THERE IS PERHAPS one universal truth about economics and that is that there is always ‘noise’. This is particularly difficult to sift through at the moment, where the visible risks are numerous and have potentially large implications for economies, policy setting and asset prices.

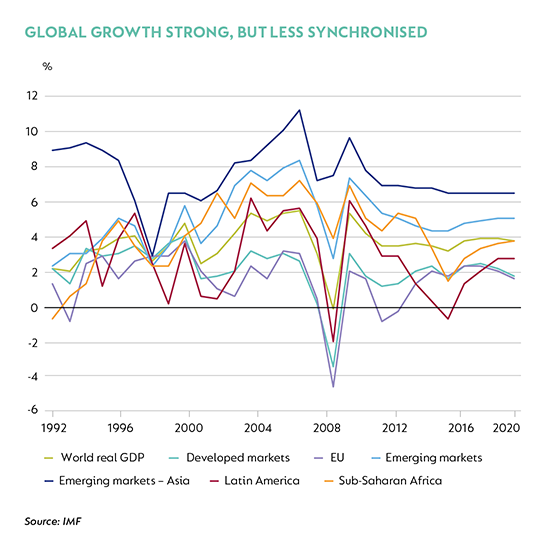

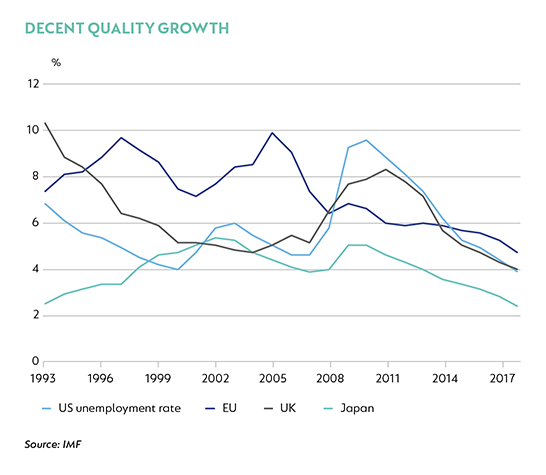

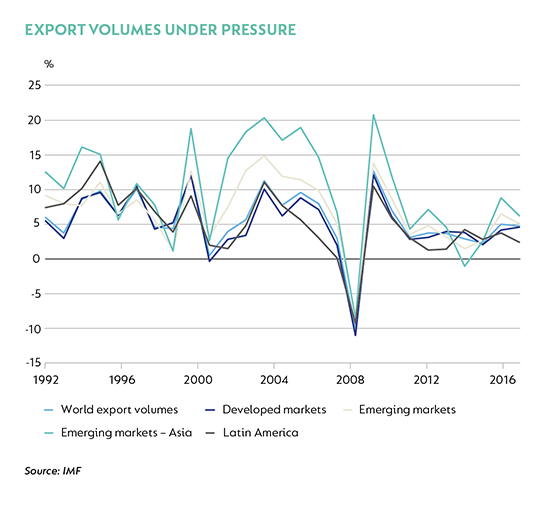

Available economic data suggest that global growth is still running at a healthy clip. The October IMF World Economic Outlook still forecasts global growth this year at 3.9% – in line with the April assessment – and 3.9% in 2019. Healthy employment gains have helped offset moderating trade volumes, and capital investment is an ongoing support for good-quality growth, especially in developed economies.

But the composition of growth has become more uneven, and the risks, mostly downside, have become greater. Growth remains generally strong in advanced economies, but momentum has slowed visibly in the EU, Japan and, to a lesser degree, the UK. In contrast, US GDP continues to grow above potential, with strong employment gains and rising inflation. For developed economies, GDP should be 2.4% in 2018 and 2.2% in 2019.

For emerging and developing economies, growth is forecast at 4.9% in 2018 and 5.1% in 2019, but this forecast implies quite a wide variance across countries.

Recent market volatility highlights that the risk of a sharper tightening of global financial conditions is the biggest risk to the outlook for growth. US Federal Reserve (Fed) policy is, as always, central to global developments. Given the strong, broad-based growth being experienced in the US, the Fed is on track to continue raising interest rates over the next two years – at this stage ahead of its counterparts in other countries. This should, on balance, support the US dollar, but it also implies tighter financial conditions in emerging markets and the likelihood of developing economies becoming more restrictive. Were the Fed to tighten more quickly than the markets expect, a broader range of countries could come under pressure.

The next visible area of risk is a further deterioration in trade tensions, with ongoing implications for growth, investment, asset prices and confidence. The US has initiated adverse trade actions against a wide range of countries, but most aggressively against China. Recent negotiations suggest some conciliation with the North American Free Trade Agreement partners, and talks have started between the US, EU and Japan.

However, the threat of higher tariffs across a bigger base of Chinese imports is becoming increasingly likely.

The high oil price is also becoming a source of concern. Since June, Brent crude oil prices have risen from $72 per barrel to over $80 per barrel – a level last seen in 2014. Historically, high oil prices have contributed to slowing global growth, as rising inflation erodes real incomes and undermines spending. In a world in which support from trade is moderating, making economies more reliant on domestically-driven growth, this becomes a greater risk.

Turning to country specifics, the US economy is poised to continue growing strongly over the next two years. Substantial fiscal stimulus has fuelled already strong domestic demand, which is, in turn, supported by healthy employment gains and still-accommodative monetary policy. GDP is forecast at 2.9% in 2018 and a slightly more moderate 2.6% in 2019. With the unemployment rate at multiyear lows, strong growth is likely to be increasingly accompanied by rising inflation and increasing domestic demand, rising demand for imports and a wider current account deficit. The upcoming midterm elections could have a meaningful impact on fiscal policy into the 2020 presidential election.

In Europe, data suggest that the recovery off 2018’s first quarter weak spot has peaked. Underlying currently strong growth, sentiment indicators and industrial production growth have started to moderate. GDP for the region as a whole is forecast at 2.1% this year and 1.8% in 2019. The European Central Bank has signalled an end to its quantitative easing programme from December 2018, and has already started tapering monthly purchases, but has stated that the policy rate will remain unchanged until at least the middle of 2019.

With negotiations underway, and with some agreement amongst the NAFTA negotiators, it bodes well for a de-escalation of trade tension with the US. But this is still a visible risk to European growth, with the US threatening to raise the tariff on imported European vehicles from 2.5% to 25%. Germany is Europe’s biggest car manufacturer, but, with healthy domestic growth, smaller peripheral producers may be harder hit. Encouragingly, the start of trade talks between the US and both the EU and Japan perhaps limits some of this risk at the time of writing.

The UK’s journey to Brexit has, to date, not been a big issue for the EU, but as the March 2019 deadline approaches (and an agreement or extension is needed well before this time), both countries within Europe and the UK will be at risk of negotiations failing. In the UK, Prime Minister Theresa May still faces complex and considerable challenges in facilitating an agreement with both the EU and then at home, with a combination of her own divided party, its coalition partner and the opposition. The time is short.

Amid this uncertainty, the UK economy continues to muddle along. On balance, it has lost momentum since the referendum in 2015, but data have been more recently mixed. Unemployment has fallen steadily and, at 4%, is at multiyear lows. Retail sales data have recently been stronger and the economy is expected to grow 1.2% in 2018 and an uncertain 1.3% in 2019.

Japan’s economy continues to grow at a solid pace, with growth of 3.0% registered in the second quarter of 2018 and an overall expectation that the economy will expand 1.1% for the year. A series of natural disasters will disrupt output in the second half of 2018, but here too, unemployment is very low, at 2.4%, and strong corporate profit growth has lifted capital expenditure. Preparations for the 2020 Summer Olympics in Tokyo could see spending elevated through the early part of 2019. Headwinds for growth include trade uncertainty and the scheduled value-added tax increase, which could disrupt consumption in late 2019.

Elsewhere in Asia, China is at the forefront of the trade conflict with the US. While official data still show GDP running at about 6.5% year on year, activity data have softened. The negative impact of slowing credit impulse has weighed on construction and general infrastructure, although retail, property and even trade has held up reasonably well. Recent data, however, suggest that the trade sector is now showing signs of the impact of US tariff increases, with the latest round of 10% of $200 billion of Chinese imports effective 24 September likely to weigh further. Offsetting policy measures, including a softer stance on credit growth and a range of tax cuts, are unlikely to fully offset the intensifying impact of trade tensions on sentiment and investment in China.

More broadly, emerging markets have experienced powerful crosswinds in recent months. The strong US dollar, rising US interest rates, rising oil prices, trade tensions and areas of geopolitical conflict all impact emerging economies in different ways. While global policy setting is still broadly supportive of emerging market growth, markets have started to differentiate between economies with specific vulnerabilities or political uncertainties. On balance, interest rates have increased across emerging markets, with the most vulnerable economies experiencing significant currency depreciation and higher policy rates. In economies such as Turkey and Argentina, growth is likely to slow sharply as a result. Elsewhere, oil exporters such as Russia may benefit from higher prices, but here too, political uncertainty and the ongoing risk of US sanctions will weigh on the outlook and the currency.

While the global backdrop is reasonably strong, with areas of decent quality growth, the outlook for emerging markets remains alright. However, it seems unlikely that conditions in developed economies will improve from here. The threat of higher US rates than the market expects, along with a stronger US dollar and ongoing wider trade tensions, all suggest that the outlook for emerging markets is likely to remain challenging, albeit to different degrees, in coming quarters.

South Africa - Institutional

South Africa - Institutional