Investment views

Addendum 5: Stress testing worst-case scenarios

- assessing asset class performance in weak state regimes

VENEZUELA

This is an exceptional example of a failed state. This sovereign has an extensive history of alternative developmental directions, fractious internal and external politics, excessive commodity concentration and dependence, gross fiscal mismanagement, and a litany of other poor policy choices.

Venezuela reached a peak in per capita US dollar GDP in 2012. After multiple exchange rate devaluations, unresolved sovereign debt defaults, episodes of hyperinflation, crippling sanctions, and mass emigration, among other issues, this is currently estimated at being around 30%-40% of those peak levels, with limited prospects for improvement in the short term. This is effectively a dollarised economy (legally from 2020), as fiscal monetisation and other internal distortions continually debase the local currency, the Venezuelan bolívar (VEN). Consider that since the beginning of 2020, inflation has averaged 20% per month (c. 1,100% p.a.).

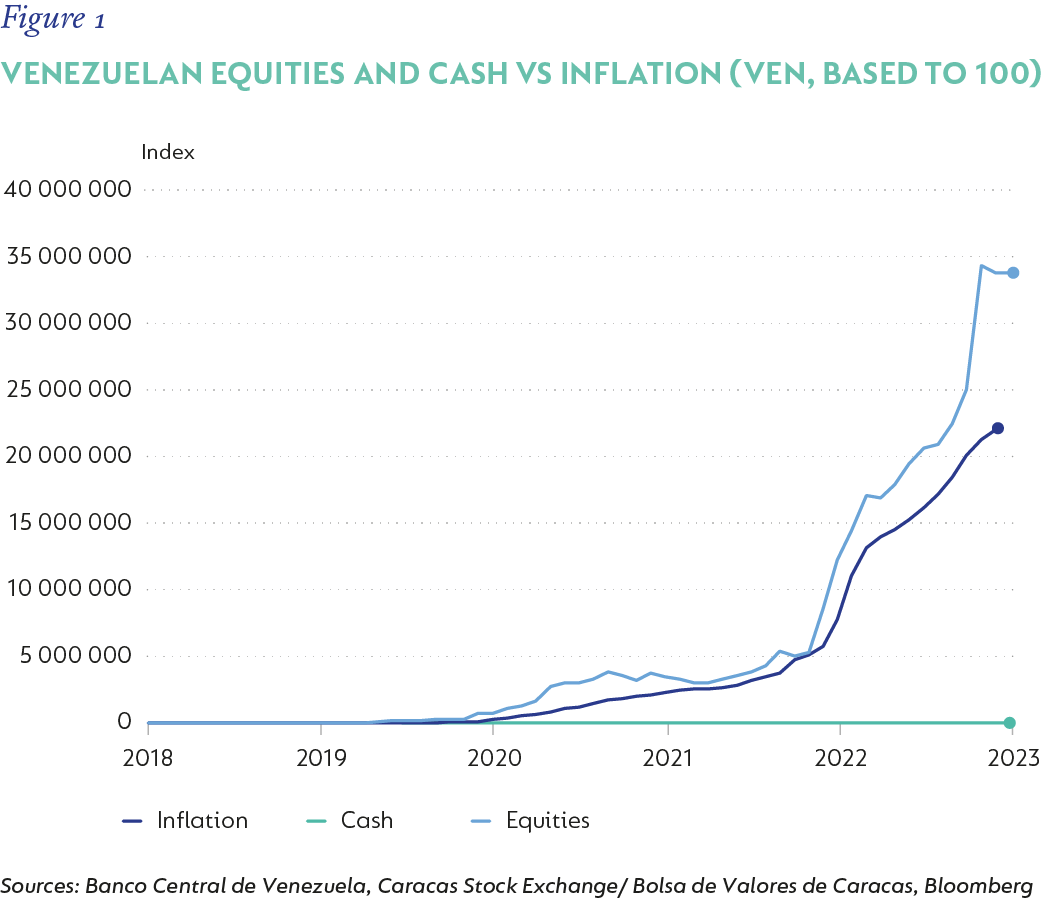

In such instances of complete currency debasement, the perpetuation of domestic legal tender exists almost exclusively as a means – often ineffective – of seigniorage[1] and capital control. With the domestic currency sorely lacking as a store of value, unit of account, or medium of exchange, the real economy pragmatically operates using hard currency. In this sense, the bolívar is little more than a perfunctory numeraire. But, as Figure 1 illustrates, the real return provided by equities listed on the Caracas Bourse has still been positive on a cumulative, multi-year basis. This reflects the asset class as a store of (internal) value at a minimum and possibly even one of value generation.

As noted, Venezuela is an outlier illustration. Here, a complete breakdown of policy orthodoxy and domestic currency sanctity served to destroy much of the formal sector economy for over a decade. Nominal instruments (i.e., all asset classes with direct valuation links to the domestic currency) are completely ineffectual stores of value; indeed, at this stage, these exist primarily as sources of rent extraction for the State. However, assets with direct cash flow links to the real economy retain real value. Not surprisingly, there is an extensive survivorship bias of listed entities in Venezuela: exporters, banks, State-owned entities, and other protected firms. However, this doesn’t detract from the ability of equity prices to appropriately reflect fundamental value which, in Venezuela’s instance, is one of the few remaining asset classes to do so.

[1] Government profit via currency issuance/monetary expansion

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

United States - Institutional

United States - Institutional