Investment views

The luxury goods love affair

When desirability becomes necessity

- A consumer’s relationship with luxury goods is a deeply emotive and personal one.

- Luxury brands must balance perceived exclusivity with selling millions of products each year.

- The key to success in luxury goods is controlling the entire customer experience and never devaluing the brand.

- Successful luxury goods companies are among the best businesses in the world.

YOU’RE 25, AND you spot an object of desire across the room. You ask around, find out their name, and then set out to do some research on them. You stalk them on every available social media platform – check how many mutual friends you have on Facebook and see how many followers they have on Instagram – verifying their ‘desirability’. Having established their suitability as a partner, you express some interest.

So the courtship begins. They woo you at every turn … invitations to prestigious events, flowing champagne, playful flirting, subtle compliments and charm. They seem to know exactly what you like. What began as infatuation evolves into falling in love. It’s exhilarating, you’re obsessed. They’re all you can think about. You begin planning a future together, you picture them on your arm forever.

Not your future marital partner, but a Hermès Birkin bag. Or a Chanel 2.55. Or a Lady Dior. All of them are classic enough to be on your arm forever. In fact, Louis Vuitton still sells two bags it designed in the 1930s, the Keepall and the Noé.

The relationship between a consumer and a luxury goods company can ebb and flow and, much like the dating game, the rules are changing in this increasingly digital world. Many of the luxury companies are struggling to keep apace, while others are thriving in this new paradigm.

FOREVER LOVE

Our work on the luxury sector has identified a number of key tenets to ensuring a lasting romance:

Luxury companies are clearly polygamists but need to create the illusion of being in a monogamous relationship with you. This is the largest conundrum for luxury companies; creating and maintaining perceived exclusivity while still selling millions of products each year. It is a very fine balancing act between growth and ubiquity, and brands that grow too quickly run the risk of losing brand cachet and desirability. Successful brands such as Louis Vuitton and Hermès have achieved this by continually putting through price increases rather than increasing volume, increasing product ranges, launching exclusive capsule collections with known artists and celebrities, and expanding product categories into areas such as luggage, accessories, beauty, perfume and cosmetics.

Luxury companies must never devalue your relationship. Many luxury companies sell entry-priced items but manage to do so without devaluing their core brand. Selling entry-priced items is important in courting ‘new-to-luxury’ customers and serves to reduce the cyclicality of the business. But doing so without devaluing the brand is a balancing act. Brands achieve this by only ever advertising their most expensive products. This has the additional positive outcome that when a consumer finds a less expensive item, they feel like they are getting a bargain, perhaps even a mispriced item. In addition, brands ensure that entry-priced items are never readily available. There is often a lengthy waiting list, such as for the Rolex Submariner Hulk.

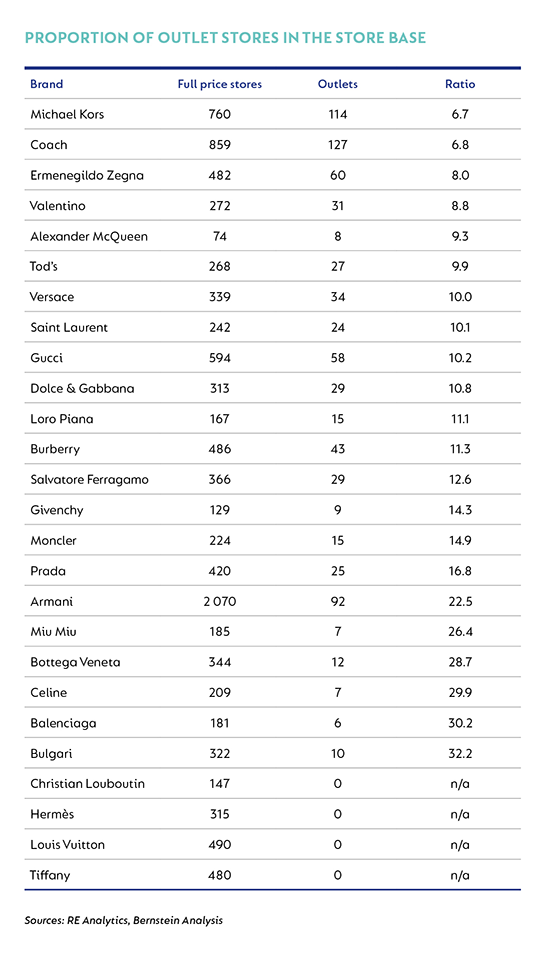

Luxury companies must never undersell themselves. Louis Vuitton is famous for saying they would rather incinerate unsold products than sell them at a discount. Luxury brands have all come to realise this is the correct strategy, but many have opted still to have specific outlet stores which sell the off-price items, minimising the impact to the brand while still allowing them to clear unwanted inventory. Christian Louboutin, Hermès, Tiffany and Louis Vuitton are four brands that have zero promotions and no outlet stores either, cementing the strength of their brands and serving as an aspiration for peers.

Luxury companies must get to know you and control the path of the relationship. Luxury brands that sell wholesale and rely on third-party companies to sell to the end-consumer are not in control of their own destiny. They cannot get to know their customer, are not in control of the customer experience and run the risk that the end-customer winds up loyal to the third party rather than to the brand.

The truly successful brands are those that sell 100% retail, own all their own stores, and operate their own ecommerce sites, or operate via a concession on an e-tailer. This allows them to build up knowledge of their client in order to generate personalised recommendations and utilise the data to drive revenue.

Luxury companies must ensure you continue to feel special. Luxury companies can achieve this with specialised treatment for their VIP customers, as well as through exclusive offers. Many luxury brands invite their most important customers to exclusive events and fashion shows. Louis Vuitton offered its Supreme/Louis Vuitton capsule to VIP customers on an invitation-only basis.

Luxury companies must relentlessly maintain their beauty. Luxury companies need to invest continuously in their store network, their creativity and their marketing. Stores are expressions of art, style and beauty – they need to provide an experience, not just a clothing rail, and need to be continually revamped. Creative directors need to keep designs fresh and unique, and marketing directors need to keep the brands alive and relevant.

Luxury companies must be good at social media. Social media likes, comments and followers are becoming increasingly important in creating brand desirability. Chinese consumers and millennials are becoming bigger luxury consumers, and they are often digitally native consumers. Many luxury goods companies are currently launching Instagram click-through sales and this channel looks set to become increasingly important. Kering is currently the leader in embracing digital, with Gucci the largest-selling online brand.

In an increasingly narcissistic world, luxury goods companies are thriving. Their products allow consumers to look and feel better about themselves by owning an item which they perceive as special and exclusive. Even better, they can Instagram themselves, earning kudos and credibility in an increasingly superficial world.

ATTRACTIVE IN MORE WAYS THAN ONE

Luxury companies are better businesses than we at first appreciated. This is for a number of reasons:

There are a finite number of brands. The majority of the truly successful brands have two things in common – heritage and provenance. One of the things required for a luxury brand to gain legitimacy is time. Relatively ‘new’ brands such as Dior, Saint Laurent and Ferragamo are more than 50 years old. Gucci, Fendi, Loro Piana and Prada are over 100 years old, and Hermès, Cartier, Louis Vuitton and Burberry are more than 200 years old. Provenance is equally important. With only a few exceptions, such as Burberry in the UK or Loewe in Spain, nearly all of the luxury houses are either Italian or French. As a result, it is highly unlikely that new brands or new competitors would spring up overnight.

Barriers to entry are high, especially with the demise of department stores. A certain level of scale is required in order to afford a very expensive store network located in prime retail locations, an e-commerce platform and expensive marketing. This has raised barriers to entry for newcomers.

Pricing power and exponential price relative to quality. Brands are able to charge exponentially higher prices for slightly higher quality items. This enables luxury goods companies to deliver extremely high margins and high returns on capital, compounding returns for shareholders.

Excellent cash flow generation. Many of the luxury goods companies are excellent cash flow generators, converting c. 90% of earnings to cash.

Luxury goods companies with strong portfolios of brands are relatively defensive. The LVMH Moët Hennessy Louis Vuitton (LVMH) portfolio of brands is both geographically and divisionally diversified, creating a defensive portfolio. In 2009, revenue declined by only 0.8% while operating income fell by only 7.6%, an admirable achievement during the Global Financial Crisis.

As a result, we believe luxury companies are far better businesses than often perceived. In our view, they are among the best businesses in the world.

We particularly like those luxury companies that are run by astute management teams with large shareholdings in their personal capacities, such as LVMH, owned by the Arnault family, and Kering, owned by the Pinault family. Both businesses have generated significant returns for shareholders over all meaningful time periods and we look forward to long and lasting relationships with both of them.

Disclaimer

South Africa - Institutional

South Africa - Institutional