Economic views

Global outlook

Inflation – it’s time to pay attention

- History does not always repeat itself; not every crisis is the same

- The macro building blocks for sustained higher inflation are in place

- However, divergent policies, timing, measurement issues and base effects temper some of the upside risk for now

IN DECEMBER 2020, former Federal Reserve Governor Bill Dudley warned, “A lot of people believe that inflation in the US is dead or, if not dead, in a state of suspended animation for the foreseeable future. They could be setting themselves up for an unpleasant surprise”. At the time, only a few were voicing concerns about inflation risk; after all, headline and core inflation rates were broadly below targets. Also, oil prices remained below pre-pandemic levels, output gaps were assessed to be large, and GDP and employment levels were well below their pre-pandemic norms. While stimulus was abundant, especially in developed economies, this absence of concern was informed by recent history, when the ringing warnings of inflation risk post the Global Financial Crisis (GFC) stimulus had come to naught. So, is this time different? We think so, yes.

Economists broadly subscribe to one of two theories about the causes of inflation.

- Monetarists believe that prices rise when too much money chases too few goods.

- Keynesians believe that when demand exceeds an economy’s ability to provide goods and services for agents’ needs and wants, this pushes up the prices of those goods and services.

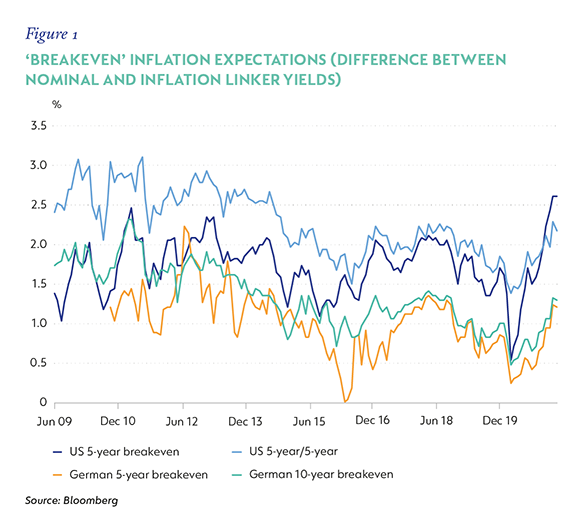

The two ways of thinking aren’t mutually exclusive – too much money could push demand for goods and services beyond an economy’s short-term capacity to produce them. If it’s true, as economist Milton Friedman said, that “inflation is always and everywhere a monetary phenomenon”, then it’s reasonable to question whether this round of massive stimulus could raise inflation in the months ahead. Developed market inflation expectations have adjusted sharply upwards in recent weeks, as financial markets start anticipating this risk, as seen in Figure 1.

THE BUILDING BLOCKS OF INFLATION

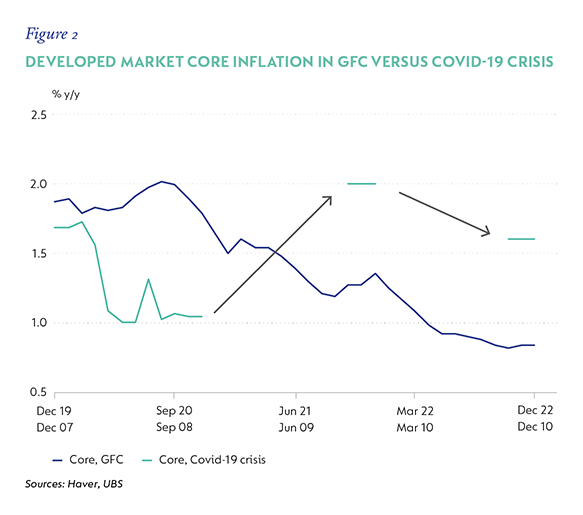

The Covid-19 pandemic’s policy and economic characteristics are different to those that accompanied the GFC. In these differences may lie the building blocks to a sustained level of higher inflation (Figure 2).

- Base effects. First to note is that within the next few months printed inflation in most economies will accelerate meaningfully as the decimated base of 2020 normalises. Also, oil prices have recovered strongly, and the prices of products or services that were restricted and collapsed in 2020 may even be higher than before. UBS estimates that US headline inflation will rise from 2.3% year on year (y/y) in March to 3.9% y/y by May; in the EU the increase is forecast at 1.9% y/y from 1.3%, and in the UK from 0.5% y/y to 1.9%. These largely base-related peaks will differ by region, and there is significant uncertainty about the timing and duration of this acceleration (and what additional drivers there may be). Next year, in the absence of sustained price increases elsewhere, such as the services sector, these base effects will swing back. There is some risk that this won’t happen, but the dynamic is a powerful one. More on this later.

- The nature of the crisis. The economic impact of the Covid-19 pandemic has been more like a war or a massive natural disaster – sudden, disruptive, and devastating to lives and livelihoods. This is not the bursting of a leverage-inflated bubble, which carries long-term balance sheet damage and a painful deleveraging that weakens aggregate demand and drags on growth. Importantly, it has not damaged the financial sector; balance sheets are in reasonably good shape, and monetary and financial transmission mechanisms should be relatively intact. That’s not to say regions and sectors won’t feel the very adverse effects for a long time, but as the nature of the crisis has been different, so will be the nature of the recovery.

- The nature of the remedy. The policy response to the pandemic is unprecedented in peacetime. Covid-19 triggered both monetary and fiscal responses aimed largely at protecting those lives and livelihoods – income support, balance sheet protection, and financial and banking sector buffers. The IMF estimates that average fiscal support in developed markets was 6% of GDP in 2020. While some of this momentum has faded, new policies in the US and Europe, combined with a more generalised concern that too-swift consolidation could push countries to a fiscal cliff (another sudden moderation in growth), will add duration to the stimulus.

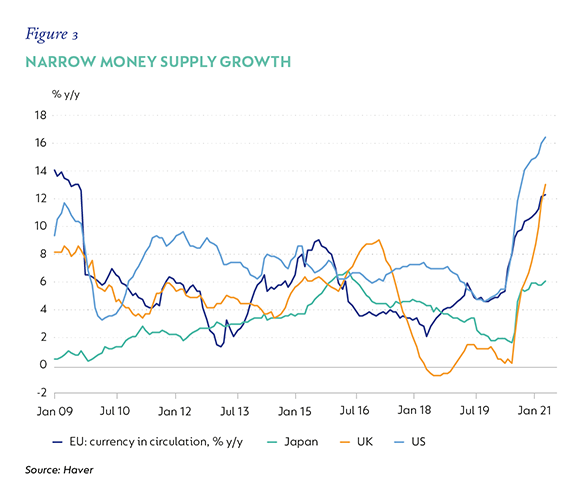

Monetary stimulus has also seen developed market central bank balance sheets expand by c.21.5% of GDP, and narrow money supply (currency in circulation) in the US is up by 16.5% y/y (Figure 3). This is in contrast to the policy response triggered by the GFC, which was mostly monetary, with liquidity provision aimed initially at protecting the very fragile financial sector, and then at stimulating growth. At the time, money supply growth peaked at 11.7% y/y in early-2009. Bank lending has also been actively encouraged, with governments guaranteeing bank loans to mitigate risk. This may support stronger demand for credit now than before.

- In hindsight, inflation drivers were misdiagnosed last time around. In the aftermath of the GFC, many commentators were concerned about the potential inflationary impact of massive liquidity provision. But nothing happened. In fact, many developed market central banks battled to raise inflation to targeted levels. In retrospect, one of the critical issues was that the increase in broad money was not met by a strong increase in demand for ‘transaction’ money. The money created remained in the financial system; in part because the underlying economies were weak, and in part because there was an accompanying change in the regulatory buffers required of banks, which made them unwilling or unable to lend. Combined, this meant that very little of this ‘excess liquidity’ or ‘money creation’ made its way into the traded economy. The pandemic has not shared these challenges, and, as mobility continues to normalise, it seems likely that demand for money will, too. The risk of ‘excessive’ money creation is greater this time around. Put differently, there is more available money to drive demand for goods and services than before.

- A faster pace of recovery. The pandemic hit a relatively healthy global economy. While the rapidity and force of early lockdown was an unprecedented economic shock, policy intervention and the increasingly rapid vaccine rollout should lead to a swifter return to normalcy than we saw post the GFC, where balance sheet and financial damage was enduring. Many economies will see GDP at pre-pandemic levels this year (some are there already), with a lagged but steady recovery in employment. That said, the recovery is diverging – developed economies that were able to inject massive support and vaccine strategies are recovering much faster than emerging markets, which have more limited policy options and poorer vaccine strategies. In these economies, inflation risk is not absent, but more heavily concentrated in exchange rate risk.

- Bottlenecks and supply disruptions. Specific to Covid-19, the impact of supply bottlenecks is already being seen in rising prices of specific goods and services. Container and freight costs have surged. Labour shortages in some countries have become an issue, with more people required to be at home (to meet caring and homeschooling needs) than before.

- Price normalisation risks lie to the upside and could compound base effects. Specifically, the collapse of service sector activity saw the prices of key components of the consumer inflation basket fall sharply. These include restaurants and hotels, travel and transport, and various items related to recreation and holidays. In some instances, they have fallen by more than two standard deviations below their long-term averages. As mobility returns and people not only go back to more normal consumption of these goods, but binge a bit on pent-up demand, supply could be constrained, which would see prices rise. Services (broadly) typically carry a large weight in measured inflation, and even though the impact on CPI will be non-uniform, it may pose a considerable risk to near-term inflation outcomes.

- The role of expectations and policy mandates. The Federal Reserve Board and the European Central Bank are leading central banks that have explicitly changed their mandates to actively encourage higher inflation after long periods of undershooting targets. This has increased market jitters that greater tolerance of inflation overshoots could see price acceleration run ahead of behind-the-curve central banks. This is certainly not a given, but it may affect market pricing as well as the inflation expectations of economic agents.

There are also long-term trends – not related to the pandemic – that could play into this frothier environment. Work done by Charles Goodhart and Manoj Pradhan* takes a detailed look at the history of falling inflation over the past 40 years and concludes that among the most important drivers of lower inflation was the impact of moderating global wage pressure. This is reflected in the emergence of China as the world’s manufacturing epicentre and the rise in participation rates in developed markets, mostly by women. The withdrawal of these lower-cost workers is likely to have the opposite impact on global wages over time. In tandem, ageing workers not only don’t produce, but also increase the demand for specific goods and services, which could also see specific prices rise.

The process of ‘deglobalisation’ has likely been accelerated by the pandemic, as countries seek to ensure that critical goods and services are produced locally, and are not subject to the uncertainty of long global supply chains and changeable geopolitical dynamics. Where onshore production is more expensive than procuring the same goods from a low-cost producer elsewhere, price pressures could emerge.

… NOT SO FAST

Despite all these emerging or potential pressures, there are still important issues of measurement and timing. Not only does the composition of various inflation measures vary, but the measurement of goods and services does too. Also, for all the listed ‘macro building blocks’ of inflation, recent years have shown some of these relationships to be more tenuous drivers of inflation than in the past.

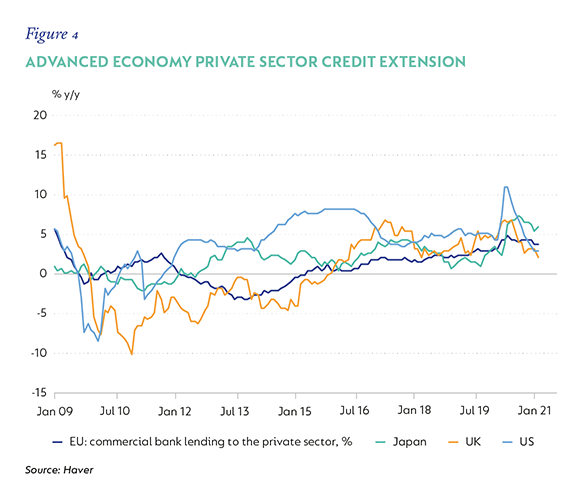

- The relationship between broad money supply growth and inflation is historically quite weak. The degree to which strong money supply growth generates inflation depends on whether it pushes aggregate demand to be in excess of supply. For this to happen, the rate of money supply growth needs to be sustained, and accompanied by matching spending and/ or loan growth. So far, this is not happening. Figure 4 shows that loan growth remains weak in recovering developed markets and the ratio of money supply to nominal GDP (money velocity) has been falling. It is possible that excess savings and rolling mobility restrictions have limited spending and loan growth, but for now this link is weak.

- Price normalisation may not be uniform. Lockdowns produced excess demand for certain goods and services (home refurbishment, IT, work-from-home infrastructure, courier and communication services, and so on), and the prices of these items have increased. Price normalisation of recreational- and mobility-related services affected by lockdowns may rise – in some cases sharply – but these may be offset by moderating inflation elsewhere. Here, it is also worth noting that the role of rentals (and imputed** rent) in many countries’ inflation baskets are either a strong anchor to services inflation (as in South Africa), or a possible risk, such as in the US, where the housing market has had a strong recovery. But even there, the pass-through from listed rental increases to CPI happens with a considerable lag and is not seen as an imminent threat.

- For all the optimism about a strong global growth recovery, by region and country, recovery rates are extremely divergent. The IMF’s April forecast update upgraded global GDP growth expectations for 2021 to 6.0% from 5.2%, primarily on the upward revision of developed market growth from 3.9% to 5.1%. The varying rate of vaccine rollouts and the economic cost of the 2020 lockdowns will probably see emerging markets recover more slowly, and degrees of economic scarring will vary. That said, almost without exception, expectations of labour market recoveries lag, implying ongoing labour and wage slack.

- Expectations play a key role in price formation. Moderating expectations in the past 40 years have had a reinforcing influence on both wage-and price-setting behaviour. While markets have repriced inflation risk, expectations are not yet historically high, and certainly not what could be called ‘unanchored’. While these remain reasonable, price-setting behavior should too.

- Finally, and importantly, there isn't a strong ‘global inflation cycle’. In this note, we have discussed the broad drivers of inflation, and compared and contrasted these to the circumstances that prevailed after the GFC and may evolve as economies recover from the pandemic. But idiosyncratic factors are likely to remain critical drivers of short- to medium-term inflation. In some emerging markets (Turkey, Brazil, India), inflation is above target, and policy rates have already started to rise. That said, the repricing of US inflation risk in particular could have meaningful and material repercussions for the pricing of global assets.

IN CONCLUSION

The generalised nature of this note provides an outline of the broad contours of global inflation drivers. In the short term, base effects will dominate, and CPI is expected to accelerate into year-end. After that, the degree to which inflation persists or subsides will vary by country: where liquidity remains ample and the recovery robust, prices will reflect the difference between money growth and real GDP and are more likely to remain elevated. Supply disruptions could affect pricing more in smaller economies, and those with delayed vaccine strategies may see relative prices take longer to normalise, and economic slack persist – such as South Africa and parts of Europe. We expect developed market inflation to be higher in coming years than in the post-GFC period and asset prices to adjust, but we don’t think the building blocks for runaway inflation are yet in place.+

*Goodhart, Charles and Pradhan, Manoj. “The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival”. August 2020

** An estimate of the rent an owner would pay to rent their own property.

Disclaimer

Global (excl USA) - Institutional

Global (excl USA) - Institutional