Quarterly Publication - January 2017

HAMMERSON - January 2017

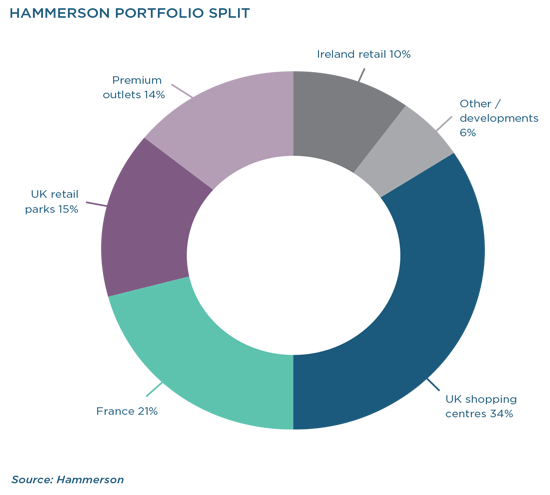

Hammerson is a dominant property group in the UK, owning some of the leading shopping centres across the country. The company, which is listed both in London (it is included in the FTSE 100 Index) and Johannesburg, also owns a portfolio of UK retail parks and shopping centres in France, as well as premium outlet centres in other European countries. Most recently, Hammerson gained exposure to Ireland, acquiring a stake in a portfolio of retail assets towards the end of 2015, which included that country’s largest shopping centre, Dundrum.

DOMINANT SHOPPING CENTRES

Following years of a relatively stagnant retail environment, the UK has shown signs of recovery in recent years, with both consumer confidence and retail sales exhibiting green shoots. While it is unclear what the impact of Brexit will be on these metrics when the UK eventually leaves the EU, we expect Hammerson’s portfolio to continue to benefit from the ongoing recovery in the retail environment thanks to its relatively limited exposure to London and the dominance of its assets.

In addition to giving the landlord leverage with retailers, having a dominant shopping centre is also defensive. In downturns, retailers would sooner close an average store in a secondary location than a flagship shop in a prime location. We view Hammerson’s portfolio of UK shopping centres as among the most prime of the various UK landlords. Management has consistently invested in the centres over the years, optimising their leisure proposition and securing strong tenants, thereby creating ideal shopping destinations. Partly owing to the work that has gone into the portfolio, we expect the estimated rental value (ERV) of Hammerson’s UK shopping centres to show growth in the low single digits over the next few years, broadly in line with the 2.2% compound annual growth recorded in the three-and-a-half years to June 2016.

With the rise of e-commerce, the sustainability of shopping centres has increasingly come under scrutiny. The UK is among the leading adopters of internet shopping, which already represents a mid-teen percentage of total sales. The need for bricks-and-mortar outlets in an age where product can be bought online and delivered on the same day, remains a key question going forward for all owners of shopping centre real estate. However, not all shopping centres are created equal. Mid-tier centres whose only offering is product that can be found online will likely feel the impact of 'e-tailing'. On the other hand, we believe that dominant shopping centres, with flagship stores and a sufficient entertainment offering, complement the e-tailing trend and remain a key avenue in a retailer’s omnichannel arsenal.

While its UK shopping centre portfolio may be among the best in the country, the strength of Hammerson’s retail park portfolio is not at the same level. Its retail park portfolio has seen like-for-like net rental income growth that is some 100 basis points below the average growth achieved by the Hammerson shopping centre portfolio over the past five years.

However, the retail park market has managed to maintain a healthy occupancy rate and rental growth rates have been more than decent in recent years. While we do not expect retail park rentals to go backwards, given the relatively high base rates, we see limited to no growth in rental over the next five years.

GEOGRAPHICAL DIVERSIFICATION

Unlike its London-listed peers, whose portfolios are almost exclusively UK focused, Hammerson’s domestic exposure represents only 60% of its asset base. The balance is in euro-denominated assets in Ireland, France and a few other countries on the continent. This substantial euro exposure means that an investor in Hammerson faces much less UKidiosyncratic risk than with its peers, and this is particularly pertinent in the wake of the UK referendum outcome on EU membership. While the details of the Brexit process remain murky, it is clear that the impact of any fall in asset values should hit Hammerson’s net asset value (NAV) less than other members of the ‘big four’ (British Land, Land Securities and Intu) given its euro exposure.

On balance, this diversification element outweighs what we perceive as a relatively weaker portfolio of French shopping centres. The French retail market is facing headwinds and we expect rentals in the French portfolio to chug along sideways over the next few years, as the retail environment remains lacklustre, while occupancy cost ratios are close to their maximum levels.

Meanwhile, despite much criticism in the market relating to the full price paid for the Irish acquisition, the fundamentals of the Irish retail market are the strongest in over a decade. As a result, we see strong growth potential in ERV at Dundrum, which should lead to substantial value accretion. As long-term investors, we judge the soundness of an investment by its potential return over the long term, not just the acquisition yield in year one. With an expected compound annual growth rate in ERV of 4% to 5% over the next five years, we see Dundrum adding substantial value to the Hammerson business.

PREMIUM OUTLETS

In addition to traditional shopping centres and retail parks, Hammerson owns premium outlet centres both in the UK and on the continent, via its stakes in Value Retail and VIA Outlets (through joint venture holdings). Luxury brands are sold at discounted prices at these centres, which have attracted growing interest from tourists, both local and international. The outlet market has seen sales growth of 8% to 10% per annum since the financial crisis, with rental growth coming in at a similar level, as the rentals charged are mostly based on turnover. In recent months, Hammerson has invested additional capital into the VIA Outlets business, reflecting management’s confidence in continued growth in the sector. On mainland Europe, saturation levels for outlet centres are at different points, but some runway remains for this part of the business to make up a greater portion of the Hammerson asset base.

DEVELOPMENTS

Good managers of real estate continuously work and invest in their assets to fend off competition and keep shoppers visiting. Hammerson has a pipeline of development opportunities representing just over a quarter of its standing investments. These include plans either awaiting approval or already approved, and range from leisure extensions to existing centres to the construction of new phases on vacant pieces of land adjacent to standing developments. The company recently completed phase one of its Victoria Gate development in Leeds, and is in the process of completing a dining and leisure extension at Westquay in Southampton. Additionally, three major projects are in the planning phase, expected to be completed around 2021/2022. Two of these are Croydon and Brent Cross, which are expected to breathe new life into the company’s assets in South and North London respectively, cementing the dominance of its shopping centres in these regions. Together with the development of the Goodsyard project in London, these three major projects should see an investment of about £1.3 billion, which should be accretive to NAV upon completion.

MANAGEMENT

Hammerson’s management team is among the leading managers of real estate in the UK. The team has consistently delivered growth in ERV across the portfolio, and in addition to that has been able to sign rentals that are consistently above the passing rent (the previous rent amount before the renewal). In the four-and-a-half years to June 2016, Hammerson has achieved leasing levels that were on average an impressive 10% above passing rent. This has been reflected in the compelling growth in NAV per share since the financial crisis, as well as similarly impressive growth in earnings and dividend per share.

Strategically, the decision to exit the office sector in 2012 has shown management to be good allocators of capital, with the proceeds from the sale put to better use in the outlet business. While management could not have anticipated the Brexit vote, the group is also now in a better position than its peers who are more exposed to office space, which is coming under pressure following the referendum.

We believe management’s decision to enter the Irish market confirms its prudence. As highlighted earlier, given the strong retail market backdrop in Ireland, the ERV growth prospects of the Irish acquisition more than outweigh the perceived ‘overpayment’ from an initial yield perspective.

CONCLUSION

We like Hammerson’s portfolio of dominant assets, its geographical diversification as well as its management team. With the company having recently listed on the JSE, we are now able to gain exposure to a quality portfolio under an excellent management team, without using our offshore allowance.

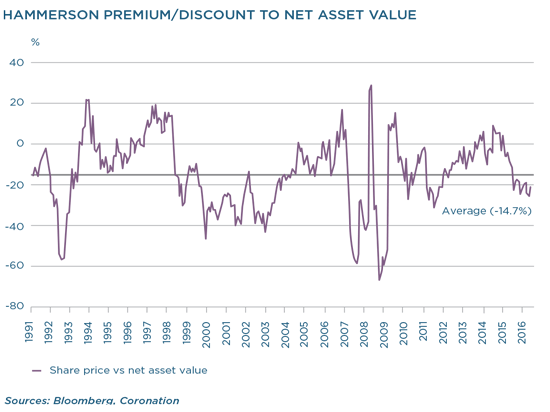

We expect the value creation that should come from the UK shopping centre business, the Irish acquisition as well as the strong outlet business to outweigh the pedestrian performance of the UK retail parks and French business. With the counter trading at a discount of 20% to 25% to its last stated NAV, we believe that at these levels, Hammerson is a quality stock that is worth adding to our portfolios

This article is for informational purposes and should not be taken as a recommendation to purchase any individual securities. The companies mentioned herein are currently held in Coronation managed strategies, however, Coronation closely monitors its positions and may make changes to investment strategies at any time. If a company’s underlying fundamentals or valuation measures change, Coronation will re-evaluate its position and may sell part or all of its position. There is no guarantee that, should market conditions repeat, the abovementioned companies will perform in the same way in the future. There is no guarantee that the opinions expressed herein will be valid beyond the date of this presentation. There can be no assurance that a strategy will continue to hold the same position in companies described herein.

Global (excl USA) - Institutional

Global (excl USA) - Institutional