Personal finance

Against what are you anchoring your income fund return expectations?

Remember your own tolerance for risk

The Quick Take

- A significant amount of investment flows have been redirected towards the lower end of the risk spectrum so far this year

- Managed income funds have been the primary beneficiaries of this de-risking trend

- Of concern is the return expectations gap for this fund category, which may be due to investors using an inappropriate return anchor

- To avoid any future disappointment, we believe that investors should either consider moving up the risk spectrum into a fund with low equity exposure or adjust their return expectations in line with what we believe is a more reasonable return going forward

The managed income fund space has been a significant beneficiary of investment inflows so far this year as South Africans de-risk their investment portfolios in response to some of the worst market conditions in decades.

But while these investors are seeking refuge in funds that invest in the more conservative, less volatile asset classes, it seems as though their return expectations are out of sync with what we believe can reasonably be expected from this fund category going forward.

This is of concern and could be a recipe for disappointment a few years down the line.

WE’VE SEEN THIS PLAY OUT BEFORE

About a year ago, the results from our annual investor survey showed that investors’ collective expectations were around 2% per annum (p.a.) higher than what we believed to be prudent for the immediate income fund category, in which our flagship managed income fund, Coronation Strategic Income, resides. We believe these expectations were anchored in the historical returns delivered by managed income funds through much of the 2010s. At the time, we cautioned that those expectations were too high given prevailing market conditions, where cash yields were trading at multi-decade lows.

Fast forward a year and again investors’ collective return expectations for the immediate income category are pitched too high in our opinion compared to what we believe is realistic for these funds going forward. We suspect the reason is because of anchoring against the high yields on offer in local government bonds.

In our view, using the yield for a single asset class (SA government bonds) is a flawed reference point for an expected return from a managed income fund given the difference in risk profiles. If we use modified duration as one metric of fixed income risk (it measures overall sensitivity to changes in interest rates), we can see that the risk taken in Coronation Strategic Income is less than a quarter of that associated with a 10-year government bond.

SO WHAT IS A MORE APPROPRIATE ANCHOR FOR A MANAGED INCOME INVESTMENT?

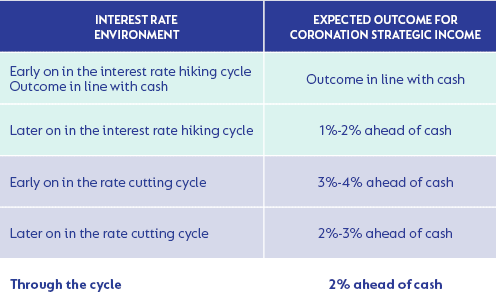

It is important for managed income investors to remember what these funds set out to achieve when thinking about their expected returns. As a reminder, managed income funds are suited to those investors who want to beat cash over the medium term (1-3 years) and can stomach a little more volatility than that of money market fund.

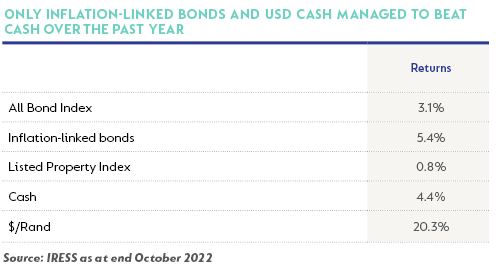

In the case of Coronation Strategic Income, we manage the fund to have a high probability of outperforming cash by 2% (p.a) through the interest rate cycle (which we have achieved since inception more than 20 years ago), and to deliver cash-like returns during volatile environments (as we have recently experienced as illustrated by the table of investable asset class returns below).

DON’T EXPECT A LINEAR RETURN SERIES

Given that the fund needs to take on some risk through its portfolio positioning decisions in order to meet its return target, its return series will not be linear like that of a money market fund. Over short measurement periods, capital at risk can fluctuate. We will however never position the portfolio towards a single outcome. Instead, we create portfolios that comprise a diversified set of assets and always take a conservative approach to risk (e.g. through option protection strategies).

This means that there will be times, in the short term, when the fund will do much better than cash (e.g. when rates are falling) or when the fund is unable to deliver on this cash plus 2% target (e.g. rising interest rate environments as has been the case since November 2021).

However, looking forward, we do believe that the fund is well positioned to achieve cash plus 2% over the medium term. The current fund yield is well over 9%, which we deem to be attractive relative to its duration profile, as well as to our short-to medium-term repo and inflation forecasts.

BUT WHAT IF YOU STILL WANT LOW DOUBLE-DIGIT RETURNS?

If an investor still prefers to achieve double-digit returns without taking on too much volatility, we believe they should consider moving up the risk curve (beyond the income fund category) into a more diversified portfolio that offers some growth asset exposure, but which doesn’t expose their full investment to a single asset class, such as our conservative multi-asset fund, Coronation Balanced Defensive.

IT’S ABOUT ALIGNING YOUR EXPECTATIONS WITH YOUR TOLERANCE FOR RISK

We understand that setting appropriate return expectations might be confusing at a time when markets remain in flux. The most appropriate strategy in our view is to consider your own return expectations and how much risk you are willing to take, and then match those needs to the most appropriate fund type.

Disclaimer

SA retail readers

South Africa - Institutional

South Africa - Institutional