IN LAST QUARTER’S commentary we discussed how “2019 was a strong year for equity markets, with the MSCI All Country World up 26.6%”. However, we also cautioned that “after a sustained period of strong equity returns, declining interest rates, reduced tax rates, expanding profit margins and rising valuation multiples, investors should recalibrate return expectations lower. The conditions in place today are quite different to those in place a decade ago. We have no insight into short-term market moves but feel that absolute returns could very well be lower over the next 10 years compared to the last 10”.

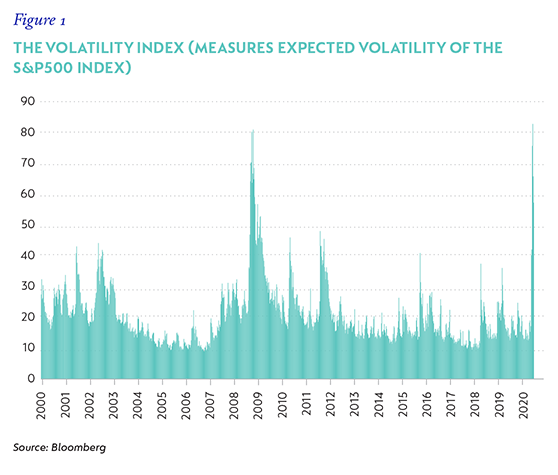

Well, we didn’t have to wait long. Risk assets plunged over the quarter as the economic consequences of the Covid-19 pandemic started to become apparent. (For a full discussion, please see Coronation’s commentary here). Economic activity in many countries and sectors around the world has come to a halt. This unprecedented ‘full stop’ caused stress and market dislocations across the spectrum. Volatility was back with a vengeance, and in both credit and equity markets, indicators spiked to levels above those seen in the Global Financial Crisis, as shown in Figure 1.

With this as a backdrop, the Strategy returned -22.3% for the quarter, slightly behind the benchmark’s -21.4.%. Quarterly returns will inevitably be noisy, but we were cognisant of the high relative performance base coming into the year following a strong 2019, which delivered 12% outperformance, and are reasonably satisfied to have at least protected these relative gains. Markets have now delivered negative returns over the last 12 and 24 months, with the Strategy outperforming by 3.4% and 1% p.a., respectively. While it is short term in nature, it is hopefully some vindication of our valuation-driven investment approach. Since its inception in December 2014, the Strategy is 50 basis points behind the benchmark.

KEY PORTFOLIO ACTIONS

Most of our large holdings going into the quarter were well positioned for the coming economic stress. In the top 10, Chinese internet businesses Tencent (via Naspers) and Alibaba are arguably net beneficiaries, being leaders in gaming and ecommerce, with strong balance sheets.

Charter Communications, a broadband provider in the US, is seeing much higher demand for their essential internet service, although the business is not immune, and cord-cutting will accelerate and subscriber growth slow as the unemployment wave hits. Tobacco businesses Philip Morris and British American Tobacco have seen stable demand. All of these businesses were among the top 15 contributors for the quarter.

Airbus is a good example of the extreme market reactions that have taken place. In the short term, the airline industry – Airbus’s customer base – is facing financial ruin, as airline travel has collapsed to a fraction of normal levels for this time of year. Airlines are cyclical, highly leveraged and thinly capitalised businesses (which is why we have rarely owned any in the Strategy historically) and will need to be recapitalised en masse in order for air travel to return to some semblance of normal. The impact on Airbus in the short term will therefore be quite negative, as airlines delay receipt of orders for new planes they manufactured in the last few years and, in some cases, cancel them entirely.

In the medium term, however, this crisis will pass, and air travel will recover, in our view. The short-term financial impact will be manageable – airlines make regular payments during the build stage of a plane and pay penalties for cancelled or massively delayed orders.

They also outsource a large chunk of production to suppliers, so the pain of delayed orders is not solely theirs to deal with. Overall, about 75% of costs are variable in nature, so the cash burn during this downturn can be managed, and Airbus starts off in a significant net cash position of €13 billion. This is 28% of current market cap and equivalent to two times last year’s (adjusted) operating profit. We estimate that, due to their positive credit rating, they have straightforward access to an additional €12 billion of funding, if required, so even in a dire scenario where their working capital moves highly negative, with no corresponding set-offs from clients and suppliers, they have ample liquidity to see them through a very depressed 2020 and 2021. There is also €3.3 billion of annual research and development expenses that could be scaled back, if required. The duopoly nature of the industry means that customers only really have two choices of supplier, and however tough things may be for Airbus, they pale in comparison to those of their only competitor, Boeing, which is highly leveraged and still dealing with the aftermath of the grounding of the 737 Max airliner last year.

Although it is not without risk, we are positive on Airbus long term and continue to hold it in the Strategy. By our estimates, even with a 50% decline in total deliveries over the 2020-2022 period, by 2022, Airbus will already be generating €4 billion in free cash flow, compared to a current market cap of €45 billion at the time of writing, close to a 10% free cash flow yield two years out. The company guided to a more benign outcome, with a projected reduction in output of one third starting from this second quarter of 2020.

The Strategy took advantage of a few anomalies – good businesses that initially sold off in line with the market, but whose prospects had only changed marginally. Unilever is a case in point. The stock traded close to 14 times earnings, and with a dividend yield nearly 4.5% at the lows, which we thought provided good value – in particular when the potential range of outcomes for the average business had widened so considerably. Unilever ended the quarter as a top 10 holding.

Earlier in the quarter, we exited holdings that had performed strongly and approached our estimates of fair value. Adidas and Tsuruha (a leading Japanese drugstore business) were both sold. We also meaningfully reduced Blackstone prior to the market decline, but it remains a portfolio holding.

OUTLOOK

Markets could very well remain volatile as the nature of the pandemic evolves and progresses. As a team we are focused, as always, on researching individual businesses, assessing their long-term earnings power, understanding the potential impact this black swan event may have on the investment case, managing risk, and adjusting the portfolio accordingly. While the backdrop has changed dramatically, our process hasn’t.

Disclaimer

South Africa - Institutional

South Africa - Institutional