Markets remained extremely volatile throughout this quarter as global markets digested the real possibility of higher interest rates for longer to deal with stickier inflation. Concerns about sovereign debt levels, both at home and abroad, also added pressure to longer-term interest rates. Ultimately, these rates impact all asset classes as they represent the benchmark risk-free rate used in the pricing of assets. Some of the substantial gains achieved in the first half of the year reversed over the quarter.

In the latest quarter, the MSCI World Index retreated -3.5%, the MSCI Emerging Markets Index -2.9% and the FTSE World Government Bond Index -4.3% (all in USD). Strong global equity market gains in the first half of the year, combined with rand weakness, have resulted in solid positive real returns year to date for South African investors of 23.5% (MSCI World, Developed Market equities), 13.2% (MSCI EM, Emerging Market equities) and 8.2% (WGBI, Global Bonds) respectively.

In contrast, domestic asset returns have been dismal. Year to date, the FTSE/JSE Capped Shareholder Weighted Index is essentially flat, listed property is down -4.5%, the FTSE/JSE All Bond Index has delivered a meagre 1.5%, and the rand has weakened 10% against the dollar. These returns are, in part, a reflection of the attractive yields on offer in developed markets, but equally, they are all a reflection of increasingly evident inhibitors to growth in the domestic economy, the weakening commodity cycle and the fiscal pressure that results. National Treasury has communicated the need for budgetary restraint but appears increasingly isolated. The likelihood of any meaningful belt-tightening coming to pass seems low – particularly in an election year when policies such as the introduction of National Health Insurance and an extension of the Social Relief of Distress grant are likely to be central to an ANC campaign.

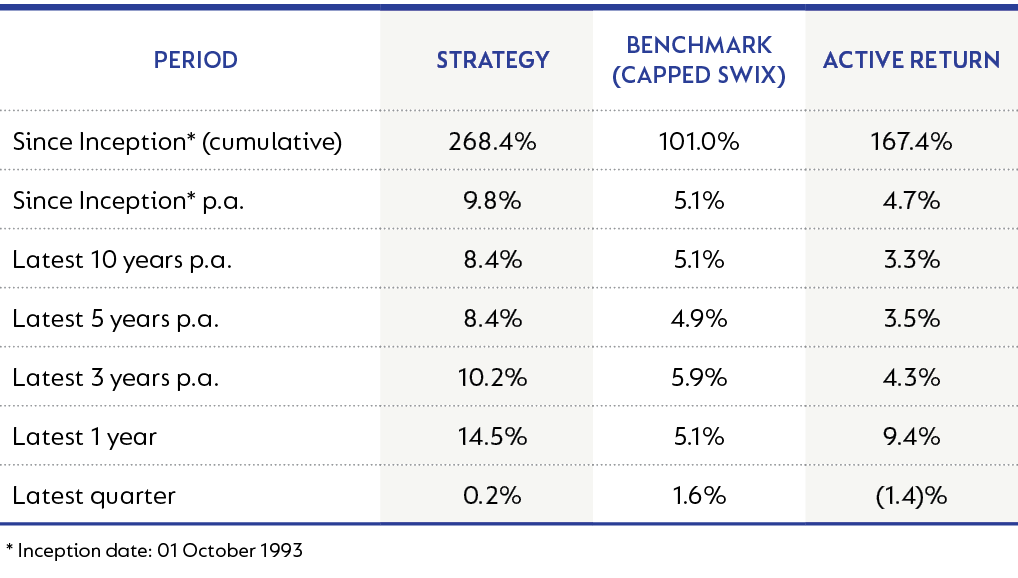

Against this backdrop, the Strategy has delivered very pleasing performance over all meaningful periods. The Strategy’s performance as at 30 September 2023 is shown below:

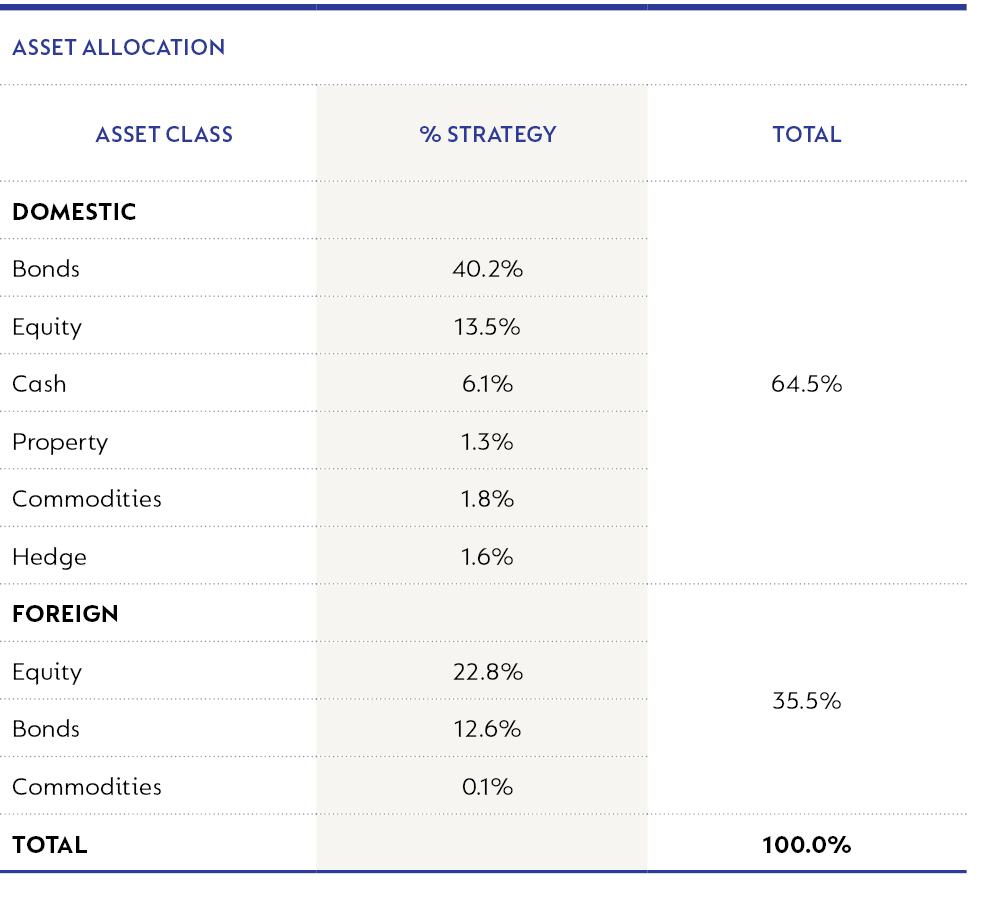

The most significant contributor to Strategy performance year to date remains its allocation to global assets, with both equity and bond selection delivering good returns. We continue to have meaningful exposure to global assets, currently at c.36% of the Strategy. Global equity indices have rebounded strongly over the past 12 months, and the US, in particular, certainly does not look inexpensive, but the breadth of that market has been exceptionally narrow. We continue to see attractive investment opportunities in select global equities but remain mindful of the risk of a general drawdown and have therefore retained the significant put protection over this portion of the Strategy. In addition, we continue to hold a diversified basket of global corporate bonds where we consider yields attractive.

Earlier in the year, we bought shorter-dated US Treasuries (USTs) (above 4.5% on the two-year) as yields were appealing relative to offshore cash. More recently, the curve has flattened somewhat, and the yield on the 10-year UST has moved above 4.6% (heading rapidly towards 5% as we write), driven in part by the factors discussed earlier. It’s early days, but for the first time we can recall, longer-dated global sovereign debt is starting to look interesting. Towards the end of the quarter, we elected to add duration and initiated a small position in the US 10-year bond.

Domestic assets also contributed positively to Strategy returns. Bonds made a more significant contribution given their larger weighting in the Strategy, but good selection in equities and bonds resulted in outperformance of their respective benchmark indices. While real yields on SA government bonds appear attractive, we are alive to the increasingly challenged fiscal position in which SA finds itself and the implications for longer-term debt sustainability. For this reason, we continue to limit duration of the bond carve-out and balance the holding of government nominal bonds with meaningful exposure to both inflation linkers and corporate paper. Within domestic equities, Standard Bank, OUTsurance and Prosus were the most significant contributors to returns year to date; Anglo American, Impala Platinum and British American Tobacco were the largest detractors.

During the quarter, we reduced exposure to risk assets slightly in the Strategy, principally through a reduction in SA equities (commodity stocks in particular), and we retain sufficient cash to take advantage of opportunities should they present themselves. This action is supported by cash now offering an acceptable yield.

Our asset allocation and top 10 holdings as at 30 September 2023 are shown below:

Higher developed market long bond rates logically imply that the market should apply a higher discount rate in valuing assets. For this reason, broad equity indices are likely to remain constrained for as long as uncertainty remains around the likelihood of recession and the commencement of a rate-cutting cycle. At the same time, the yield on longer-dated global bonds becomes more attractive and presents an interesting entry point for the first time since the Global Financial Crisis.

Back home, a weaker commodity cycle and increasingly evident infrastructural constraints (power, rail, roads, water) will place more significant pressure on economic growth and social stability. We are of the view that it is only the higher quality domestic businesses that will be able to navigate a low- or no-growth economy successfully, and it is these companies that feature in the domestic equity carve-out of the Strategy, along with a significant holding in SA-listed global-facing businesses.

Despite this, we continue to see opportunities in instrument selection, particularly in the global space. Our bottom-up assessment of expected returns by asset class gives us confidence in being able to deliver targeted returns for clients over the medium term.

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Institutional

South Africa - Institutional