LAST YEAR WAS one in which South Africa celebrated a change in political leadership and, at least initially, had high hopes of a social and economic recovery. These were short lived and a combination of consecutive growth-related disappointments, revelations of deeper and more intractable political (and private) malfeasance and the slow pace of change we ended 2018 a little more bruised, possibly more realistic and certainly more downcast than we were at the outset.

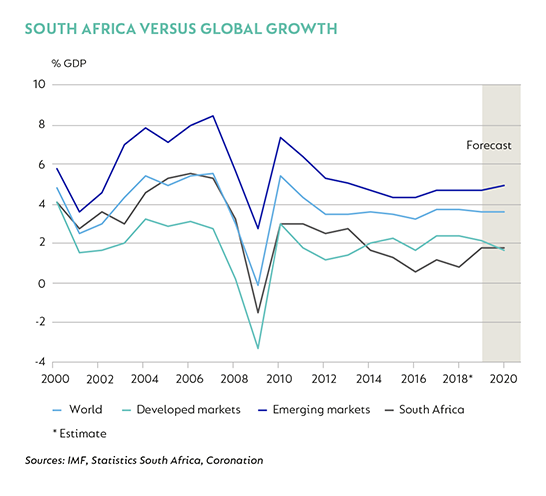

Many forecasters – including ourselves – started 2018 believing that GDP growth approaching 2% was relatively easy to achieve. Within a supportive global environment, a great improvement in consumer confidence, reinforced by low inflation and low but positive real disposable income growth provided a decent support for consumer spending acceleration, despite the increased tax burden. A small amount of replacement capex and at the margin some rebuilding of commercial and industrial inventories from historically low levels all added up nicely.

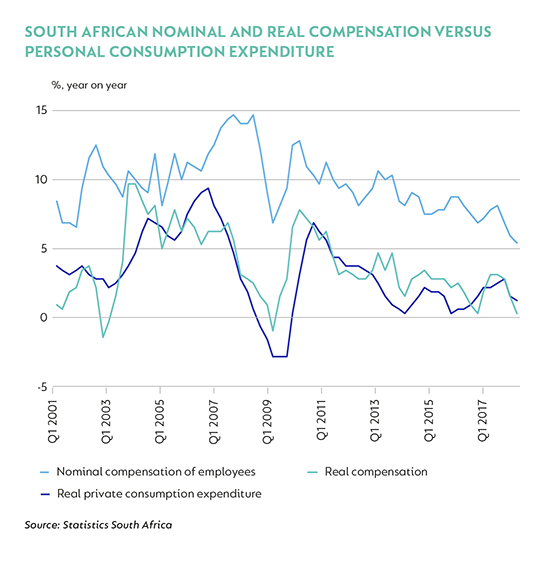

However, little came to pass. With a steady deceleration in compensation (wage) growth, a significant increase in the fiscal burden on consumers (tax bracket changes, a rising fuel levy, the VAT increase and rising utility levies) and not enough confidence to increase credit utilisation, consumer spending has remained weak. State capex retreat pulled overall gross fixed capital formation down. On the supply side, the deep contraction in agriculture was exacerbated by a series of derailments, refinery outages and strikes that affected mining, manufacturing and transport output. South Africa slid into recession in the first half of 2018 and while there was a nascent recovery in the third quarter (Q3) of the year, it is now unlikely to deliver even half the growth that was forecast at the beginning of 2018.

CHANGING MOOD

Through the course of these events, there has been a general deterioration in sentiment. Despite the meaningful and important political changes made in key economic institutions and ministries, the fact is that incomes remain under pressure and the political situation, although vastly improved from a year ago, has not yielded much visible economic benefit. The reality is also that ordinary South Africans simply have not felt that things are getting any better.

At the end of a hard year during which bad news seems to have come in waves, each more depressing than the next, the recent news about the full extent of Eskom’s financial and operational failure feels like the proverbial last straw.

So, it is hard to see how growth will pick up materially in 2019, and recent data continue to pose downside rather than upside risk to existing forecasts. There are certainly lots of reasons to think that growth momentum will remain under pressure. Household spending accounts for 60% of GDP and compensation growth slowed to 5.4% year on year (y/y) in Q3 2018. This is the lowest nominal growth since the 2008/2009 Global Financial Crisis (GFC). In real terms it is only just positive, and little better than the low point of -0.8% y/y in the second quarter of 2009. Additionally, gross fixed capital formation was 1.4% y/y in Q3 2018 – positive at least, but still historically weak. Private sector job creation is stagnant, while both consumer and business confidence retreated in Q3.

NOT ALL BAD?

But there are areas where pressure has eased, and momentum seems to be improving.

Stability in compensation growth, which has been slowing steadily, should help improve momentum in disposable income. In December, retail fuel prices were cut heavily, and the rate of increase in monthly outlays should slow steadily. Inflation is set to remain relatively benign and we do not expect the same degree of fiscal pressure to be repeated in 2019/2020. We would again make an argument for some growth in replacement capex and inventory recuperation – now off even lower levels than last year – but uncertainty remains.

At the margin, some small boost from capital committed during the President’s Investment Summit will also help. The falling oil price – if sustained – implies an improvement in terms of trade and a more positive contribution to growth from net exports. On the supply side, both mining and manufacturing output improved towards year-end. Our long-held forecast is for growth to accelerate to 1.8% in 2019.

THE ESKOM ELEMENT

Eskom is now the biggest and most immediate domestic threat to growth and a positive political outcome. From a growth perspective, meaningfully higher electricity tariffs will raise inflation and undermine household disposable income growth. Supply disruptions undermine not only business confidence but also inhibit the ability of companies to produce output.

The fiscal risk posed by Eskom is meaningful. Not only has Eskom asked for significant tariff increases of 15% per annum over the next three years, but the latest results also contained a request for

R100 billion in debt to be transferred to the state balance sheet. This amount represents about 2% of GDP and would – under this proposal – increase South Africa’s government debt stock by as much. Government is already in a fiscally constrained position, with the October Medium-Term Budget Policy Statement detailing yet another deterioration in the government’s debt profile over the next five years and the expectation that annual fiscal deficits are likely to be larger than previously budgeted for. Gross debt is expected to continue to climb to a peak of 59.6% of GDP in 2023/2024 and moderate very slowly thereafter. The request potentially creates a dangerous precedent and the fallout might be enough to change South Africa’s last remaining investment grade credit rating.

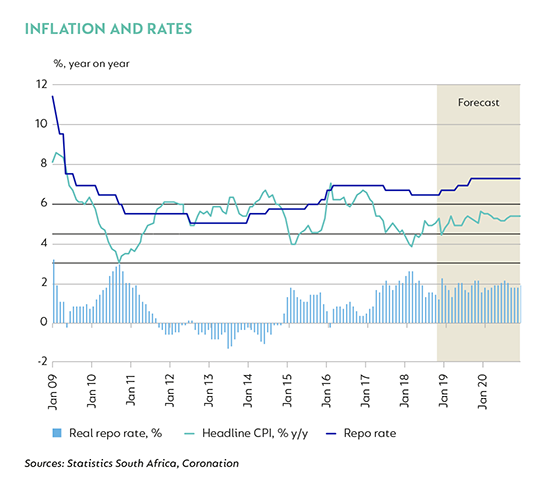

The good news is that inflation is unlikely to also become a big headwind for the consumer. Relatively low food inflation provides a good anchor for overall inflation, but a sharp decline in retail fuel prices – and base effects – help contain two large and potentially volatile influences of headline inflation. The weak economy has also seen a steady moderation in service prices and limited much of the pass-through from a volatile and weaker currency.

Administered prices, including Eskom, remain a large inflationary influence on headline inflation and arguably still represent a tax on consumption. We forecast average CPI at 4.6% in 2018, with a modest acceleration to 5.3% in 2019. In this environment, we think there is limited scope for a steady interest rate hiking cycle, and anticipate moderate and slow rate increases by the central bank in 2019. Both our inflation and interest rate forecasts carry downside risk at this point.

Incoming data suggests global growth momentum continued to slow into year-end.

CAN WE AVOID THE GLOBAL HEADWINDS? MAYBE, MAYBE NOT.

That we experienced a very weak progression in domestic growth during a period in which the global economy experienced the most joined-up recovery in a decade – albeit now slowing and becoming much less even – raises understandable concerns that any local recovery in a weaker global context is unlikely. Certainly, slowing global trade volumes and weaker growth in key export partners are a clear headwind.

What is possible is a cyclical recovery driven by domestic demand. This requires the alignment of some recovery in domestic growth drivers outlined above and the rehabilitation of a range of supply-side one-offs, including various outages, strike action and Eskom’s load shedding. Because the economy has not grown, there are also few visible excesses – household balance sheets are in reasonably good shape, credit growth has been low and households have deleveraged. Employment has been poor and capex visibly weak and confidence is low. The current account deficit is relatively small. If the economy has not managed to grow, at least there are fewer parts which are exposed to a potentially sudden stop.

WHAT WE NEED IS TIME

While this is hardly an uplifting picture, it is a hopeful one. What now stands in the way is time. Linked to the clear frustration with an economy seemingly stuck in low gear has been a growing expectation that the necessary and painful reform needed to unlock better growth – much of which faces some opposition from the ANC-led alliance partners – will become manifest after the May 2019 election.

However, we are more hopeful that the marginal changes to policy already announced will gain velocity and that the quality of the conversation between the public and private sectors will continue to improve than we are of the election delivering a political payload that would significantly impact economic policy.

But what we do not have is a lot of time. Growth has been low for so long that it is at risk of stalling. Low growth limits options: it reduces revenue and undermines the State’s ability to more productively allocate capital, it limits employment opportunities and makes earning a wage capable of raising living standards impossible, and it discourages investment.

And those factors are just what we need. The swift delivery on some of the promises made, including the release of spectrum* and an accelerated and urgent review of visa regulations might only go a small way to boosting growth at first; but they could go a long way to bolstering confidence that there is more to these commitments than just words, and addressing some of the practical constraints to key growth areas. We also need an intervention which prevents Eskom from totally derailing these emerging green shoots, and we need it soon.

GLOBAL GROWTH SLOWED through most of 2018. But the pace of slowing accelerated meaningfully from mid-2018 into the first quarter of 2019. ‘Recession indicators’ started rising in the US, and growth concerns in Europe and China were reinforced by an escalation in trade tensions and ongoing deterioration in an increasingly wide set of economic data. Uncertainty about the future interconnectivity of the global economy will undoubtedly play a bigger long-term role in the global growth moderation than the direct impact of trade weakness, but the current situation has undeniably been exacerbated by idiosyncratic issues in several key economies, which should ease. The longer-term cost of heightened uncertainty is still to be counted.

Within this context, it is instructive to try to identify the sources of economic weakness and uncertainty, and then assess how durable the effects may be. These seem to fall broadly into three buckets:

1. CHINESE ECONOMIC ACTIVITY

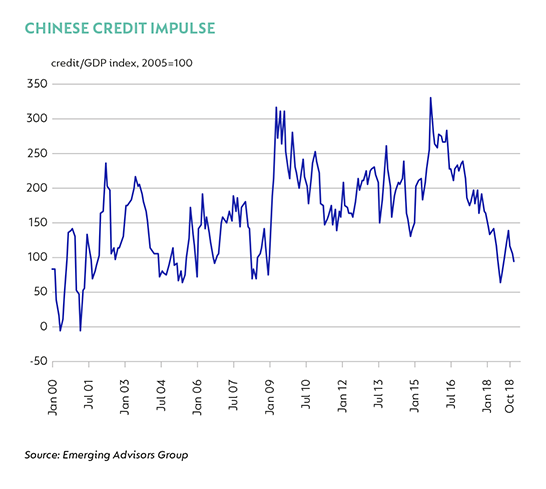

The internal, policy-driven moderation in Chinese economic activity started in 2017. Successive stimulus interventions have seen an unprecedented accumulation of debt relative to GDP in China, which peaked at an estimated 250% of GDP in mid-2017. Reasonable concerns about the sustainability of both the stock and the rate at which it has increased prompted policymakers to moderate credit availability from the end of 2016. The impact of credit withdrawal led to a moderation in growth momentum, which affected domestic activity and then rippled into global trade.

2. US-SINO TRADE TENSION

The above factors coincided with the escalation of US-Sino trade tension, which saw the US initially impose 10% tariffs on $200 billion of Chinese imports in mid-September, followed by retaliatory tariffs from China on $60 billion of US imports. While the US and China’s negotiations are still ongoing, global trade indicators remain weak. The knock-on has started to affect global manufacturing and, more broadly, sentiment and business investment. The hardest hit have been large trading economies, including Germany, much of Asia and Japan.

3. INDIVIDUAL MARKET EVENTS

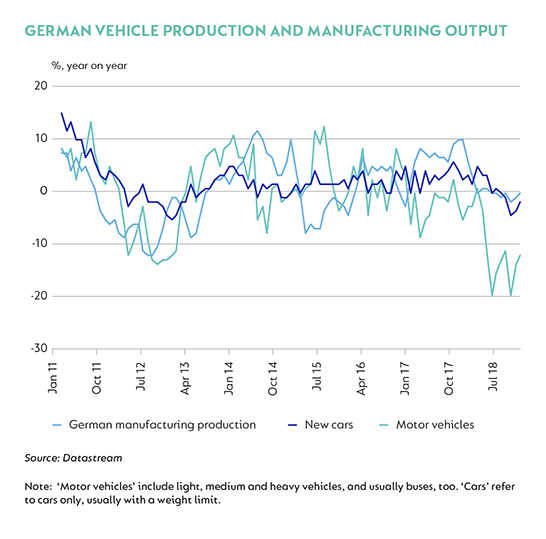

More randomly, there are a number of idiosyncratic events which have either materially exacerbated the impact of the above, such as the change in emissions regulations in Germany, or had the effect of weakening broader sentiment and hard data, such as a combination of US market volatility, the polar vortex and the shutdown of the Federal government in February. Elsewhere, political tension in France and the chaotic Brexit negotiations have negatively affected confidence and biased growth weaker.

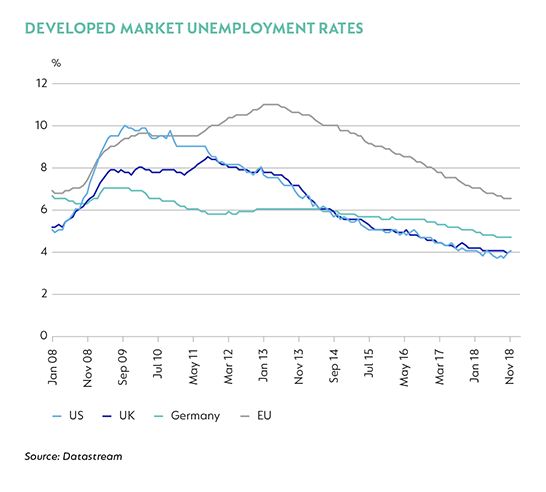

For all this weakness, the resilience of domestic demand in these economies has provided a relatively robust buffer. Across a broadbase of developed and some emerging markets, the current economic cycle has seen unemployment fall to multi-decade lows. While there are ongoing questions about the quality of this employment growth, low levels of unemployment support wage growth – and we have seen earnings pick up in the US, UK, Japan and parts of Europe, to the extent that developed markets’ income growth now rivals the last expansion. This has not been enough to mitigate all the headwinds, but it is an important source of stability.

Despite all the bad news, at the time of writing, there is mounting evidence that the first quarter of 2019 may be the low point of global growth. Several ‘nowcast’ models (UBS and JP Morgan), which track changes in high-frequency data to monitor the state of the economy in real time, are pointing to an improvement in global growth momentum. While the activity data are still mixed, there is enough evidence to suggest that, at the minimum, disruptions in the US and parts of Europe are normalising, and policy intervention is gaining traction in China.

This base is narrow because global trade-related activity and associated indicators are still uniformly weak. Data published by Morgan Stanley suggest that global trade volumes slowed to just 0.5% year on year in March, from 1.0% in February, based on export expectations in the IFO Institute for Economic Research survey and hard export volume data from Korea captured by their trade indicator. For better certainty of a recovery in global growth, we need a few things to go ‘right’:

Firstly, China’s outlook is critical to the prospects and magnitude of a global recovery, given its significant contribution to the global demand weakness over the past six to nine months. The main drag on growth remains property construction and manufacturing capex. This should be countered by an improvement in consumer spending and the support from fiscal stimulus. The rise in China’s Purchasing Managers’ Index new orders for the second consecutive month is encouraging.

Secondly, some resolution to the US-Sino trade tension is needed in the form of an agreement on terms and implementation between the US and China. Not only is this key to an improvement in trade volumes; a better framework for dispute resolution is also a necessary condition to avoid a repeat of the past year’s standoff or a deterioration to something more hostile. The likelihood of achieving a robust agreement with long-term solutions is questionable given the US and China’s very different economic policies, but a stabilisation in tariff uncertainty should support confidence lost in the current state of flux.

Then, we need to continue to see the influence of the ‘one-offs’fade, especially the disruptions to US activity and spending after February, and the lesser influence of the manufacturing disruptions in Germany. The US Federal Reserve’s commitment to ‘patience’ should also provide a meaningful fillip by keeping global financial conditions easy for a prolonged period, although better growth could also see an uptick in inflation and ultimately put pressure on the Federal Open Market Committee to continue raising rates. Similar very dovish guidance from the European Central Bank suggests it will take a considerable change to conditions to alter its outlook, and we assume monetary policy will stay accommodative in coming months, even as activity picks up again.

Lastly, the ‘red flags’ raisedduring this period of slowing growth need to be tested. Not all the decline in growth momentum that we have seen in the past two quarters can be fully explained by the events listed above and, in some cases, these have not been resolved.

In China, we assume that much of the slowdown started with tighter credit conditions, which have started to ease modestly, and that fiscal interventions will buoy activity in the second half of 2019. It is possible, however, that the impact of credit withdrawal has not yet fully played out, notably on the property market, and that we have yet to feel the full impact of the trade war with the US. Both factors are considerable uncertainties, and hard to quantify.

For the US, the combined sluggishness in the housing market – which is at odds with the very supportive macro factors, including employment and wage growth, household formation and very supportive financing conditions – and emerging weakness in business investment are traditional signs of cyclical weakness, which are important to monitor.

In Europe, the impact of protracted weakness in the external sector may have a much deeper effect on growth. Global trade is a much stronger driver of internal growth momentum than in the US or China. Political uncertainty will play in the background and is not limited to Brexit. It also includes the outcome of the European Parliamentary elections, taking into account more populist and less traditional leadership in several member countries, as well as the impact of weak growth on Italian fiscal metrics, especially under the coalition government.

The umbrella risk is that the uncertainty imposed by all these factors becomes reinforcing in a global economy that is weaker and more fragile than it was at the start of 2018. Our base case, however, is that one-offs correct – and a few things go right – aided by strong domestic demand conditions in key economies and very supportive monetary policies.

We expect global growth to slow to about 3.4%, from 3.8% in 2018, and to recover to 3.7% in 2020. Within this, growth from emerging markets should be supported by recovering economies hard hit in 2018, including Argentina and Turkey, with emerging market aggregate growth expected to be 4.7% in 2019 from 5.0% in 2018, and 5.1% by 2021. Developed economies are more likely to remain under pressure, with the growth forecast flat at 1.8% in 2019 and 2020 as momentum from 2018 is lost and the US tax boost fades.

Disclaimer

SA readers

Global (ex-US) readers

US readers

*Making additional radio frequencies available will boost wireless network capacity. This will bring down the costs of communication and increase internet access, which is essential to economic growth and innovation, ensuring that SA keeps pace with the 4th industrial revolution.

South Africa - Institutional

South Africa - Institutional