“We need to focus on both basic education and advanced education. We need to have key primary schools, key middle schools and key universities. We need to have a stringent exam system in order to keep the top talent in key middle schools and key universities.” – Deng Xiaoping

Deng Xiaoping was the paramount leader of the People’s Republic of China from 1978 to 1989. He led China through far-reaching market-economy reforms, which started opening up China to the global economy.

I wonder if Deng could have foreseen what the Chinese education system has become today? It has moved from a system where students were selected based on political and family backgrounds in the early 1970s to a system which, while still highly selective, is focused on academic achievement and is exam-centric. There is little autonomy on admissions; all public universities and high schools are required to admit students based on scores achieved in the National College Entrance Examination (commonly known as Gaokao). The Gaokao is a nine-hour exam over two days and is a source of anxiety for children from a young age – as well as for their parents. Due to huge demand, key universities such as Peking university and Tsinghua university have the lowest acceptance rates in the world (much lower than the top US ‘Ivy League’ schools).

The system clearly works for China, which is focused on innovation. In 2016, China produced 4.7 million science, technology, engineering and mathematics (STEM) graduates. This is 80% more than India, in second place with 2.6 million STEM graduates and more than eight times the US, in third place. It is also not just quantity over quality. A recent study by Qingnan Xie of Nanjing university and Richard Freeman of the US National Bureau of Economic Research found that, in 2016, 24% of scientific papers had an author with a Chinese name or address (37% when Chinese language papers are included).

Given the extremely competitive nature of the education system, after-school tutoring (AST) is used extensively by parents to give their child an edge. In China, AST is considered a must should you wish your child to receive the best possible education and achieve the best subsequent career path. Parents who can afford AST make use of it from as early as preschool.

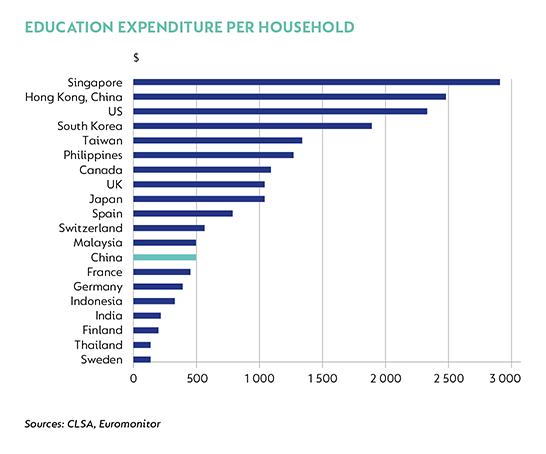

The Chinese AST market is forecast to grow in the low to midteens, driven by a combination of the relaxation of the one-child policy, increasing urbanisation, rising wealth levels and AST penetration growing to levels closer to those of developed Asian peers. When asked to rank spending priorities for increased family income, Chinese consumers rank their children’s education as the highest priority. The graphs illustrate that China’s education spend per household lags other countries. This should grow as household income grows.

New Oriental Education & Technology Group, a recent addition to our global emerging markets strategy, is the largest and most recognised provider of private educational services in China (mainly AST and overseas test preparation, which helps students prepare for foreign admission exams). It has 6.3 million student enrolments per year (excluding online students), a network of 1 081 learning centres and over 28 000 teachers, and it operates in 75 cities.

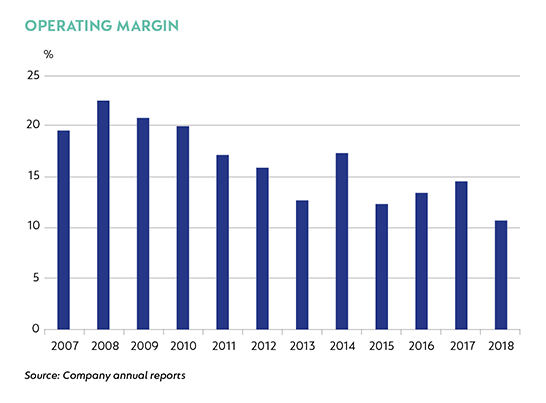

New Oriental and industry counterpart TAL Education Group are by far the biggest players in this fragmented market. Despite years of above-industry growth, they each still only have low-single-digit market shares. With real benefits to scale (a national footprint, the best teachers, proprietary content and computerised systems with the most data), they should continue to consolidate the market over time. New Oriental’s strong capacity rollouts in recent years have led to lower class utilisation levels, as learning centres take some years to mature. This, along with investments into online to offline (O2O) – combining physical classroom teaching with online teaching resources – and pure online education initiatives has led to New Oriental reporting decade-low operating margins in its 2018 financial year. However, these investments drive growth and strengthen competitive positioning. As current high investment spending and low utilisation levels normalise (lower and higher, respectively), operating margins should revert to levels materially higher than the current 10.7%.

More recently, New Oriental’s share price has come under pressure (along with industry peers’) as a result of the State Council releasing a document to regulate extracurricular training institutions as a measure to ease students’ heavy workload. While the regulations could result in a few short-term hiccups such as longer approval times for expansion plans, resulting in slower revenue growth, our view is that the regulations strengthen the position of the industry leaders. Smaller independent operators will struggle to abide by the new, higher standards, which set out required teaching qualifications, minimum class sizes – at three square metres per learner – and business and educational licences. Consequently, we believe the regulations have enhanced New Oriental’s ability to consolidate the industry and report above-market growth rates over the long term, which offsets the potential shorter-term hurdles.

We used the recent share price weakness as an opportunity to build a position in New Oriental, which currently trades on 20 times forward earnings and 14 times forward free cash flow (upfront payment terms result in over 100% conversion of profits into free cash flow), and has 27% of its market cap in cash and short-term liquid investments on the balance sheet. The founder, Michael Yu, is still involved as executive chairman and owns 13% of the company. Strong brand equity, a defensive earnings stream and returns on equity consistently in the high teens to low twenties add to New Oriental’s attractiveness.

We believe the extremely competitive education system that Deng reinstalled in China is enduring and will ensure that there is always a place for AST in China. Just like Deng believed in key schools and universities, we believe that key AST providers in China (New Oriental and TAL) will continue to grow at above-market rates for many years to come.

Disclaimer

United States - Institutional

United States - Institutional