Quarterly Publication - October 2017

International Portfolio Update - October 2017

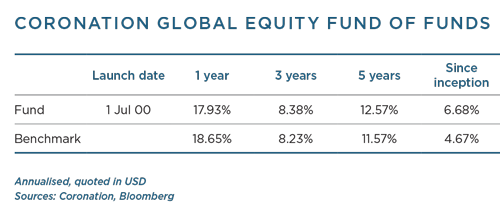

The fund advanced 5.8% over the quarter against its benchmark (MSCI All Country World Index) return of 5.2%, bringing the rolling 12-month performance to 17.9% against the 18.7% returned by the index.

Europe was again the best-performing region this quarter, rising 6.5% (in US dollar terms). Asia ex-Japan delivered the weakest return, rising 3.7% (in US dollar terms). Japan returned 4.0% (in US dollar terms) and North America rose 4.7%. Emerging markets advanced 7.0% (in US dollar terms). The fund continues to be overweight North America, underweight Europe and Japan, and has maintained its overweight position in emerging markets.

Among the global sectors, energy (+8.2%), materials (+8.3%) and information technology (+8.2%) generated the best returns. The worst-performing sectors were consumer staples (-0.9%), real estate (+1.3%) and utilities (+2.3%). On a look-through basis, the fund was positively impacted by its overweight position in information technology and underweight position in utilities and telecommunications. Its overweight position in consumer discretionary detracted from performance.

Three underlying managers were largely responsible for the fund’s performance over the quarter. Contrarius Global Equity had an excellent three months, advancing 11.1%. This was largely a result of having a significant overweight position in energy stocks which benefited from the oil price rise of 12%.

Coronation Global Emerging Markets Equity also contributed strongly to the fund’s overall outperformance for the quarter. Despite already strong returns in emerging markets, the fund delivered alpha of 7% as its Brazilian education stocks, Kroton and Estácio, rose substantially on solid growth numbers and potential future merger and acquisition plans. Chinese internet-related stocks such as Baidu, 58.com and Naspers (Tencent) also weighed in with good performances.

Likewise, Conatus Global Equity enjoyed strong gains from its emerging market exposure (for example, Tencent) and internet stock holdings (for example, Facebook). The underlying manager also benefited from PayPal, which is being supported by the continued shift to e-commerce; Ferrari, which is expanding its product offering; and Adidas, which continues to take market share in the US sports apparel market.

Three underlying managers that did not perform over the period were Maverick Capital, Vulcan Value Fund and Tremblant Capital. Maverick lagged the index due to a large overweight to US healthcare, a sector at the centre of huge political debate and which did not advance as much as the overall index.

Vulcan was also hurt by an overweight to healthcare. Tremblant did see positive contributions from its internet holdings such as Baidu and Netflix, but exposure to media names such as Viacom and CBS more than offset those gains, causing the underperformance over the quarter.

Satisfactory global growth and favourable liquidity would indicate that equity markets may have further to run in the near term. We have previously noted that US equities appear expensive when viewed against measures such as the Shiller price earnings ratio, but relative to other asset classes, equities in other parts of the world do still seem reasonably attractive.

Rising geopolitical tensions are a cause for concern and there may be some volatility ahead as world leaders negotiate their way around North Korea, Iran, Brexit and other pressing issues.

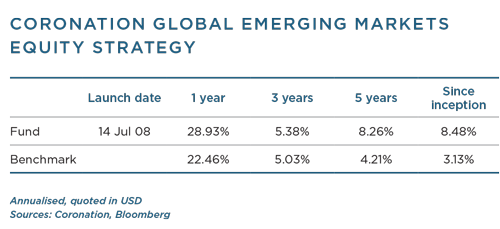

The strategy marginally underperformed its benchmark over the quarter, but is materially ahead year to date, as well as over the 12-month and two-year periods. The two year absolute performance number of 21.4% per annum is particularly gratifying against the benchmark return of 15.3% per annum. Since inception, the strategy has delivered marginally positive alpha.

Coronation Global Equity will soon celebrate its three-year anniversary, and while the first year of its existence proved to be a very tough initiation period, we are confident of deploying our consistent philosophy of focusing on the longer term with success into the future.

The most notable contributor to performance over the past quarter was our position in Estácio, the second largest tertiary education operator in Brazil.

The two positions that hurt performance most over the three months were L Brands (as featured in our July 2017 issue) and the investment holding company Pershing Square Holdings, actively managed by the activist fund manager Bill Ackman. It contains a portfolio of blue-chip US companies which are trading at significant discounts. We continued to add to both positions as we remain convinced of their long-term investment merits. TripAdvisor was another disappointment over the 12-month period, but in this case we sold out of our holding in light of another change in company strategy and continued (in our opinion) poor operational execution by management. Our holdings in the retail pharmacy networks in the US and the UK also disappointed. While we are closely monitoring Amazon’s intentions and ambitions in this space, we remain holders of these stocks for now.

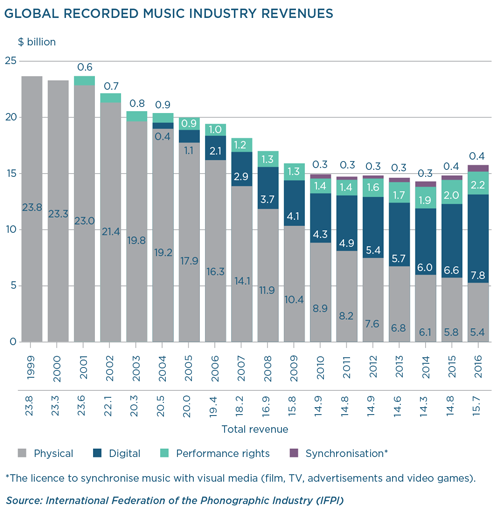

One of the new names introduced into the portfolio over the last three months warrants additional commentary. The French media group Vivendi caught our eye when we started analysing its record label business, Universal Music Group (UMG). The last two decades have been extremely tough for music owners as the methodology for selling music kept evolving in a digital age. But while monetisation has decreased substantially due to piracy, among other reasons, consumption has continued to rise. We have seen a decided turn in fortunes for the industry over the last few years (see the accompanying graph). Subscription services are growing handsomely in the developed world, and we believe that, given time, this industry will relive its former glory days. UMG is the largest of three significant global players and owns the most comprehensive music catalogue, which we believe is underappreciated within the wider Vivendi group. The group holds other media and communication assets like pay-TV, telephony and more recently, advertising agencies. It is controlled by a successful, if somewhat contentious, French industrialist family led by Vincent Bolloré. Although we would have preferred to own the music assets directly, we think Vivendi’s unique corporate structure and controversial family control have given us the opportunity to buy the position at what we believe is an attractive entry price.

The strategy returned 15.4% for the quarter, which was 7.5% ahead of the benchmark return of 7.9%. The one- and two-year performance figures are also strongly positive in both absolute and relative terms, recording 6.5% alpha over one year and 10.9% alpha per annum over two years. While this short-term performance is pleasing – particularly after a tough period from late 2014 to late 2015 – it is the long-term performance that matters and what we believe best illustrates the alpha-generating ability of the strategy.

In this regard, the strategy’s five-year outperformance is 4.1% per annum, the seven-year outperformance 4.4% per annum and since inception (now over nine years ago) outperformance is 5.4% per annum.

The biggest contributors to the strategy’s outperformance over the quarter were the two Brazilian education stocks, Kroton and Estácio. Their attempted merger was blocked just before the end of the previous quarter, which resulted in a sharp share price decline for Estácio in particular. Given our view that both Kroton and Estácio remained very attractive on a standalone basis, our combined holding in these two stocks remained close to 8.5% of strategy.

During the quarter, Estácio’s share price more than doubled, while Kroton’s was up 35%. Some appreciation in the Brazilian real added to the local currency return generated by the two stocks, and collectively they contributed 3.5% to alpha over the quarter. Estácio outperformed Kroton as its results for the second quarter were well ahead of expectations and investors reappraised the longer-term outlook for the business’s margins. Historically, Estácio’s operating margins have been less than half of Kroton’s – mid-teen margins for Estácio versus low 30s for Kroton. This large difference in profitability is partly why Estácio carried a lower rating than Kroton and one of the reasons why Kroton wanted to buy Estácio.

This margin gap has already started to close and we believe Estácio can narrow this gap even further, which brings down the multiple quickly as one looks further out – although Kroton’s scale advantage will mean that Estácio’s operations are unlikely to ever reach Kroton’s margin on a sustainable level. While we reduced the strategy’s Estácio position over the past few months, we believe it remains attractive. Today just over 7% of the strategy is invested in the Brazilian education stocks, with Kroton being a 5.0% position and Estacio a 2.2% position.

The Chinese internet stocks 58.com and Baidu were the next biggest contributors. The former was up 43% (contributing 1.2% to alpha), while the latter was up a more modest 38% and contributed 66 basis points (bps) to alpha. In Baidu’s case, the struggles of last year, which resulted in the cleanup of its advertiser base, seem to have largely passed, while profitability has improved significantly. This has led to an increase in earnings per share of 70% year on year in the second quarter.

For the last 18 months, the big concerns with 58.com have centred on its property business. The company is the leading player in advertising existing home sales and as the Chinese government clamped down on the property market to prevent an asset bubble, investors sold out of 58.com. This created a buying opportunity for us. The results released for the second quarter saw the company beating its own previous guidance by almost 10%, with revenue growth of 33% (for the half year).

More critically, there are signs of significantly improved profitability as 58.com went from making losses in the first half of last year to now earning operating margins of 14%. The property business has held up well in spite of the issues in the broader market. This is not unexpected as it is more akin to a membership service for estate agents than an online estate agent which tries to earn commissions on sales, an inherently more cyclical business. Despite the sharp move in the share price, we believe 58.com remains very undervalued. It has largely dominant positions and several years of high revenue growth ahead in all its key verticals (online blue-collar jobs, online housing and general online classifieds), while the reduced investment needs and natural operating leverage that comes with higher revenue can see margins expand substantially from current levels.

The Russian stocks Sberbank (+37%, 66 bps contribution to alpha), Magnit (+20%, 51bps contribution) and X5 Retail Group (+29%, 39 bps contribution) also came through strongly over the period. Brilliance China Automotive was up 32% for the quarter, bringing the one-year return to 117%. We had been consistently reducing our holding into strength and sold out of the position during the quarter as it reached our fair value.

There were two new buys in the strategy – Noah Holdings (0.6% of strategy) and Airbus (3.0% of strategy). Noah is a wealth and asset manager with tremendous growth potential in what is still a very fragmented market in China. The ranks of the wealthy in China have surged over the last two decades, but their savings and investment holdings remain relatively unsophisticated. This is a tremendous market opportunity for Noah, and with the founders still involved in the business (and being material shareholders), we believe they have the operational capability to be successful. Noah also generates high returns on capital (c. 20%) and is very cash generative (free cash flow conversion of c. 90%). Today Noah trades on around 12 times forward earnings (excluding cash), which we believe is very attractive for what is a high-quality business.

Airbus earns around 55% of revenue from emerging markets, and the share of its order book (future confirmed orders by airlines) from emerging market airlines is 60% and rising. A look across Airbus’s product portfolio shows all their major designs are well beyond the development phase and, as the A350 production ramps up, operating margins can reach double digits within the next few years. We believe the share offers substantial upside to fair value. The company is in effect part of a global oligopoly (Airbus and Boeing together have 90% market share) in a structurally growing category (global air travel) with very visible earnings and free cash flow growth over the next five years.

During the quarter, the team undertook several trips, including to China and India, where we met with various companies we own or are interested in purchasing for the strategy. The big moves in share prices have seen us reduce, or sell out from, positions that are approaching fair value and reinvest in either new ideas (like Airbus or Noah), or buy additional exposure to some stocks that we believe are very attractive but have lagged in recent months (such as Magnit). The overall upside of the portfolio – our assessment of fair value versus current share prices – is around 40%.

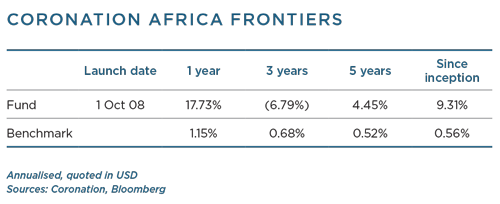

The fund marginally underperformed its benchmark over the quarter, but is ahead of it over most longer time periods. The since-inception number of 9.3% per annum is particularly gratifying compared to the benchmark return of 7.0% per annum, and the one-year number of 14.8% is strong both in absolute terms and against the benchmark (10.3%).

While our stock picking did not result in positive alpha over the quarter, our credit positions performed well ahead of the overall bond market. Our property holdings lagged somewhat, but our gold positions contributed positively. Over the last 12 months, our equity selection was very good, offset by low exposure to this well-performing asset class. Property and credit selections both performed very well over the last year, offset to some extent by a disappointing outcome from our merger and arbitrage bucket (primarily the Rite Aid position). These trends are also true for the five-year attribution, although the property outperformance was only marginally positive.

The most notable contributor to equity performance over the past quarter was our position in Estácio (as discussed in the Global Equity Strategy commentary). The two equity positions that hurt performance the most over the three months were L Brands and Pershing Square Holdings.

We entered the last quarter of the year maintaining relatively low exposure to equities, and probably our lowest exposure to credit in the last five years. We have increased our property holdings slightly, both in the US and in Europe (after quarter end). We remain cautious on the outlook for global equities, and have continued to roll some of our equity hedges. We remain very negative on the outlook for global bonds as we are seeing more signs of inflation creeping back into the US economic system.

Over the past three months, the performance of markets across Africa continued to be strong. The strategy delivered a gross return of 1.8% for the quarter, compared to its benchmark (3 Month USD Libor + 5%) return of 1.6%, and the FTSE/JSE All Africa ex-SA 30 Index, which was up 3.9%. Year to date, the strategy has returned 24.6% and since inception the strategy has delivered 9.3% per annum.

The strategy’s performance would have been even stronger were it not for a write-down of our Zimbabwean assets. This was offset by a strong underlying asset price performance in our other markets. Egypt, which continues to be our largest country exposure, saw strong gains (+6.5% for the quarter) as the government’s economic reform agenda continues to play out. Morocco (+3.4%) and Kenya (+7.4%) were also strong over the period. The solid performance in Kenya came during a quarter when the Supreme Court nullified the results of its August presidential elections, a first on the continent. The revote is currently planned for the end of October, and in the interim economic activity has slowed, although thankfully, there has been no repeat of the 2007 violence. After a standout second quarter in Nigeria (+26.6%), the country gave back some of the gains and ended down 3.9% for the three-month period. Foreign interest in Nigeria remains strong although at this point it is fixed income rather than equity investors who are most bullish.

The Zimbabwean stock market index was up 113.5% in US dollars over the quarter. Unfortunately, this was less about company fundamentals and more to do with the deteriorating conditions in Zimbabwe. At the end of July, we impaired the valuation of our in-country Zimbabwean exposure by 30%. At that stage, we were comfortable using the Old Mutual dual-pricing discount as a reference for the impairment, as the discount between physical dollar and electronic dollar and bond notes persisted. Since then, the currency discount has opened up even further, while locally listed Zimbabwean equity prices have seen excessive and unwarranted gains. This is a result of locals looking to hold physical assets rather than electronic dollar. As a reminder, it remains practically impossible for us to repatriate funds out of the country.

African markets continue to present opportunity, but challenges are to be expected. In the past year, three currency markets have been extremely testing: Egypt, Nigeria and Zimbabwe. As an African company, we are accustomed to managing money amid ongoing currency shocks. This has helped us become disciplined investors who can cut through the noise and focus on the long term. Indeed, our exposure to Egypt and Nigeria has delivered positive outcomes for the patient investor. In both markets, the strategy achieved significant gains after currency markets started to normalise.

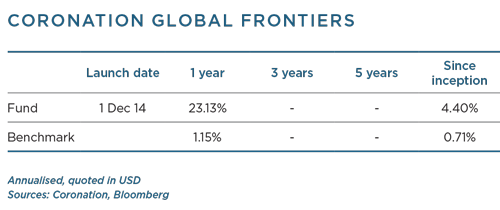

Over the past three months, the strategy delivered a gross return of 2.8% compared to the benchmark (3 Month USD Libor + 3.5%) return of 1.2%. As in previous quarters, our return differs materially from that of the MSCI Frontier Markets Index, which was up 8.3% over this period. Year to date, the strategy is up 23.1% and since inception the fund has returned 4.4% per annum.

The write-down of our Zimbabwean assets (as discussed in the Africa Frontiers commentary) had a material impact, but was offset by strong underlying asset price performance in our other markets. Of the large MSCI constituents, Kuwait (+17.8%), Argentina (+9.5%), Vietnam (+6.1%) and Morocco (+2.4%) were all strong. Kuwait benefited from market participants anticipating the country’s inclusion into the FTSE Russell Emerging Markets Index. Notable laggards were Sri Lanka (-6.1%), Nigeria (-3.2%) and Pakistan (-15.8%). Over the quarter, Pakistan suffered from negative news headlines, including the resignation of its prime minister, the removal of both its central bank governor and the chairman of its market regulator, the indictment of the finance minister and the announcement of a US regulatory fine on the largest bank in the country, Habib Bank. The sell-down has resulted in a number of very interesting opportunities in select Pakistani stocks.

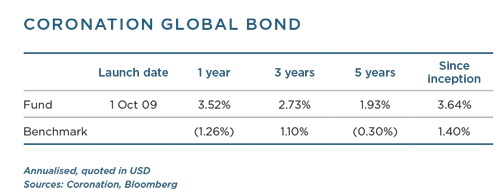

Stronger growth and modest inflationary pressures helped most government bond markets to perform well this quarter, while continued low volatility encouraged investors to seek out higher yielding assets, which boosted emerging and credit markets. The US dollar remained weak during July and August before finding support during the month of September. The fund returned 1.63% for the quarter, against a return of 1.76% from the Barclays Global Aggregate Bond Index over the same period.

US economic activity data surprised on the upside during the quarter, having disappointed in the preceding three months. Inflation meanwhile continued to undershoot expectations. It is, however, worth pointing out that economic activity in the next few months may well be affected by the two large hurricanes that recently struck the southeastern US region. Yields on US Treasuries fell across the curve (with 10-year yields falling as low as 2.01% in early September) as markets priced out less than a single 0.25% move in the Federal Funds rate for the next 18 months.

Following more hawkish comments from Federal Open Market Committee members, markets retraced and 10-year yields closed the quarter broadly unchanged at 2.33%. The current trading range of 0.6% on US 10-year bonds is the lowest since 1965. After a series of weak CPI figures, breakeven rates are relatively low and the fund increased its exposure to five-year Treasury Inflation-Protected Securities as inflationary pressures are expected to re-emerge in the coming months. The fund also reduced the duration of its US holdings in early September after the market priced out any movement in rates.

The US Federal Reserve (Fed) announced its intention to begin to unwind its balance sheet, starting in October, by $10 billion a month ($6 billion Treasuries, $4 billion Mortgagebacked Securities) and increasing by the same magnitude each three months until the total sum is $50 billion a month. At this pace, the taper should take three to four years to achieve. The Fed’s near-term dot plot chart was unchanged at the September meeting, but the long-term target fell from 3% to 2.8%, suggesting the committee’s longer-term view of inflation and growth has fallen, with the implication that the output gap may be tighter than perceived.

In early September, Stanley Fischer, the current vice chair of the Fed, announced he would step down this October. This means that four of the seven Fed board positions are now open, with Janet Yellen’s chair position coming up for renewal in February 2018. Fed policy could therefore look very different in 2018, depending on how much weight new members (and a possible new chairperson) place on the current outlook for inflation. The European Central Bank left its policy setting unchanged at its September meeting. The disinflationary effects of the stronger euro were noted and forecasts for CPI lowered. The governing council indicated it may recalibrate its quantitative easing programme in October, with the current €60 billion a month programme likely to reduce by around €5 billion a month during 2018.

The focus for investors in the UK remains the progress of Brexit negotiations. While prime minister May’s speech in Florence maintained that no deal is better than a bad deal, she did for the first time propose a transitional period and accepted that the UK would need to honour its financial commitments. The price tag associated with those commitments does, however, remain as uncertain and controversial as the process itself. UK inflation has continued to feel the effects of the post- Brexit weakness in pound sterling. The softer Brexit stance, combined with more hawkish CPI-inspired comments from the Bank of England members, had the effect of propelling the currency back above 1.35 to the US dollar – its highest level since Brexit. The fund used the recovery in the currency to reduce its exposure.

In Japan, prime minister Abe’s LDP party called a snap election for 22 October in the hope of strengthening support for his hardline policy on North Korea. Opposition parties have decided to merge to fight the election, and their rising popularity has introduced a degree of political uncertainty into the market. In recent months, economic activity has surprised to the upside, labour markets remain tight and capital investment has picked up. Any suggestion that the Bank of Japan could deviate from its current strong commitment to a 2% price stability target would likely trigger a much stronger yen. The fund has reduced its long-standing underweight position in yen as economic fundamentals appear to be improving and it remains a currency likely to rally in the advent that risk aversion returns to markets.

The majority of local currency emerging market bonds continued to outperform US Treasuries, with strong returns from Brazil, Russia, Indonesia and SA. A modest appreciation in emerging market currencies helped boost dollar returns further, although there was more dispersion within foreign currency than bond returns. The fund sold its holdings in Brazil after yields recovered strongly from the May selloff. The fund bought back into longer-dated SA government bonds after the yield curve steepened. The fund retained its Mexican exposure but hedged out its currency exposure and switched some fixed rate exposure into inflation-linked assets during July. The fund retains a holding in shortdated Egyptian Treasury bills and Argentinian currency forwards, but unwound its holdings in Turkey as the currency strengthened.

The Emerging Markets Bond Index spread fell from 328 bps to 307 bps during the quarter as investors continued to support hard currency emerging market debt. Issuers have been keen to tap into this demand, with the largest deal ($12.5 billion) coming from the government of Saudi Arabia. Sovereign issues also came from the likes of Ukraine, Russia, Turkey, Colombia, Bahrain, Iraq and Azerbaijan, to name a few. Of the $500 billion of new emerging market debt issues in the third quarter, only 17% ($84 billion) were by governments, while 45% came from financial institutions, with Chinese renminbi issuance now accounting for 44% of total issuance versus only 29% in US dollars.

Corporate bonds posted another quarter of strong returns, with the broad credit indices outperforming government bonds by around 1%. Credit spreads continued to tighten, shrugging off a brief bout of volatility in August on the back of concerns over North Korea and central bank tapering. While longer-dated instruments performed best, it was more a function of their high duration, as short-dated spreads also rallied and returns across the rating spectrum were not dissimilar.

The fund bought back into MTN, added exposure to National Grid via an inflation-linked issue and added to existing holdings in Intu and Cromwell convertibles. The fund also invested in Investec PLC’s new subordinated deal and reduced its exposure to the firm’s senior debt. The fund’s holding of BR Malls was tendered for and we sold its holdings of JP Morgan and Citigroup subordinated debt.

The fund remains underweight duration, predominately via low duration positons in Europe and its lack of exposure to Japanese bonds. The fund also remains relatively defensively positioned within corporate bond markets where spreads appear tight. The consequences of an upcoming taper of asset purchases by central banks remain unclear and as a result the fund scaled back its exposure to emerging markets. We would be surprised if volatility within markets can remain as low as it has, and this argues for greater risk premiums going forward. After a poor performance since the beginning of the year, the US dollar has ceased falling and the fund has now moved back to an overweight position, as we expect the currency to perform better as monetary conditions tighten by more than current markets expectations.