Investment views

A long journey to the destination

“The relationship between commitment and doubt is by no means an antagonistic one. Commitment is healthiest when it is not without doubt, but in spite of doubt.” Rollo May, The Courage to Create

The Quick Take

- At Coronation, investment ideas often result from an organic process with inputs from various sources

- Our investment journey with Uber illustrates how an interesting idea can develop into an attractive opportunity for the benefit of client portfolios

- Initially cautious on risks, we gradually gained conviction that the stock offered significant risk-adjusted upside to fair value

- Uber has been a strong contributor in our portfolio, and we built a meaningful position in the company when sentiment was very poor

While idea generation can be very structured, such as screening the S&P 500 Index of stocks based on historical financial metrics, it often unfolds as a more organic process at Coronation. Our journey with the ride-hailing service Uber is an excellent example of a company we have been researching even since before its initial public listing, enabling us to invest when it offered attractive risk-adjusted upside potential several years later. We built conviction through meticulous research, drawing insights from various sources.

THE BIRTH OF AN IDEA

In March 2016, three years ahead of Uber’s initial public offering (IPO), when the gig-economy business model was still in its infancy, Uber’s then-Chief Business Officer, Emil Michael, made a few “aha” points at an investment conference we attended in San Francisco. For example, Michael highlighted that cars in the US were under-utilised by as much as 96%, with 70% of car owners spending just 45 minutes a day in a car, and 100 million families owning two cars. His vision was for 70% of the US to access an Uber within 10 minutes in five to 10 years, extending eventually to 70% of the world.

The discussion also delved into Michael’s perspective on the threat of driverless cars. Michael’s view was that the rise of driverless cars was inevitable, and the debate was simply whether it would be seven, 10 or 12 years from that point. However, the quality of service offered through driverless rides would be critical and would have to improve significantly before it became mainstream.

Following the conference, Uber was now a company on our radar. It had a large addressable market, provided value to many entities in society, and was led by an ambitious yet seemingly sensible management team that understood that low prices are often good in business.

Our initial subsequent research confirmed our positive view of the significant opportunity Uber was trying to tackle and suggested that the company was making progress on the services it offered.

Importantly, our research also showed that regulatory risks were likely a more pressing challenge as existing regulations did not cater for gig work[1], with most drivers averaging about 10 hours of driving a week – a far cry from full-time work and thus requiring different regulation.

However, by 2017, Uber had become a mess, culturally. A viral #DeleteUber campaign ensued when Uber lifted surge pricing during a protest. An Uber engineer, Susan Fowler, posted a blog about widespread sexual harassment and gender discrimination, and The New York Times ran an exposé under the headline “Inside Uber’s Aggressive, Unrestrained Workplace Culture”. Uber started losing market share to its ride-hailing competitor, Lyft.

Despite the negative publicity and cultural issues, by the time Uber launched its (IPO) in May 2019, it had already become a ubiquitous consumer service. However, our research showed that ride-hailing growth was slowing in the US, which meant that incremental growth would need to come from more competitive, or more regulated, geographies and Uber’s more competitive food delivery segment. Additionally, Uber was burning cash, with gross margins after marketing spend (measured as a % of gross bookings) equal to about half of its fixed operating costs. We chose not to participate in the IPO.

BUILDING INDUSTRY KNOWLEDGE AND UNDERSTANDING

In the meantime, an online food delivery platform in China, Meituan, piqued our interest and helped us build our knowledge of gig-economy businesses. Our work on Meituan yielded valuable insights that were relevant to Uber. Firstly, economies of density[2] favour an incumbent, meaning that a company with a leading market share has a competitive advantage over smaller rivals. The platform with more drivers has a denser distribution of drivers across a city, reducing a consumer’s wait time.

Another key insight was that the market share leader benefits from several small economic advantages per delivery or ride. On a huge volume of deliveries/rides, these minor advantages make a big dollar profit difference. The leader can pay drivers slightly less per order than smaller competitors, but due to better utilisation, drivers can earn more per hour.

The leader also benefits from lower marketing costs due to the stronger consumer experience (reduced waiting time and lower prices), which results in both stronger brand awareness and better loyalty amongst the highest-spending consumers.

UNDERSTANDING UBER

We decided to deepen our focus on Uber in 2021. The business was, understandably, challenged during the pandemic due to mobility and close contact restrictions. The initial recovery in ride-hailing growth was weak post-pandemic and, at the time, there was rising concern that legislation related to gig-worker classification would harm Uber.

Uber has two key businesses, namely ride-hailing and delivery, each contributing about half of gross bookings, but with 90% of segment earnings, as measured by earnings before interest, tax, depreciation and amortisation (EBITDA), generated by the ride-hailing business.

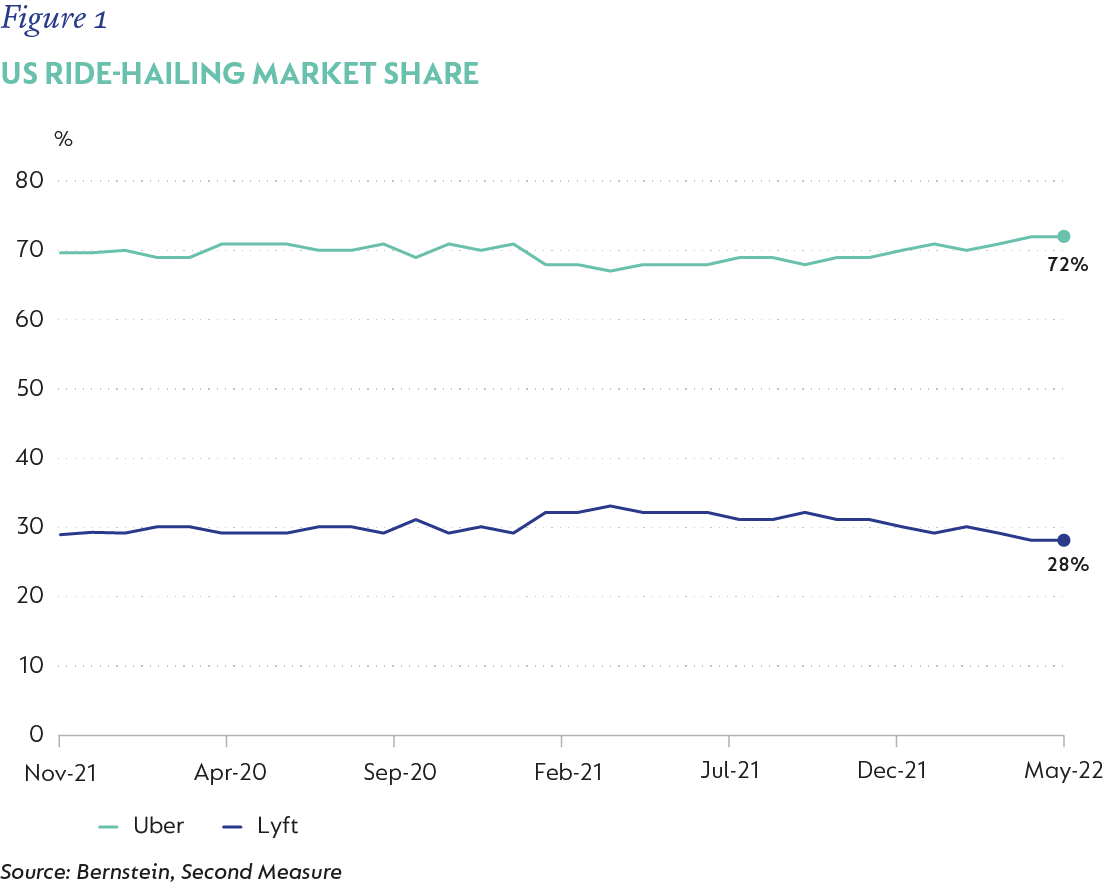

The ride-hailing business looked fantastic, with the company having about 70% market share in countries making up 70% of rides gross bookings – a very strong competitive position. In the US, Uber’s largest ride-hailing market, Uber had more than twice the market share of its closest competitor, Lyft (Figure 1).

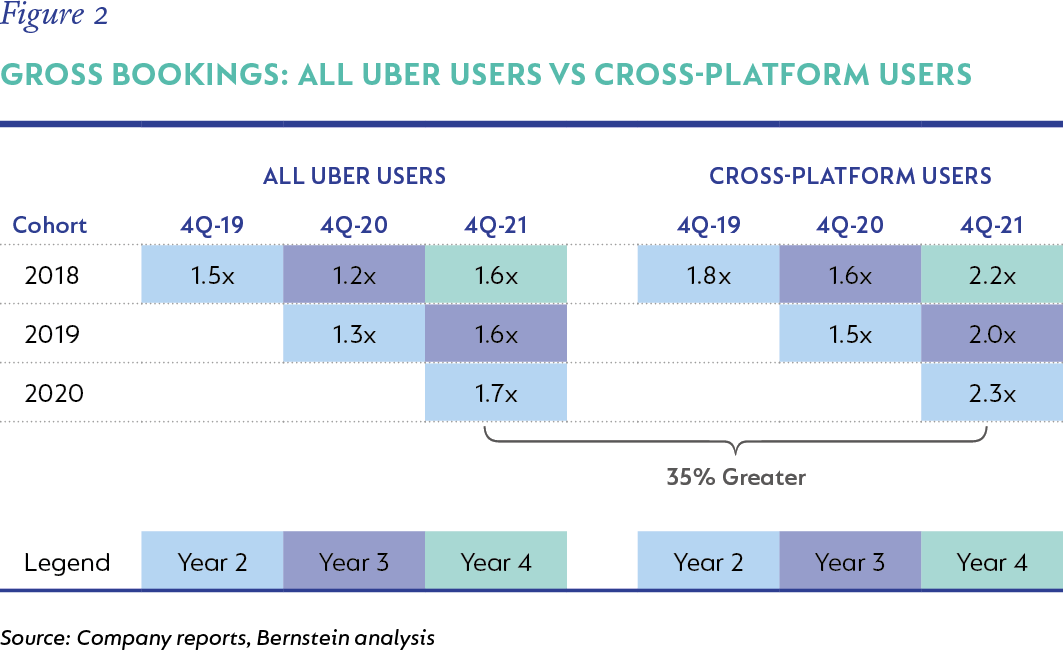

Furthermore, Uber has many cross-platform users who use both its ride and food delivery offerings, and the research shows that Uber’s structural advantage lies in its cross-platform potential. The cohort data (Figure 2) shows the gross bookings of all Uber users as well as cross-platform users by year of joining the service. For example, customers joining in 2019, increased their usage 1.3x in 2020. Within this cohort, the cross-platform users (shown in the right-hand side of the graph), made 1.5x the gross bookings that the overall cohort made in 2019. Bernstein’s analysis further shows that cross-platform users spend five times more than customers who use only the rides or only the delivery service, are 25% easier to retain and 75% cheaper to acquire than through paid channels[3].

The delivery business had weaker economics than the rides business and a weaker competitive position. However, Uber could leverage its strong rides position to lower its customer acquisition cost by cross-selling delivery to its large base of rides customers. Uber could also lower research and development and other central costs by sharing these between the two businesses.

Beyond delivering take-away food, we recognised that Uber had a longer-term opportunity to build a very profitable advertising business, and to expand to convenient grocery and non-food delivery. Uber also developed a membership programme, called UberOne, which could increase customer stickiness and was differentiated and appealing.

Based on an understanding of the financials of the business, it appeared that the conversion from net profit to cash flow would be very strong, given the low capital requirements and negative working capital cycle, once profitability was reached.

ASSESSING THE RISKS

A key risk related to regulation, given the labour-intensive nature of gig-economy businesses and because the industry had ballooned before regulators could catch up with technological developments. We viewed the appointment of Dara Khosrowshahi as CEO in late 2017 as a positive development.

Khosrowshahi’s worked with regulators to develop an independent contractor+ (IC+) model, effectively improving countries’ existing part-time work models. If adopted by countries or states, an IC+ model would allow part-time work with expanded benefits and protection for workers.

We systematically assessed the status of gig worker regulations in Uber’s major markets. Besides the US, most key markets seemed to have a legal framework supporting an IC+ model. By the end of 2022, it seemed that the US regulatory environment was becoming more accommodating too. This positively impacted our assessment of the risk versus potential reward.

Autonomous cars remain a long-term risk, but experts suggested autonomous companies would likely partner with Uber to maximise utilisation to amortise the higher capital cost. This probability is underscored by Waymo, Alphabet’s autonomous driving unit which has partnered with Uber for freight delivery in 2022.

We also received confirmation from an ex-employee that Khosrowshahi had done an excellent job of fixing the corporate culture.

GRADUALLY, THEN SUDDENLY

We initially purchased a small position in the company in April 2021 (Figure 3) and as we built our conviction on the positive skew of the risk-reward trade-off, we increased our position.

As regulatory risks receded market-by-market and it became clearer with each earnings release that the business model was sustainable and that GAAP (generally accepted accounting principles) profitability was approaching, the market price began better reflecting the underlying company value. We pared our position as the price increased during 2023.

Our decisions over this time were based on years of in-depth work to build a comprehensive understanding of Uber’s business model; the industry; the structure of similar companies; Uber’s competitive position and advantages; issues with the company culture; regulatory and technological risks; and a financial valuation, which allowed us to assess the potential return against the risks we identified. Uber has outperformed strongly over the past year, and it is pleasing to see that it has been a significant contributor to the performance of client portfolios over the holding period.

[1] Gig work, according to Oxford Languages is “temporary or freelance work performed by an independent contractor on an informal or on-demand basis”

[2] Efficiencies resulting from urban density

[3] Initiating coverage on US Emerging Internet: Pick your spots and wear a helmet, Bernstein, 23 May 2022

Disclaimer

SA retail readers

SA institutional readers

Global (ex-US) readers

US readers

South Africa - Institutional

South Africa - Institutional