THERE IS NO shortage of articles, policy papers and opinion pieces detailing how weak South Africa’s economic growth has become, why this has happened and what remedial action needs to be taken to improve the situation. Some offer very sensible advice. Some don’t. What is seldom articulated clearly is what the effects of this very weak growth are and what they mean for the country’s long-term ability to manage the structural challenges it faces.

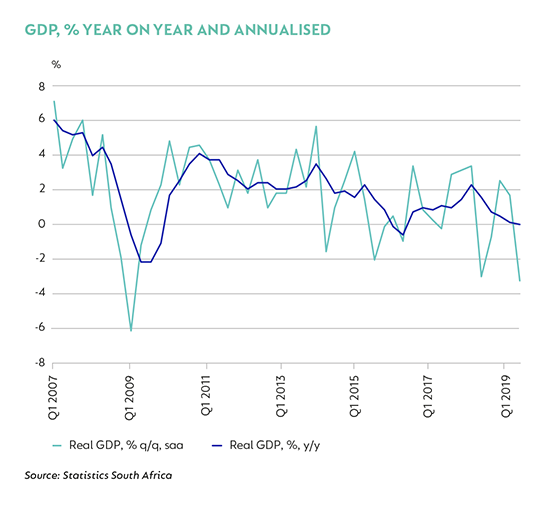

South Africa’s economy is unlikely to grow by more than 1% in real terms in 2019. This follows growth of just 0.7% in 2018. After two positive quarters of growth in the second half of 2018 (H2-18), GDP contracted by 3.2% quarter on quarter, seasonally adjusted and annualised (q/q, saa). This was the worst fall since the -6.1% q/q, saa contraction in the first quarter of 2009 (Q1-09) over a decade ago, at the height of the Global Financial Crisis when the economy lost almost a million jobs in one year! This recent weakness was exacerbated by electricity outages that intensified in March, but was ultimately broad based, with real output falling across the primary, secondary and tertiary sectors. When measured on an annual basis, real GDP was flat.

AS COMPARED TO LAST TIME …

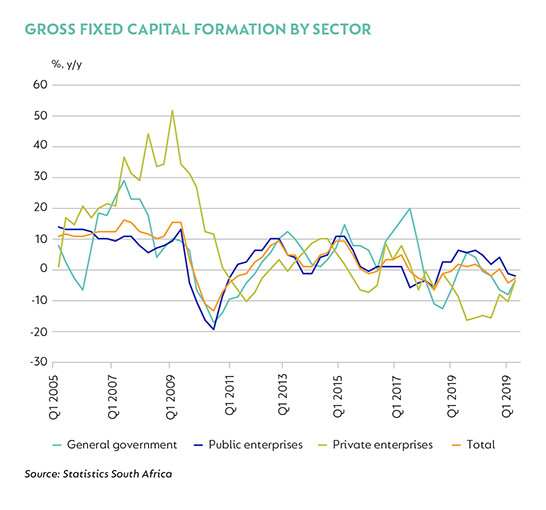

A closer look at expenditure-side data shows very worrying details: real household consumption, which accounts for 62% of GDP and is usually a solid anchor for growth, contracted by 0.8% q/q, following 3.2% q/q growth in Q4-18, shaving 50 basis points (bps) off GDP. The decline in spending reflects very weak real-wage and remuneration growth, weak employment, poor confidence and several years during which the fiscal burden on households has increased. Fixed investment, the critical driver of both future capacity and productivity, contracted by 4.5% q/q and has fallen for 10 of the last 13 quarters. Inventories also detracted, falling R11.6 billion in Q1-19. The final blow came from net exports, which fell by 7.5% q/q in Q1-19 as imports fell 4.8%, but exports collapsed by 26.4%.

Seen as a whole, the shape of South Africa’s growth in Q1-19 echoes challenges faced by many other economies at this juncture; economic growth is the fragile balance between the health and resilience of domestic demand and the impact of external factors – falling trade volumes and rising uncertainty, and the subsequent knock-on to confidence.

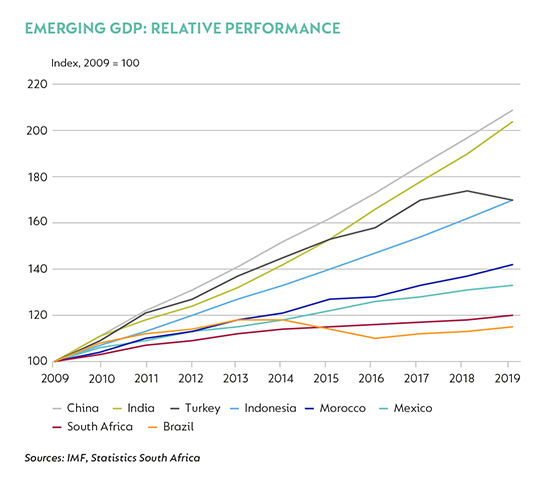

However, unlike most of the world’s advanced economies and a large proportion of emerging markets, domestic demand in South Africa has been alarmingly weak, dragging growth lower instead of providing a buffer. In fact, this is not new - South Africa has lagged global growth for more than a decade.

ONE THING LEADS TO ANOTHER

As we can now see very clearly, economic weakness isn’t just about the economy growing slowly; it’s also about weakness relative to other countries’ economic performance. By growing more slowly than its peers, South Africa continues to fall behind. Both outcomes deliver fewer resources – slower absolute growth shrinks the pie, while relatively slower growth attracts less capital. This means that there are fewer resources at the disposal of both the private sector and the State, not only to stimulate further growth but also with which to address market failures, structural shortcomings, inequality and poverty.

There are several very dangerous features of economies that suffer extended periods of weak growth. First, the slow process of a decline is often not felt initially in everyday life; the consequences are only felt after a delay. In the first years, the economy can live off its capital, household and corporate balance sheets are in good health, and institutions are reasonably resilient. However, over time, weak growth triggers microeconomic decisions, such as delaying consumption, which exacerbate the downward spiral. This then leads to the second danger – that periods of growth weakness become reinforcing – and then, thirdly, that it becomes extremely difficult not only to stop the relative underperformance, but also to turn it around.

Periods of weak growth can be materially exacerbated by an increase in ‘rent-seeking’ behaviour among economic actors. Imagine a hypothetical economy where households have to choose one of two ways to obtain income: to engage in activities that produce goods and services that can be sold on the market or working for a salary (rent creation); or to seek a redistributive income, that is, to earn an income paid by the State or private institutions, financed by the work of other economic actors, without generating additional growth (rent seeking).

Through time, the more people who shift from productive to redistributive activity, the lower an economy’s aggregate output becomes. For the unproductive, there is also increasing safety in this shift, because it becomes easier for them to hide. The economic cost of this shift from productive to extractive actors intensifies as the allocative distortions increase with the removal of resources from productive activities, and as innovation is lost. This becomes worse if rent seeking is institutionalised within the State. Rent-seeking societies prolong the weakness of growth and can lead to an insidious decline of an economy.

HOME TRUTHS

In South Africa’s case, we now know post-crisis economic weakness has been prolonged by a mal-allocation of resources that is first and foremost visible in both weak aggregate and weak relative growth. The protracted period of negative investment reflects the redistribution of resources away from productive activities and the loss of capacity in rent-creating entities. Pressure on households has increased and spending has suffered because of low income growth and rising unemployment, as well as the higher fiscal burden. Financially unviable and operationally dysfunctional state-owned enterprises (SOEs) are a further casualty of this process. The fiscal cost of this deterioration that has unfolded over the last decade is only now starting to be felt.

Looking ahead, our base-case expectation is for a modest, cyclical improvement in growth. We expect employment to stabilise, and for a combination of less negative compensation growth and a small, ongoing increase in credit utilisation to allow household spending to grow at 1.5% year on year (y/y) in real terms. At this stage, we do not expect fixed investment to grow, but we should see some moderation in the extreme contraction of the past three years and possibly some normalisation in inventory levels. We forecast GDP growth this year of 0.7%, and a still-weak 1.5% in 2020.

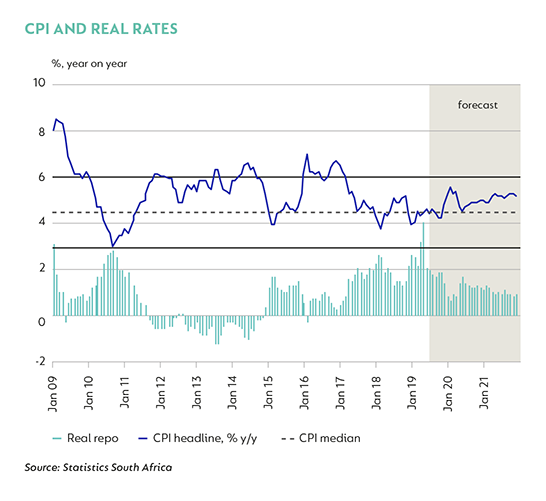

Inflation within this very weak context remains subdued, with average headline CPI forecast at 4.4% in 2019 and 5.0% in 2020. We expect the central bank to provide some monetary support for growth, and we anticipate 50bps in rate cuts this year, with the first 25bp reduction announced at the 18 July Monetary Policy Committee meeting.

On the downside, the economy remains hostage to what is now a long period of growth weakness and the negative consequences of the redirection of resource allocation over the last 10 years. This is most immediately visible in the need to provide financial support for SOEs, notably Eskom. Despite National Treasury allocating R23 billion per annum for the next 10 years in additional funding for Eskom in this year’s National Budget, it has become increasingly clear that more will be needed, and sooner. Details remain unclear, but ensuring financial stability for Eskom will invariably add debt to government’s already strained balance sheet, increasing the annual deficit and incurring additional financing costs.

We expect debt-to-GDP to exceed 60% in the current fiscal year and to escalate over the medium term. The pace of debt accumulation will depend heavily on the ability of the economy to move from low growth to a sustainable recovery. This, in turn, requires a dedicated enforcement of rent-creating policy implementation and practice to rehabilitate the long period of decline.

Disclaimer

Global (excl USA) - Institutional

Global (excl USA) - Institutional