Quarterly Publication - October 2017

Zimbabwe - October 2017

You may think that the countries with the best-performing stock markets are those whose economies are booming, and those that enjoy large foreign investment inflows and stable political environments. However, when you look at the list of the best-performing stock markets thus far in 2017, you will find that the top spots are occupied by some unlikely candidates. Markets like Argentina and Kazakhstan (both up by more than 40% year to date in US dollar) saw strong recoveries from very low bases, but the real outliers are the two countries right at the top of the list, which are there for completely the wrong reasons.

In Venezuela, the stock market gain of more than 1 000% merely reflects the currency printing and hyperinflation in the economy. The official exchange rate is not the rate at which people unofficially exchange US dollars and the stock market gains therefore largely signify the true currency devaluation.

There are parallels that can be drawn between Venezuela and the second-best performer, Zimbabwe, which is up 189% year to date (to end-September). You would think that the performance in Zimbabwe – which adopted the US dollar as its official currency – should not reflect a currency devaluation, but in reality the country has created a new form of currency printing. As a result a dollar in a bank account in Zimbabwe is no longer worth the same as a physical US dollar elsewhere.

The problem with adopting the US dollar for Zimbabwe, which imports more than it exports, is that the dollars in the economy reduce if there are not enough foreign investments or international funding to plug the gap. After adopting the US dollar in 2009, Zimbabwe experienced a few years of economic growth, with renewed interest from foreign investors. However, in addition to the severe decline in agricultural output which turned the country from a net maize exporter to a net importer over the past three decades, a number of factors more recently resulted in accelerated outflows of US dollars.

Exports declined as gold, which accounts for almost a third of Zimbabwe’s exports, fell from above $1 700 per ounce in 2012 to below $1 100 per ounce in 2015.

As Zimbabwe’s largest trading partner, the fact that SA’s rand lost almost half of its value against the dollar between 2012 and 2016 has left Zimbabwe completely uncompetitive. It became much cheaper to import, hitting local businesses hard. It also meant that the US dollar value of diaspora remittances reduced, dropping by almost 18% in 2016 alone.

Net direct foreign investments slowed from $473 million in 2014 to $255 million in 2016, and portfolio investments also turned negative last year.

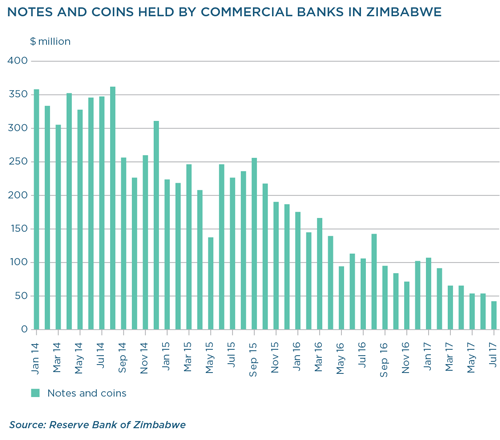

It has also become almost impossible for the country to access international funding, as these lenders are demanding significant reforms. This means that the physical US dollars in the economy are now close to being depleted, which is evident from the following graph showing the decline in currency held by the commercial banks.

The cross-border flow of dollars, particularly out of the country, has become more and more regulated, with imports of basic food products and the inputs of net exporters being prioritised, while the capital of investors is (much) lower down on the list. This means that for all practical purposes it has become impossible for a foreign investor to repatriate funds.

In 2016 the cash shortages became so problematic that the Reserve Bank started printing the so-called ‘bond notes’, basically a new form of local currency that officially holds the same value as the US dollar. However, what started as $10 million in bond notes injected into the market in November 2016 grew to at least $175 million, with talk of much more to come. The combination of the US dollar shortage and the fact that foreign companies do not accept bond notes as payment for imports meant that people were quickly willing to pay more than one bond note for one US dollar. From anecdotal evidence, the premium was between 10% and 25% earlier this year, but this recently increased to around 60%. In many ways this is similar to the black market for US dollars in Venezuela.

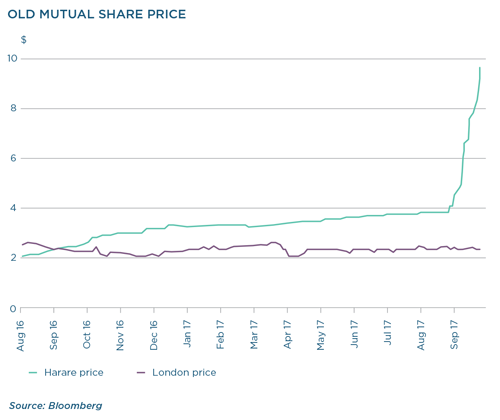

Objective evidence that there is a large difference between a physical US dollar and an electronic dollar or bond note in Zimbabwe is the fact that the share price of Old Mutual, which is listed in both Zimbabwe and London, trades at vastly different values on the different exchanges. Many investors track this difference as an estimate of the effective currency devaluation. The following graph shows that Old Mutual’s Zimbabwean-listed shares, which traded at parity in August 2016, were almost four times more expensive than the London-listed shares at the end of September 2017. Stated differently, the Old Mutual share price in Zimbabwe needs to be impaired by 73% to reflect the same share price as the London listing.

At ATMs in Zimbabwe, people struggle to draw more than $20 per day, and the money they do get can either be in the form of US dollars or bond notes, with the latter being much more likely. Although locally produced food products are still priced at a level fairly similar to what they were at the beginning of the year, signs of hyperinflation are emerging, with some imported products tripling in price over the last few months.

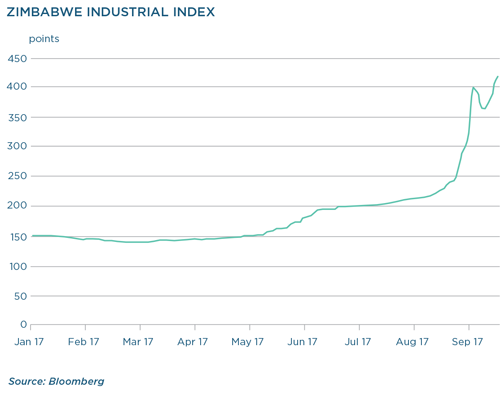

With the hyperinflationary mid-2000s still fresh in investors’ memories, they are doing exactly what they did during that time and are using all cash trapped in Zimbabwe – either in the form of bond notes or electronically such as a bank account balance – to buy assets that store value. Property prices rise as people put their cash into real estate and companies are even reporting a jump in the sales of electronic goods.

But the most conspicuous reaction is the way people have been piling into the stock market. Locally listed Zimbabwean equity prices have seen excessive and unwarranted gains, with share prices now well above our estimates of fair value. Using these quoted prices, our African-focused portfolios showed large paper gains. However, as these gains are not realisable, we had to evaluate our valuation methodology for these companies to ensure that we do not overstate performance, and that both new investors into these funds and clients who want to withdraw funds are treated fairly. As a result we have impaired a significant portion of the value of all in-country Zimbabwean assets to account for the unwarranted gains.

The Zimbabwean exposure of our African portfolios is largely concentrated in Econet Wireless and Delta Corporation. With returns for the first nine months of this year of 243% and 212% respectively, these two companies still contributed positively to the funds’ overall returns over this period, despite the write-downs.

Although the operating environment in Zimbabwe is currently extremely challenging, these two high-quality businesses are entrenching their moats as the dominant players in their respective industries.

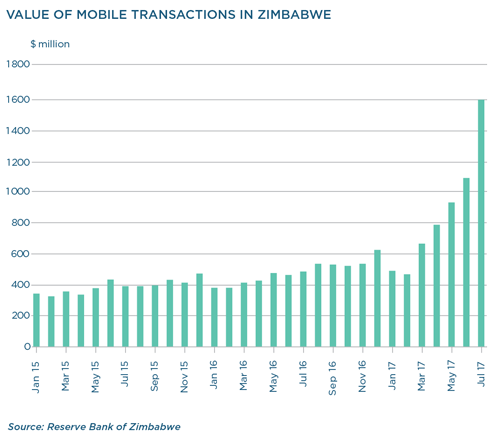

A good example is EcoCash, Econet’s mobile money business. With a market share of close to 100%, this business is thriving in the current environment. Zimbabwe’s cash shortages resulted in a spectacular rise in the number of transactions on its mobile money platform, as demonstrated by the graph below. This environment is driving a massive acceleration in the adoption of mobile money technology, which has transformed this business. From simply providing an alternative option for payments a few years ago, EcoCash is now an absolutely fundamental part of the economy.

Africa has experienced a number of currency crises over the years. We know they do not last forever and we have seen the positive outcomes of being invested in countries like Egypt and Nigeria when their currency situations improved. We do not know when this will happen in Zimbabwe, but what we do know is that at some point something has to give. If shelves are empty and filling stations run dry, the country will be forced into significant interventions, and with its recent traumatic events still fresh in memory, this might well play out much faster this time around. The signs of hyperinflation are already clearly visible and the possibility of a watershed moment is as real as it has ever been, with increased discontent among the general public, more reports of political infighting and government’s finances basically depleted.

We still view the Breadbasket of Africa as a country with immense potential and our focus is on owning the highquality companies that will emerge from this volatile environment as stronger businesses.

South Africa - Institutional

South Africa - Institutional