INCEPTION DATE

1 October 1993

PORTFOLIO MANAGERS

Karl Leinberger, Sara-Jane Alexander and Adrian Zetler. Karl is Coronation’s chief investment officer and has 18 years’ investment experience. He has been managing the Global Houseview portfolio for more than a decade. The strategy is co-managed by Sarah-Jane Alexander (14 years’ investment experience) who joined Coronation in 2008 and Adrian Zetler (9 years’ investment experience) who joined Coronation in 2009.

OVERVIEW

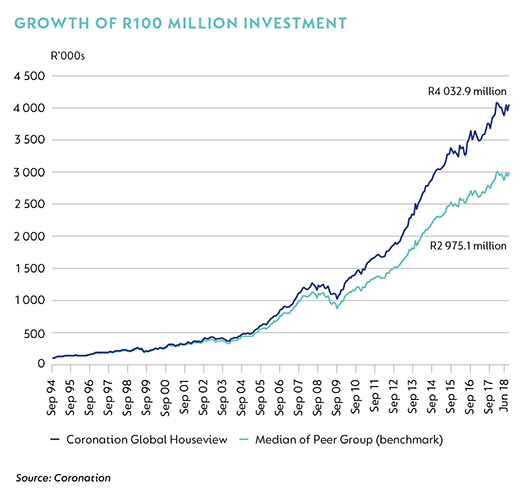

Celebrating its 25th anniversary in October this year, the Coronation Global Houseview Strategy is used by many retirement funds as a core holding or trustee default option. It is managed in accordance with Regulation 28 of the Pension Funds Act and represents our best investment view for a global balanced mandate across all major asset classes – equities, property, bonds and cash – both in South Africa and abroad.

STRATEGY

Global Houseview is an actively managed portfolio that looks to provide real growth to investment portfolios over the medium term to long term.

The strategy follows the Coronation investment philosophy, which is underpinned by an unwavering commitment to the long term. With a time horizon of more than five years, the portfolio can invest in undervalued assets that are trading at discounts to their long-term business value (fair value). In calculating fair values, we focus on through-the-cycle normalised earnings and/or free cash flows using a long-term time horizon.

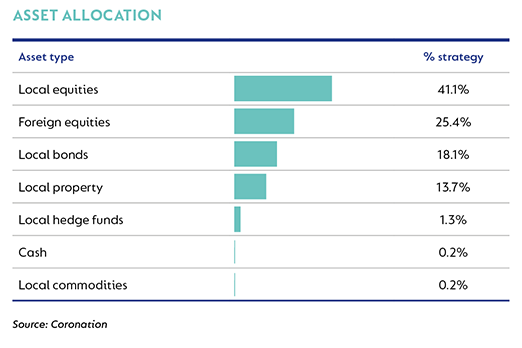

Asset allocation and risk management play a key role in the construction of the portfolio. Our proprietary research is done by a single, integrated global investment team. This allows us to look through the capital structure and risk/reward trade-off for every single investment opportunity and allocate appropriately. Investments are not researched in silos. All our analysts and fund managers sit in an open-plan environment where the merits of different asset classes and investments are debated and measured against one another. We believe this perspective results in better investment decisions across asset classes, which are particularly evident in a balanced fund like Global Houseview. We can sift through the entire spectrum of assets and identify those that can offer the best risk-adjusted returns for the fund.

The portfolio is constructed on a clean-slate basis based on the relative risk-adjusted upside to fair value of each underlying security. We do not equate risk with tracking error or divergence from a benchmark, but rather with a permanent loss of capital. The unique ability of this portfolio to allocate across asset classes and geographies is of particular importance in the South African context. This is due to the existence of exchange controls as well as an equity market with a large number of dual-listed and multinational companies.

PERFORMANCE

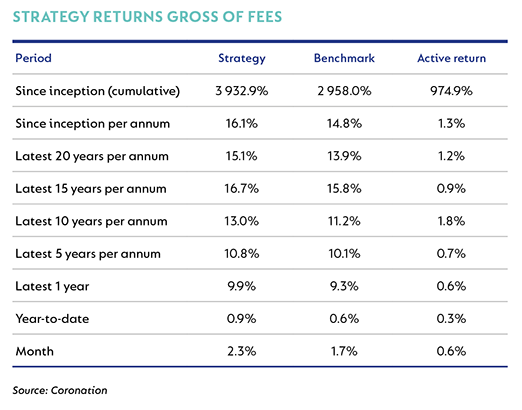

Global Houseview has a multidecade track record of consistent benchmark outperformance in all market conditions. Since inception, it has delivered an active return of 1.3% per annum (gross of fees).

OUTLOOK

Equities remain our preferred asset class for producing inflation-beating returns. However, the portfolio has reduced its weighting in global equities in the first half of the year, as valuations have become increasingly stretched and risks increasingly elevated (as a result of trade wars, economic populism and geopolitics). The portfolio continues to hold large positions in several JSE-listed offshore stocks. These positions are held for stock-specific as opposed to thematic reasons.

The post-elective conference rally in domestic stocks provided an opportunity to take profits in certain domestic stocks and add to names including Naspers, British American Tobacco and Anheuser Busch InBev. As the domestic rally reversed and the rand weakened, we took the opportunity to add to our positions in domestic, high-quality defensive names such as hospital stocks (Netcare and Life Healthcare) as well as food producers and retailers. We still have limited exposure to economically sensitive domestic companies because valuations do not yet offer a sufficient margin of safety, in our view. Within resources, Anglo American and Northam Platinum remain our largest holdings, while Mondi and Sasol (a beneficiary of strong oil prices) were reduced on the back of strong performance.

Domestic financial stocks came under broad-based pressure, giving up most of their post-elective conference gains. The weakness provided an opportunity for us to build a holding in FirstRand, a well-run domestic bank which has built a leading retail franchise despite competitive markets.

We continue to hold low exposure to fixed rate bonds (both locally and offshore). This positioning was vindicated as global bond yields increased in response to the US hiking rates and an increasing aversion to risk. Foreign selling of South African government bonds drove sharply rising domestic yields, which created an opportunity for the portfolio to build a position in government bonds at attractive levels. Although valuations reached compelling levels in the domestic market, this was not the case in global markets. In our view, yields are simply too low to justify the risk that comes with rising levels of indebtedness and an increasingly reckless disregard for fiscal discipline from many of the world’s leading economies.

Within properties, we continue to avoid most of the counters within the Resilient stable and find more value in the A property sector as well as in blue-chip domestic names such as Growthpoint, Redefine and Investec Property Fund.

Markets have had a tumultuous start to the year as the first-quarter domestic rally rapidly reversed in the second quarter. As always, valuation remains our beacon in these turbulent times, and we have used the volatile price environment to build positions in some attractively priced shares.

(For more detail on the positioning of this portfolio, please refer to the South African Portfolio Update.)

South Africa - Institutional

South Africa - Institutional