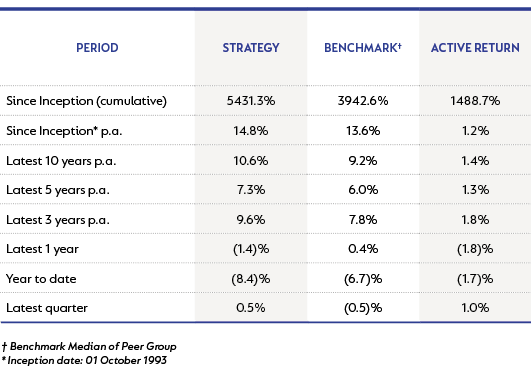

The Strategy outperformed over the recent quarter and performed well against its peer group over all meaningful time periods.

After a tough first half of the year, markets showed brief respite in the first weeks of the third quarter. However, the latter part of the quarter saw broad weakness across asset classes as worries that plagued markets during the first half of the year (high inflation, rising rates and slowing growth) resurfaced. The MSCI World Index declined -6% for the quarter (dragging year-to-date returns to -25%). The Strategy started the year with very low exposure to global equities given valuation concerns. We have been adding steadily to the Strategy's holdings in response to market weakness.

The Strategy’s performance as at 30 September 2022 is shown below:

The commitment of central banks to contain inflation (even at the cost of rising unemployment and potential recession) surprised markets during the quarter. Higher inflation and bigger rate hikes weighed on bond yields, with the Bloomberg Barclays Global Aggregate Bond Index declining -7% in US dollars for the quarter (YTD -20%). Despite the significant sell-off in global bonds, we feel real yields remain insufficient to compensate for the risks of high inflation, slowing global growth and highly indebted sovereign balance sheets. The Strategy continues to have no exposure to global sovereign bonds.

The ongoing Russian invasion of Ukraine has kept energy prices as well as geopolitical tensions high, with increasing polarisation between NATO and the rest of the world. US Speaker Nancy Pelosi’s third-quarter visit to Taiwan created further unease given China’s commitment to Taiwan “reunification”. China continues to stick to its zero-Covid policy despite the economic cost. This weighed on the MSCI Emerging Markets Index which underperformed MSCI World Index with a -12% decline for the quarter (bringing YTD declines to -27%). The commodity basket experienced broad price declines given the ramifications of slower Chinese economic growth. Energy commodities were a notable exception and remain elevated. A recession in Europe looks increasingly likely against this backdrop. The United Kingdom, under its new prime minister, announced an aggressive fiscal response (including energy subsidies and tax cuts) to these challenges. A negative reaction to these unfunded tax cuts saw the pound weakening, the gilt market collapse and further weakness in UK equities.

South Africa’s (SA) economy has benefited from a strong commodity cycle over the last few years, but a slowing China poses a meaningful headwind. Underinvested infrastructure and poorly-run state entities continue to hamstring the economy. Transnet’s incompetence is undermining export volumes, while record levels of loadshedding at Eskom inhibit growth and undermine confidence. Years of insufficient maintenance at Eskom mean the grid remains fragile and power supply constrained.

Despite the structural challenges facing SA, we believe South African assets are cheap, pricing in very modest expectations. SA corporates are resilient, accustomed to operating in a stagflationary environment. We are seeing this play out in recent earnings releases, which are generally in line with our expectations. This creates a sufficient margin of safety to make these attractive investments. SA bonds offer attractive yields (in both nominal and real terms) relative to emerging market peers and cash alternatives. The JSE All Bond Index delivered a return of 1% for the quarter (-1% YTD).

The FTSE/JSE Capped Swix Index declined -2% during the quarter (-7% YTD), performing ahead of the MSCI World Index in USD YTD (-18% for the Capped Swix vs -21% for the MSCI World). We believe SA equities are cheap, offering broad value across resources, global stocks listed on the JSE, and domestics.

The resource sector declined -1% in the third quarter, leaving the sector down -6% for the year. These numbers belie the divergence in performance we have seen. The scramble by European countries to replace Russian energy supply with alternatives has kept energy prices elevated. The spike in demand for ex-Russia product comes on the back of several years of limited investment in supply given decarbonisation targets. Near term, these targets have had to be compromised to secure Europe’s energy needs for the winter, with heating restrictions already in place across several countries. For the year to date (YTD), the prices of oil (+13.1% YTD), gas (+116.6% YTD) and coal (+155.7% YTD) have all risen meaningfully.

Energy producers offer attractive free cash flows, given the tightness in near-term markets and are expected to return a significant portion of their market capitalisation in the form of dividends in the coming years. We have used the increased offshore capacity created by recent changes to Regulation 28 to diversify our energy holdings across a broader basket that includes cheaply priced global names. This will reduce company-specific risk while retaining exposure to a market we believe will remain tight.

The portfolio continues to hold large positions in diversified miners - Glencore and Anglo American. Both offer attractive free cash flow streams, even at more normal commodity prices. Despite looming threats of recession, we expect commodity markets to remain tight. A lack of investment in prior years will limit supply while a transition to a lower carbon future supports robust commodity demand.

The financials index returned -4% for the quarter (YTD -5%) as bank earnings delivered an ongoing recovery. Drivers of recent results included advances growth, contained credit losses, growing African operations and the endowment benefit from higher rates. The portfolio has reasonable exposure to the banks via FirstRand (+2% YTD), Standard Bank (+10% YTD), Nedbank (+22% YTD), and more recently Absa (+23% YTD). Absa has been reinvigorated post their separation from Barclays. The retail business has stabilised its market share and is writing new business at good returns. The recently appointed group CEO comes from the retail division, and we look forward to further gains as the group benefits from his leadership. Life insurers (-7% Q3-22/-16% YTD) have seen more challenging trading as the businesses face low growth and competitive pricing in risk while Covid-related mortalities have inflated claims. Weak markets are a further headwind. The Strategy does not own the life insurers, preferring positions in the banks and other financials.

Industrials returned -1% for the quarter (YTD -17%), with major constituents, Naspers and Prosus down (-4%/-10% for the quarter and -8%/-27% YTD). Whilst headwinds in China continue, the open-ended buyback programme announced by Naspers and Prosus during the second quarter is well underway and should deliver considerable value. The portfolio continues to hold several global businesses listed in SA that we believe offer sizeable value. Examples include British American Tobacco, Bidcorp, and Richemont. Given increasing offshore capacity, these holdings have been supplemented with offshore names that offer comparable value. In luxury we have added Capri, which is trading on a high single-digit price earnings ratio whilst achieving strong brand traction and pricing power. In China tech we have added JD.com, a well-positioned ecommerce platform with strong logistics infrastructure.

Domestic stocks offer attractive stock picking opportunities, with low expectations and undemanding valuations. Many trade on very high dividend yields. The JSE has seen several buyouts by international bidders in the last few years, underlining the value on offer. During the current year, both Mediclinic and Massmart have received buy-out offers. Given the low valuations, buybacks are another effective way of creating value for shareholders. We have seen sizeable purchases of shares by management teams at Lewis and Motus (both held in the Strategy).

Our emphasis within the portfolio has been on finding businesses that can prosper even in a low growth economy. Examples of these include RMI and Transaction Capital (TCP). RMI’s core holding is OUTsurance, which offers strong growth prospects, particularly in Australia, and can pay out the bulk of its earnings while growing. With regards to TCP, we expect the WeBuyCars business to continue to gain market share given its convenient and trusted consumer offer. Management is working hard to build a new technology-led platform in the TCRS business to service global clients. We added to TCP during the quarter.

The portfolio has moderate property exposure, preferring to use its risk budget in equities and bonds. The property sector has lagged equities both YTD (-17%) and since pre-Covid (3-year compound annual growth rate of -9%). The medium-term outlook remains subdued as a weak economy and structural shift in demand from increasing digital engagement and work-from-home trends undermine rental tension.

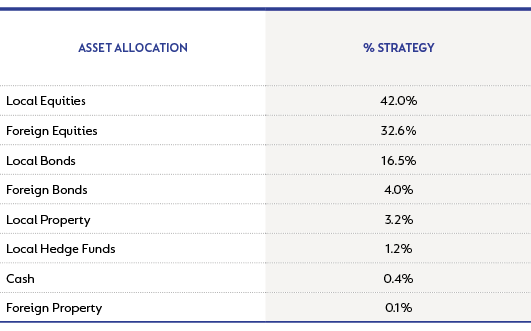

Our asset allocation as at 30 September 2022 is shown below:

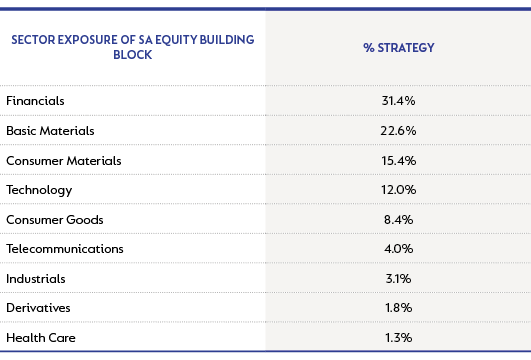

Our top 10 holdings and sector exposure as at 30 September 2022 is shown below:

As always, our commitment to long-term investing and a disciplined valuation-based approach remains the bedrock of our investment process. While headwinds exist in both global markets and the domestic economy, we believe growth assets are well priced for the risks and offer attractive returns off these low starting prices.

South Africa - Institutional

South Africa - Institutional