Investment views

Navigating our portfolios through the power crisis

The Quick Take

- The impact of more frequent power cuts over the past year varies across industries

- A holistic analysis of the impact is critical as the effect of power cuts on a company’s customers and suppliers can have a meaningful impact on a company’s bottom line

- Companies that are able to achieve organic revenue growth are better equipped to protect their earnings against the costs of loadshedding

Over the past year, the ongoing electricity crisis in South Africa (SA) has had significant consequences for local companies. While many companies and their customers were able to adapt to the increasing power cuts between 2019 and 2021 and the effects have been marginal, the disruption caused by the more frequent power cuts since 2022 have been more difficult to withstand.

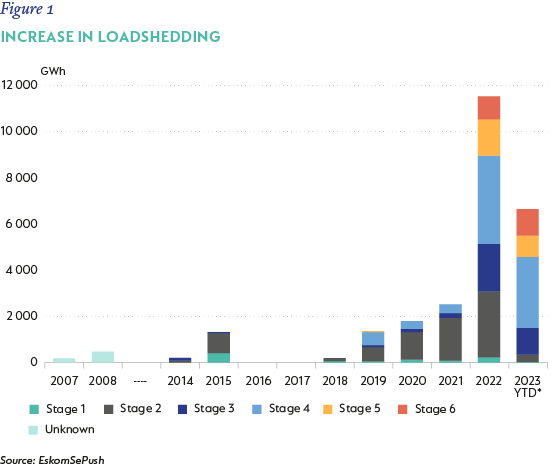

South Africans are now experiencing regular power cuts of between four and ten hours per day. In 2022, a record number of GWh were shed from the grid (Figure 1). When power is off for an hour or two, most companies can get by with small generators or batteries and implementing maintenance instead of running the business. At ten hours a day, these measures prove insufficient, water services are impaired, and consumers are more likely to stay at home. The ability of the SA consumer to absorb these impacts is further reduced by inflationary pressures, weak employment and high interest rates.

As investors, we are therefore having to look beyond the first order impact of loadshedding on a business’s prospects to the second order consequences as well. The holistic impact of loadshedding is important to understand given the potentially meaningful impact it can have on a company’s bottom line. In our analysis of a company’s prospects, assessing the vulnerability of their customers and suppliers to loadshedding is critical as it can have a meaningful impact on a company’s profitability.

Understanding the impact of loadshedding on earnings forms part of building the mosaic of information required to invest appropriately in this environment. Our research process therefore includes a careful consideration of various potential effects and scenarios, and the incorporation of a base case into forecasts. We are also mindful that the impact of power outages varies across the different industries and explore these differences below.

Loadshedding and loadshedding curtailment

Loadshedding is the State utility Eskom’s planned reduction of demand when it is not generating sufficient capacity. Stage 1 allows for up to 1000 MW of the national load to be shed while stage 6 allows for 6000 MW to be shed. During stage 4 loadshedding, South Africans are without power for around eight hours of the day while they are without power for ten hours during stage 6 loadshedding.

Heavy users of electricity and businesses for whom continuity of supply is critical to their functioning qualify for load curtailment. Load curtailment involves Eskom notifying the consumer in advance of the required reduction in electricity consumption. Users then reduce consumption rather than having no power for several hours at a time. The quantity of electricity that needs to be reduced roughly correlates with the loadshedding schedule experienced by standard users.

MINING INDUSTRY

Over the last few years, mining companies have taken measures to ensure the safety of their workforce and sustainability of operations during periods of load curtailment. Consequently, the impact of reduced electricity availability has been less significant than one would expect. However, the further decrease in availability since 2022 has started to meaningfully impact production and costs across the mining sector as the standard mitigation techniques lose their effectiveness. Mitigation includes prioritising maintenance over production for low levels of load curtailment, however, there is only so much maintenance one can do. Another mechanism is reducing the power consumption at above ground processing assets during load curtailment while continuing with mining activities. Lost processing volumes are then recouped at a later stage. More intense curtailment, however, means miners have to reduce their actual mining activities, which means permanently lost production.

A further concern for mining companies is the consistent double digit increases in electricity costs, which hurt their bottom line. Most of the listed miners are constructing solar plants in the medium term, which will reduce their reliance on Eskom, earn an economic return and reduce their carbon emissions - a great proposition. However, due to baseload requirements, the sector will continue to depend on Eskom for decades to come.

We expect mining volumes will continue to be under pressure going forward as well as unfavourable unit cost experiences as a result of lower volume and increasing electricity prices. We are capturing this in our assessment of a company’s fair value, but also acknowledge that the risk of the impact being worse than anticipated has increased. As a result, a higher margin of safety is required to account for this increase in the risk profile, making the hurdle for investing in SA mining companies higher than before.

MANUFACTURING

Manufacturing firms are under increasing pressure operating in SA, and Eskom’s woes are also compounding here. Stop-start electricity and the associated power surges wreak havoc with production lines, reduce output, and add to cost. While large power users can apply to Eskom for direct connections, allowing them to participate in curtailment instead of loadshedding, this is not a simple solution. Each connection can contain several millions of rands worth of cable, which must be funded by the company and then continuously protected to avoid organised crime syndicates stealing copper wire.

Furthermore, many manufacturing processes require water, and SA’s water systems rely on electricity to keep the taps flowing. Loadshedding is adding strain to the already stretched national water system and companies increasingly have to store and transport their own water to ensure continuity of production. This comes at a cost, which the consumer is unwilling or unable to pay, hurting profitability.

The impact on a manufacturer’s supply chain or customer base must also be considered. For example, KAP Industrial recently reported softer-than-expected earnings in their chemicals division due to stage 6 loadshedding disrupting their downstream customers, causing demand to fall. These customers are plastic bottle producers who require a continuous power for reliable operation. If the process heat falls below a certain temperature, it can take days to reset the process. This example serves as an illustration of why one needs to think hard about the various potential impacts as well as scenarios of how each business may be impacted and factor this into forecasts.

RETAILERS

Retailers, too, have shown resilience until the stage 4 to 6 loadshedding schedule was implemented over the key Christmas trading period. Their customers have been under increasing financial pressure as inflation, interest rates and weak employment reduce available disposable income. Most large players have installed battery backups and generators where necessary, but, until 2022, the operating cost impact of this was not sufficiently material to warrant commentary. The dramatic pickup in loadshedding saw the costs of self-provision pick up exponentially at the same time as consumer pressure resulted in lower discretionary spend - a toxic combination for profitability.

In food retail, where margins are comparatively low, the recent trading period highlighted the cost being borne by South African companies. Shoprite, for example, saw its diesel spending increase six times to R560 million in the six months ending January 2023, reducing SA’s operating profit by just shy of 10%. Pick n Pay, as a lower margin player, is under even greater pressure, and, if recent diesel run rates continue, they could see their SA operating profit decrease by as much as 25%. Lower margin businesses are naturally under more pressure, given the smaller gap between revenue and operating profit. Being squeezed on both costs and topline profits is devastating for these companies.

While not a retailer but still consumer facing, Multichoice (DSTV) was an unexpected victim of aggressive loadshedding, which resulted in a significant increase in the decline of their customers’ subscriptions. There is no point in paying for your DSTV package if you don’t have power for your TV.

FINANCIAL SECTOR

We see financial firms as being the least impacted by the first order effects of loadshedding. With limited electricity needs and an increasingly digital presence, they can avoid most of the operational costs associated with loadshedding. For example, in contrast to Shoprite’s R560 million spent on diesel, FNB spent a mere R40 million in the six months to December.

Additionally, the banking sector is optimistic about providing financing for solar plants and related infrastructure worth tens of billions of rands over the next decade. This is a shining light for a sector whose prospects are otherwise closely linked to the SA economy. Longer term, the growth outlook for the banking and other financial sectors will be impaired by the impact of loadshedding on the economy and consumer health.

In the insurance industry, short-term insurers are experiencing an increase in claims related to equipment failure, while life insurers are arguably the least impacted. Short-term insurers are increasing premiums in response and excluding losses resulting from a total grid failure from coverage. We expect short-term insurers to be able to recover these costs and grow their earnings bases. Given their attractive starting valuations, Santam and OUTsurance are both held in our equity portfolios.

CONCLUSION

Overall, the cost of loadshedding to the SA economy is huge and, as we have highlighted above, it plays out to varying degrees in different industries. Some capacity lost in the economy will never return as imported products pick up the slack, or a drop off in demand levels renders it unnecessary. Consumers get poorer and businesses will be less profitable because of the first- and second-order impacts of insufficient electricity. As we have detailed in a previous Corospondent article, there is light at the end of the tunnel, but only in three to four years’ time.

We anticipate that the profitability of the majority of SA businesses will continue to be under pressure until enough private sector power is installed to reduce reliance on Eskom. In this environment, it is key to incorporate the costs of loadshedding in expectations and to understand the holistic impact on a given business.

The idea is not to avoid companies that are unduly impacted by loadshedding. In our view, those companies with organic opportunity to continue growing their revenue bases within the SA operating environment are those that will outperform the rest going forward. From a positioning perspective, our SA equity portfolios remain focused on these companies where they are well priced.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

United States - Institutional

United States - Institutional