Investment views

WeBuyCars

- reflecting on its first 18 months as a listed company

The Quick Take

- WBC is a great example of the value we get from our integrated global research process

- Led by a high-quality management team with skin in the game, WBC is building a formidable ecosystem that should deliver sustained growth

- It has delivered outstanding results and achieved a meaningful increase in its share price since its IPO

- We believe the share offers good long-term value

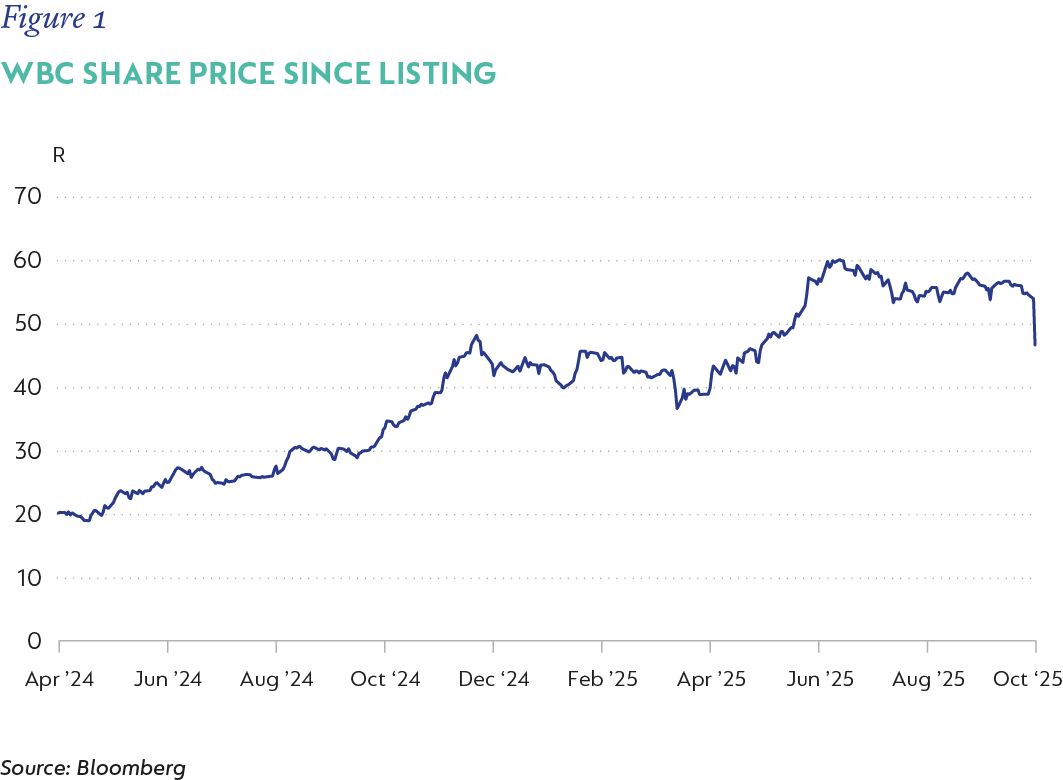

WeBuyCars (WBC) listed in April 2024. At the time, the market was so sceptical of its success that its bookrunner[1] failed to place the full allocation of shares at the targeted valuation. However, management was undeterred and ever since its listing, WBC has worked hard to defy the narrative that it is not meaningfully different from any other used vehicle retailer (or, at worst, that it is just a website with a few parking lots!).

We are great believers in the company and used the IPO to increase our shareholding, adding to the equity we had acquired during the pre-IPO restructuring process. At the time, we wrote that we believed the unbundling presented an outstanding opportunity for investors to own a high-quality company that had the potential to disrupt the used vehicle market and meaningfully grow its market share.

BREADTH OF COVERAGE, DEPTH OF RESEARCH

Unbundlings and spin-offs often create attractive investment opportunities for active investors. Limited coverage and experience of a company often mean that the market’s price discovery process is very inefficient. In the case of WBC, Coronation was well positioned to capitalise on this mispricing as our globally integrated research process provided unique insights into the business model and the outstanding success stories of Carvana, in the US, and Auto1, in Europe. This deep understanding of its peer group, combined with our proprietary work on WBC, enabled us to move quickly and with conviction when it listed.

For example, we are a significant shareholder in Auto1, which is a top holding in the Coronation Global Equity Select Fund and has yielded an understanding of the sector. It is a pan-European online used vehicle retailer that sells more than 600 000 vehicles annually. It has executed outstandingly and is today the only pan-European online retailer left standing in this sector after the market rout of 2022/2023. It has the potential to become a major player in the coming years.

Similarly, our confidence in WBC is paying off. It has delivered excellent results in its short history as a listed company. As a result, the share price has performed well, increasing two-and-a-half times from the R18.75 bookbuild[2] price (Figure 1). The market has rewarded that delivery with a high multiple today. As was seen from the very negative market reaction to the recent trading update, high multiples are vulnerable to short-term corrections where earnings delivery is not linear. In this article, we describe the structural drivers of long-term growth and why we believe the share remains undervalued.

SOURCING ADVANTAGE

Consumer-to-business (C2B) vehicle acquisition is the cornerstone of this business model. The process is heavily digitised, and its successful scaling over more than two decades has resulted in a very low unit cost, which no competitor can match. Tens of thousands of consumer leads are screened each month, with the best converting into profitable trades. This gives WBC unparalleled visibility into the overall vehicle market.

The C2B engine also serves as a low-cost wholesale channel, sourcing vehicles for the dealer market at prices lower than dealers can get themselves.

COST ADVANTAGE

WBC has a meaningfully lower cost to serve[3] than its brick-and-mortar competitors:

- Brand: WBC benefits from having a single national brand. It has grown to the point that it already rivals South Africa (SA)’s largest used vehicle classified platforms.

- Economies of scale: This scale provides material efficiencies across the business; marketing spend being a good example.

- Real estate: WBC does not carry the heavy rental costs that come with the retail footprint that a brick-and-mortar incumbent has to cover.

- Data:

- With a 24-year head start in C2B used vehicle transactions, WBC has a hard-to-replicate data advantage. Its proprietary dataset provides unmatched context on the SA vehicle parc[4] and consumer trade behaviour. Thousands of new leads added each day compound this advantage by increasing data density. Repeat trades of the same vehicles also help to refine depreciation curves.

- The company is investing this data advantage into better pricing tools and enhanced transparency. Improved pricing leads to better buying, faster inventory turns, and fewer loss-making vehicles. Advanced machine-learning pricing is also being used, with WBC autonomously pricing and purchasing a few thousand vehicles without human intervention.

TRANSPARENCY AND TRUST

To build on its trusted brand status, an internally built vehicle-assessment scorecard is slated to replace DEKRA[5] inspections. This will further improve transparency, strengthen pricing confidence, and result in more satisfied consumers.

MARKET SHARE

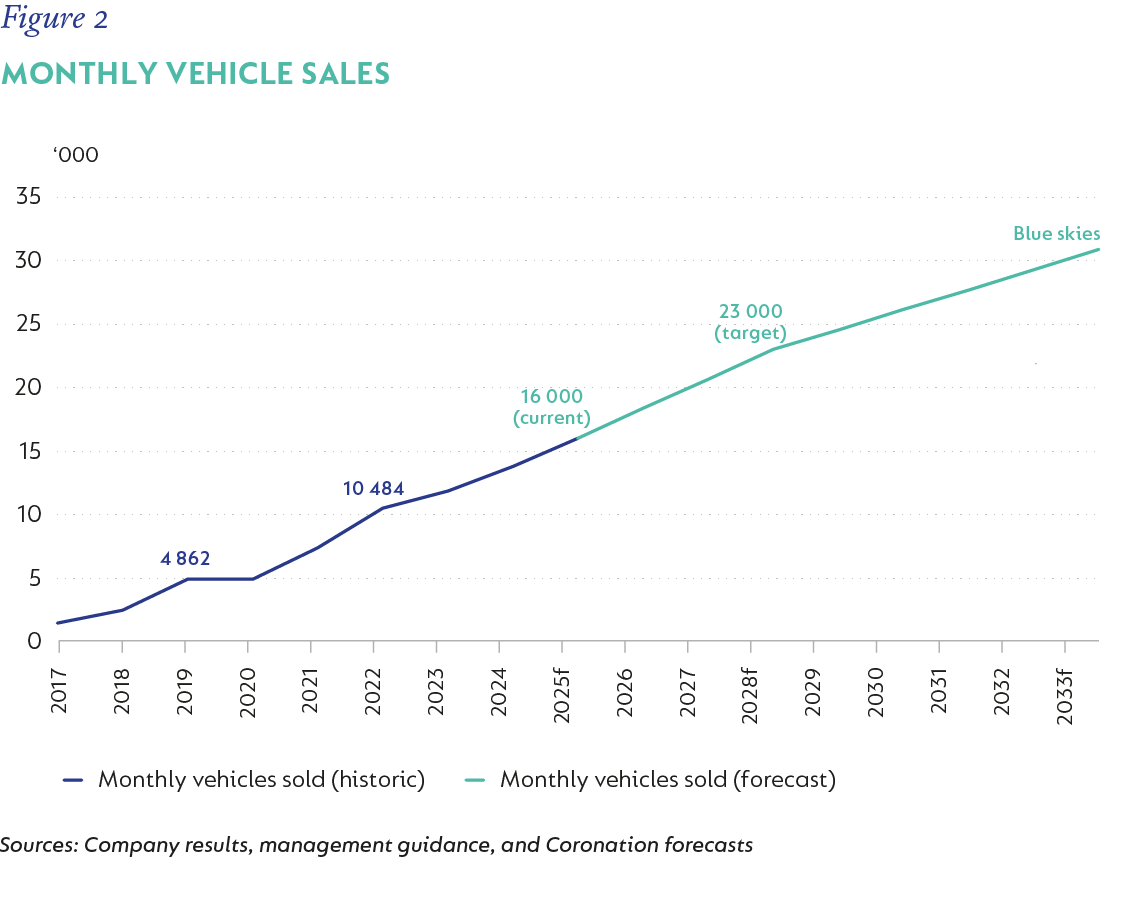

Current throughput is over 16 000 vehicles per month, implying a mid-teens market share. As impressive as this outcome has been, management is committed to keeping the flywheel going. They currently target 23 000 vehicles per month by 2028 (Figure 2):

- It currently offers customers a price and convenience that competitors can’t match, which is a customer proposition that will drive increased volumes. We expect its advantages in sourcing, costs, and data to continue to compound as the company scales.

- WBC intends to invest these gains back into the business in order to reduce its cost to serve further. This will then be passed on to customers through better pricing, which will drive further market share gains.

- Growing volumes also strengthen its bargaining power with finance-and-insurance (F&I) partners. Key partners include Netstar (an Altron Group company), OUTsurance, and Capitec (all homegrown success stories also owned by Coronation on behalf of clients). WBC will become an ever larger origination channel for these partners and should therefore, over time, increase its share in these profit pools.

CONCLUSION

While we remain confident in WBC’s long-term advantages, we continue to monitor shorter-term factors such as new entrants testing the market and the temporary pressure from cheaper new vehicle imports. We believe WBC’s scale and experience in sourcing and pricing should help it manage these challenges.

We see scope for a materially higher market share in the decades ahead, potentially as much as 30%-40%. SA precedent supports sustained share gains by scaled disruptors (case studies include Discovery Health in medical schemes, Clicks and Dis-Chem in pharmacies, and Capitec in banking). These businesses grew market shares well beyond initial expectations by reinvesting lower cost advantages into unlocking superior value for consumers. This is one of those businesses that gets better as it gets bigger. We expect WBC to replicate the kind of market share gains that these businesses have achieved over time.

We are also impressed by management’s commitment to the long term. It is not preoccupied with short-term results, preferring to invest in the business. Although this might come at the cost of short-term profitability, it will enhance the company’s long-term earnings power and deepen its moat.

We believe that the market doesn’t fully appreciate the opportunity set that this company enjoys. With superior C2B sourcing, a structurally lower cost model, and data and pricing advantages, we expect eventual market share to exceed management’s targets. If that is the case, then the current share price will prove good value.

[1] Investment bank that manages the equity issuance

[2] Initial price paid on listing

[3] Total cost of delivering a product to a customer across the value chain – marketing, sales and distribution, and client service

[4] Total number of registered vehicles in a specified area, in this case, SA

[5] A global 3rd party vehicle inspection service

South Africa - Institutional

South Africa - Institutional