Investment views

The discovery of fire

How AI’s rapid rise is reshaping industries, economies and society.

The Quick Take

- The advent of ChatGPT mainstreamed the extraordinary capability of AI, the new epicentre of geopolitical rivalry

- In the race for AI domination, China and the US are pouring trillions of US$ into capex projects, but following disparate AI strategies

- AI is not just a technology; it has dramatic societal implications – from ethics and accountability to job displacement and fake news

I. THE SPARK THAT LIT THE FIRE

Much like Apple's iconic iPhone revolutionised mobile computing by making sophisticated technology intuitive and easily accessible, the public unveiling of ChatGPT in November 2022 introduced the power of generative artificial intelligence (AI) to the world.

The key technology that enabled the creation of ChatGPT was a network architecture called the Transformer, proposed by researchers from Google and the University of Toronto. Before the Transformer, AI relied on statistical models and hard-coded rules, meaning they were not easily generalisable to different tasks. The Transformer overcame this hindrance and enabled AI to understand context and made it more scalable with compute (processing power).

Its significant impact was made possible by two important foundations that were already in place. AI leverages the corpus of knowledge of the internet and the broad distribution enabled by widespread mobile availability.

ChatGPT took the Transformer and made it usable by non-technical consumers. It rendered complex AI capabilities accessible and tangible, sparking widespread curiosity and immediate application across myriad tasks, such as summarising, creative-writing, and learning.

Effectively, chatbots such as ChatGPT allow people to talk to computers in natural language and for the computer to understand and respond using an aggregation of the bulk of knowledge stored on the internet. It is like having a personal, knowledgeable assistant. A valuable right hand who can do preliminary research on an infinite number of topics for you and synthesise the information in your preferred style, instead of you having to trawl through dozens of websites and then spend time consolidating the information.

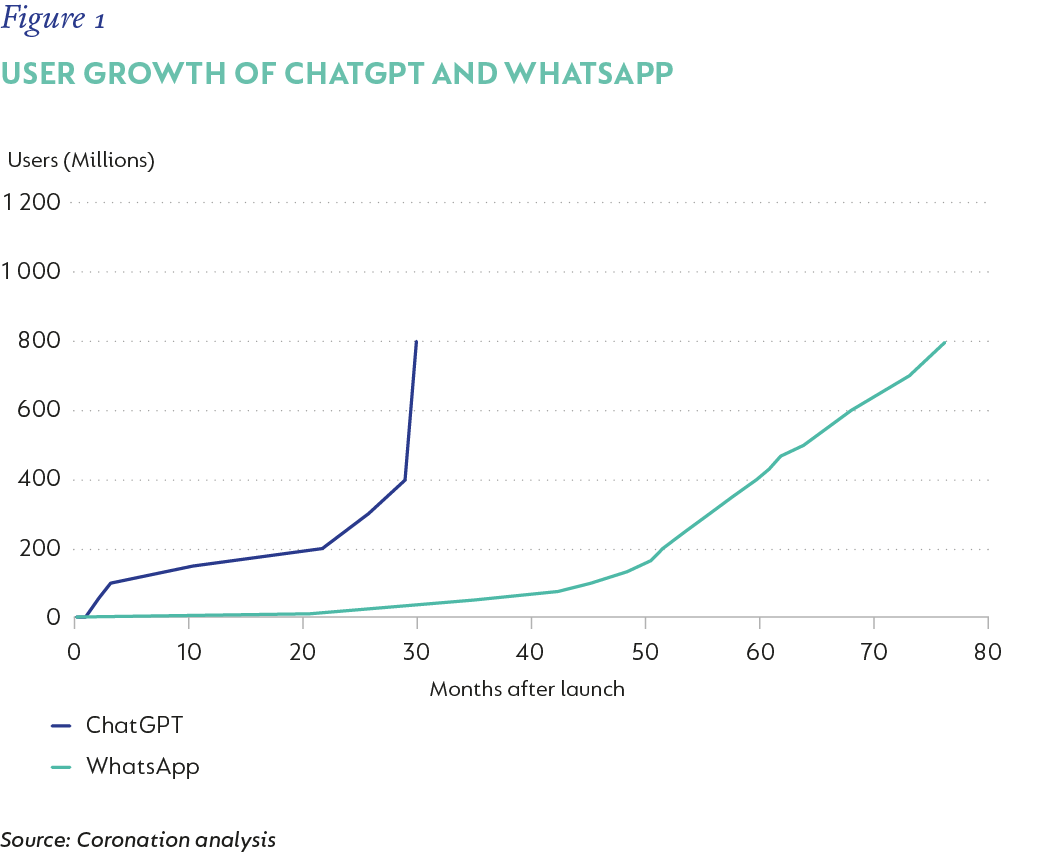

As illustrated by Figure 1, what truly sets this moment apart is the staggering rate of adoption. ChatGPT attracted its first million users in a mere five days and, astonishingly, reached 100 million users in just two months.[1] In contrast, WhatsApp, itself a benchmark for rapid technological uptake, took a significantly longer three and a half years to achieve the same 100 million user milestone.[2]

Sundar Pichai, CEO of Google's parent-company, Alphabet, offers a crucial insight into why the AI wave is different to other technological shifts. He states that AI is "much more profound than the other platform shifts" because it is "capable of creating, self-improving, and so on."[3]

Generative AI is definitely impressive, but should we collectively rush in? Despite what seems like a broad array of applications today, it is wise to be cautious not to overestimate potential new market sizes, to be wary of possible disruption to business models, and to be on the lookout for emerging unforeseen risks. Elon Musk said, “AI is likely to be either the best or worst thing to happen to humanity.”

II. THE AI SPACE RACE

The rapid advancement of AI is unfolding against a backdrop of intense rivalry between the US and China. China’s US$19 trillion GDP is second only to the US$30 trillion US GDP and is growing significantly faster. Militarily, China has been modernising its armed forces, expanding its presence in the South China Sea, and increasing its incursions into Taiwan's airspace. It is also increasing economic influence across Asia, Africa, Latin America, and Europe through its Belt and Road initiative. The US has countered by expanding defence co-operation with allies like Japan and Australia. It has also instituted export controls on advanced chips and technology to China and tariffs of approximately 30% on imports from China.

The global AI development landscape is the next frontier of the rivalry, frequently characterised as an "AI space race,". An emerging idea is that "AI leadership could beget geopolitical leadership – and not vice-versa".[4] Technological dominance in AI may become a primary driver of a nation's global standing and influence, potentially surpassing traditional geopolitical levers, such as military might or economic size alone.

China's AI approach: Beijing has made its intentions clear, aiming to establish China as the "world's primary AI innovation centre" by 2030.[5] This ambition is backed by a six-year plan that will see a massive US$1.4 trillion state-driven investment into its broader technology sector, with a significant focus on AI.[6] In its characteristic whole-of-nation approach, Chinese corporate strategies appear weighted towards the rapid and widespread deployment of open-source AI technologies. These models, such as DeepSeek and Alibaba's Qwen, offer cheap alternatives to proprietary systems and are quickly gaining traction among developers globally. Other key pillars of China's AI strategy include:

- leveraging its vast domestic data resources generated by over a billion tech-savvy Chinese - a critical ingredient for training AI models

- making substantial investments in science, technology, engineering and maths (STEM) talent – boasting c. four times more STEM graduates than the US, annually – in a push toward complete self-sufficiency in AI development.

Attempts by the US to stymie China’s AI progress through advanced-chip bans have partially backfired. Instead of acting as a drag on Chinese innovation, the bans incentivised ingenuity as demonstrated by the release of the innovative and computationally efficient mixture-of-experts (MOE) DeepSeek model. An MOE model subdivides the AI neural network into smaller expert networks. A specialised subset of networks is activated to solve a problem, improving latency and power consumption. Necessity is indeed the mother of invention.

This suggests that attempts to control AI proliferation through hardware restrictions alone may be ineffective, and innovation is occurring through alternative pathways, including sophisticated model architectures.

The US’s AI approach: The US has adopted more of a market-based approach to AI development, with companies taking individual responsibility for resource acquisition and innovation. Most leading AI firms in the US have taken a proprietary approach to their models, with end-users being charged a monthly fee to use applications or per-query charges to third-party software applications using the models. Fierce competition between private players like OpenAI, Alphabet, X, and Meta to win a perceived race to beyond-human intelligence is driving rapid iteration and innovation of advanced foundational models and applications. Much of the development in the US is funded by corporations and venture capital firms.

The government’s strategy involves federal investment in AI research and development, a concerted effort to cultivate domestic talent, and the reduction of red tape to accelerate the build out of critical infrastructure required to run AI systems, such as power capacity.

The US-China AI rivalry is not simply about which nation develops the most advanced algorithms. It is fundamentally a competition to define the global operating system and the underlying principles (policy, privacy, regulation, ethics) that underpin AI.

III. THE AI VALUE CHAIN

This is composed of layers, each of which presents unique investment opportunities and challenges.

1. Energy

Sam Altman, co-founder of OpenAI, recently tweeted that a ChatGPT query consumed energy equivalent to “about 0.34 watt-hours, about what an oven would use in a little over one second, or a high-efficiency lightbulb would use in a couple of minutes”. The immense computational demands of AI translate directly into a rapidly growing need for energy capacity. Global data centre electricity consumption was estimated at around 500 terawatt-hours (TWh) in 2023. Projections from organisations like OPEC suggest this figure could triple to 1 500 TWh by 2030 [7]—a level of consumption comparable to the current total electricity usage of a major industrialised nation like India.

2. Semiconductors

The AI revolution is built upon a new generation of highly specialised semiconductor chips. These are, primarily, graphics processing units (GPUs), initially designed for gaming but found to be well-suited for the parallel processing demands of AI. These chips are essential for both "training" complex AI models on vast datasets, or teaching the models to think, and for "inference," which is the process of running these trained models to make predictions or generate outputs in real-world applications.

Nvidia currently holds a commanding market share of the AI accelerator market, estimated at 92%, with its H100 GPU now the de facto industry standard for training large language models. Advanced Micro Devices (AMD) is a distant challenger, with its MI300 series of accelerators.

Taiwan Semiconductor Manufacturing Company (TSMC), the world's largest dedicated semiconductor foundry, manufactures the most advanced chips for Nvidia, Advanced Micro Devices (AMD), and Apple. Most chip companies outsource manufacturing to a foundry, and TSMC has a two-thirds share of this market, due to its process expertise, scale benefits, and deep partnerships with key customers. It is a critical bottleneck in the industry that is likely to benefit from the proliferation of AI across industries.

3. Data centres

Data centres are effectively the factories of the AI age, housing the tens of thousands of GPUs and related infrastructure required to power complex AI workloads.

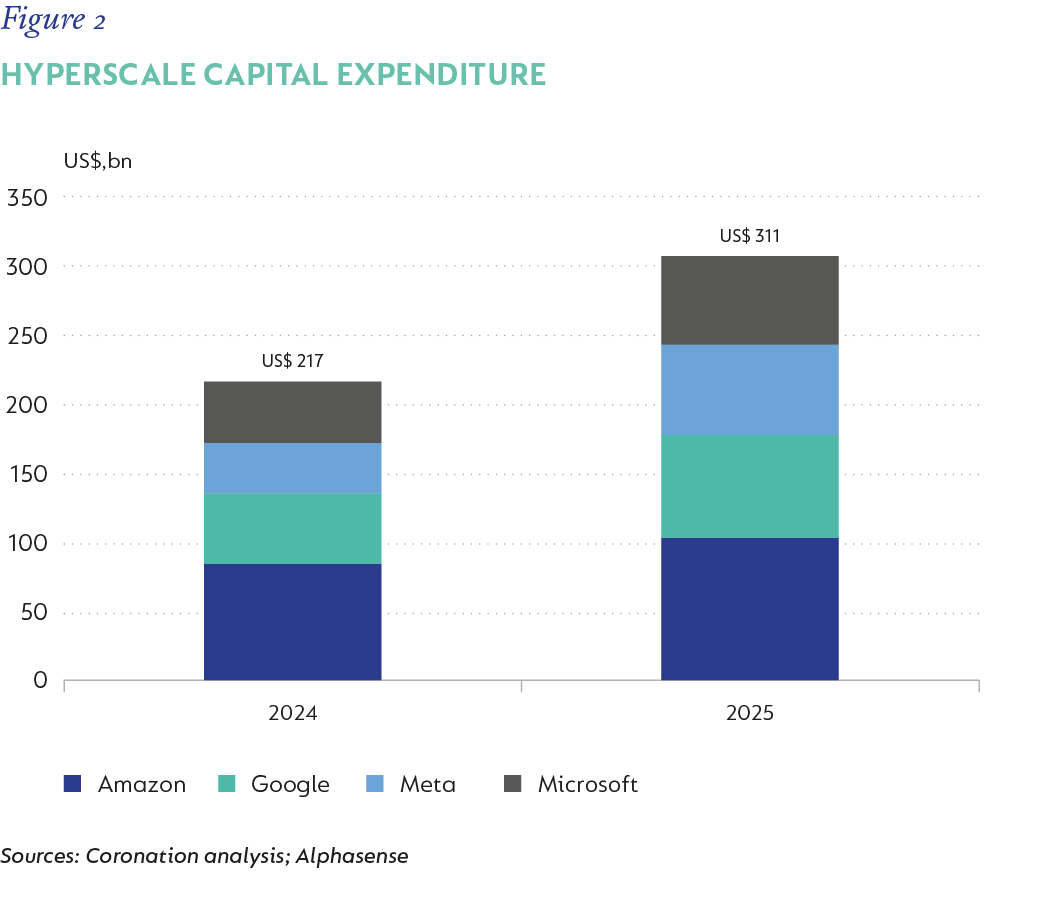

AI demand is fuelling a colossal wave of capital expenditure. Figure 2 shows that technology giants like Amazon, Alphabet, Microsoft, and Meta poured over US$200 billion into capital expenditure in 2024, most of which was allocated to AI infrastructure. This level of investment is projected to be even more aggressive in 2025, with some estimates at over US$300 billion.[8] Monetisation has lagged spend, raising questions about whether fair returns will be generated and creating the risk that the returns may be spread unevenly amongst firms.

4. Cloud Providers & Middleware: The software infrastructure

The next layer of the value chain is the AI models (for example, Gemini, GPT o3, Llama) themselves as well as the platforms that enable their development and deployment.

The cloud platforms provide the scalable infrastructure (compute and storage) and host development platforms, along with an array of AI tools and pre-trained models. This enables businesses to develop, deploy, and manage sophisticated AI applications without the enormous upfront investment and complexity of building and maintaining their own massive data centres and AI research teams.

5. Application layer: Enterprise and consumer applications

The top-most layer contains the applications that consumers or employees interact with. ChatGPT, Gemini, WhatsApp, and Duolingo are examples of consumer-facing apps that use AI functionality in their products. Salesforce, Microsoft Copilot, and GitLab similarly allow enterprise users to take advantage of AI functionality in a work context. AI coding tools like Cursor and Windsurf have enabled developers to build applications much faster than before, increasing the risk of new applications disrupting this layer.

IV. THE PRICE OF INTELLIGENCE: PLUMMETING INFERENCE COSTS

A critical catalyst of the widespread adoption of AI is the dramatically falling cost of inference—the computational process of running a trained AI model to generate outputs based on new input data. While training large AI models can be very expensive (a one-time or periodic cost), inference occurs every time the model is used, making its cost a crucial factor for scalability and economic viability.

This cost reduction is driven by several converging factors: improving AI model optimisation techniques, the development of more energy-efficient and powerful accelerator hardware (like new generations of GPUs), and novel architectures such as the MOE architecture mentioned earlier. The inference cost for a system performing at the level of OpenAI's GPT-3.5 plummeted over 280-fold between November 2022 and October 2024.[9] At the hardware level, costs for AI computation have been declining by roughly 30% annually, while the energy efficiency of this hardware has been improving by about 40% each year.[10]

V. TRANSFORMING INDUSTRIES ACROSS THE BOARD

“I spent a fair bit of time thinking several years out. And while it may be hard for some to fathom a world where virtually every app has generative AI infused in it, with inference being a core building block just like compute, storage and database, and most companies having their own agents that accomplish various tasks and interact with one another, this is the world we're thinking about all the time.”, Andy Jassy, Amazon Q4 2024

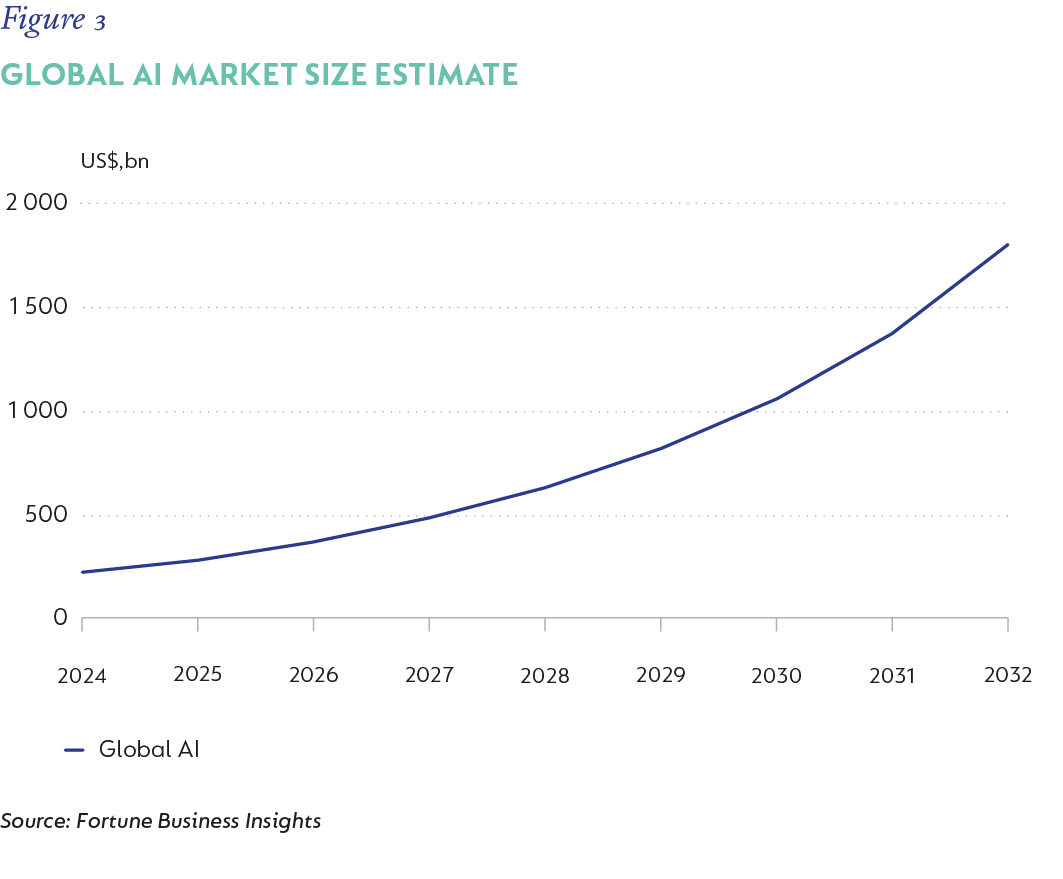

Market research indicates that the global AI market was valued at about US$230 billion in 2024. Projections (Figure 3) show this figure surging closer to US$1.8 trillion by 2032 (29% compound annual growth rate).[11]

The broad applicability of AI and the rapidly declining inference cost are making tangible impacts across a multitude of industries.

Coding and software development: One of the earliest and most pervasive AI use cases is in coding. Microsoft CEO Satya Nadella recently said that up to 30% of their code is written by AI, while developers using GitHub’s Copilot have already achieved a 26% increase in productivity.

Customer service: There are many examples of companies using AI to automate tedious customer service tasks, from websites to the call centre. Salesforce, a leader in customer relationship management, uses Agentforce to handle hundreds of thousands of internal customer service use cases with a reported 80% plus resolution rate.

Healthcare: SandboxAQ and AlphaFold, both backed by Alphabet, are two early-stage companies using AI to analyse and predict protein structures, with the aim of dramatically fast-tracking drug discovery.

Financial services: Adyen’s Uplift product uses AI to increase conversion for merchants by up to 6% and has allowed pilot customers to reduce the use of manual risk rules by 86%.

Manufacturing & logistics: AI is enabling more accurate demand forecasting and inventory optimisation, reducing waste and improving capital efficiency. Amazon states that AI helped them improve forecasting by 10% and regional predictions by 20%[12] .

Media & entertainment: AI use cases with the potential to significantly lower costs in film, music, and gaming production are emerging. Acclaimed director James Cameron has noted that AI could reduce the cost of blockbuster films by up to 50%; China’s Tencent Music has incorporated DeepSeek to enable users to produce music easily and cheaply, and Ubisoft's "Ghostwriter" tool helps game developers by generating dialogue for characters in video games.[13]

Consumer internet: Meta uses AI tools in its Advantage+ suite of advertising tools. It includes image, video and text generation tools that can help advertisers maintain brand consistency and improve personalisation. The company cited that merchants that started using Advantage+ noted a 20% increase in return on ad spend.

VI. SOCIETAL, ETHICAL, AND REGULATORY HEADWINDS

The AI revolution carries with it a host of complex societal, ethical, and regulatory considerations.

One of the most intensely debated aspects of AI's societal impact is its effect on the job market. Goldman Sachs, for instance, estimated that generative AI alone could expose approximately 300 million full-time jobs worldwide to some degree of automation.[14]

Another challenge arises from the fact that many advanced AI models are trained on vast quantities of existing data, much of which may be copyrighted material scraped from the internet without explicit permission from creators. Algorithmic bias, frameworks for determining accountability for autonomous system actions, and the risk of misinformation from high-quality “deep fakes” are other issues that society is likely to have to grapple with in the near future.

The current AI regulatory landscape is often described as "piecemeal". Nevertheless, significant regulatory initiatives are beginning to take shape, e.g., the EU AI Act has created processes for monitoring AI systems, rules supporting transparency and user rights, and governance authorities to oversee AI system operation. [15] Governments will have to strike a balance between managing risks and user rights while not stifling innovation.

VII. CONCLUSION

The rise of AI marks a transformative shift in technology and society. The speed and scale of AI adoption has surpassed most other recent technological revolutions. The impact is set to continue and possibly accelerate as these systems self-improve. Having witnessed many technological shifts over time and across geographies, we are applying learnings from prior shifts to today. While we are scouring our opportunity set for companies that will benefit from this wave, we are constantly assessing risks to existing and potential holdings from new AI-enabled entrants. Second, we are focusing our efforts on companies that will durably benefit from this new wave, given impenetrable or strengthening moats like entrenched distribution, unmatched process-capabilities or cost-structure advantages that will not be eroded by the diffusion of AI capabilities through industries and are ideally positioned at bottlenecks in the value chain.

[1] ChatGPT sets record for fastest-growing user base, Krystal Hu, 2 February 2023

[2] WhatsApp statistics 2025: Usage trends, demographics and more, Ram Shengale, WANotifier, 29 May 2025

[3]Google CEO Sundar Pichai on the future of search, AI agents, and selling Chrome, Nilay Patel, The Verge, https://www.theverge.com/decoder-podcast-with-nilay-patel/673638/google-ceo-sundar-pichai-interview-ai-search-web-future

[4] Trends, Artificial Intelligence, Bond, May 2025

[5] Intro: China’s AI Dream, Macro Polo, Paulson Institute

[6] China's AI industry could see US$1.4 trillion in investment in 6 years, executive says, South China Morning Post, 9 September 2024

[7] AI Needs More Abundant Power Supplies to Keep Driving Economic Growth, Christian Bogmans, Patricia Gomez-Gonzalez, Giovanni Melina, Sneha Thube , 13 May 2025

[8] Meta to spend up to $65 billion this year to power AI goals, Zuckerberg says, Jaspreet Singh, 24 January 2025

[9] The 2025 AI index report, Stanford University

[10] The 2025 AI index report, Stanford University

[11] Artificial Intelligence Market Size and Future Outlook, Fortune Business Insights

[12] Amazon, Q4 2024 earnings call transcript

[13] The convergence of AI and Creativity: Introducing Ghostwriter, Roxane Barth, 21 March 2023

[14] Generative AI could raise global GDP by 7%, Joseph Briggs, Devesh Kodnani, Goldman Sachs, 5 April 2023

[15] KPMG Trusted AI and the regulatory landscape

Global (excl USA) - Institutional

Global (excl USA) - Institutional