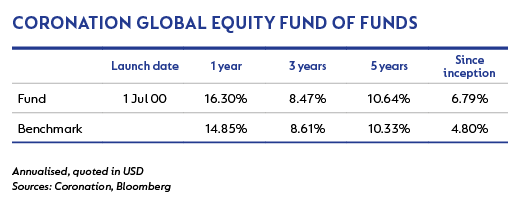

THE FUND DECLINED 0.1% against the benchmark return of -1.0%, bringing its rolling 12-month performance to 16.3% against the 14.9% returned by the MSCI All Country World Index (ACWI).

Japan was the best-performing region, rising 1.0% (in US dollar terms) over the quarter. The weakest return was from Pacific ex-Japan, which declined 3.7% (in US dollar terms). Europe also fell by 1.9% (in US dollar terms) and North America was 1.0% weaker. Emerging markets advanced 1.1% (in US dollar terms), outperforming developed markets. On a look-through basis, the fund is overweight North America and emerging markets and underweight Japan, while its weighting in Europe is in line with the benchmark.

Among the global sectors, information technology (+3.2%) and consumer discretionary (+1.5%) generated the best returns. The worst-performing sectors were telecommunications (-6.4%), energy (-6.1%) and consumer staples (-5.7%). On a look-through basis, the fund benefited from its overweight position in information technology and consumer discretionary, and its underweight position in utilities and telecommunications. Its overweight positions in consumer staples and materials detracted from performance.

The fund’s relative outperformance over the quarter was largely a result of good performance across the portfolio. Two standout performers were Egerton Capital and Tremblant Capital.

Egerton Capital returned 2.9% on strong performances from Airbus (+13%), as its order book rose strongly; Adobe (+23%), after its ongoing move to the Cloud gave rise to a strong earnings announcement; and Adidas (+18%), following the release of a good set of results and a large share buyback. An overweight position in information technology also boosted returns.

Tremblant Capital returned 2.2%. Its large exposure to consumer discretionary stocks boosted returns even though CBS, one of its top holdings, declined by 13% over the period. Palo Alto Networks (+25%) benefited from the recent US tax cuts as well as improved earnings, while FinecoBank (+14%) saw strong deposit inflows and margin improvement.

Maverick Capital, which has had a tough time in recent quarters, delivered strong alpha this past quarter. Its sizeable exposure to healthcare has been the most significant driver of underperformance over the 12-month period, especially its holding in Shire Pharmaceutical. After large losses in Shire, Maverick Capital re-examined the investment thesis, decided it remained intact and maintained its position. This was rewarded in March when Takeda Pharmaceutical Company announced its intention to bid for Shire, and the share price of Shire rose strongly. The manager also benefited from Envision Healthcare (+11%) and Adobe (+23%).

Contrarius Global Equity also had a good quarter. Like Tremblant, it benefited from a meaningful exposure to the consumer discretionary sector, especially the bricks-and-mortar stores such as Macy’s (+20%), Dine Brands (+30%) and Abercrombie & Fitch (+40%), which rebounded sharply. Twitter, a long-held position which has disappointed since its listing, also rose strongly after reporting a robust set of financial results.

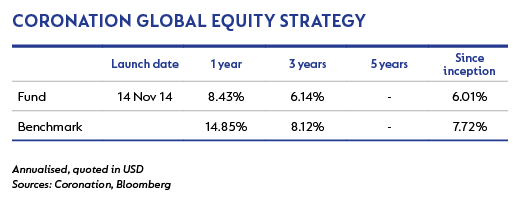

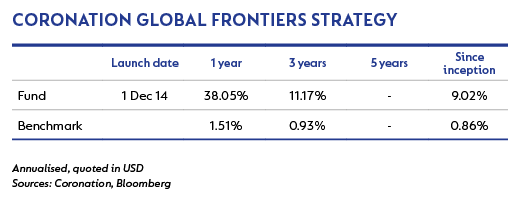

The strategy had a disappointing start to the year, underperforming its benchmark by nearly 5% over the quarter. This has affected the strategy's longer-term numbers.

The strategy's biggest positive contributors included Amazon (continued rerating on the back of sound execution and speculation about entering other categories), Advance Auto Parts (turnaround strategy gaining early traction after an oversold share price), Hammerson (an unexpected bid for the company being rebuffed by the Board) and Airbus (a recent portfolio introduction continuing to execute well). The largest detractor was the prior quarter’s top performer, L Brands, which saw a poor trading statement result in its share price retreating to previous lows. Other losers included Altice NV (a cable operator with poor results in its home market, France), Tata Motors (a victim of market volatility and poor short-term sales numbers) and Intu Properties (amid fears that the proposed Hammerson deal would fall through). Some of the strategy's consumer staple holdings were also marked down in line with the comments above.

We have significantly increased the portfolio's exposure to tobacco stocks over the last 12 months. Currently close to 10% of the strategy is invested in stocks such as British American Tobacco, Philip Morris International, Japan Tobacco and Imperial Brands. While each company potentially offers a slightly different angle in terms of future returns, the overarching investment thesis is that the development of next generation products – while disruptive to the incumbent players in what has been a very stable industry – could prove to present the market with a new growth vector. Heat-not-burn and vapour products have found favour with both existing smokers and ex-smokers, and allow the industry to benefit from premium pricing. The recently announced Food and Drug Administration review of the industry in America has increased uncertainty in the shorter term, allowing us to pay what we would consider to be attractive prices for these stocks. In the longer run, we anticipate the larger players to consolidate new technologies, leading to improving margins compared to the combustible market (assuming no adverse tax developments). Some of these companies are now trading at valuation multiples not far off those levels when they were facing potentially crippling financial legal claims, and we think these positions will serve the strategy well over the medium to longer term.

While the strategy’s short-term performance has been a disappointment, we take encouragement from the fact that the portfolio is showing very attractive potential upside based on our assessment of fair value for our individual holdings.

The strategy had a disappointing start to the year, underperforming its quantitative benchmark by more than 3.5% for the quarter. Over the longer time periods and since inception, the strategy return is still comfortably ahead of its benchmark.

Our decision to reduce the strategy's equity exposure some time ago added to relative performance, but our stock selection underperformed the ACWI benchmark materially over the quarter as well as over the last 12 months. Our instrument selection in property was also poor, as was our overweight position in the asset class. Our credit positions in fixed income performed well, and our gold holding added marginally. Over the last 12 months our biggest detractors were our underweight position in equity and our stock selection within the equity bucket.

Our biggest positive equity contributors included Amazon, Advance Auto Parts, Hammerson and Airbus. The largest equity detractor was the prior quarter’s top performer, L Brands. Other losers included Altice, Tata Motors and Intu Properties. Some of our consumer staple holdings were also marked down in line with the comments above. (For more detail on the fund's equity holdings, refer to the Coronation Global Equity Strategy above.)

While the strategy’s short-term performance has been a disappointment, we take encouragement from the fact that the portfolio is showing very attractive potential upside based on our assessment of fair value for our individual holdings in the equity and property buckets. We continue to manage overall portfolio risk, and again over the last quarter we paid around 25 basis points (bps) away in the form of portfolio insurance. The cost of protection has now risen materially, and we would in all likelihood not replace the current protection measures when they expire.

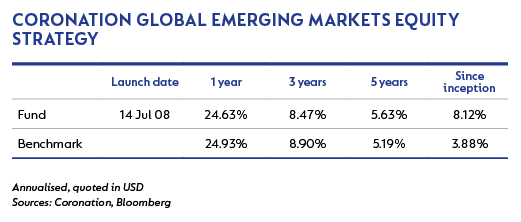

The strategy returned -2.4% for the first quarter of 2018, 3.8% behind its benchmark in what has been a challenging start to the year and indeed other shorter-term periods. Over meaningful periods, the strategy remains ahead of its benchmark, delivering outperformance of 0.4% per annum over the five-year period, 2.9% per annum over seven years, and 4.2% per annum since inception almost a decade ago.

The biggest positive contributors for the quarter all came from positions that added positively, rather than underweight positions in stocks that performed poorly. The biggest positive contributor was Airbus, up 16% for the quarter and contributing +0.52%. We continue to believe that Airbus is very attractively valued, with 45% upside to fair value, and as such it remains a large position, at 4% of strategy. The second largest positive contributor was global sportswear group Adidas (c. 55% of revenue from emerging markets), which was bought back into the strategy earlier in the year after we sold it in 2015. Since the date of reintroducing Adidas to the strategy up until quarter-end, the share price gained 22%, contributing +0.50% to alpha. As at end-March, it represented a 3% position in the strategy. Other notable positive contributors were the top Chinese online classifieds company, 58.com (+11% return, +0.35% attribution) and the leading bank in Russia, Sberbank (+10% return, +0.24% attribution).

Adidas was the largest new buy this quarter. We had previously owned only Nike, Adidas’s perennial industry rival. At the time of purchasing Nike in late 2016, the share was unloved by investors due to concerns over its perceived dependence on the US market and the basketball category in general. At the same time, Adidas could do no wrong as product innovations and other general operational improvements led to market share gains in the US and a substantial improvement in brand equity in most operating regions. Other sportswear groups also seemed to be making headway at Nike’s expense in the US, most notably Under Armour Inc., which at one point reached an earnings multiple of more than 40 times. Despite our attraction to the industry, we believed that Nike was substantially undervalued and Adidas looked expensive. Fast forward to just over a year and Nike’s share price has increased by close to 35%, while Adidas’s lagged significantly, having declined by 5% since March 2017 until time of purchase in January 2018.

The lag in Adidas created a buying opportunity, and the stock has performed very well in this short space of time. The purchase was partially funded by a reduction in the Nike position size, which has gone from over 2% of strategy in recent months to just under 1% by end-March. Although both Adidas and Nike may appear optically expensive based on near-term multiples (c. 24 to 25 times forward earnings), we believe they have well above average earnings growth prospects in the years ahead, driven by changing consumer habits toward greater fitness and ‘athleisure’, while the companies themselves have identified several routes to raising margins. These include improvements in manufacturing (to lower wasted materials) and increased direct-to-consumer sales (where the retail markup is captured in addition to the usual wholesale margin). In addition to this, Adidas’s earnings before interest and tax margins at c. 9% to c. 10% are still well below that of Nike at c. 13% to c. 14%. (You can read more about the Adidas investment case)

Besides Adidas, the only other new buy was a 1% position in KB Financial, the largest financial services group in South Korea. While banking is a relatively poor industry in South Korea in our view (the industry is mature, heavily regulated in favour of the consumer and has low returns on investment), in the case of KB Financial, we were attracted to the steps new management has taken and continue to take to improve returns. These include acquisitions in areas that have more attractive prospects (e.g. securities), acceleration of digital investment on the banking side and headcount reductions. Since the appointment of a new CEO (and full new management team) in late 2014, returns on investment have increased from c. 5% to c. 10%. Today KB Financial trades on seven times earnings, 0.7 price-to-book, with a 3.5% dividend yield for a company that, in our view, can grow earnings by c. 10% per annum over the next five years.

Over the quarter we continued to reduce the strategy’s Chinese internet exposure as share prices rose and as such moved closer to fair value. We reduced the position in 58.com to 3% of strategy – the share was up 11% in the quarter and would have been approaching a 4% position in the absence of any action. We also lowered the strategy's position in Baidu by 0.5% to 2.1%, in JD.com by 1.5% to 4.1% and sold out of Alibaba (as it reached our estimate of fair value) as well as Altaba (the former Yahoo whose main asset now is its stake in Alibaba). The combined Alibaba/Altaba position was close to 2.5% at the start of the year. Most notably for the quarter, we reduced our Naspers position by close to 3.5% to just under 4% of strategy. This was driven predominantly by concerns over the valuation of Tencent, which is Naspers’s single biggest investment. We also sold out of Aspen (given more attractive risk-adjusted opportunities elsewhere) and Yum China (due to valuation).

We increased the strategy’s position size in Ping An, China’s largest private insurer, by 1.5% to 3.9%, and raised the holding in global tobacco group British American Tobacco from 3.7% to 5.9%, both as a result of share price weakness.

Two stocks made up the bulk of the strategy’s underperformance this quarter: Russian retailer Magnit, which declined by 32% during the quarter (-1.41% attribution) and private educational company Kroton, which lost 26% (-1.44% attribution). We have written extensively about both businesses in recent years and therefore focus here on incremental news as well as why the shares have been so negatively affected recently. Magnit had already been performing poorly relative to its previous high standards in recent quarters, with sales growth declining from mid-20s to single digits. This was mostly driven by space rather than same-store sales growth. The company’s recent struggles seem to have eventually led the founder and CEO Sergei Galitsky to give up and leave the business. He had been slowly reducing his position over time to fund his philanthropic work, but eventually came to the view that, from a personal perspective, staying around for a recovery in the business and share price was not worth it. The sale of most of his c. 30% stake to Russian investment bank VTB Capital (that will look to increase its value substantially for a resale) has led to meaningful changes in management and strategy that we believe will be beneficial in the long term. An example is the company’s historical overemphasis on maintaining margins at the expense of reinvesting in the existing store base. This worked fine when the competition was weak and fragmented, but as X5 Retail improved its operations in recent years, the product offering at X5’s stores far exceeded Magnit’s more basic stores and led to negative traffic at Magnit. We believe that greater reinvestment in the business would have delivered better returns, as fewer customers would have been lost to competitors and the additional sales revenue would have delivered greater absolute profits to Magnit, even if margins were slightly lower. Galitsky’s exit also highlighted that the business has been lacking in professional management, with many senior managers being responsible for multiple portfolios. Professionalising the management structure and having distinct control of functions assigned to specialist managers will help improve processes and make the company less dependent on a single individual in future. We were buyers of Magnit over the quarter and at end-March it was a 3.7% position.

The other big detractor has been Kroton, which has fully given up the gains it achieved since the blocking of its merger with Estácio by competition authorities in the middle of last year. Investor perception toward the private education industry in Brazil has cooled in recent quarters due to a variety of factors. First, intakes have declined or stagnated as affordability has become more of an issue for students. Although the Brazilian economy has exited its deep recession of 2015 and 2016, the recovery has been very shallow, without a substantial improvement in job prospects for the workforce. With most of the students working in the day and studying by night, the poor job market has made affordability quite difficult for new entrants and has even affected the existing student base, which has seen a spike in dropouts after holding up well until recently. Ordinarily the government student financing scheme would have helped maintain enrolment momentum, but since 2015 this scheme has been halved and made more expensive for those that qualify. The tough market has also put pressure on pricing, with many industry players offering discounts to entice students, leading to lower average fees (‘tickets’, as they are referred to in Brazil). This has been particularly pronounced in the distance learning segment where barriers to entry were lowered substantially by the government last year. From a high level viewpoint, the industry is seen as one where near-term revenues will be under pressure, so the only chance of decent profit growth is through margin expansion. As the largest player in the industry and with many government student loan beneficiaries due to graduate this year and the next, the market is pricing Kroton for revenues to decline. As its margins are already the highest in the industry (thanks to economies of scale and excellent management) there is little scope for Kroton to deliver earnings growth if one subscribe to this viewpoint. Kroton has therefore de-rated to 10 times earnings.

While we acknowledge the merit in some of these issues, we believe there are strong counterarguments that make Kroton a very compelling investment, which is why we have been increasing the position into share price weakness. It is important to identify that the longer-term drivers of the industry remain intact – Brazil has a dire skills shortage and the return on investment for students who study certain courses is very high. The industry is fragmented and the profitability of smaller players is minimal – many survive simply because they own the building out of which they operate and therefore do not have to pay rent. Kroton’s high market share should therefore not serve as a barrier over long periods of time to continued student growth, as the market will consolidate over time. Kroton’s scale and strong brands make its degrees more attractive, which raises long-term pricing power. With its solid balance sheet and high profitability, the company is uniquely positioned within the industry to offer pioneering financing schemes that allow students to spread out their payments beyond the duration of their degree, which will make them more affordable to marginal students. This will help offset some of the negative impact of lower government student loans.

During the quarter we met with the CEO, CFO, CTO and various divisional heads of Kroton in Brazil. In our view, the strength and depth of management at the company places it among the best in emerging markets. Kroton long ago identified that pricing would be an issue and has slowly migrated its intake away from low-ticket courses such as business administration into more technical courses (like nursing, dentistry, education and law) where the average ticket is three to four times higher and the barriers to entry for smaller players to follow are far higher. The regulatory hurdles that limit the pace at which new courses can be added to existing universities mean this process will take several years to play out, but the end result will be higher student numbers driven by organic growth, higher average tickets as Kroton’s course mix shifts toward more expensive courses and higher margins as the company reaps further economies of scale. Kroton is also making a concerted push into the private school market as this industry also has great economics (a student stays with you for 12 years instead of 4) and remains very fragmented despite many strong local brands. At 10 times earnings we believe you are buying the current earnings stream at a substantial discount and getting all of the above optionality for free. Kroton was a 5.0% position at end-March and is the second largest position in the strategy.

Members of the team continue to travel extensively to enhance our understanding of the businesses we own in the strategy, their competitors and the countries in which they operate. In the quarter the team visited Brazil, India and China, while we will visit Russia, South Korea, Taiwan, Indonesia and Singapore in the coming weeks. The weighted average upside to fair value of the strategy at the end of March was c. 45%.

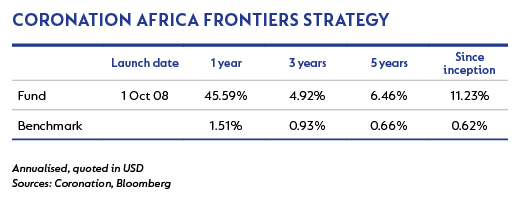

After a strong performance in 2017, markets across Africa continued to rise in the first three months of 2018. Against this backdrop, the strategy’s gross return was 12.2%, compared to its target (3 Month USD Libor + 5%) which was up 1.7% and the FTSE/JSE All Africa ex-SA 30 Index, which was up 11.9% for the quarter.

While volatility increased in developed markets, the large African economies shrugged off these concerns and went from strength to strength. Over the quarter, Egypt was up 15.1%, Kenya up 13.7%, Nigeria up 9.5% and Morocco up 7.4%. Zimbabwe was down 10.1%; however, this is somewhat misleading as the decline in equity prices was due in part to an improved economic outlook and increased trust in the monetary system. Equities are no longer viewed as a necessary safe haven and cash holdings have increased in the hope of currency normalisation following the November 2017 regime change.

The main contributors to performance over the quarter were Eastern Tobacco, Stanbic IBTC and Seplat Petroleum, which contributed a combined 6.1% to the strategy’s performance. Eastern Tobacco benefited from a number of improvements in its corporate governance, the share’s inclusion in the MSCI Emerging Markets and the FTSE indices and speculation that the company would pay out its excess cash reserves by way of an interim dividend. An interim dividend was confirmed in early April. There were no meaningful detractors, with no single position detracting more than 25 bps.

We continue to be fully invested in Egypt and we are very excited about the prospects of our various investments. Over the quarter we met a number of Egyptian corporates in Cairo, Cape Town and Dubai. Most talked to an improving trading environment. Inflation has normalised, with March seeing headline inflation of 13.3%, down from the 33.0% peak in July 2017. The Central Bank cut interest rates by 200 bps during the quarter and most economists expect further cuts in the coming months. The reforms put through over the past two years are already bearing fruit. As inflation and interest rates continue to decline, we would expect Egypt to experience a multiyear period of growth. Given the past few years of hardship it is unsurprising that many of the companies we meet have earnings well below our estimate of normal. As such, despite the stock market performance, we continue to find companies that are trading below their intrinsic value.

The strategy significantly increased its exposure to Qatar National Bank Alahli (QNBA) over the quarter. QNBA is the largest private sector bank by loans and second-largest by deposits in Egypt. The bank is well positioned to benefit from Egypt’s improved business confidence. As interest rates decline, loan volumes should pick up meaningfully. As loans increase, so too should the associated fees and commissions. This will drive a normalisation in non-interest revenue, which is currently at multiyear lows. Over the longer term, the Egyptian banking sector is incredibly attractive. Credit penetration is very low at c. 35% and retail growth should continue for years to come. Finally, QNBA’s parent Qatar National Bank is well funded, with strong international relationships that stand to benefit QNBA. The share trades at half the price-to-book multiple of the more liquid Commercial International Bank (CIB). We do not believe that simply because a company has a larger free float, it should trade at twice the price of a less liquid peer. As a result, while we believe that CIB is an attractive investment in its own right, we see QNBA as more attractive from a valuation perspective.

While we remain excited by the holdings in Egypt and across the strategy, we are always sceptical when years start as strongly as 2018 has. We are pleased with performance year-to-date but remain mindful that markets are volatile and seldom increase in a straight line. We continue to believe that for the valuation-focused, bottom-up investor, returns in the long run will be attractive despite any near-term volatility.

The strategy returned 7.2% (gross) for the quarter, compared to the target (3 Month USD Libor +3.5%) which was up 1.4% and the MSCI Frontier Markets Index, which was up 5.1% over this period. The strong performance was driven by Vietnam (+18.4%), Egypt (+15.1%), Kenya (+13.7%), Nigeria (+9.5%), Morocco (+7.4%) and Kuwait (+5.1%), while Bangladesh (-12.9%) and Argentina (-5.3%) declined.

When selecting investments we use a bottom-up, valuation-driven approach. We are completely benchmark agnostic and our focus is to generate attractive absolute returns for investors in the fund, rather than to outperform an often poorly constructed benchmark. We avoid overpaying for companies where valuations are not justified, which ensures that we minimise the risk of a permanent loss of capital. A case in point is some of the valuations we currently see in Vietnam.

We visited Vietnam in March where we met with a number of companies. With strong GDP growth and booming exports it is easy to see why investors love the country. The market is incredibly well liked and is widely held in frontier and even emerging market funds. As a result, Vietnam is up 18.4% over the past three months and up 61.5% over the past 12 months. From a bottom-up perspective, however, the market is trickier. Many companies have reached their foreign ownership limits, which means that foreigners have to pay large premiums to buy shares in these companies – sometimes as high as 30%. Your return as an investor will therefore be materially different from the return shown by the quoted share price.

There are a number of quality businesses in Vietnam we would want to own at the right price; however, the optimism is clearly reflected in the valuations of these businesses. A number of banks are trading on price-to-book valuations above three times; for one of the largest banks in the country, Vietcombank, you now have to pay almost five times book value. There are also many consumer-focused businesses trading on high price/earnings multiples, some higher than 30 times earnings. Recently, a stake in Sabeco, the country’s largest beer producer, was sold at a multiple of approximately 44 times earnings. The growth that these businesses will have to achieve over the next few years to justify these multiples are simply too ambitious in our view. In our experience, paying a high multiple on earnings that are already at elevated levels is very dangerous.

We believe that the benefits of a valuation-driven approach is demonstrated by the fact that despite owning no companies in Vietnam over the last three months and only a small position over the past year, the strategy still performed better than the MSCI Frontier Markets Index over three months, one year and since its inception in December 2014. The largest contributors to performance over the past quarter were Eastern Tobacco (adding 1.5% to the strategy return) and CFC Stanbic (adding 0.9%). Both are quality companies which we own because they trade well below our assessment of fair value and not because of their weight in an index.

Another problem with an index benchmark is that a company’s and a country’s weight in the index increase as valuations get higher. As value investors, we prefer the opposite – as a company becomes more expensive, the position size in the fund should reduce. A year ago, when valuations in Vietnam were much lower than what they are today, Vietnam accounted for less than 10% of the MSCI Frontier Markets Index. Today Vietnam is more than 15% of the index.

We believe there are a number of very attractive opportunities across the frontiers universe. We hold investments that trade below our assessment of intrinsic value and we size our positions according to the return opportunity on an absolute basis, irrespective of the size of these investments in any particular benchmark. By doing so, we believe that the strategy will deliver attractive long-term returns to our investors.

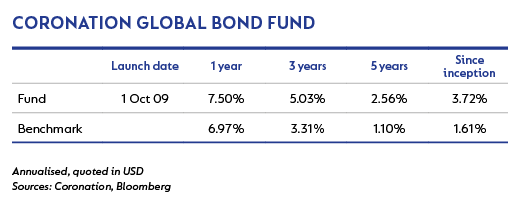

The fund returned 1.2% for the quarter and 7.5% over the last 12 months, against a return of 1.4% and 7.0% respectively from the Bloomberg Barclays US Aggregate Bond Index.

US yields continued to rise over the quarter and US government bonds were by far the weakest of the major markets, with a total return of -1.2%. German yields rose modestly, but the income generated was sufficient for German government bonds to post a modest total return. Elsewhere, peripheral Europe and a number of emerging markets posted healthy gains despite the rise in volatility. While corporate bonds performed well during January, credit spreads widened during February and March, to the extent that they underperformed government bonds for the quarter, the first time since the end of 2015.

Global growth is currently in a sweet spot, benefiting from a cyclical upturn in all major regions, and running at its fastest rate since 2011. The question is where the risks of a slowdown may emanate from. Will it be the return of inflation that prompts a more rapid tightening of monetary policy, or will it be geographical (the risk of a looming trade war)?

After the passage of the US tax bill, the country’s trade deficit has now become the focus of the Trump administration. Renegotiating the North American Free Trade Agreement

(NAFTA) may have been a first salvo, but more recently the imposition of tariffs on a range of imported products has riled allies, adversaries and investors. In addition, there are signs in many regions of more protectionist attitudes to national industry champions. Taken together, these actions in an economy growing above its potential are more likely to see price pressure increase. While tensions on the Korean peninsula appear to be easing, risks in several other geopolitical hotspots threaten market sentiment, most likely via rising energy costs.

The upward movement in US Treasury yields during the quarter reflected the impact of the passing of the tax legislation, with market participants upgrading economic forecasts for 2018 and 2019, and investors expressing concerns about the increasing size of fiscal deficits. US 10-year yields peaked at close to 3.0% in February before retracing slightly to 2.7% by quarter-end, having closed 2017 at 2.4%. The yield curve continued to flatten as shorter-dated yields rose most. With breakevens relatively stable, the bulk of the sell-off has come from rising real rates, with 10-year real yields rising to 0.7% over the quarter.

The Federal Open Market Committee (FOMC), led by the new chair Jerome Powell, raised rates in March by a further 0.25%, with the upper bound of the US Federal Reserve (Fed) funds target range now at 1.75%. The FOMC also amended its growth projections upwards to 2.7% in 2018 (from 2.5% in December and 2.1% pre-tax cuts) and 2.4% in 2019 (up from 2.1%). Its unemployment rate forecast fell slightly in 2018, and was lowered to 3.6% in 2019 and 2020. This would be consistent with the lowest unemployment rate since the late 1960s. Some investors have begun to draw parallels with policies of the Nixon administration and worry that the twin deficits will lead to a loss of confidence and a weaker dollar, as was the case in the early 1970s. The FOMC also adopted a slightly more hawkish stance in its projection of interest rates, with the dot plot rising from 2.688% in December to 2.875% in March, and 2020 projections increasing from 3.062% to 3.375%.

While official rates may have only increased by 0.25%, rates in the interbank market have been rising much faster. The 3 Month USD Libor spread has risen to 0.6% (from 0.3% at the end of December) as a result of several factors coming together. Part of this is driven by much higher Treasury bill issuance, following the resolution of the debt ceiling (further exacerbated by the Fed shrinking its balance sheet). The other element has been more supply from banks and less demand from corporates as a result of changes in the US tax system. The result is that the 3 Month USD Libor has risen 1% in the last six months. At 2.3%, it is now a credible alternative for investors who may not want exposure to longer-dated Treasuries, which are more volatile and does not carry a much higher yield at present.

We believe the Fed’s 2020 forecast for its funds rate now looks overly aggressive. We remain wary of valuation in longer maturities, which we believe will face growing headwinds from rising supply and less support from overseas buyers, as hedging costs have increased. The fund switched its remaining mid-curve exposure to the five-year area of the curve and switched its inflation-linked bonds into conventional fixed rate Treasuries. Total US Treasury exposure was reduced as the fund increased exposure to emerging markets and credit.

European government bond markets performed well during the quarter, led by the periphery despite an Italian election in March that resulted in a hung parliament. Coalition talks continue in Italy after a month-long stalemate that has failed, so far, to bridge the gap between parties of very different political persuasions. Political risk has subsided in Spain for now. The ostracised Catalan leader Carles Puigdemont, who was forced to flee Spain, has so far escaped attempts by Madrid to extradite him from Germany. On the economic front, momentum has slowed to its weakest level in more than a year as the composite Purchasing Managers’ Index fell abruptly in February and March. Indications still suggest annual growth in the region of 2.5% and some of the weakness may be in part explained away by weather, supply chain bottlenecks and unusually high levels of absenteeism due to flu. The slowdown comes at a delicate moment for the European Central Bank as policymakers debate further tapering of their bond buying programme. Meanwhile, inflationary pressures remain modest despite evidence of a firming of some underlying elements, such as within services.

With respect to Brexit, in March the UK reached an agreement that a 21-month transitional period would begin in March 2019, giving the impression that headway is being made in discussions with the EU. However, some of this progress is viewed by Eurosceptic Members of Parliament (MPs) as merely the result of a compromise of previous ‘red lines’. While markets have become more optimistic that a manageable ‘muddle-through’ result will ultimately be achieved, the chances of a ‘no deal’ because of future insurmountable hurdles, or the failure of a final deal to be ratified by MPs, remain significant. In the meantime, inflation remains above target at a time when slack in the economy has reduced and wage pressures are picking up. A further rate increase is widely expected by the market in May, with tightening thereafter likely to be heavily dependent on whether global growth (and in particular the EU) remains above trend. Cooling house prices (albeit London-focused) and sluggish retail sales are symptomatic of the high level of indebtedness, a decline in real wages and economic uncertainty among consumers.

Emerging markets hard currency debt performed well during the quarter, despite a backdrop of weaker corporate bonds. The US-dollar denominated emerging markets debt spreads ended the quarter only 10 bps wider at 320 bps. Local currency denominated debt performed well this quarter, up 4.7% in US dollar terms.

The star performers include South Africa (up 8.6% in local currency and 13.5% in US dollar terms) and Mexico (up 3.6% in local currency and 11% in US dollar terms). Higher inflation in the Philippines resulted in a weakening of bond yields and foreign exchange markets (resulting in a combined loss of 8% in US dollar terms), while bond market returns in Turkey and Argentina suffered against a backdrop of weaker exchange rates as investors perceived politicians to be compromising the independence of their central banks. The fund increased its exposure of predominately short-dated dollar instruments, adding to positons in Argentina and Qatar as well as switching Turkish and South African government exposure to slightly longer-dated instruments to take advantage of a steep credit curve. The fund recently added exposure to local currency Turkish government bonds where yields are now high.

Credit spreads remain relatively tight but have begun to soften slightly under the weight of supply and a less supportive equity backdrop. The weakness in corporate bonds was not limited to the US market, and euro and sterling spreads also widened. It is noteworthy that since central banks’ asset purchases have begun to be reduced, markets have struggled to extend their gains. At this stage, we continue to see the immediate risk to valuations as more dependent on changes in the flow of funds into the asset class (exchange-traded funds and passive investment are significant in this regard) than solvency related. The more fundamental credit challenge will come as central banks adjust policy rates higher, the world economy begins to slow and large amounts of refinancing come due (in 2019 and 2020). After the recent move, we are more constructive on shorter-dated corporates but remain cautious of longer-dated instruments. The fund added to its credit exposure via Sasol during the quarter and via convertibles such as Intu Properties, Impala Platinum and Redefine Properties.

Within foreign exchange markets, the US dollar continued to struggle despite a continued widening in interest rate differentials. Within the G10, the yen was the best performer (up 6%) despite the Bank of Japan dismissing speculation that it may be beginning to consider tapering its stimulus programme. The Norwegian krone also performed well after the central bank lowered its inflation target from 2.5% to 2%. With inflation now above the new target, the central bank suggested a rate hike was likely as soon as September. Sterling also rallied against the US dollar (up 3.7%) just ahead of the euro (up 2.5%). The Canadian dollar was among the weakest currencies, as expectations for rate rises moderated and concerns surrounding NAFTA weighed on the currency, despite Mexico being the best-performing currency. The fund remains slightly overweight US dollars and neutral yen. An underweight position in euros remains the main funding currency for positions in emerging markets that include Mexico, Turkey and Egypt, and to a reduced extent, South Africa.

The fund remains underweight duration, predominately via low duration positions in Europe and no Japanese bond exposure. We retain a preference for shorter-duration positions within government and credit markets within the US. The fund’s exposure to mainstream credit remains low with our exposure to higher yielding assets expressed via convertibles and emerging market debt. We expect the recent pickup in volatility to continue as central bank liquidity is drained from the system.

South Africa - Institutional

South Africa - Institutional