Managed income funds are typically not suitable for longer investment periods. Their limited exposure to growth assets constrains their ability to provide adequate protection against the eroding effects of inflation on one’s purchasing power.

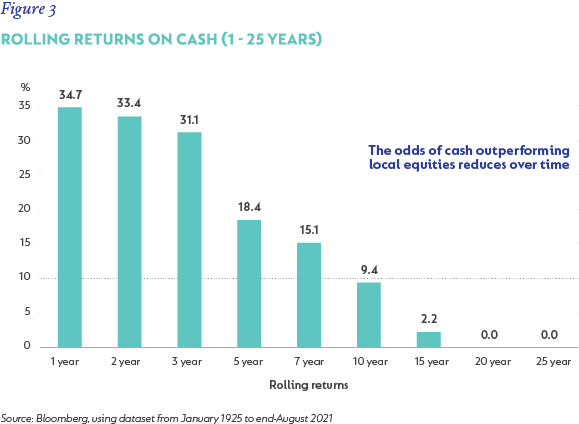

The following graphs demonstrate the benefit of maintaining exposure to growth assets over an appropriate time horizon. As is clear from the figures on the next page, cash returns become less likely to outperform equities the longer you remain invested, and investing too conservatively dramatically depresses long-term wealth creation.

Global (excl USA) - Institutional

Global (excl USA) - Institutional