REVIEW FOR THE QUARTER

THE START OF 2020 has been an incredibly painful one. The combination of the Covid-19 pandemic and the oil price war has led to a bear market in virtually all global assets. Not even gold, traditionally a safe haven, has escaped. Global frontier markets have not been spared, with the MSCI Global Frontiers Index down 26.6% year to date. The Strategy’s year-to- date performance was -19.7%, 7.0% ahead of the index.

Longer-term performance remains healthy, with the Strategy 3.1% p.a. ahead over three years and 2.0% p.a. ahead over five years. Even against the larger global emerging market universe, the Strategy is 0.4% p.a. ahead of the three-year MSCI Emerging Markets Index and 0.5% p.a. behind over five years. We remain focused on prioriti-sing long-term performance above all else. With a five-year track record, we are now beginning to approach investment periods that we would classify as long term.

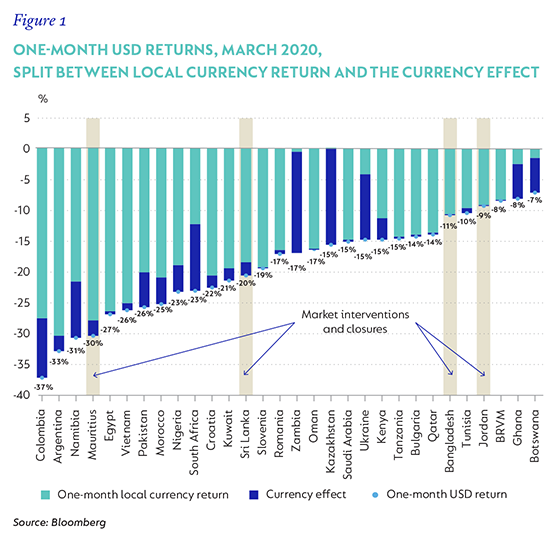

Figure 1 captures the (brutal) March performance of many of the markets in the Strategy’s universe. All markets were negative, with relative better performance typically an indicator of a market that was closed, such as Jordan and Bangladesh; or simply small and illiquid, as is the case with Botswana, Ghana, Bourse Régionale des Valeurs Mobilières SA and Tunisia.

It has been one of the most painful months in the Strategy’s history. The Strategy started the year with 20.5% in Egypt (-26.8% return), 11.0% in Jordan (-9.1% return), 9.1% in Kenya (-14.6% return) and 8.2% in Vietnam (-26.1% return).

Valuations have changed significantly over the quarter. In many markets, businesses with leveraged balance sheets and exposure to highly Covid-19- sensitive industries, such as tourism or quick-service restaurants, have sold off as much as companies with strong balance sheets, stable demand and strong free cash flow generation. While all businesses are impacted by Covid-19 and its second-order economic effects, not all businesses are impacted equally.

We have reviewed our entire portfolio holdings and continue to run various sensitivity analyses to ensure that the businesses we own can survive the likely impact of social distancing and lockdowns. Strong balance sheets have become even more valuable this year. The market sell-off has also given us the opportunity to acquire positions in high-quality, compounder businesses that have typically traded at valuations we had considered too high in the past. As a result, the portfolio is looking stronger and higher quality than ever before.

The largest contributor for the period was Al Eqbal Investments, the largest position in the portfolio, which added 0.8% to performance. This came as the share rose 11.2% after being subject to a takeover from a consortium of shareholders that included the founding family and the largest institutional shareholder. The announced deal price of JOD16.0 is still above the EGP13.7 market price before the exchange went into lockdown. The following two largest contributors were Speed Medical, an Egyptian diagnostics business, and Dis-Chem, the South African health and beauty pharmacy chain.

The largest detractors were, unsurprisingly, some of our larger positions, including Eastern Tobacco (-1.6%), Dragon Capital’s VEIL fund (-1.4%) and British American Tobacco Kenya (-1.2%). Encouragingly, Eastern Tobacco has announced a share buyback equivalent to 3% of the company. The business is in a net cash position and it’s positive to see the directors prioritising shareholder returns at this time.

Looking back over the past five years and four months since inception, it has certainly been a tough time to be invested in global frontier markets. The index has returned -4.0% p.a. over this period. The Strategy has returned -1.3% p.a.

The period now includes the Covid-19 pandemic, the oil price crashes in 2014/2015 and 2020, the float of the Egyptian pound and subsequent 50% move in the currency, the largest ever International Monetary Fund deal in Argentina, and MSCI upgrades to United Arab Emirates, Qatar, Argentina and Pakistan.

Despite the macro headlines, many businesses across our universe continue to consistently compound US dollar earnings, generate free cash flow, improve corporate governance and deepen their moats. Unfortunately, share prices have not always compounded as well.

A mere three months ago we wrote: “We have learnt that starting the year with valuations deeply discounted for companies growing earnings strongly, the odds are weighted in the investor’s favour. We invest in thin markets, and capital flows exaggerate returns. 2020 certainly has the potential for a significant rerating should there be any new flows to the asset class.

“Consequently, we are very excited about the year ahead. With the valuations of several high-quality businesses having reduced meaningfully over the past year, future returns should be healthy.”

Since then, valuations have become even more attractive. We remain excited about the businesses we own. In our view, upside to fair value in the Strategy (even after adjusting for the impact of Covid-19) is now the most attractive we have seen in the history of the Strategy.

Disclaimer

United States - Institutional

United States - Institutional