Personal finance

Overview

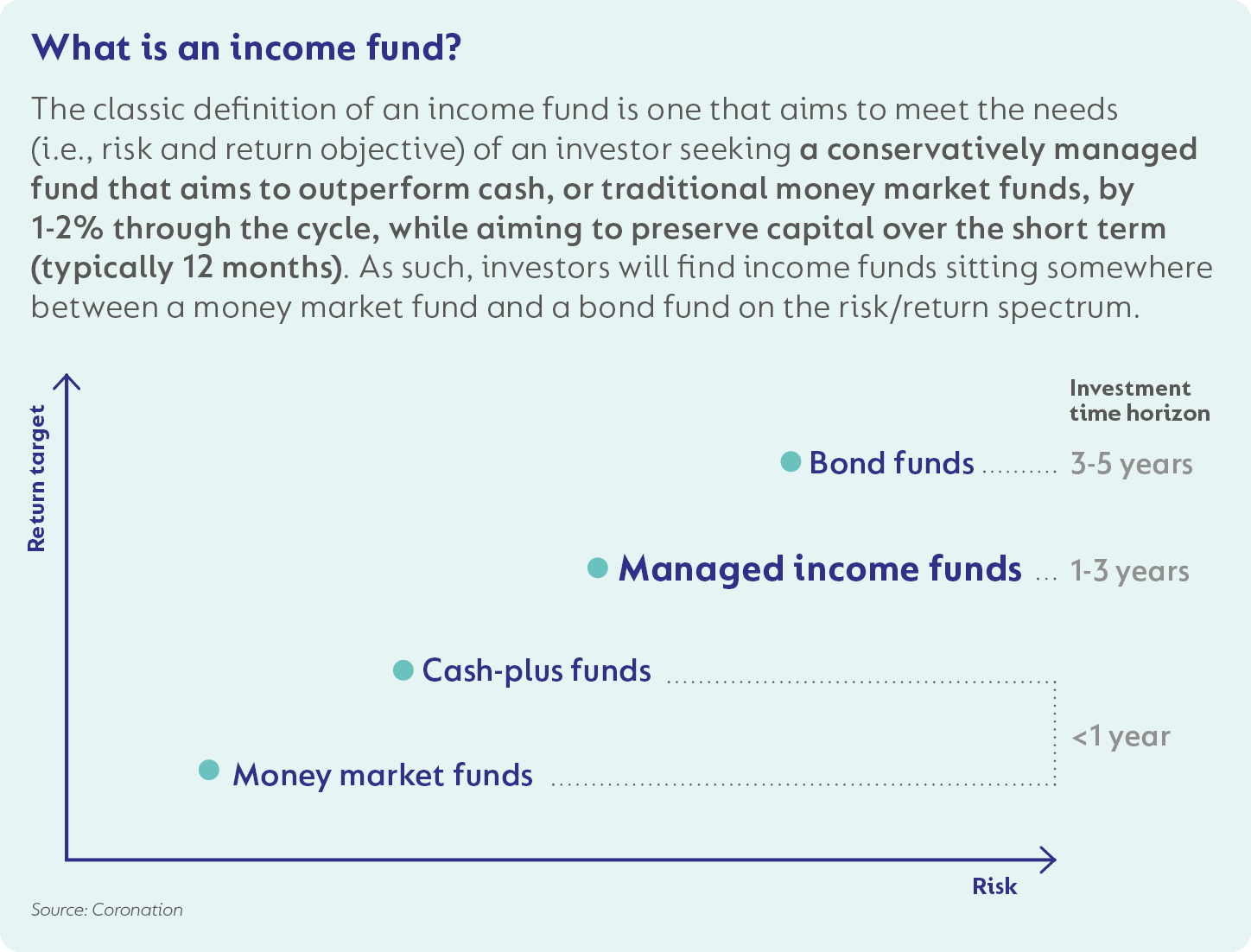

Income funds can play an essential role in your overall investment portfolio.

Their purpose is to provide a consistent and predictable income stream from a portion of your overall portfolio where capital preservation may be needed.

But not all income funds are of equal risk and thus return, and it is important to carefully choose a fund that meets your objectives.

To help you navigate your fund options, this edition showcases our range of income funds, with a spotlight on our managed income solutions. It explains how they are built and how they utilise the asset classes available to them and demonstrates their track records of cash outperformance through various interest rate and economic cycles.

When to consider investing in a managed income fund

Investors may seek to keep a portion of their savings in cash for different reasons.

- They may need access to their money in the medium term (to pay for a child’s education that commences in a year or two’s time, a deposit on a new home, or to start a new business).

- A recent retiree may wish to keep a portion of their capital unexposed to near-term market risk.

- Business owners with lumpy cash flow may need to park some capital in cash to pay monthly bills and salaries.

Whatever the reason for needing access to cash in the short term (the next 1-3 years), you can consider investing it in a managed income fund.

WHAT DO MANAGED INCOME FUNDS INVEST IN?

Managed income funds can invest in a wide variety of assets, such as cash, bonds, listed property and even equities, with the primary objective of maximising income on behalf of investors. The category allows for a high level of flexibility, with portfolios being able to invest as much as 45% offshore, 10% in equity and 25% in listed property. This means that you need to choose your managed income fund carefully and ensure that you are clear about your chosen fund’s expected return path as well as the risks it will take to deliver on that return profile.

WHAT ARE THE BENEFITS OF CONSIDERING A MANAGED INCOME FUND?

1. Access

Unlike a fixed deposit at a bank, you maintain access to your money while invested.

2. More than just interest

Managed income funds aim to deliver a better return than what you would achieve via a deposit at a bank.

3. Active management across multiple asset classes

Managed income funds seek to invest across a diversified pool of fixed income instruments, focused on identifying the best opportunities within different types of bonds, money market instruments and other interest-bearing instruments, and then actively adjust these holdings in response to the changing environment and factors affecting returns.

4. Expert guidance

Rather than navigating the complex fixed income landscape yourself, an experienced fund manager makes decisions and adjustments to a portfolio on your behalf when interest rates change or certain investments become more attractive than others.

Coronation’s managed income fund solutions

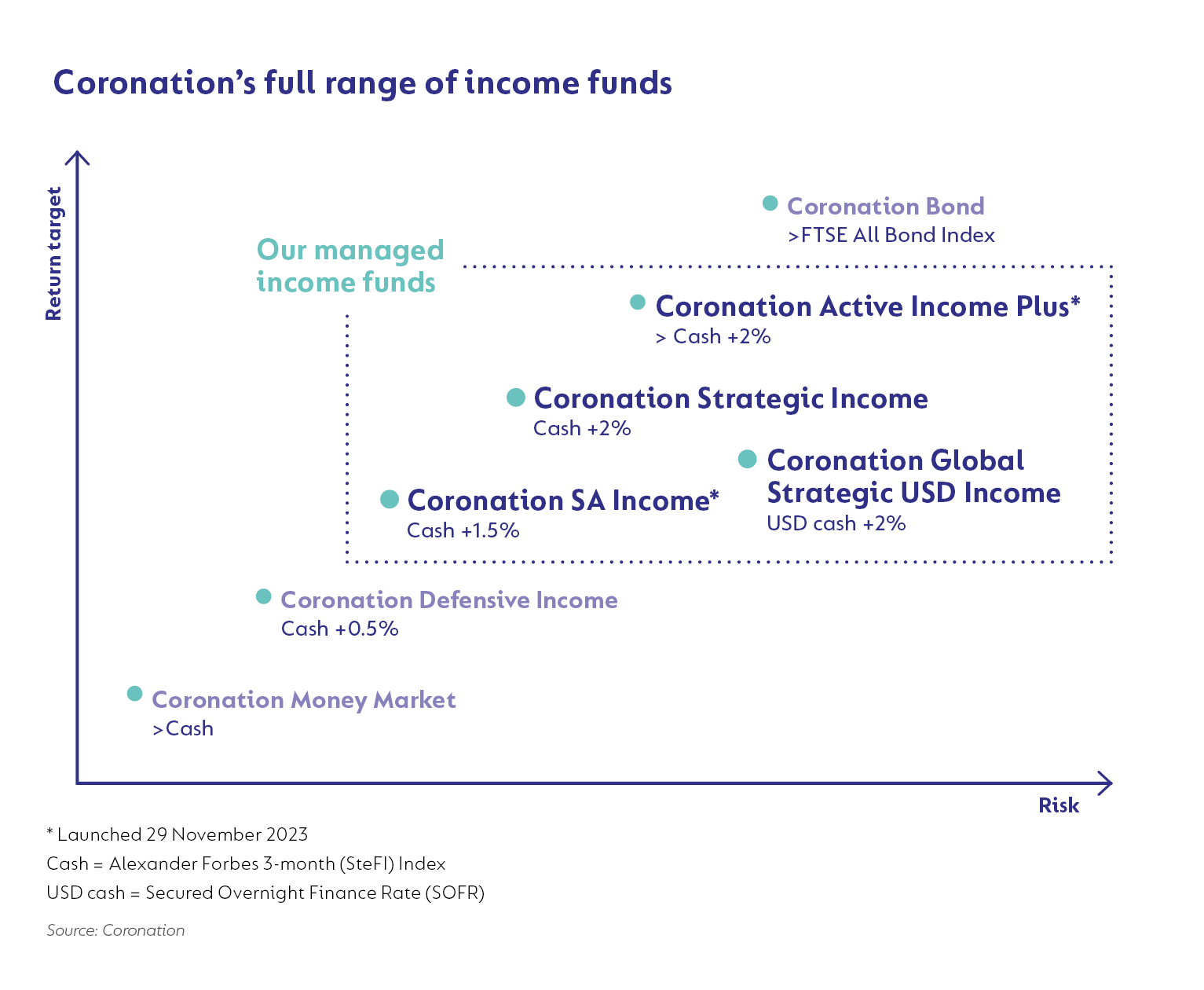

Coronation offers four managed income funds of varying risk profiles. The four funds form part of a comprehensive range of income fund solutions, aimed at meeting various income investors’ risk, return and currency needs.

Our managed income funds are managed by the same team and were born out of the same principles of:

- capital preservation in the short term (over rolling 12-month periods); and

- having a strong focus on risk management (we never take more risk than is required to deliver on the funds’ stated return profiles).

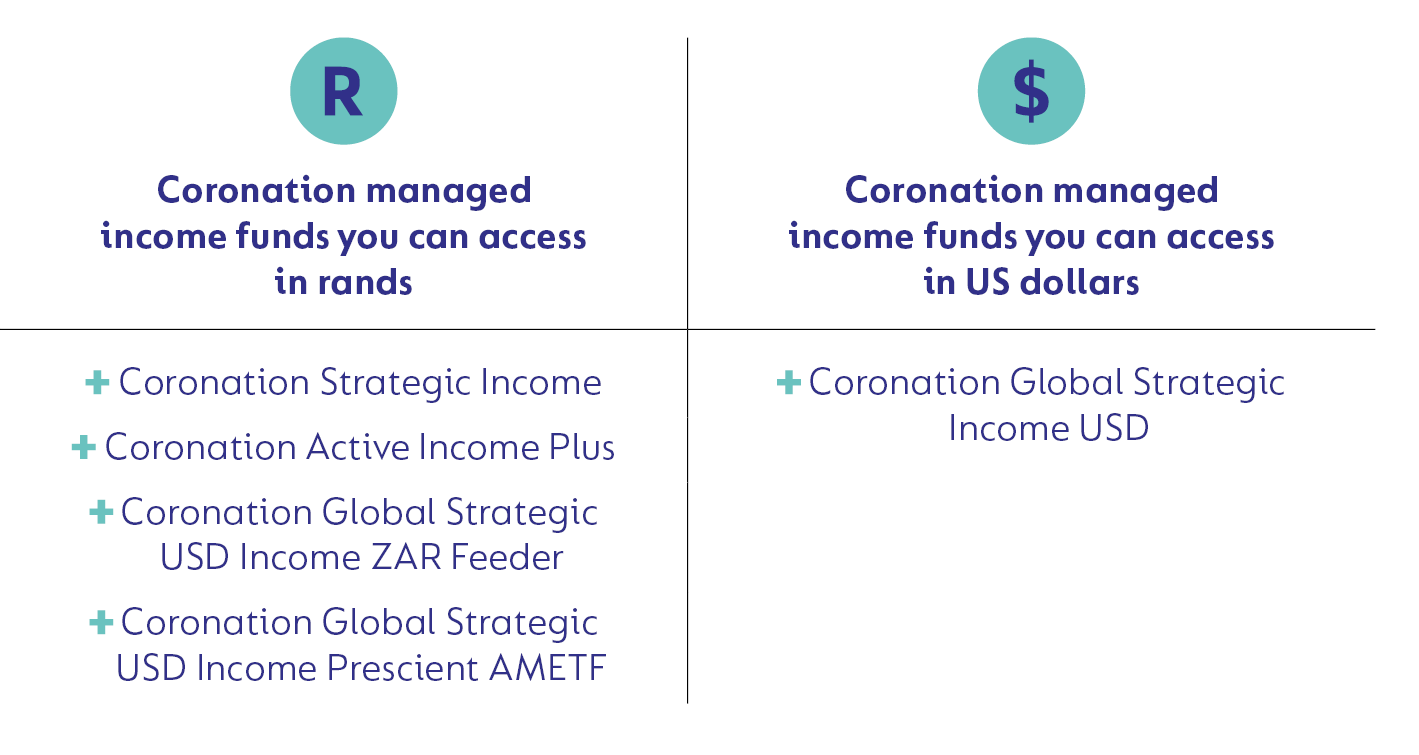

These funds can be accessed in rands or in US dollars:

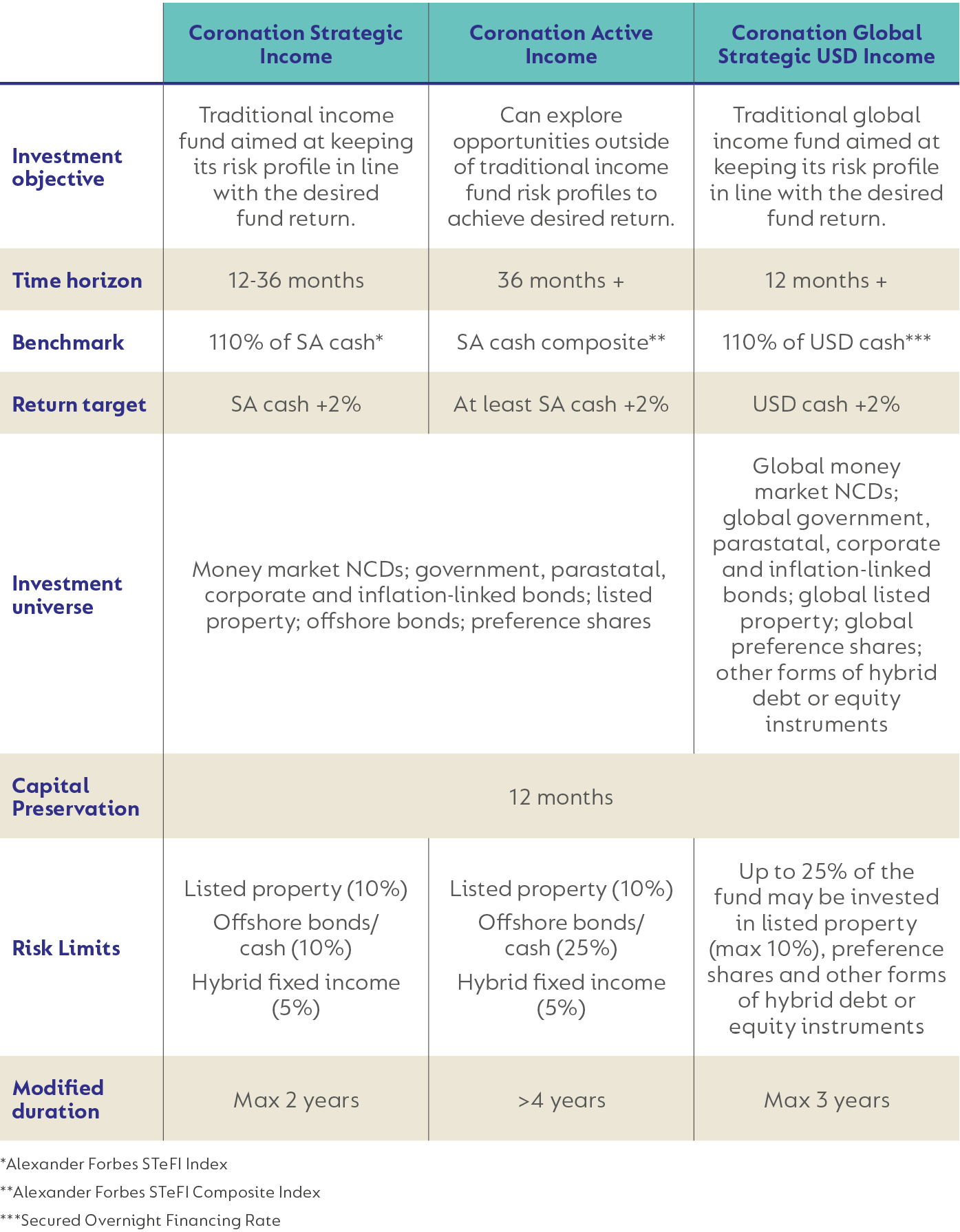

Coronation Strategic Income, our managed income fund with the longest track record, caters for investors wanting to achieve a better return than domestic cash.

Coronation Active Income Plus caters for investors seeking a slightly higher return profile from a portfolio that can invest in opportunities beyond the risk profile of a traditional managed income fund, while still aiming to preserve capital over a 12-month period.

Coronation SA Income is our lowest risk managed income fund that aims to outperform traditional money market or ultra-short duration income funds through a diversified portfolio of SA-only interest-bearing assets.

We also offer a dollar-denominated managed income fund – Coronation Global Strategic USD Income – that can be accessed in rands, in US dollars or as an Actively Managed Exchange-Traded Fund (AMETF) (read more about our three access points in our Offshore Investing Corolab).

Despite being held in rands, there are strategic benefits to utilising a dollar-based managed income AMETF in your JSE investment portfolio. These benefits include: Easy access to US dollar exposure within your JSE investment portfolio; Active management aimed at outperforming US dollar cash whilst protecting capital; and Global diversification across a broad spectrum of yielding asset classes.

Choosing the right Coronation managed income fund for your needs

The following table highlights the key differences between our three most popular managed income funds.

Best-in-class fund disclosure

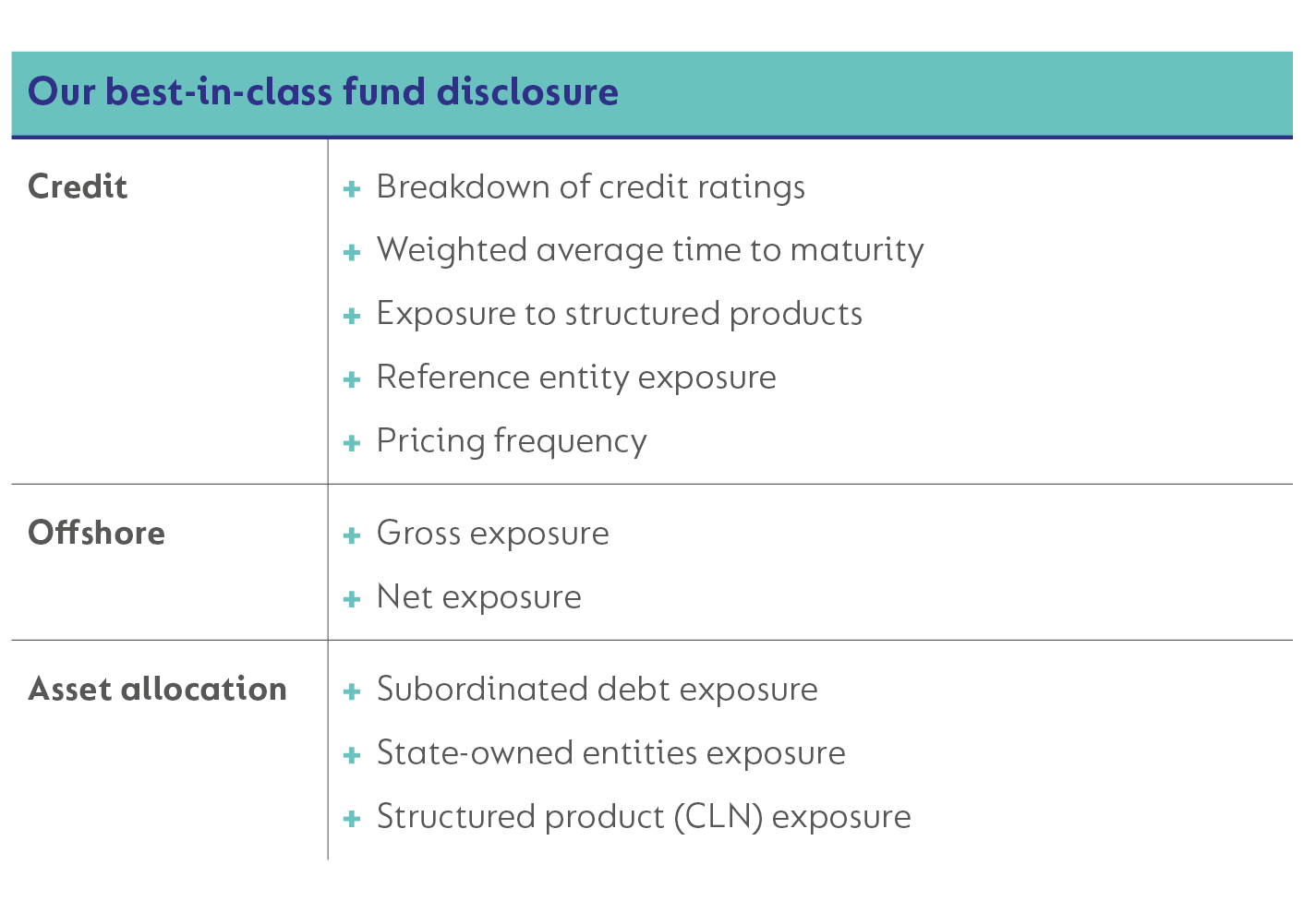

To help make it easier for investors to end up in the right income fund that meets their desired risk and return profile, our best-in-class fund disclosure addresses the risk taken to achieve the funds’ desired return. This includes detailed reporting on the type of credit to which the funds have exposure, exposure to offshore instruments, as well as detailed asset allocation exposure (as shown in the table below).

Check your investment time horizon

It is important to remember that managed income funds are typically not suitable for longer investment periods. Their limited exposure to growth assets constrains their ability to provide adequate protection against the eroding effects of inflation on your purchasing power.

How our managed income funds achieve their return profiles

We apply the following fundamental principles to deliver on the stated risk and return objectives of our range of income funds.

1. A broad and deep team supporting these return profiles

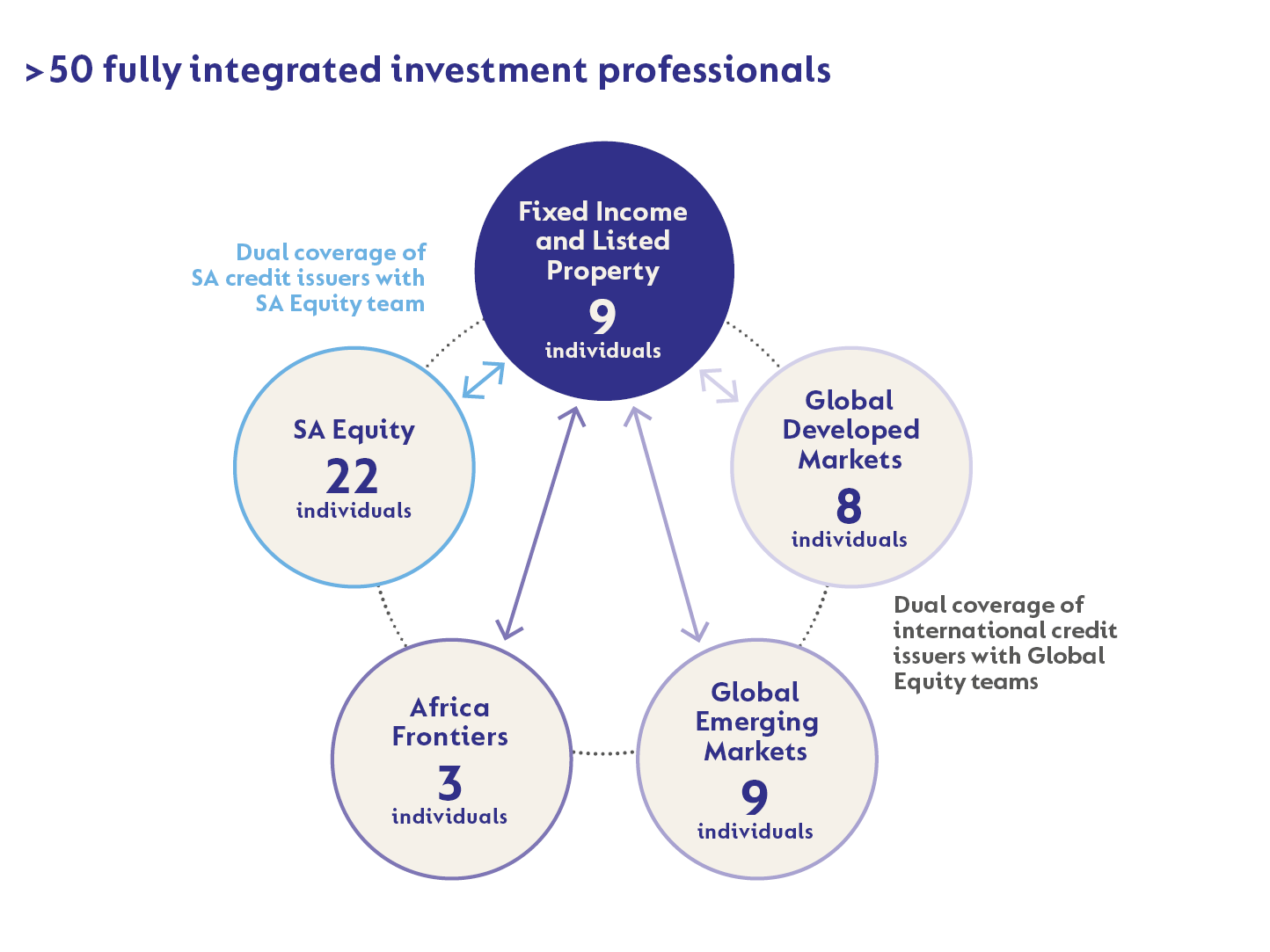

Our fixed income team of 9 specialists is well-resourced and fully integrated into our global investment team of more than 50 professionals (see below).

These specialists provide vital inputs to extract maximum value across the potential return enhancers in the fixed income universe. The team covers instruments both locally and offshore. And to enhance the rigour of our investment process in this universe, we share dual coverage with our respective local and global equity teams of the local and international credit issuers held within our portfolios.

2. Robust portfolio construction

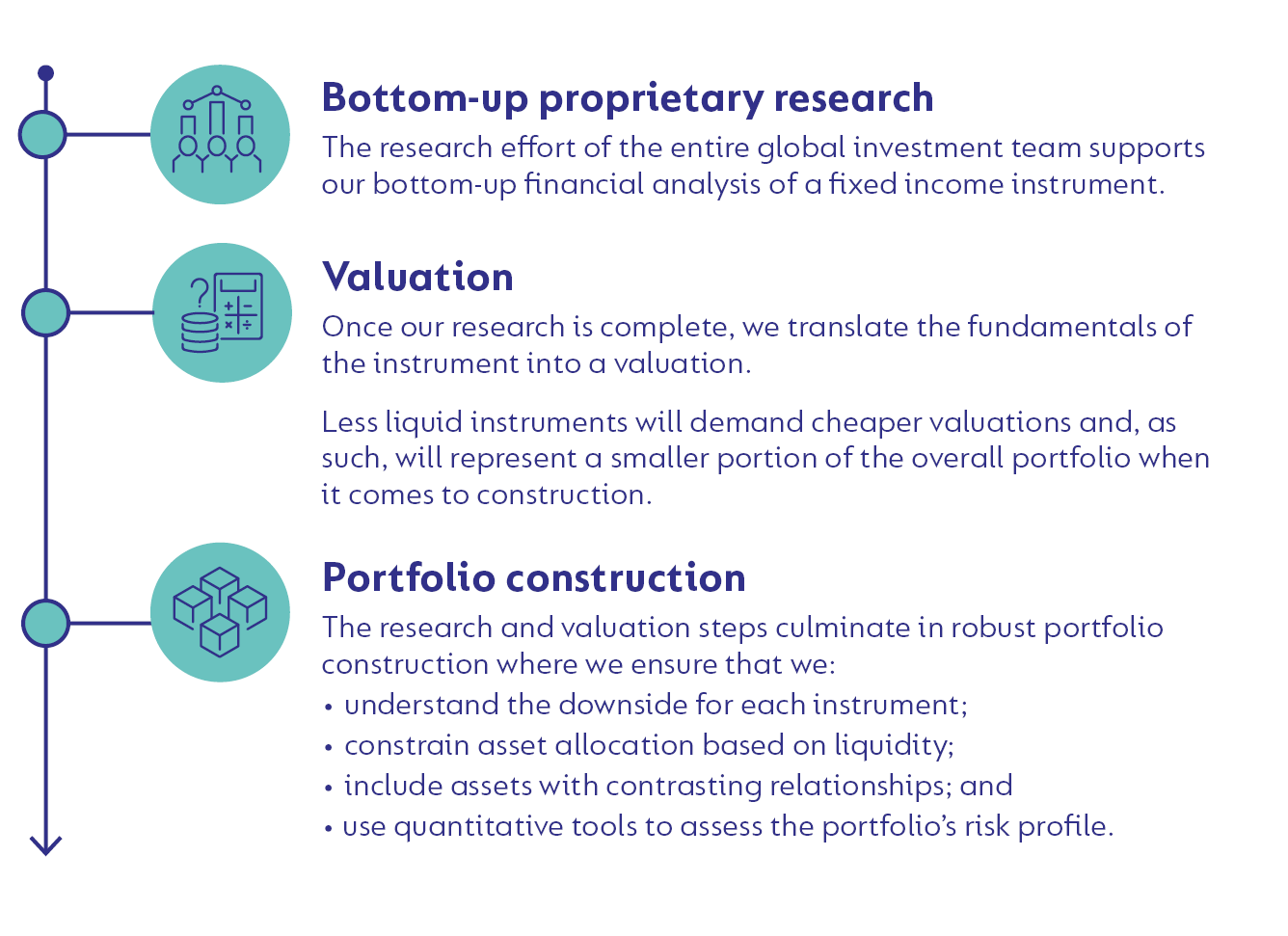

As with equities, we believe we can add value to investors in our income funds through bottom-up security selection when assets are mispriced.

Our approach to asset allocation within the local and global fixed income universes mirrors that of the broader Coronation investment team, but the process is overlaid with certain constraints given the needs of our income fund investors. These constraints include allocating to a blend of assets that:

- can deliver on our income funds’ respective performance objectives (see table in the prior section);

- while prioritising capital preservation over 12 months; and

- providing liquidity to investors with immediate income needs (such as those drawing a regular retirement income).

The following visual demonstrates our process, from research to how we ultimately build our portfolios.

3. Placing capital at risk

The reality is that in order to outperform cash, we need to take risk within our income portfolios. However, we never do this at the expense of our capital preservation commitment, or if it puts the fund at risk of underperforming cash. So we set out to put capital at risk according to the following guardrails.

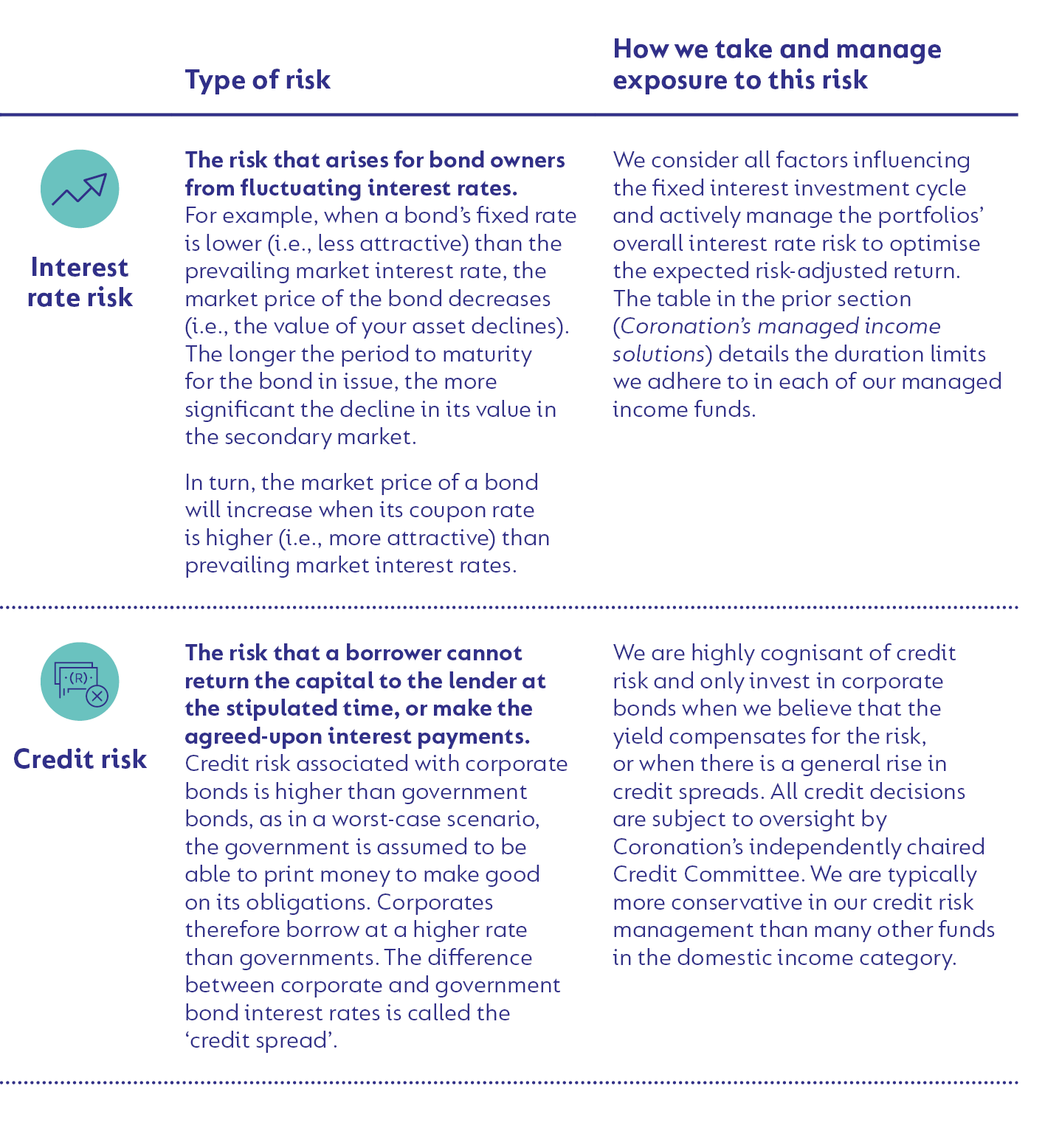

Taking considered interest rate (duration) and credit risk where appropriate

The following table explains the two types of risk and how we manage exposure to these across our income portfolios.

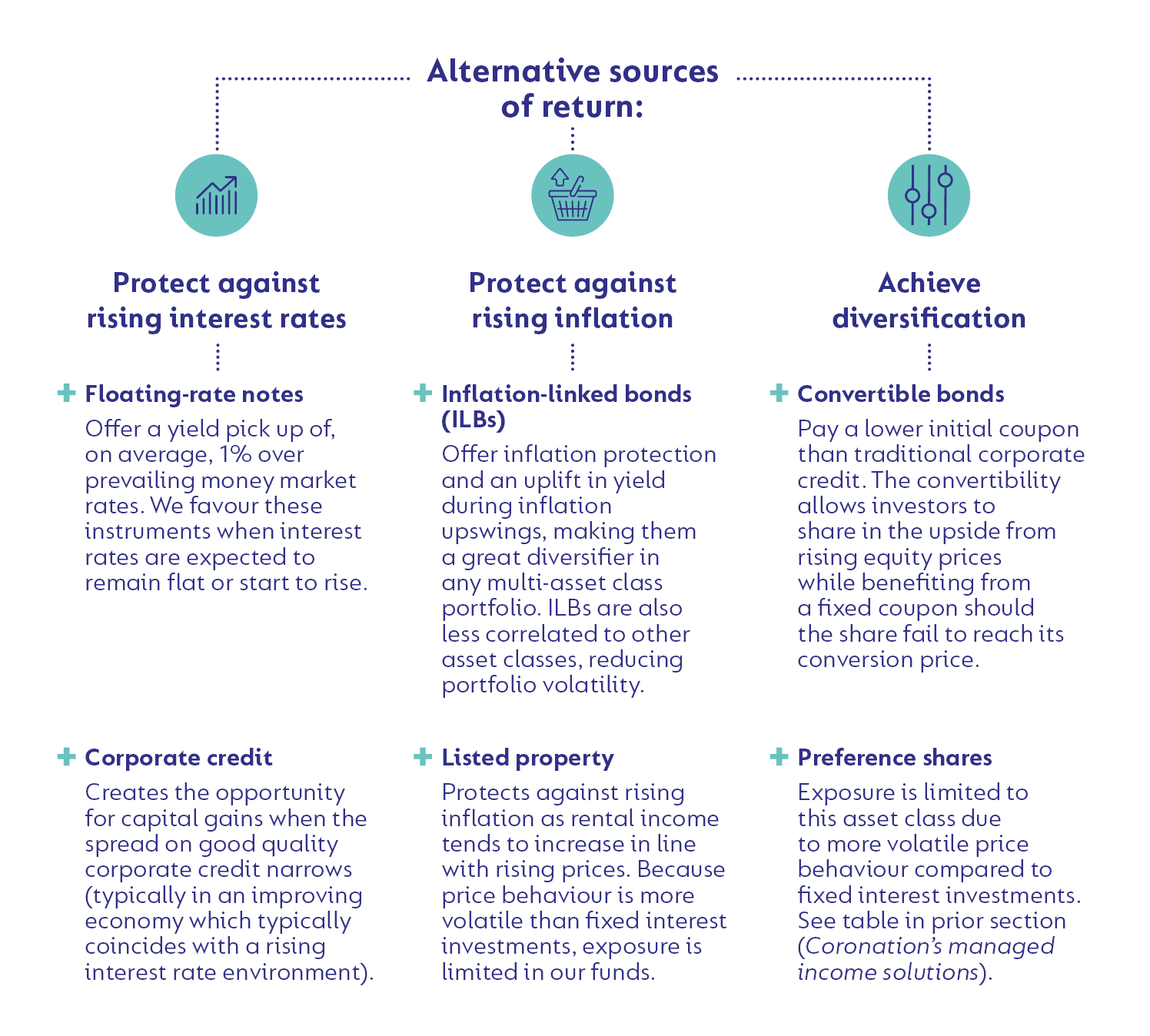

Actively managing our exposure to alternative sources of return when the likelihood of outperformance is high

To achieve our internal performance targets over the corresponding investment time horizons, one could argue that it is as simple as building a portfolio that only comprises instruments that offer yields in excess of cash. However, allocating to alternative sources of return that offer protection and diversifying qualities requires careful analysis of the prevailing market environment and then to dynamically adjust exposure when the likelihood of outperformance changes as detailed in the visual below.

4. Avoiding excessive risk for certainty of return

As part of our disciplined portfolio construction process, we never aim to increase our managed income funds’ risk profile or performance by increasing the possibility of investor downside.

This means that we won’t attempt to deliver more than the stated return target if we believe it will put our capital preservation commitment at risk or if it will result in us underperforming cash. To achieve this, we use quantitative modelling to arrive at a blend of assets that allows us to meet our risk/return target with a high degree of certainty.

How our managed income funds have delivered on their return profiles

Don’t expect a linear return series

As explained before, the need to put capital at risk through the portfolio decisions means that our income funds will not have a linear return series like that of a money market fund.

Over short measurement periods, performance can fluctuate. However, we will never position our income fund portfolios towards a single outcome. Instead, we create portfolios that comprise a diversified set of assets and always take a conservative approach to risk (e.g., through option protection strategies).

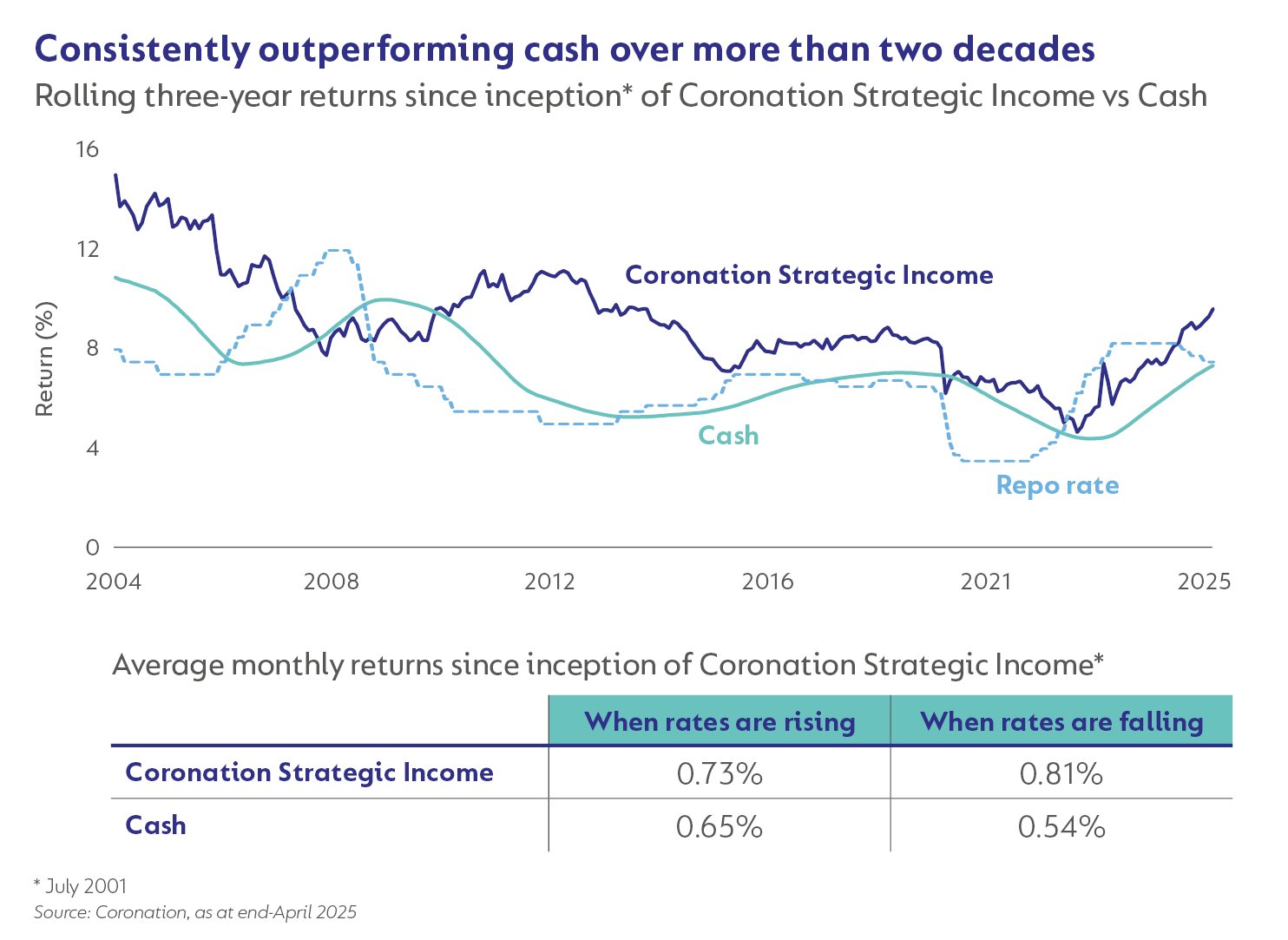

Sometimes, in the short term, these funds will not deliver on their cash plus targets. Rising interest rate environments make it more challenging to provide cash plus returns. When rates are falling, it becomes easier to achieve this goal (as shown in the chart and table below). However, we are confident that we can consistently deliver on the funds’ cash plus targets through the cycle.

Expertise that culminates in desired outcomes for conservative investors, both locally and offshore

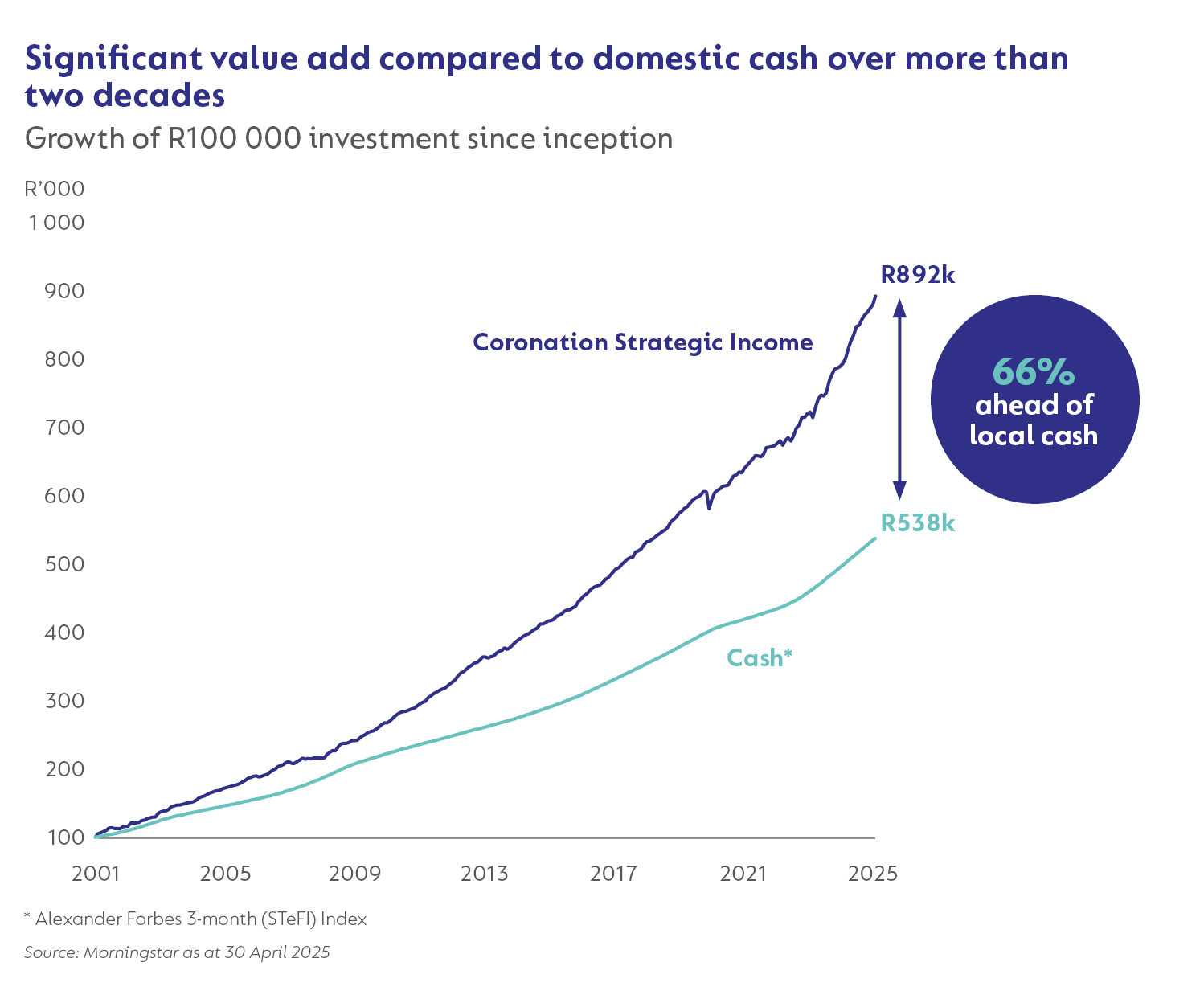

Our flagship domestic income fund, Coronation Strategic Income, consistently outperformed cash over its almost 24-year history, resulting in a value uplift of 66%, as shown in the graph below.

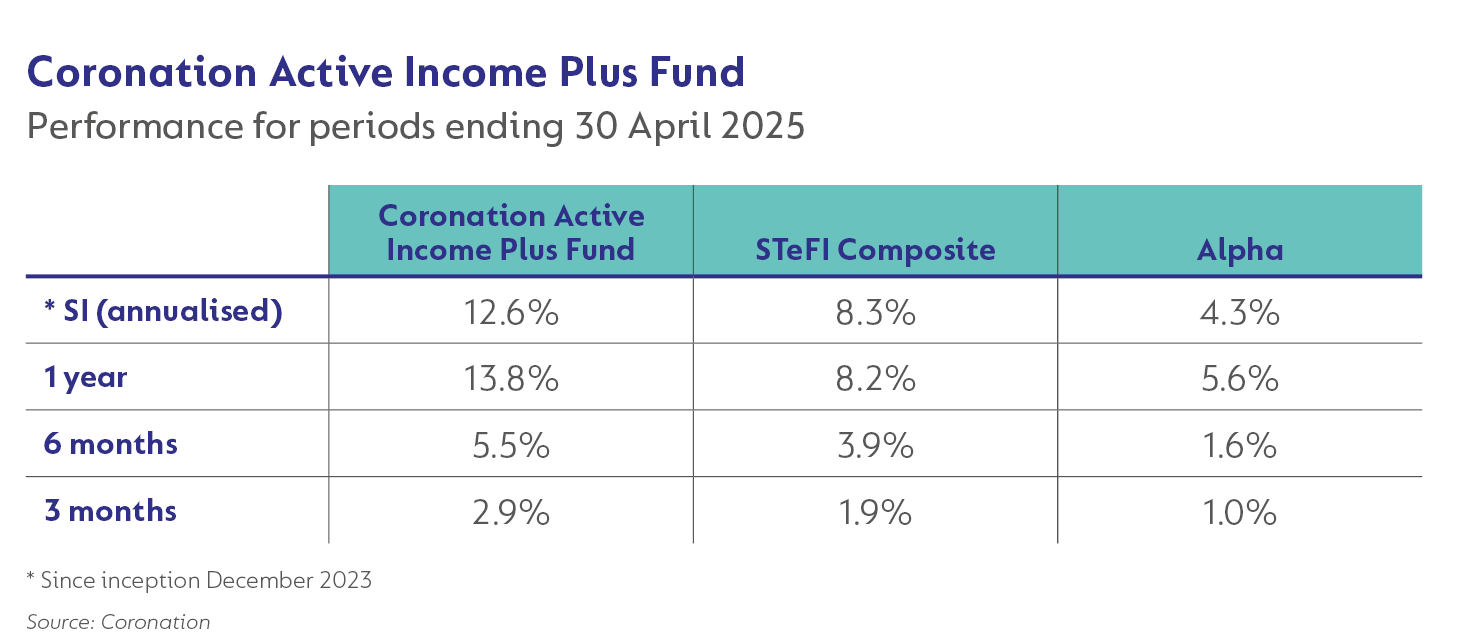

Equally, the Coronation Active Income Plus, albeit over a less than two-year period, has comfortably outperformed its cash benchmark (see following table) since inception in December 2023.

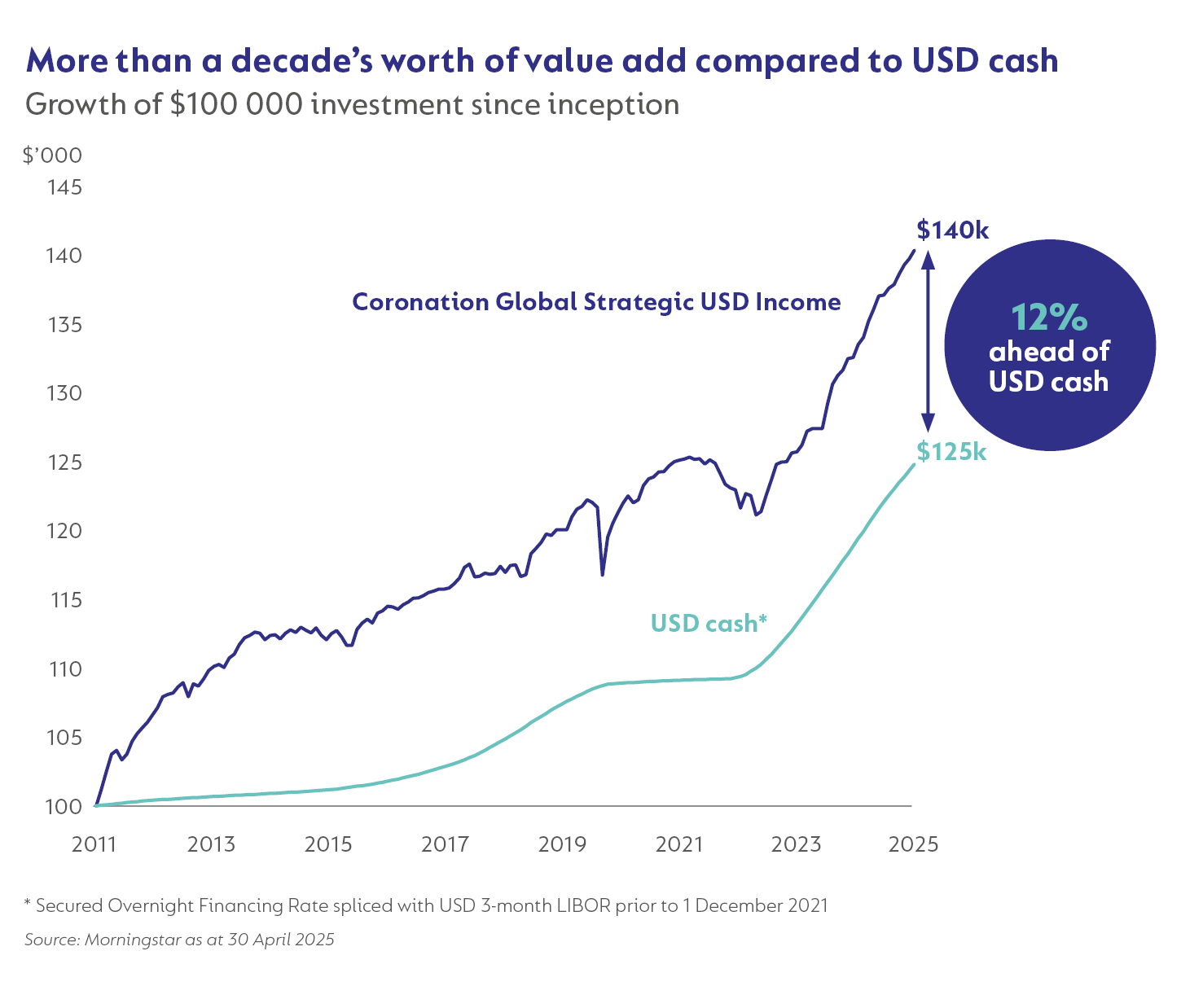

Coronation Global Strategic USD Income produced returns ahead of US dollar cash over its almost 14-year track record, resulting in a value uplift of 12% compared to USD cash since inception, as shown in the graph below.

Conclusion

This edition explained the essential role that a local or global managed income fund can play in an investor’s overall portfolio. It also demonstrated the fundamental principles we apply to our range of managed income funds to arrive at their stated risk and return objectives. And as demonstrated in the long-term track records of our two flagship income funds, Coronation Strategic Income and Coronation Global Strategic USD Income, this approach has created significant value relative to local or US dollar cash over multiple decades.

Disclaimer

SA retail readers

United States - Institutional

United States - Institutional