make financial assets relatively less attractive. For countries like South Africa and Turkey, which are reliant on foreign funding, this would see a (much) weaker currency, higher yields and pressure on the central bank to raise policy rates.

At present however, a moderate rise in developed market inflation to more normal levels will probably be accompanied by a modest slowing in growth, and a slow, well-telegraphed normalisation of monetary policy settings in large developed economies. There will always be risks – of higher (or again lower) inflation, of disruptive central bank balance sheet management, high debt levels, ongoing leverage and geopolitical events. But in a world supported by sustained decent growth, these risks pose less of a threat than at any time in the past almost decade.

United States - Institutional

United States - Institutional