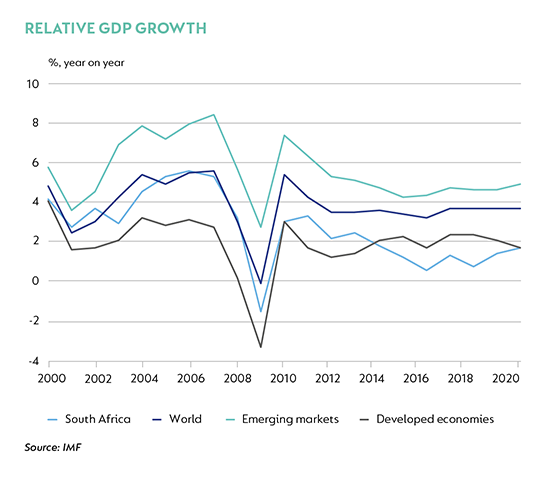

IT HAS BEEN a consistently disappointing year for growth. After a decade in which growth barely topped an average of 1.5%, accompanied by a grinding deterioration in political environment and institutional integrity, it wasn’t hard, arithmetically, to justify a sentiment driven reprieve this year. Indeed, at the start of this year, the drivers of growth seemed broadly in line. Global growth accelerated into the fourth quarter of 2017, domestic terms of trade were elevated, the US was set to deliver a decent taxpayer boost to already strong output activity, and low global inflation pointed to only a slow normalisation of very accommodative global monetary policy settings.

Then a number of things went wrong. Global growth momentum, especially in developed economies, slowed meaningfully in the first quarter of 2018. The US saw GDP moderate to 2.2% q/q saa from 2.3%, but in Germany growth slowed to 1.5% q/q saa from 2.2%, and Japan’s economy registered a contraction. Some of the slowing reflected one offs which reversed in the second quarter, but the disruption stalled the momentum which built through 2017. While global growth is still robust, it has become more uneven and, importantly, visible risks have increased. And they are all to the downside.

In South Africa, high frequency data was discouraging to start with: mining production contracted and manufacturing was weak, affected by refinery closure and other disruptions. Net trade fell hard in the first quarter, with an iron ore derailment at least in part to blame. Agriculture was much weaker than expected, affected by the drought, and a high base.

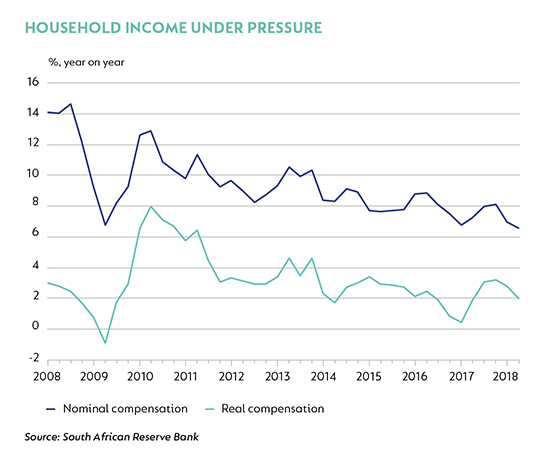

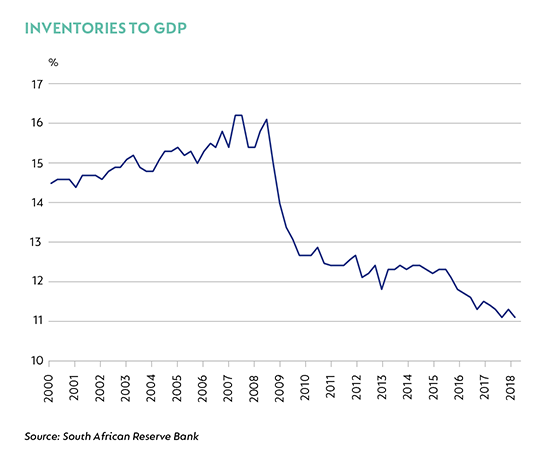

From an expenditure perspective, data for the first half of this year points to households under immense strain. Real household income has been under pressure since 2010. With the VAT hike, and another year in which there was effectively no adjustment for bracket creep, consumers have seen a meaningful increase in their tax burden relative to income. Household spending contracted 1.3% year on year (y/y) in the second quarter of 2018 off a low 1.0% y/y in the first quarter. In addition, gross fixed capital formation contracted for the second consecutive quarter as government and public corporation spending fell, offsetting a nascent recovery (albeit important) in private capex. The various supply side one offs led to a massive inventory contraction, which took an additional 2.9pps off GDP. Net trade was the only real positive, with a recovery in export volumes.

By mid-year, hopes of a speedy recovery were dashed. Output data have improved, but momentum is too slow, for now, to meet high hopes of a post Zuma recovery this year. It’s all taken a lot longer than expected.

As we head into 2019, it’s hard to be optimistic, because a number of things have now deteriorated:

- Global growth is slowing, and has become more uneven;

- Global trade volumes are under pressure and trade tensions have risen;

- Higher US interest rates, and possibly elsewhere in coming months, implies a more adverse environment for emerging market assets;

- High oil prices threaten inflation and reduce real incomes;

- Domestic policies remains messy despite the best efforts of the new administration;

- Domestic employment and wage data are still weak;

- Profitability is under pressure; and

- Sentiment has deteriorated.

While these developments make it hard to expect a meaningful acceleration in growth in South Africa, I still think the worst is behind us. So let’s indulge in a little sideways thinking. What could go right?

With South Africa having scored so many own goals in terms of policy and political rhetoric that negatively affected sentiment and growth and having suffered a number of ‘one offs’ which affected output, there is some merit to the argument that the country may benefit from stability in these areas. The economy, demonstrably, hasn’t grown. Without growth there is limited room for a deceleration - You can’t fall off a cliff if you haven’t climbed it! Growth is always a function of a combination of labour absorption (consumption), capex and productivity gains. In turn, consumption is a function of income growth and a willingness to spend, while capex usually requires a change in capacity constraints and an improvement in expected returns and is usually the biggest driver of efficiency (productivity).

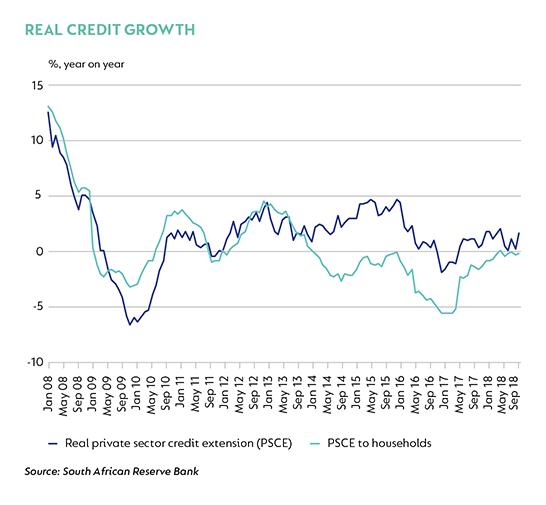

The protracted period of economic malaise has seen deleveraging (except the state). There are few visible excesses and credit growth in real terms is low but stable. Importantly, consumers should see some easing in their very constrained positions in coming months. Most recent data suggest a modest acceleration in credit extension to households. Consumer confidence, which undoubtedly overshot in the first half of the year, remains elevated by historic standards and is historically consistent with stronger spending. Household leverage has declined, and debt service costs remain low. Household saving has turned positive, which suggests some cushion has been rebuilt. While higher fuel prices are a rising headwind, the rate of change should slow in early 2019, and we expect food inflation to remain reasonably low. Importantly, we do not expect a similar increase in household tax burden in 2019/20. The outlook for employment is stable, and it is possible that government’s infrastructure plan could improve employment at the margin. Similarly, the extension of the youth employment tax incentive should also help.

While gross fixed capital formation was very weak in the first half of 2018, private capex was positive. The available data shows companies have increased investment in non-residential structures and transport equipment, and recent data for building plans passed has visibly picked up. In addition, inventories, run down excessively in response to interrupted mining and manufacturing supply, have room to recover.

It is likely that a meaningful acceleration in domestic demand will push the current account deficit wider. It is also possible that the sharp depreciation in the currency and recent moves to simplify tourist visa requirements could facilitate a bumper tourism season in the year ahead. The currency may be vulnerable, but some offset is possible too, if we get just a few things right.

With this in mind, we expect growth to recover moderately in the third quarter and accelerate further into 2019. With a real growth forecast of 0.8% this year and 1.8% next year, the forecast still implies a relatively constrained acceleration and modest growth in 2019 only just at or slightly below potential. This not only implies a return to an uninspiring past, but also an environment in which core inflation should remain low. Our forecast for inflation is for CPI to average 4.6% in 2018 and rising to 5.4% in 2019 despite the weaker currency and acceleration in oil prices. In this context, we are unlikely to see an aggressive interest rate cycle, despite the risk that the SARB Monetary Policy Committee (MPC) may decide to moderately increase nominal rates as inflation ticks up. We expect real rates to remain accommodative. Our base case is for interest rates to remain on hold through mid-2019, acknowledging the risk that the MPC may opt to start gradually raising rates should rising headline inflation threaten long term expectations. It is, however, worth highlighting that within this relatively benign base case, considerably faster and more inclusive growth is needed to ensure fiscal and social stability.

What drives sentiment? More and more bad news has driven domestic sentiment weaker for a decade. While this year has certainly taught us that lost momentum and a deficit of trust takes more than we’d thought to heal and in turn translate into committed capital either by households or businesses, it is possible that, at the margin, the rate of deterioration has bottomed.

GLOBAL GROWTH SLOWED through most of 2018. But the pace of slowing accelerated meaningfully from mid-2018 into the first quarter of 2019. ‘Recession indicators’ started rising in the US, and growth concerns in Europe and China were reinforced by an escalation in trade tensions and ongoing deterioration in an increasingly wide set of economic data. Uncertainty about the future interconnectivity of the global economy will undoubtedly play a bigger long-term role in the global growth moderation than the direct impact of trade weakness, but the current situation has undeniably been exacerbated by idiosyncratic issues in several key economies, which should ease. The longer-term cost of heightened uncertainty is still to be counted.

Within this context, it is instructive to try to identify the sources of economic weakness and uncertainty, and then assess how durable the effects may be. These seem to fall broadly into three buckets:

1. CHINESE ECONOMIC ACTIVITY

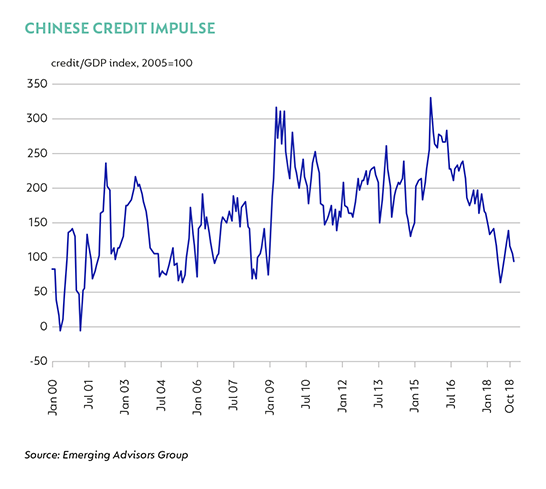

The internal, policy-driven moderation in Chinese economic activity started in 2017. Successive stimulus interventions have seen an unprecedented accumulation of debt relative to GDP in China, which peaked at an estimated 250% of GDP in mid-2017. Reasonable concerns about the sustainability of both the stock and the rate at which it has increased prompted policymakers to moderate credit availability from the end of 2016. The impact of credit withdrawal led to a moderation in growth momentum, which affected domestic activity and then rippled into global trade.

2. US-SINO TRADE TENSION

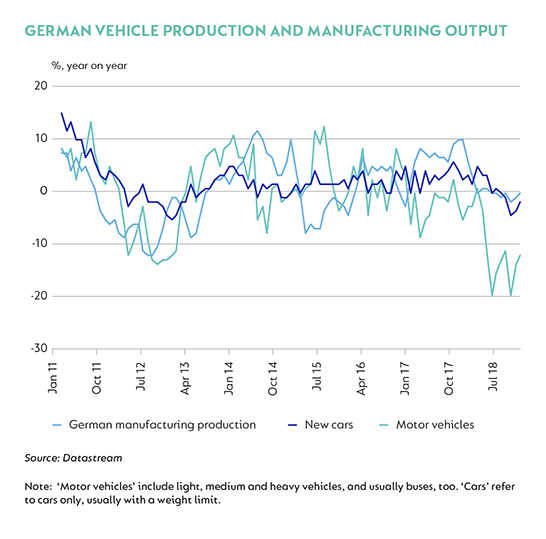

The above factors coincided with the escalation of US-Sino trade tension, which saw the US initially impose 10% tariffs on $200 billion of Chinese imports in mid-September, followed by retaliatory tariffs from China on $60 billion of US imports. While the US and China’s negotiations are still ongoing, global trade indicators remain weak. The knock-on has started to affect global manufacturing and, more broadly, sentiment and business investment. The hardest hit have been large trading economies, including Germany, much of Asia and Japan.

3. INDIVIDUAL MARKET EVENTS

More randomly, there are a number of idiosyncratic events which have either materially exacerbated the impact of the above, such as the change in emissions regulations in Germany, or had the effect of weakening broader sentiment and hard data, such as a combination of US market volatility, the polar vortex and the shutdown of the Federal government in February. Elsewhere, political tension in France and the chaotic Brexit negotiations have negatively affected confidence and biased growth weaker.

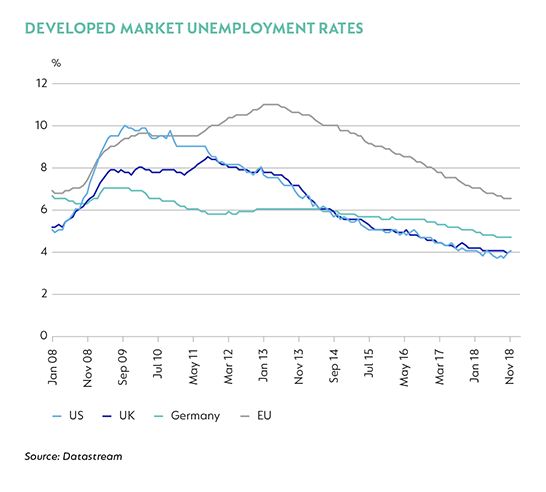

For all this weakness, the resilience of domestic demand in these economies has provided a relatively robust buffer. Across a broadbase of developed and some emerging markets, the current economic cycle has seen unemployment fall to multi-decade lows. While there are ongoing questions about the quality of this employment growth, low levels of unemployment support wage growth – and we have seen earnings pick up in the US, UK, Japan and parts of Europe, to the extent that developed markets’ income growth now rivals the last expansion. This has not been enough to mitigate all the headwinds, but it is an important source of stability.

Despite all the bad news, at the time of writing, there is mounting evidence that the first quarter of 2019 may be the low point of global growth. Several ‘nowcast’ models (UBS and JP Morgan), which track changes in high-frequency data to monitor the state of the economy in real time, are pointing to an improvement in global growth momentum. While the activity data are still mixed, there is enough evidence to suggest that, at the minimum, disruptions in the US and parts of Europe are normalising, and policy intervention is gaining traction in China.

This base is narrow because global trade-related activity and associated indicators are still uniformly weak. Data published by Morgan Stanley suggest that global trade volumes slowed to just 0.5% year on year in March, from 1.0% in February, based on export expectations in the IFO Institute for Economic Research survey and hard export volume data from Korea captured by their trade indicator. For better certainty of a recovery in global growth, we need a few things to go ‘right’:

Firstly, China’s outlook is critical to the prospects and magnitude of a global recovery, given its significant contribution to the global demand weakness over the past six to nine months. The main drag on growth remains property construction and manufacturing capex. This should be countered by an improvement in consumer spending and the support from fiscal stimulus. The rise in China’s Purchasing Managers’ Index new orders for the second consecutive month is encouraging.

Secondly, some resolution to the US-Sino trade tension is needed in the form of an agreement on terms and implementation between the US and China. Not only is this key to an improvement in trade volumes; a better framework for dispute resolution is also a necessary condition to avoid a repeat of the past year’s standoff or a deterioration to something more hostile. The likelihood of achieving a robust agreement with long-term solutions is questionable given the US and China’s very different economic policies, but a stabilisation in tariff uncertainty should support confidence lost in the current state of flux.

Then, we need to continue to see the influence of the ‘one-offs’fade, especially the disruptions to US activity and spending after February, and the lesser influence of the manufacturing disruptions in Germany. The US Federal Reserve’s commitment to ‘patience’ should also provide a meaningful fillip by keeping global financial conditions easy for a prolonged period, although better growth could also see an uptick in inflation and ultimately put pressure on the Federal Open Market Committee to continue raising rates. Similar very dovish guidance from the European Central Bank suggests it will take a considerable change to conditions to alter its outlook, and we assume monetary policy will stay accommodative in coming months, even as activity picks up again.

Lastly, the ‘red flags’ raisedduring this period of slowing growth need to be tested. Not all the decline in growth momentum that we have seen in the past two quarters can be fully explained by the events listed above and, in some cases, these have not been resolved.

In China, we assume that much of the slowdown started with tighter credit conditions, which have started to ease modestly, and that fiscal interventions will buoy activity in the second half of 2019. It is possible, however, that the impact of credit withdrawal has not yet fully played out, notably on the property market, and that we have yet to feel the full impact of the trade war with the US. Both factors are considerable uncertainties, and hard to quantify.

For the US, the combined sluggishness in the housing market – which is at odds with the very supportive macro factors, including employment and wage growth, household formation and very supportive financing conditions – and emerging weakness in business investment are traditional signs of cyclical weakness, which are important to monitor.

In Europe, the impact of protracted weakness in the external sector may have a much deeper effect on growth. Global trade is a much stronger driver of internal growth momentum than in the US or China. Political uncertainty will play in the background and is not limited to Brexit. It also includes the outcome of the European Parliamentary elections, taking into account more populist and less traditional leadership in several member countries, as well as the impact of weak growth on Italian fiscal metrics, especially under the coalition government.

The umbrella risk is that the uncertainty imposed by all these factors becomes reinforcing in a global economy that is weaker and more fragile than it was at the start of 2018. Our base case, however, is that one-offs correct – and a few things go right – aided by strong domestic demand conditions in key economies and very supportive monetary policies.

We expect global growth to slow to about 3.4%, from 3.8% in 2018, and to recover to 3.7% in 2020. Within this, growth from emerging markets should be supported by recovering economies hard hit in 2018, including Argentina and Turkey, with emerging market aggregate growth expected to be 4.7% in 2019 from 5.0% in 2018, and 5.1% by 2021. Developed economies are more likely to remain under pressure, with the growth forecast flat at 1.8% in 2019 and 2020 as momentum from 2018 is lost and the US tax boost fades.

Disclaimer

South Africa - Institutional

South Africa - Institutional