Quarterly Publication - October 2017

Spar - October 2017

Alfred Pennyworth: “Took quite a fall, didn’t we, Master Bruce?” Thomas Wayne: “And why do we fall, Bruce? So we can learn to pick ourselves up.” – Batman Begins (2005)

Four years ago, when we last wrote about Spar South Africa, the company had just turned 50 years old. Having faithfully served its communities throughout the decades, and handsomely rewarded investors since listing in 2004, the business and its share price were solid outperformers … until about a year ago. From a high of R219, the share has tumbled nearly 25%, with the stock now having underperformed the market over the last five years.

Recent earnings have disappointed and some valid concerns are being raised around Spar as an investment. We too have wrestled with these concerns, and having concluded that the challenges are surmountable, we explain our thinking in this article.

IS PARADISE (REALLY) LOST IN SOUTH AFRICA?

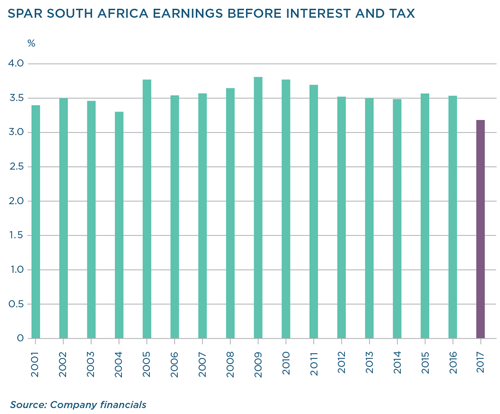

In the six-month period to end-March 2017, Spar South Africa reported its lowest ever operating margin of 3.11%.

This was a shock to the market and to us. Here was a business that, with metronome-like regularity, delivered 3.5% as a matter of course. While a difference of less than 0.4% may not sound like much, it is actually a 10% reduction in profitability levels – on margins that are already this thin! Compounding this was the fact that total revenue had declined in real terms, driven by a 5% decline in volumes through the retailer’s distribution centres.

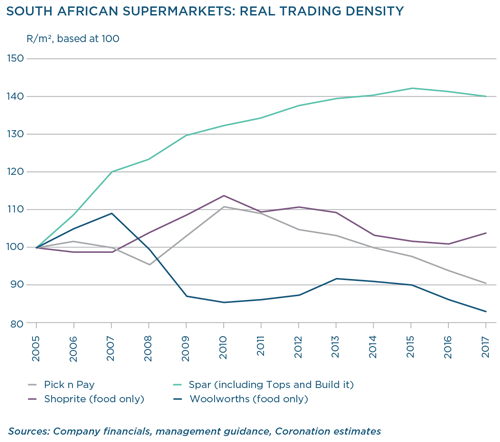

The following graph shows the evolution of retail space productivity in real terms, relative to 2005. What is clear is just how well Spar has managed this. Over the last two years, however, it has been declining, due to a number of reasons. First, Spar’s excellent execution over many years has built a high base. Importantly, the economy is much weaker and consumers are very distressed. In addition, Spar is experiencing challenges with its business model. While the economy should recover eventually, the big fear is that Spar’s model may fall down.

We have spent a lot of time speaking with various people in the organisation as well as outside of it (competitors, suppliers, franchisees), thinking through these issues and contextualising recently reported numbers against longterm history. These channel checks have provided invaluable insight into the business model. We believe the model will withstand current pressures and that the market’s fears are overdone.

Some of the factors we considered are:

- Loyalty of franchisees.Given the current difficulties, some of Spar’s independent franchisees are currently weighing up the pros and cons of staying or leaving. Though it might be tempting to exit the agreement, the costs would almost certainly outweigh the benefits:

- Being a member is financially lucrative. Spar carries the stock burden, so franchises have become a lot more cash generative over time. Ten years ago, its creditor days (the average time a company takes to pay its creditors) were at parity with stock days (the average number of days the company holds its stock before selling it). Now, creditor days are twice as long.

- Spar’s systems and processes are easy to use, freeing up franchisees from having to deal with suppliers and investing in fleet.

- The transparent nature of the agreement with Spar engenders trust. Franchisees can easily compare it with that of competing retailers. Spar suffered only a single defection in the last year – the agreement is evidently compelling.

- Being a member is financially lucrative. Spar carries the stock burden, so franchises have become a lot more cash generative over time. Ten years ago, its creditor days (the average time a company takes to pay its creditors) were at parity with stock days (the average number of days the company holds its stock before selling it). Now, creditor days are twice as long.

- Limited threat of independent buying groups. As beneficiaries of down-trading over the last few years, these retailers have managed to increase their market share. However, they are unable to effectively compete for Spar’s customers in two key categories: fresh food and prepared/convenience meals. This limits their ability to entice Spar’s franchisees away en masse, which lowers the risk of Spar being replaced as the wholesaler of choice.

- Coordination of retail strategy. Because the agreement between Spar and its franchisees is voluntary, it is no surprise that execution varies from store to store. This has resulted in differences in what customers find on shelves and in terms of the services offered (even within the same format), and has added to the difficulty of drawing new customers into their stores. Management has now confirmed two big, compulsory initiatives for all franchisees:

- Money market counters and kiosks are part of the South African customer experience. These provide another reason for consumers to enter the store and two additional opportunities (sending money and receiving money) for Spar to build a long-term relationship with the customer.

- The ‘My Spar Rewards’ programme has to be very visible in-store. The programme is being heavily promoted after Spar historically undervalued the importance of loyalty programmes.

- Money market counters and kiosks are part of the South African customer experience. These provide another reason for consumers to enter the store and two additional opportunities (sending money and receiving money) for Spar to build a long-term relationship with the customer.

- Price perception set to improve. Consumers wrongly view Spar as expensive, regardless of the store format. The company’s previous marketing campaigns have not shouted loud enough about price. Future campaigns will see more price-focused advertising that clearly highlights how much consumers can save. Across the stores, all franchisees are now also running off a single point-ofsale system, which will allow promotions to be pushed seamlessly across the stores.

- Space growth. Spar’s recent store roll-out has been slowed due to the weak environment. Franchisees have grown skittish about opening stores, while new property developments have been delayed. The company still has a healthy pipeline of new sites in areas where they lack a presence, and this will come on-line in the near to medium term.

- Sustainable profitability. We believe Spar’s long-term profitability is higher than that reflected in today’s margins. Operating costs have outgrown revenue, gross profit margins declined and volumes were negative – all simultaneously for the first time. Not the usual service we have come to expect over the years! In fact, volumes have never been negative over a full 12-month period. Pleasingly, volumes have picked up even as food inflation has come down, and there is every chance that volumes will finish the year in the black. Given Spar’s largely fixedcost base, this improvement suggests great potential for fatter margins in future. We expect 3.5% may be sustainable in the foreseeable future.

Once the environment stabilises and starts to improve, Spar should be off to the races. We expect the business to return to at least maintaining (and even growing) its retail space productivity. Along with the normalisation of margins, the earnings recovery should be strong off what we believe is a low South African earnings base.

EUROPEAN ACQUISITIONS

In recent years, Spar bought related retail businesses in Ireland, South-West England and Switzerland. Were these European acquisitions a mistake?

We think the acquisitions were strategically important, and see them as a natural extension of the business, given the limited scope for big store roll-out in South Africa as the group protects franchisee profitability. All the European businesses work on the same model as in South Africa, and in fact three of them are Spar licensees in those countries. In our view, management is staying within its circle of competence, reducing the risk of the acquisitions. Some R2.1 billion has been spent on these acquisitions and, seeing as they were acquired on price/earnings multiples of between seven times and 14 times, with good earnings growth potential, they make financial sense too.

Ireland – huge convenience opportunity

In developed markets, food retail formats are more clearly defined than what we are used to in South Africa, each with its own set of strengths and weaknesses. In BWG, Spar South Africa has acquired multiple banners (brands) which play in various formats. We estimate that 70% of group sales is in the convenience sector (think KwikSpar in South Africa), and BWG is the biggest player in this market in Ireland. We are excited about the very attractive fundamentals of this format:

- The convenience market looks set to take share from other formats, given rising income levels and an evolution in Irish lifestyles. DINK (dual income, no kids) households are on the rise, while elderly people living in cities increasingly demand prepared meals. These developments underpin a more stable demand, enhancing the defensiveness of the format.

- Convenience retailing is hedged against price debasement from discounters, given its different mix of products. Discounters have brought price deflation to fruit and vegetables, as well as to high-value groceries. In contrast, convenience stores specialise in home meal replacement, emergency buys and treat purchases. They also offer very high service levels, while stores are located in busy thoroughfares where discounters are not present.

- Store productivity is high given the heavy footfall through a small space, as well as the high price points of (and high margin on) goods.

In Ireland, distribution facilities are underutilised, which presents an attractive opportunity to drive volume. In South Africa, franchise loyalty sits between 80% and 85%, but this is far lower in Ireland (in the 60s). Franchisees also typically have more power given their size, where big players can run 50 to 200 stores, compared to only five to ten in South Africa. Over the last two years, loyalty has been increasing as Spar has proven its distribution expertise in Ireland, while demonstrating an ability to distribute the whole category basket.

In conjunction with our positive revenue outlook, we think margins have some way to go before reaching their true long-term potential. While margins are around 2% today, these should get above the 2.5% level and tend towards 3%.

Switzerland – a right-sized bet

The acquisition of Spar Switzerland appears to have been a bit rushed on the back of successful purchases in Ireland and the UK. Though management knew they were buying a sub-scale business (which has a market share of only 1% versus the top two players with a combined 80%), it turns out their due diligence intelligence was poor. Profits have fallen since acquisition. Sadly, of the European acquisitions, management paid the highest multiple for this one.

What is reassuring is that Spar has managed the size of its up-front investment accordingly. Spar only acquired 60% of this business versus 80% to 100% of its UK and Irish acquisitions. Furthermore, of Spar’s R2.1 billion European investment, only a third was spent on this business.

Although it has disappointed, there are some early signs of a turnaround. Spar has relocated the former head of its KwaZulu-Natal distribution centre to take charge of the Swiss business, with the help of two other South African colleagues. After months of revenue decline, Switzerland has at the time of writing completed six consecutive weeks of sales growth. The Swiss operation represents 8% of group revenue, and while it does not make any money at the moment, just getting it back to a reasonable margin level will be very positive for group earnings, while growing revenues will provide further upside.

CONCLUSION

While Spar South Africa looks different today than it did four years ago, its essence remains the same. Fundamentally it remains an above-average return generator and converter of earnings into cash, with stable margins. Also, its management has a good track record of allocating capital. The business has stumbled in the last year, but much of this is because of the very subdued environment.

Spar is one of those agile businesses that, when faced with adversity, will emerge wiser and stronger. Given its current valuation – it trades on 12.5 times our assessment of normal earnings while offering a 4.5% dividend yield – we like the share more than we did a year ago, and we own a lot more of it as a result. Like the dark knight himself, we expect Spar to rise, and to contribute positively to our portfolios in the process.

This article is for informational purposes and should not be taken as a recommendation to purchase any individual securities. The companies mentioned herein are currently held in Coronation managed strategies, however, Coronation closely monitors its positions and may make changes to investment strategies at any time. If a company’s underlying fundamentals or valuation measures change, Coronation will re-evaluate its position and may sell part or all of its position. There is no guarantee that, should market conditions repeat, the abovementioned companies will perform in the same way in the future. There is no guarantee that the opinions expressed herein will be valid beyond the date of this presentation. There can be no assurance that a strategy will continue to hold the same position in companies described herein.

Global (excl USA) - Institutional

Global (excl USA) - Institutional