OVERVIEW

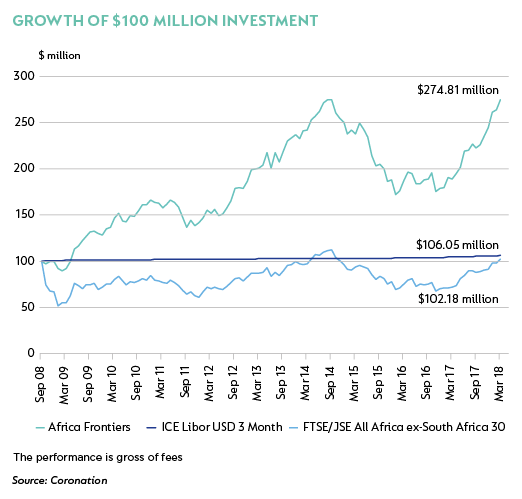

In October this year, we will celebrate the tenth anniversary of our Coronation Africa Frontiers strategy. Over the years, we have repeatedly made the case for a direct allocation to frontier markets, as they are underrepresented in major global indices and under-researched by the world’s investors. The Africa Frontiers Strategy leverages off our multi-decade experience in managing money in an emerging market like South Africa.

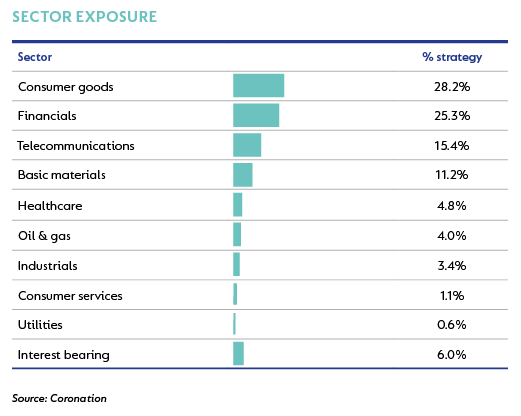

Coronation Africa Frontiers Strategy aims to maximise the long-term risk-adjusted returns available from investments on the African continent through capital growth of the underlying stocks selected. It is a flexible portfolio, primarily invested in listed African equities or stocks listed on developed and emerging market exchanges where a substantial part of their earnings are derived from the African continent. The Strategy may hold cash and interest bearing assets where we find this appropriate.

STRATEGY

Coronation Africa Frontiers follows a long-term, valuation driven investment philosophy. We emphasise bottom-up stock selection rather than top-down geographic allocation or macro-themes, an approach that has been applied across all our strategies for more than two decades.

The portfolio holds shares which we believe offer the most attractive risk-adjusted fair value relative to current market prices. Given the lack of reliable information in many frontier markets, calculating what we believe to be fair value of a business requires intensive on-the-ground research, constant contact with management teams and detailed financial modelling that focuses on through-the-cycle normalised earnings and free cash flows over the long term.

Given that shares often trade on near-term earnings prospects instead of their long-term earnings power, we aim to cut out the ‘short-term noise’ by focusing exclusively on the long term. We believe that our ability to invest with a time horizon of five years and longer is a key competitive advantage, allowing us to invest in assets that, in our view, are trading at substantial discounts to our assessment of their underlying value.

The Portfolio is constructed on a clean slate basis based on the relative risk-adjusted upside to fair value of each underlying security. It is constructed with no reference to a benchmark, as we do not equate risk with tracking error, or divergence from a benchmark, but rather with a permanent loss of capital.

PERFORMANCE

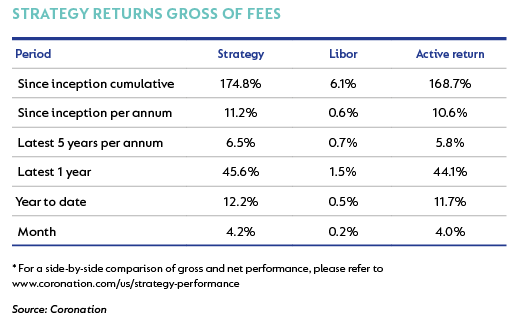

The Africa Frontiers Strategy has delivered compelling performance over all meaningful time periods since inception.

After a strong performance in 2017, markets across Africa continued to rise in the first quarter of 2018. The Africa Frontiers Strategy returned a gross performance of 12.2%, well ahead of its target (outperformance of the 3 Month ICE Libor USD) as well as the FTSE/JSE All Africa ex-SA 30 Index, which was up 11.9%.

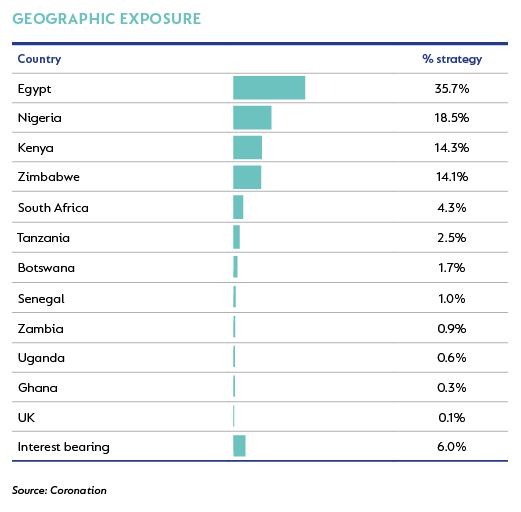

The large African economies went from strength to strength, shrugging off the increased volatility of developed markets the quarter. Egypt was up 15.1%, Kenya up 13.7%, Nigeria up 9.5% and Morocco up 7.4%. Zimbabwe was down 10.1%, however, this decline in equity prices was due in part to an improved economic outlook and increased trust in the monetary system. Equities are no longer deemed a necessary safe haven and cash holdings have increased in the hope of currency normalisation following the November 2017 regime change.

Eastern Tobacco, Stanbic IBTC and Seplat Petroleum contributed a combined 6.1% to the strategy’s performance. Eastern Tobacco benefited from improvements in its corporate governance, the share’s inclusion in the MSCI Emerging Markets and the FTSE indices and speculation that the company would pay out its excess cash reserves through an interim dividend. There were no meaningful detractors to performance, with no single position detracting more than 25 basis points.

OUTLOOK

We are positive about the prospects of our various investments and remain fully invested in Egypt. See Peter Leger's article for more on this market. We met a number of Egyptian corporates in Cairo, Cape Town and Dubai this quarter and most spoke of an improving trading environment. Headline inflation normalised down to 13.3% in March from the 33.0% peak in July 2017. Interest rates were cut by 200 bps this quarter and most economists expect further cuts in the coming months. The economic reforms implemented over the past two years are already yielding positive results. As inflation and interest rates continue to decline, we have expectations for Egypt to experience a multiyear period of growth. Given the hardships of the past few years, it is not surprising that many of the companies we meet have earnings well below our estimate of normal. Despite the strong stock market performance, we thus continue to find companies that are trading below their intrinsic value.

We increased the African Frontier strategy’s exposure to Qatar National Bank Alahli (QNBA) significantly this quarter. QNBA is the largest private sector bank by loans and second-largest by deposits in Egypt. Over the longer term, the Egyptian banking sector is incredibly attractive and QNBA is well-positioned to benefit from Egypt’s improved business confidence.

We are excited by the holdings in Egypt and across the African Frontiers Strategy, however, we always remain cautious when years start out as strong as 2018. While pleased with performance year-to-date, we are mindful that markets are volatile and seldom increase in a straight line. Despite any near-term volatility, we continue to believe that long-term returns will be attractive for the valuation-focused, bottom-up investor.

The volatility of the ICE LIBOR USD 3 Month Index ("Benchmark") represented above may be materially different from that of the Strategy. In addition, the holdings in the accounts comprising the Strategy may differ significantly from the securities that comprise Benchmark. The Benchmark has not been selected to represent an appropriate benchmark to compare the Strategy’s performance, but rather is disclosed to allow for comparison of the Strategy’s performance to that of a well-known and widely recognized benchmark. Material facts in relation to the Benchmark are available here: https://www.theice.com/iba/libor. In addition, for further information, we have also included the FTSE/JSE Africa Top 30 Ex RSA Index above. Material facts in relation to this benchmark are available here: https://www.jse.co.za/services/market-data/indices/ftse-jse-africa-index-series/all-africa

South Africa - Institutional

South Africa - Institutional