Quarterly Publication - October 2016

International portfolio update - October 2016

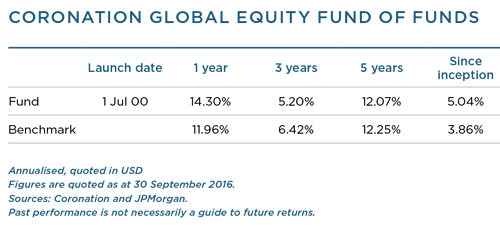

The fund advanced 7.8% in the third quarter of 2016, ahead of the benchmark increase of 5.3%. This brings the rolling 12-month performance to 14.3%, compared to the 12% returned by the benchmark.

Equity markets enjoyed a strong third quarter, with the MSCI All Country World Index (ACWI) advancing 5.3% over the period. Investors started to shrug off the shock Brexit referendum result late in the previous quarter, as key central banks continued with their stimulative monetary policies. As widely anticipated after the Brexit vote, the US Federal Reserve (Fed) postponed a further increase in interest rates and the Bank of England cut rates by 0.25%. In addition, the Bank of Japan (BoJ) announced changes to its monetary policy to further boost the Japanese economy. The European Central Bank was the only such institution that did not announce any further changes, but as at the time of writing there is talk about ending the negative interest rate strategy it is currently following. This buoyed the markets, and especially those in emerging countries.

Over the past quarter, Japan was the best performing region within the fund, returning 8.8% (in US dollar terms). It was closely followed by Asia ex-Japan, which returned 8.2% (in US dollar terms). North America was the laggard, returning only 4.1%, while Europe managed to deliver positive growth of 5.5% (in US dollar terms). Emerging markets rebounded by 8.3% (in US dollar terms).

Among the global sectors, IT (+12.7%) and materials (+9.2%) generated the highest quarterly returns. There were also good returns from the financial (+6.3%) and consumer discretionary (+5.8%) sectors. The worst performing sectors were utilities (-4.1%), telecommunications (-3.2%) and healthcare (-0.2%). On a look-through basis, the fund was positively impacted by overweight positions in IT and consumer discretionary, and an underweight position in utilities. Low exposure to financials and industrials had a negative impact.

The fund’s strong performance over the quarter was primarily due to four managers: Contrarius, Viking Global Investors, Egerton Capital and Eminence Capital.

The Contrarius Global Equity Fund returned 15.2%, a significant outperformance driven by a number of the fund’s top holdings. Its exposure to resources via Teck Resources (+36.9%), Fortescue Metals Group (+45%) and Stillwater Mining Company (+12.6%) was a key contributor. Exposure to Twitter (+36.3%), JD.com (+22.9%) and Apple (+18.9%) also contributed. Marginal detractors were the fund’s exposures to gold mining companies.

Viking Global Investors benefited from exposure to largecap tech companies such as Facebook (12.2%), Alphabet (+12.3%), Amazon (+17%) and Microsoft (+13.3%). Other key contributors included Biogen (+29.4%), Encana (+34.6%) and MasterCard (+15.8%).

Large-cap tech names such as Facebook, Alphabet, Tencent (+21%) and Priceline (+17.9%) also made a solid contribution to the outperformance of the Egerton Capital Equity Fund over the quarter. In addition, the fund benefited from exposure to Charter Communications (+18.1%), S&P Global (+18.3%), Visa (+11.7%) and the London Stock Exchange Group (+11.1%).

Eminence Capital, whose portfolio differs materially from the other managers in the fund, enjoyed a strong quarter. The fund’s holdings in Autodesk (+33.6%), Zynga (+16.9%), ARRIS (+35.2%) and Housing Development Finance Corporation (+12.3%) drove its strong returns over the quarter.

Conatus Capital and Coronation Global Emerging Markets both made positive contributions to performance, but Lansdowne Developed Markets and Maverick Capital both detracted over the quarter.

The final quarter of 2016 brings with it a number of key events that could provide some market volatility. These include the US presidential election, a constitutional reform referendum in Italy and a widely anticipated second interest rate rise by the Fed. There will also be further clarity on the Brexit process, which so far has had a much smaller impact than originally feared. However, that may still change as the way forward emerges.

Also of concern is the fact that Deutsche Bank is under severe pressure and at risk of needing a bailout, something the German government has so far ruled out. Equity and bond markets are in the later stages of a multi-year bull market, and investors are rightfully cautious on the near-term future. However, if the US economy proves resilient – and we believe it may, as discussed here – then, combined with modest cyclical growth improvement in Europe and Japan as well as investment-led momentum in China, the global growth outlook may be more favourable than anticipated.

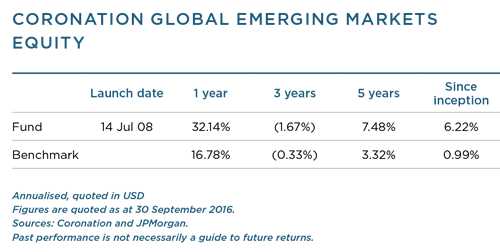

The Coronation Global Emerging Markets Equity Strategy returned 9.04% during the third quarter of 2016, which was in line with the index’s return. Year-to-date the fund has now appreciated by 21.6%, which is 5.6% ahead of the index’s return of 16%, and over the past one-year period the fund has returned 32.1%, which is 15.4% ahead of the 16.8% return from the index.

Over the past year, five of the top ten contributors were Brazilian stocks, collectively contributing 9.2% of the fund’s 15.4% outperformance. All five (Kroton, Estácio, Itaúsa, Hering and BB Seguridade) are up by over 50% in US dollar over the past year, with the education company Kroton being the standout, having appreciated by 143% in US dollar and contributing 4.8% to outperformance. Other notable contributors over the past year have been the owner of Jaguar Land Rover, Tata Motors (+78%; 2.2% contribution), the Indian private bank Yes Bank (+70%; 1.8% contribution) and the Russian food retailer X5 Retail (+66%; 1.2% contribution). Not owning Tencent and Samsung Electronics detracted by around 1.4% each, although a positive contribution from Naspers (whose biggest asset is its stake in Tencent) partly offset the negative Tencent attribution. The only other negative detractor of more than 1% was the Indian IT services company Cognizant (-24%; 1.1% negative contribution).

We would make the point, as we always do, that a one- or two-year period is a short time period, and not too much should be read into performance over these timeframes in our view. In this regard, while the fund has now outperformed the market by 15% over the past one year, this time last year the fund was in fact 12% behind the market.

Given our long-term focus and the fact that we therefore often own stocks that are disliked by the market because of a poor short-term outlook (Brazilian stocks being the most recent case in point), it is often necessary to go through periods of short-term underperformance in order to achieve the fund’s objective of significant long-term outperformance of the market. In our view, only periods of five years or longer are meaningful, and ideally, performance should be assessed on this basis. In this regard, since the fund launched just over eight years ago, it has outperformed the index by 5.2% per annum. Over the past five years it has outperformed the index by 4.2% per annum.

There were a few notable developments on the political front during the quarter, however none had a material impact on the fund’s performance. The final impeachment and removal of former president Dilma Rousseff in Brazil was highly anticipated and therefore did not really have an impact when it happened, as the big upward moves in Brazilian equities and currency had already happened in the first half of the year. We did continue to reduce the fund’s Brazilian exposure by slowly decreasing a few of the bigger positions, with the result that the total Brazilian exposure is now 16.6% of fund compared to 20.3% at the end of June.

The fund’s biggest Brazilian exposure is still in the education companies. In this regard Kroton and Estácio’s shareholders approved the proposed merger at an increased offer price to that initially proposed by Kroton, and the deal is now awaiting regulatory approval by the country’s anti-trust authorities.

We remain very positive on the long-term prospects for the Brazilian education industry, and in particular the prospects of a combined Kroton/Estácio (who are respectively the number one and two tertiary private education companies in Brazil). We think both assets are actually still very attractive on a stand-alone basis, and even more attractive as a combined entity due to the scale, nationwide footprint, synergies and the fact that the best management team in the industry will be running the combined entity. As such, 7.8% of the fund is still invested in Brazilian education, made up of 4.6% in Kroton and 3.2% in Estácio.

The attempted coup in Turkey in early July and its aftermath has severely dented investor confidence in the country. The fund held only two Turkish stocks prior to the coup attempt – small positions in Garanti Bank and in BIM, a hard-discount food retailer. We sold out of the position in Garanti Bank – as a bank it was simply too exposed to a big downturn in the Turkish economy and therefore the risk/ reward trade-off did not, in our view, warrant retaining the position, despite what appeared to be reasonable upside in the share. In contrast, we believe BIM is one of the best food retail operators in emerging markets and should not be materially impacted by post-coup developments, so we have marginally increased the fund’s exposure to BIM as it has declined (along with the Turkish lira). It still remains a sub-1% position and we would require more upside before increasing the position size materially further.

In terms of portfolio activity over the quarter, on the sales side a notable reduction in position size was that of the Indian banks. In our view, India remains one of the most attractive emerging markets on a ten-year view. Its banks offer a significantly cheaper way to get access to the Indian consumer – through very low financial services penetration that is gradually increasing, as well as through market share gains from the State banks – than the country’s more obvious names in the household and personal care space, which trade on eye-watering multiples.

We had been adding to the positions in the two banks that the fund owned (Axis Bank and Yes Bank) from the fourth quarter of 2015 while their share prices declined (along with the broader market) as investors lost faith in the pace of regulatory reform in India under the Modi government. We also bought a third (HDFC, a mortgage provider that also has a stake in HDFC Bank, as well as insurance and asset management interests) for the first time in early March. From their bottom at the end of February, all three banks are up sharply – Axis Bank, the largest position, is up close to 50%; Yes Bank, the second largest position, has almost doubled; and HDFC, the smallest position, is up 35% (all returns in US dollar).

Naturally we have trimmed position sizes in response to such large moves in share prices. Although all three are still reasonably attractive, their reduced upside warrants a smaller exposure. At the end of June the combined holding in the three amounted to 8.3% and by 30 September their collective exposure was down to 4.8% of fund. This, in turn, meant the fund’s Indian exposure decreased from 16.4% to 12.2% over the quarter.

During the quarter there were also a few new buys. The largest of these was LiLAC (Liberty Latin America and Caribbean), which is now a 1.5% position. LiLAC was initially created as a tracking stock by Liberty Global to spin out their Latin American broadband, mobile and pay-TV assets. During the spin-out process, LiLAC bought Cable & Wireless Communications (mobile telecoms in the Caribbean and Central America), which itself had just purchased Columbus (broadband and pay-TV in the same region).

The single biggest market for LiLAC is Chile (25% of total operating profit), followed by Panama (19%) and Puerto Rico (12%), with various Caribbean islands making up the bulk of the rest. The share price is down by a third since late-May after poor results and from an overhang of shares, with the latter having had the bigger impact in our view. Many of the shareholders in Liberty Global (who were the recipients of LiLAC shares due to the unbundling) may have little interest in holding onto their LiLAC shares given how small the business is/was in the context of the overall Liberty Global business (5%).

Aside from revenue opportunities from rolling out services in countries where there is low penetration and also from market share gains, there are big cost saving opportunities due to the new-found scale of the business, as well as the ability to realise synergies. For these reasons we believe margins have scope to increase from current levels. In addition, capital expenditure is currently high and will reduce to a more normal level over the next few years. As a result of these factors, we believe the company will generate significant free cash flow looking a few years out, and LiLAC trades on only a high single-digit multiple of this free cash flow. In addition, we have high regard for the capital allocation skills (running an efficient balance sheet, undertaking significant share buybacks, etc.) of John Malone (the chairman and controlling shareholder of both Liberty Global and LiLAC) and his senior managers, and we believe that over time these same capital allocation skills will be applied to LiLAC to the benefit of shareholders.

Over the past few years we have spent a lot of time researching and understanding online classified businesses due to the fact that these businesses make up a large part of the valuation of the fund’s largest holding, Naspers.

We like dominant online classifieds businesses – the largest player in each vertical benefits from the virtuous circle of most sellers/service providers and most buyers/users being attracted to the biggest site, and as such it is very hard to disrupt once established as the network effect creates a high barrier to entry. They are also inherently very cash generative (converting over 100% of earnings into free cash flow) and generate very high returns on capital. In this regard, the fund’s second largest buy during the quarter was a 1.2% position in 58.com, the leading classifieds website operator in China. The company is very strong in a number of key classified verticals, with dominant positions in job listings (70% market share of the blue-collar job market), online classifieds (85% market share) and property (in which they have three of the leading property sites). The company is investing significantly in these three verticals as well as others, in order to achieve dominance and the economic benefits that come with this. It is also investing heavily in its home services arm, which will allow plumbers, electricians and other service providers to offer their services online and be booked directly by the customer. Customers will be able to rate the quality of the service provider, creating a feedback mechanism and loop that will entrench customer loyalty and trust for good service providers, much like (as an example) the review system works for hotels on TripAdvisor.

This investment in the business means that current profitability is low (single-digit EBIT margins) and is well below normal in our view. The leading (those with > 50% market share) online classifieds businesses in the world (both in emerging markets and developed markets) are extremely profitable and typically generate EBIT margins in the 40% to 60% range (Avito in Russia, for example, generates 45% EBIT margins). In this context one must bear in mind that 58.com already has dominant positions in a number of verticals, and in fact currently generates gross margins of 90%. We would not expect 58.com to generate EBIT margins of 40% to 60% (its business model requires higher cost because of a large direct sales force), but we do believe that normal EBIT margins will ultimately be much higher than the current single-digit level.

The online classified industry in China is still in its infancy and 58.com has many leading positions in this market. In our view, it is well placed to retain these leading positions. As a result, we believe that its revenue, profits and free cash flow will grow at a high rate over the next five years and beyond. We also like the fact that Tencent owns over 20% of the business. Tencent is dominant in social media in China and captures a very high percentage of all online traffic; it also has management that we have high regard for. In addition, we like the fact that the founder and CEO of 58.com still retains a big stake (11%) in the company, resulting in an alignment with minority shareholders.

While the weighted average upside to the portfolio has come down (now just below 50%), this is still very attractive upside. At the same time a useful positive backdrop is provided by the fact that political environments appear to be getting slightly better in many emerging markets (Brazil, South Africa and India stand out in this regard) and arguably worse in a number of the main developed markets as populism takes hold (US, UK and Europe would fall into this category). This arguably increases the relative attractiveness of emerging markets.

We are continuing to find a number of potentially interesting ideas – either stocks that we cover already but that are becoming more attractive due to share price declines or as a result of additional work we are doing on them, or stocks on which we are doing the detailed work for the first time.

Over the past quarter, we went on research trips to South Korea and China and also met with management from a number of portfolio holdings and other companies in London and New York. During October we will be going to Asia and will be returning to Brazil in January, followed by India in February.

‘The future is never clear and you pay a very high price for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values.’ – Warren Buffett

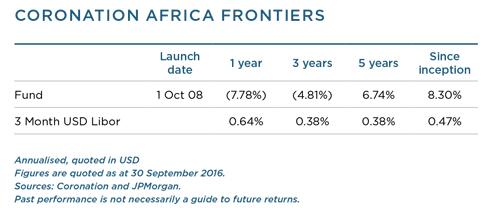

Over the past three months the performance of markets across Africa was mixed. Egypt, which is still the fund’s largest country exposure, was up 10.3%. In contrast, Nigeria was down 14.5% on the back of further naira devaluation, and Kenya was down 5.9%, largely as a result of new banking regulations announced in August 2016. Against this backdrop the fund returned 3.1% over the quarter, compared to its benchmark (3 Month USD Libor + 5%), which was up 1.5%, and the JSE Africa Top 30 ex South Africa Index, which was up 3.6%.

Policy uncertainty is still one of the key concerns for many investors in African markets. Excise tax changes, pricing caps for mobile operators, one-off super taxes and pegged currencies have all added to this concern over the past few years.

During the past quarter we saw another regulatory intervention when the Banking Amendment Bill was passed in Kenya. This legislation stipulates the maximum interest rate banks are allowed to charge clients, as well as the minimum interest rate they have to pay on deposits. The average interest rate Kenyan banks were charging prior to the new bill was more than 400 basis points higher than the new maximum rate. Therefore, this will no doubt have a material negative impact on their net interest margins and overall profitability.

The bill was introduced by the Kenyan parliament without consultation with the banking sector. Although many consumers will benefit significantly from lower interest rates on outstanding loans, there will likely be some unintended consequences:

- Small banks that are mainly focused on higher-risk lending at high interest rates will not be able to run profitable businesses. We spoke to bankers in Kenya who estimate that at least half of the banks in the country will be making losses under the new legislation, and are at risk of failing.

- We might well see a significant slowdown in lending, which would impact the economy as a whole.

Prior to the new legislation, Kenyan banks’ high profits provided investors with a sense of certainty, which led to a very cheery consensus on that country. None of these risks were priced into Kenyan multiples, particularly in the banking space. We have said in the past that we believe most of the larger Kenyan banks are just too profitable, with net interest margins above 10% and returns on equity north of 30%. The fund therefore had no exposure to the largest banks in Kenya. Admittedly, our base case was that competition, rather than regulation, would drive down the net interest margins of the industry over time. However, we have seen many times that very profitable businesses that are charging high fees are more likely to be a target for governments.

The only bank in Kenya owned by the fund is CFC Stanbic, which has a lower – but in our view, a much more sustainable – profitability level. CFC Stanbic will be impacted by the new regulations, but we expect the impact to be more pronounced for its competitors that have higher net interest margins. In the week following the announcement, CFC Stanbic was down 4.4%, compared to Equity Bank, which lost 23.6%, and KCB Bank, which fell by 15.3%.

We typically put a lower rating on businesses that are more exposed to regulatory risks, and therefore normally view banks as discount businesses. We also put a lower rating on earnings streams that we view as unsustainably high. However, we are willing to pay up for high-quality businesses with strong moats. These businesses are typically better positioned to withstand regulatory changes and, when these changes occur, they often come out stronger on the other side.

While many investors might perceive a company that is simply too profitable as a low-risk investment, our view is the opposite – these businesses actually present larger risks as profits do eventually normalise, whether this happens through competition or as a result of government intervention. We rather try to identify quality businesses where current earnings are below our assessment of normal. We believe there are a number of these businesses across the African universe that offer excellent opportunities for investors who are willing to take a longer-term view.

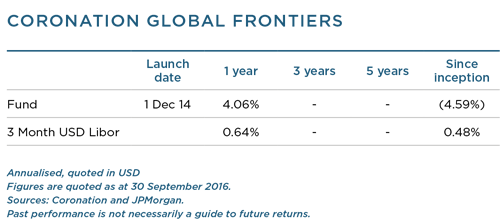

Over the past quarter, the performance of frontier markets was mixed, as detailed in the Africa Frontiers commentary. Egypt, which is still the fund’s largest country exposure, was up 10.3% and Sri Lanka, the fund’s second largest country exposure, was up 3.9%. In contrast, Nigeria was down 14.5% and Kenya was down 5.9%. Against this backdrop the fund returned 5.9% over the quarter, compared to the 3 Month USD Libor, which was up 0.2%, and the MSCI Frontier Markets Index, which was up 2.7%.

We continue to have sizeable holdings in the telecommunications sector. These businesses are generally good cash generators with attractive dividend yields. In addition, we find the growth prospects of mobile money in the frontier universe particularly attractive. Mobile telecommunication companies across the globe have grown spectacularly over the past two decades. In many countries the mobile penetration rates are now well above 100% – which means that there are more mobile phones than people. In many frontier markets the mobile industry is still in an early stage of its life cycle.

A case in point is Pakistan, where mobile penetration is estimated to be below 80% and 3G or 4G subscribers make up only 24% of the population (July 2016 data). Despite the strong growth outlook in Pakistan, there has been intense price competition among the five mobile operators over the past few years. Large promotions and price cuts led to call rates in Pakistan falling to levels among the lowest in the world. It is our understanding that none of the mobile operators in Pakistan were profitable in 2015 – a situation that is clearly not sustainable.

In the past we saw a similar phenomenon play out in Kenya, and we believe this seemingly dire situation presents some interesting investment opportunities. During 2011 and 2012, intense competition in Kenya drove voice tariffs down significantly and today Kenya ranks as one of the countries with the lowest voice tariffs in Africa. As a result, the earnings and share price of Safaricom, Kenya’s largest mobile operator, came under pressure in 2012.

However, in 2013 the competitive environment improved when competitor behaviour became more rational. In the years following this price war we saw very strong profit growth. In the most recent financial year the profit of Safaricom was three times higher than it was in 2012, while its share price increased fivefold over this period.

In 2016 we have seen a definite change in the competitive environment in Pakistan, with the merger of Mobilink (largest operator) and Warid (smallest operator) in July 2016. Mobile tariffs have stabilised and the aggressive promotions of particularly the smaller operators have reduced significantly.

Two companies owned by the fund which should benefit from a more rational competitive environment are Global Telecom Holding (GTH) and Pakistan Telecommunications Company Limited (PTCL). GTH owns the largest mobile operator in Pakistan, while PTCL is the monopoly fixedline operator which also owns one of the smaller mobile operators called Ufone.

The industry consolidation, coupled with the fact that voice tariffs are already among the lowest in the world, leads us to believe that the risk of further tariff cuts is limited. In addition, capital expenditure is on a downward trend following the large investments in spectrum and mobile networks. In our view, this should lead to a large improvement in the profitability and cash generation of these mobile operators going forward.

While many investors focus only on the short-term earnings of a company, we continue to spend our time trying to identify quality businesses where current earnings are below our assessment of normal. We believe there are a number of these businesses across the frontier universe which offer excellent opportunities for investors who are willing to take a longer-term view.