Investment views

Hotel California - South African investor heaven or hell?

South African investor heaven or hell?

- When it comes to investing in Africa, negative newsflow obscures the facts

- Allocating to Africa is akin to selecting any other stock

- The Africa Frontiers Strategy has outperformed South African equities against meaningful time periods

- Seldom have valuations been so attractive and many countries across Africa have superior prospects relative to SA

FRONTIER MARKETS HAVE been on the bleeding edge of the listed-equity universe. A number of countries have swung from being failed states to show some promise, only to collapse back into an economic pile of questionable future. The share of news airtime has sadly been tilted in favour of high drama as opposed to the promise of high returns. Egypt’s Arab Spring, Argentina’s record International Monetary Fund default, Nigeria’s multiple-currency default, and Zimbabwe’s eternal death spiral, to name a few stories.

Having managed an African fund for 12 years now, it has started to feel like ‘Waiting for Godot’, with me telling the story of future returns to come, while these continue to remain elusive. As my colleague likes to serenade – you can check in, but you can never leave. The question is, though, is this true – has Africa been the Hotel California of investments?

FIRST SOME BACKGROUND

In 2004, then-President Thabo Mbeki granted South African pension funds the flexibility to invest 5% of their assets in Africa (ex-South Africa). Few took up his offer, and those that did, nibbled, staying well shy of the 5%. And judging from the introduction above, if you ask anyone whether they should have held more Africa in their balanced funds, they will shout, “No!” But would they be right?

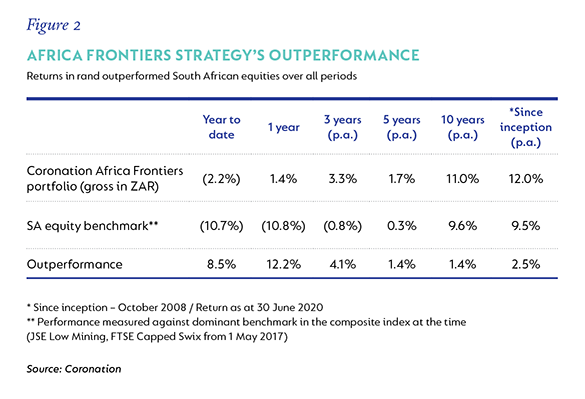

Index returns have been terrible. Since the inception of the Coronation Africa Frontiers Strategy, the FTSE/JSE All Africa (ex-South Africa) 30 Index has returned 4.2% p.a. in rand and a negative 2.1% p.a. in US dollars. However, our Strategy has returned 12% in rand and 5.2% in US dollars. Frontier markets lend themselves better to stock pickers, given the dearth of quality compounders.

‘Smoke and mirrors’, I hear you say when using a rand return. However, I would argue that a rand return comparison is appropriate, as an Africa allocation would have come from a portfolio manager’s rand bucket, and not the precious outright US dollar allocation they have available. So, the right measure is to compare the Strategy’s returns to a South African equity benchmark that balanced funds would measure against and which would be Regulation 28 compliant*.

IT’S AN ALLOCATION DECISION

In fact, the decision to allocate to Africa is just like selecting a stock – not a massive off-piste investment idea. And, while any one country at any time might look challenging, when considered in a portfolio context, over time, returns are diversified and the bumps smoothed out. Yes, we have taken hits in different countries, but, these are appropriately valued at realisable values and, in my view, will add to returns over time rather than detract.

Investing often comes with a large dose of dissonance – where we think one thing is perfectly normal, yet something else is an uncomfortable departure for our senses. If, when casting an eye over the top holdings in a balanced fund, a position that is high conviction and somewhat differentiated will catch your attention, but will also be what you’d expect from a stock-picking manager – after all, that is how value is added over time. A 5% Africa allocation, however, causes more of a stir – and the question is: why should it be, relative to the comfort of our more known benchmark universe?

THE PROOF OF THE PUDDING

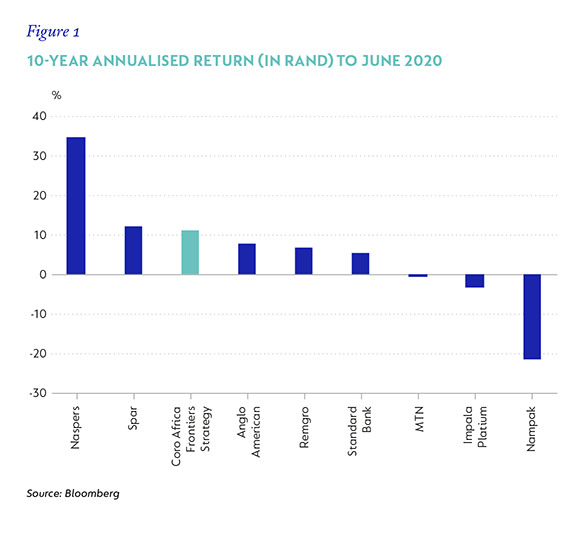

Stripping out emotion, the past decade’s returns (the timespan that is becoming a meaningful period for manager measurement) are as shown in Figure 2.

We have outperformed South African equities against every time period. Within these returns, we have marked down virtually all of Zimbabwe, conservatively valued the Nigeria naira and, wherever there is doubt, looked to value assets as realistically as we can. In short, these returns are very realisable. In the life of our Strategy, we have never had to gate** it due to liquidity constraints and have handled large inflows and outflows seamlessly.

WORTHY OF DEBATE

It does feel like investors in the asset class are at a point of capitulation. I urge investors to be aware that their fatigue is more because of the noise around the asset class as opposed to its delivered and expected returns. Seldom have I seen more attractive valuations and, relative to South Africa, many countries and companies across Africa have superior prospects. The asset class should really be afforded more debate when it comes to an allocation within a South African pension fund.

In conclusion, Hotel California hasn’t been as inhospitable as one might feel, and relative to South Africa, it has delivered more. Don’t let a bad story spoil the facts – it’s not the dark desert highway people make it out to be. +

* Regulation 28 of the Pension Funds Act

** A manager’s right to limit or halt redemptions.

Disclaimer

South Africa - Institutional

South Africa - Institutional