Economic views

The Economy - My laundry list of concerns

Restoring confidence is key to growth recovery

- We’re experiencing a perfect storm of economic headwinds to global growth

- Policy inertia continues to dog growth and confidence

- The government debt-to-expenditure ratio is of grave concern

- The world at large is in a state of upheaval; quantitative easing is back

TO SAY THAT we are living in uncertain times seems more than ever a gross understatement. South Africa’s political landscape is in transition from a decade of maladministration towards painful stabilisation. Economic growth has suffered and the path to recovery is still unclear.

EXODUS

People are leaving and at times the political narrative is toxic. Globally, populist politics and protectionism are weakening traditional allegiances; while against a backdrop of slowing economic growth, traditional policy instruments seem stretched beyond effectiveness. This turbulent combination finds us in choppy, unchartered waters. In this note, I try to distil the issues that concern me most.

OVER THE RAINBOW

My most immediate concern is the outlook for domestic politics. Importantly, whether this administration will deliver sustainable policies that are necessary to improve domestic growth. This extends beyond the President, through an administration which has thus far failed to act decisively or think creatively when the economy needs it most.

When Cyril Ramaphosa won the ANC presidency at the ANC’s 2017 National Conference at NASREC, the country was euphoric, expecting (or hoping against hope?) one man to transform a corrupt state and a growthless economy into an accountable state and a growing economy. To date, progress has been slow at best, and expectations have been disappointed. Several reasons for this sluggishness have emerged in the intervening 19 months:

- The degree and depth of corruption in both the public and private sectors were much worse than suspected. The Zondo Commission, among others, has revealed this, and recent public statements by the President have confirmed it.

- The President has had to opt for a strategic, reformist approach, which takes time to implement. His narrow NASREC victory, coupled with ongoing opposition from his detractors, both within and from outside the ANC, means he has had to use commissions and review committees, the mechanism of the courts, and the slow attrition of opponents to reach decisions and make appointments. This has taken time.

- Unfortunately for the President, his ability to build an economic dialogue with enough momentum has been thwarted by a number of other distractions. These constraints seem to be easing, as he recently confirmed the imminent announcement of new policies; however, we still await key decisions.

- There have been some notable successes, including the appointment of a credible commissioner of the South African Revenue Service, a renewed and credible head of the National Prosecuting Authority, and the rehabilitation of various institutional investigative units. These are all important, positive steps to restoring institutional resilience.

A STATE OF INERTIA

A decade of poor policy setting and weak implementation, exacerbated by state rent seeking, has led to a considerable depletion of domestic resources. Offshoring by local companies, and an acceleration in emigration have hollowed out the financial and skills bases. It is unclear whether the economy will be able to make a full recovery, but the result has been a protracted period of very low growth.

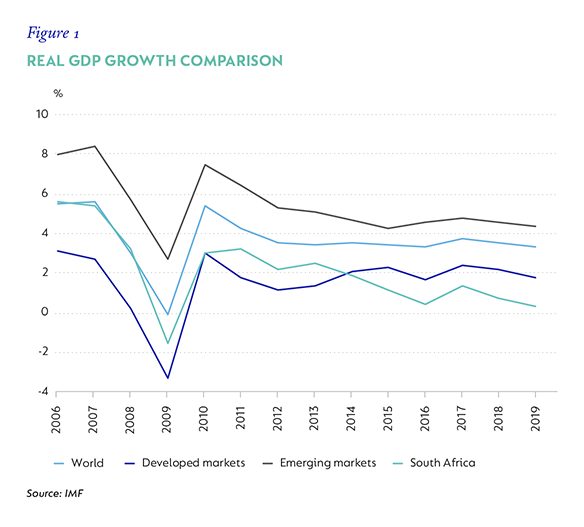

Low nominal growth is the next concern. Achieving better, stronger growth really is the most important economic challenge for South Africa at this critical stage. It is the means by which economies generate opportunities and government the resources by which to provide for people where economic allocations fail. It doesn’t fix inequality, but it allows the state to make provision for the most vulnerable. Without growth we have no options. The South African economy has underperformed global growth, across developed and emerging markets, since the 2008/2009 Global Financial Crisis (GFC). This became (and has stayed) more pronounced in 2012 (see Figure 1).

This at least partly reflects the effects of post- GCF policy choices: at the time, government spending accelerated as revenue collapsed. This was the right thing to do in a crisis. However, the way in which government spent, hiring many people and expanding their incomes at a rate well ahead of inflation, had a permanently negative effect on government expenditure. At the time, government expected growth to return to pre-crisis rates; only it didn’t. The result is that revenue has fallen much faster than expenditure has been able to adjust, and the shortfall has been met by an accelerated accumulation of debt. And, in spite of all the best efforts of the National Treasury, this continues to be the case. It means that the two fastest-growing expenditure lines in the budget are the public sector wage bill and the price of servicing government debt.

DROWNING IN DEBT

This brings me to my next biggest concern, because the two are linked – rising government debt combined with the financial and operational condition of state-owned enterprises (SOEs). In the case of the former, because growth has been so much weaker than expected, revenues have consistently underperformed budgeted amounts and the allocation to expenditure, and government has funded the shortfall by raising debt.

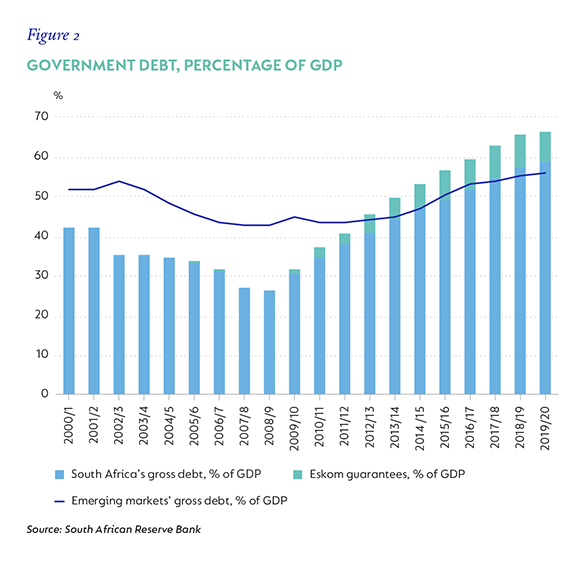

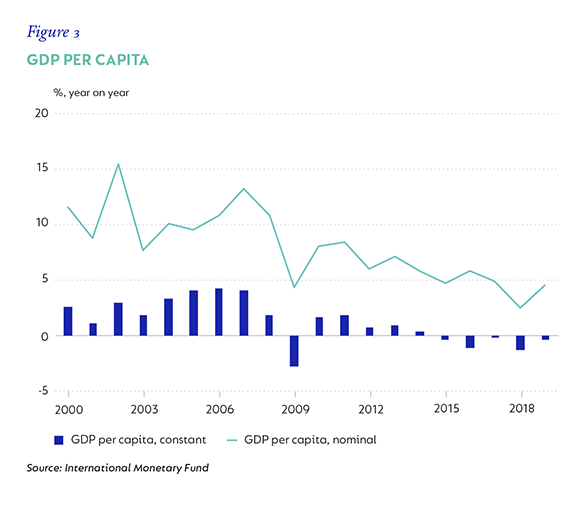

Government debt is expected to hit 60% of GDP in the current fiscal year, excluding the debt owed by the SOEs. Alone this is not alarming, but the trajectory is: government debt bottomed at 24.6% of GDP in the third quarter of 2008; since then, it has increased to 56.7%, a compound annual rate of 7.9%. As we stand, government debt will not stabilise, but will continue to build over the medium term (refer to Figures 2 and 3).

Why does it matter? The bigger the debt burden becomes, the greater the cost it exacts on the economy. Not only are financial resources directed away from productivity-promoting investment to finance the debt; but it must ultimately be repaid. We can already see that increased debt is weighing on the economy’s ability to grow. Rising issuance puts pressure on long-term interest rates, which affect borrowing costs across the economy by raising the cost of debt and debt service.

Taken together, the increased cost of debt, coupled with a rising risk that the situation will become increasingly unsustainable, undermines any appetite for investment. Less investment now means less growth later, which means high levels of debt have a lasting impact on both realised and potential growth. As this happens, living standards fall. Outside of a cumbersome wage bill, the costs to the fiscus of troubled SOEs have increased enormously. Eskom remains the biggest challenge. This is the next big concern – the financial and operational viability of Eskom and the risk this poses to both sustainable growth and government finances.

DARK MATTER

In February, the National Treasury allocated an additional R23 billion per annum of taxpayers’ money over the next decade to keep Eskom afloat. By March (the very next month) it became clear that this wasn’t enough, and government front-loaded R13 billion of this year’s annual allocation to the entity. At the end of July, Finance Minister Tito Mboweni tabled a Special Appropriation Bill, allocating an additional R26 billion transfer to Eskom in the current fiscal year, and a further R33 billion in 2020/2021. Despite promises that these transfers would be made on condition that certain reforms be met, further details have not been forthcoming.

Eskom’s financial and operational fragility really emerged at the start of Ramaphosa’s presidency in mid-2018. While the causes pre-date this, the situation has deteriorated visibly since, and the complex nature of Eskom’s challenges has become more apparent:

- Eskom is insolvent. Years of corruption, coupled with a failure to invest in adequate capacity, and falling revenues have resulted in a debt stock of R420 billion, and its revenues cannot meet the combined cost of servicing this debt and its operating expenses. By our estimates, without dramatic remedial intervention, Eskom will need direct financial assistance (taxpayers’ transfers) for the foreseeable future.

- The remedy requires difficult decisions. At group level, recurrent expenditure (wages and debt service) continues to rise, and there is little appetite to reduce these costs. To add to these woes, revenue is constrained by a shrinking customer base and chronic non-payment.

- Eskom as an entity is an anachronism and needs to be restructured. This includes vertical disintegration, higher tariffs, and, importantly, a new way of managing its excessive debt burden.

- Eskom is unable to meet the energy needs of a growing economy.

- It isn’t clear that decision makers realise the urgency with which this needs to be addressed.

Probably the most important parallel requirements for stability are a detailed (and agreed) turnaround strategy for a disintegrated entity, and what Eskom and the government propose to do with its debt. The former is up to the Department of Public Enterprises, the President and stakeholders; the latter requires that these agree and then negotiate with the bondholders. At this late stage, while there has clearly been a lot of consultation, there seems to be little agreement. As we head into the tabling of the Medium- Term Budget Policy Statement in October, we have yet to see any evidence of real progress.

This means that there is real risk that Minister Mboweni will table a policy statement with a fiscal position considerably worse than was estimated at the time of the February National Budget (which is widely expected), but with few compensating measures. In this case, domestic debt to GDP will not only rise above 60% this year, but is also unlikely to reflect the necessary conditions for stabilisation. In this dim light, growth prospects are further diminished. And there is little relief in looking to the rest of the world to find it. This time, there is cold comfort to be found abroad.

A WORLD AT SEA

South Africa is a small, open economy operating in a very uncertain world. More than ever, political signalling is driving asset markets and economic policy in a global environment that is more disconnected than it has ever been in the post-war period. Across economies, growth has decelerated since late-2018, owing mostly to moderation in China, compounded by falling global trade volumes and the escalation in trade tensions between the US and China. At the same time, political tensions remain high. China-related protests in Hong Kong are ongoing, with little obvious source of diffusion; the Middle East remains a source of great potential unrest; and the UK’s EU exit date is fast approaching, with its own fraught political uncertainty. And, US President Donald Trump continues to be a disruptor across a range of issues and geographies.

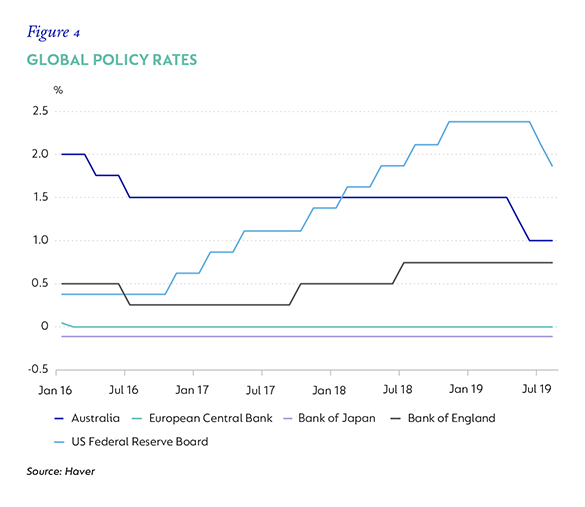

Central banks in the US, the EU, Japan and across emerging markets have increased monetary support for their economies in response to this weakness and the uncertainty it poses to domestic growth. At the September news conference of the Federal Open Market Committee, Jerome Powell, Chairman of the Federal Reserve Board, reiterated that the decision to cut the fund’s rate for the second time this year, despite decent growth in the US, was due to a weaker external environment, with growing risk and inflation persistently below the 2% target.

Similarly, outgoing European Central Bank President, Mario Draghi, announced not only a deposit rate reduction into deeper negative territory, but open-ended direct support for asset markets in the form of a renewed targeted longer-term refinancing operation. Japan’s stance is also accommodative and “more keen to ease than before since overseas risks are heightening” (refer to Figure 4).

Ultimately, the outlook for global growth in coming quarters will be in the balance between supportive monetary and fiscal policies for reasonably solid domestic demand, and an ongoing deterioration and heightened escalation in uncertainty playing out in global trade.

For now, we expect global growth to stabilise at weaker levels as policy support matures, acknowledging the pronounced uncertainty.

For South Africa, there is much to be gained from clarified policy direction, despite rising global headwinds. In particular, decisive action on Eskom could go a long way to restoring confidence among businesses and consumers. Recent data from the Bureau for Economic Research confirmed that confidence among these key growth drivers hit multi-decade lows in the third quarter of 2019, inhibiting consumption and capex decisions. With few easy short-term drivers of growth available, restoring confidence is key to the start of any growth recovery.

Disclaimer

South Africa - Institutional

South Africa - Institutional