Investment views

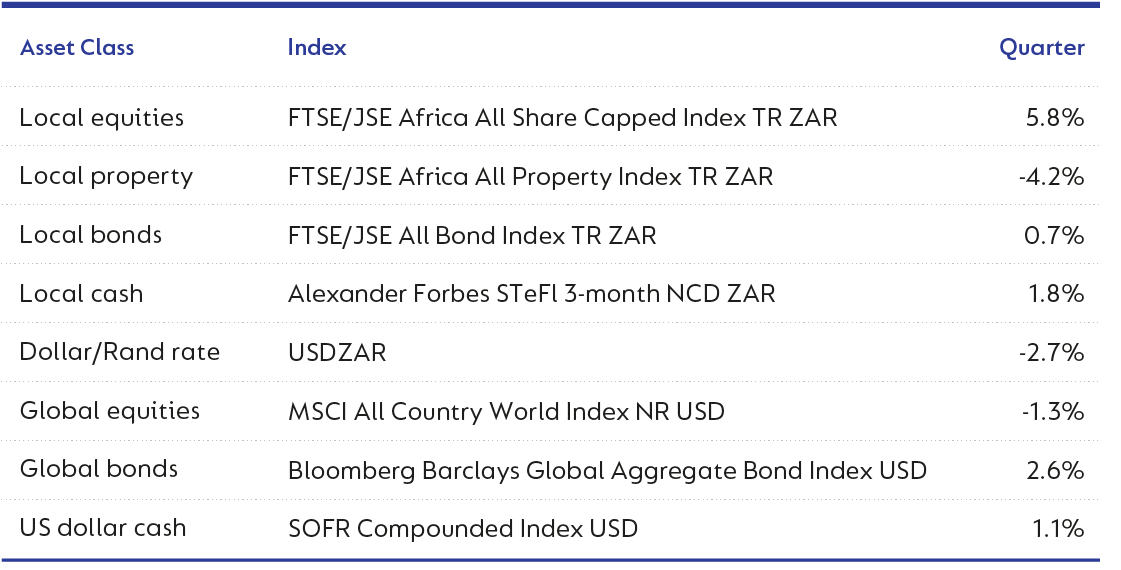

US equity indices and the US dollar weakened over the quarter on fears that the Trump administration’s erratic tariff policy will slow growth and raise prices in the world’s largest economy. European and emerging market equities performed relatively better as some investors rotated overweight US positions to these markets. Bonds and gold also benefited from increased uncertainty and weaker sentiment.

Domestic economic news was dominated by National Treasury’s inability to pass an expansionary budget in February and the South African Reserve Bank’s decision to leave the repo rate unchanged at 7.5%, despite inflation (CPI) remaining close to the bottom end of the inflation targeting range. Healthy local equity market returns in the first quarter were driven by the gold and platinum miners, as well as other dual-listed shares such as Prosus and AB Inbev.

READ MORE SOON IN OUR Q1 2025 COMMENTARIES

More information on specific funds' positioning and performance, as well as market-moving events post quarter end, will be available on our website later this month.

United States - Institutional

United States - Institutional