Aggregate global growth is expected to be 3.7% in 2019, above potential for the second consecutive year. The strong growth performance has seen unemployment in most developed economies fall to multi-decade lows. Subsequently, tight labour markets have put pressure on wages and inflation has started to rise. An increasing number of countries have inflation running ahead of their central bank targets, prompting a general, if uneven, normalisation in global monetary accommodation in developed economies. However, the way in which this outcome unfolded was far from smooth, especially for financial markets, and the outlook remains highly uncertain.

In recent weeks there has been a significant shift in the way in which financial markets are pricing growth and policy settings, especially in the US. Following a year in which the US led the growth outperformance, the duration of the upswing as well as the combined weight of escalating trade tensions and weakness in other economies has seen weaker data emerge. Financial markets have slowed, and with a significant adjustment in US equity markets, no further US Federal Reserve (Fed) rate hikes for the coming year.

Because US policy rates influence global funding costs, the way in which financial markets respond to US rate expectations is important. For now, we think the recent adjustment is overdone. Market concerns about a US recession have been heightened by a flattening in the US yield curve, but additional signposts for a pending recession in the US are visibly absent. There are certain signs slowing, but abject weakness seems unlikely.

PAST RECESSION SIGNPOSTS

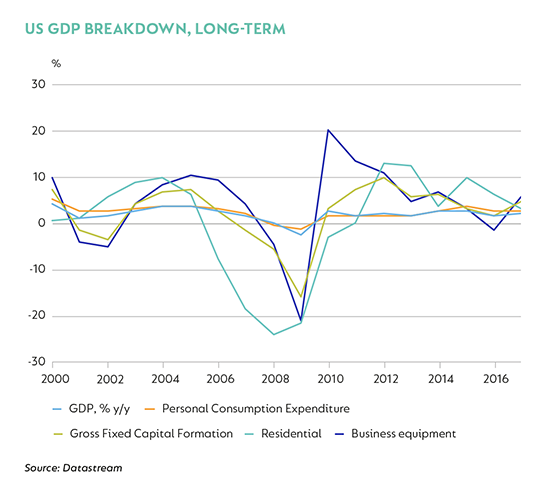

A closer look at past recessions offers some good guidance in assessing current risk. The first thing to note is that US recessions are always driven by domestic demand. External economic dynamics, including the global manufacturing cycle, have not, to date driven a growth contraction in the US. And typically, domestic demand in the US shows several consecutive quarters of sub-trend weakness before contracting. The graph below indicates that the main components of domestic demand are still growing strongly.

US recessions also broadly tend to follow a pattern: a sharp slowing in capital formation. This usually takes the form of a collapse in residential housing investment, followed by falling consumption expenditure and a collapse in business investment. This is not always the case, but when a collapse in business investment comes early, it is usually accompanied by weakness in household investment and outlay. To date we have not yet seen even one quarter of real weakness across any of these factors.

Another characteristic of past recessions has been the buildup of excesses; again, often in housing or business investment. Excessive housing inventory accumulation undoubtedly aggravated the recession in the US between 2008 and 2010. These inventories also delayed the recovery and contributed to the muted growth in housing activity through this expansion. That said, despite the softness in the housing market due to rising interest rates, there is more scope for it to become a point of resilience in the current environment (very low employment and excess demand) than a source of vulnerability.

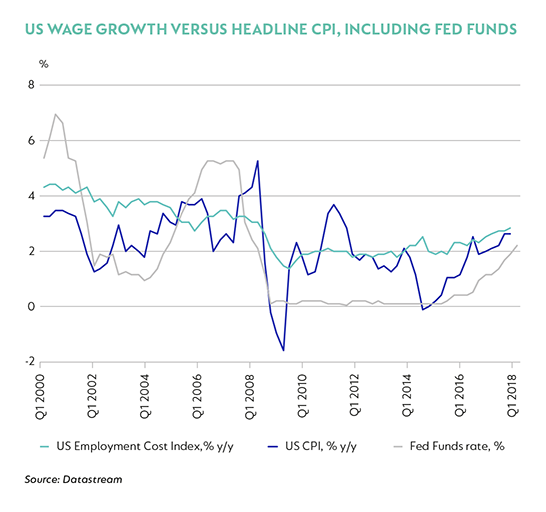

Household spending accounts for almost 70% of real GDP in the US. Unemployment is currently 3.7% and survey data suggest that it is becoming harder to fill vacancies. A tight labour market has seen an increase in wage inflation and a moderate rise in headline consumer prices. While inflation has also tended to accompany recessions in the past, with prices outpacing wage increases, choking disposable incomes and prompting ever-rising policy rates, this dynamic is also not yet visible in the current data. Wage growth has exceeded inflation, and with lower oil prices may continue to do so for some time. This could, in fact, improve in 2019 relative to 2018.

Lastly, the corporate sector is often a factor in the path to and severity of recessionary periods. Rising wage costs, rising debt costs and past-peak profitability is likely to put increasing pressure on margins. Certainly, both wage and interest expenses are likely to rise in coming quarters, but for now, corporate balance sheets remain in reasonably good health and are considerably less stressed than at the tipping point of previous recessions.

Considered together, we do not think that US growth is at risk of a sudden slowdown in 2019. What we do expect for now is that domestic demand will continue in line with the current trend, with some areas of softness, namely housing, being largely offset by stronger consumer spending. It also suggests that the Fed is more likely than not to continue hiking, as data stay consistent with an economy operating at or above potential, and almost certainly by more than current market pricing anticipates. In turn, this implies a relatively resilient US dollar, although we do not anticipate significant additional appreciation from current levels, given a somewhat overvalued starting position.

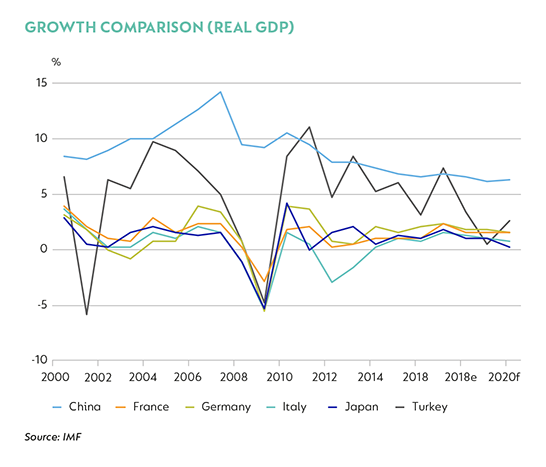

GLOBAL GROWTH OUTLOOK – DOWN, BUT NOT OUT

Under this US baseline, the outlook for other major markets is also reasonably benign. Europe, which was considerably weaker in 2018 than initial expectations, suffered a series of idiosyncratic hits to growth. While poor weather is a regular disruptor of first-quarter activity, a debilitating flu, strikes in France and changing automobile emissions regulations all affected growth in the two largest economies, with repercussions to the periphery. Italy’s political challenges and weak underlying fundamentals saw growth stagnate in in the third quarter. A full recovery of lost momentum is unlikely and there is still clear political risk across Italy, Germany and France. Tight labour markets, a recovery in investment and some fiscal support should offset most of the drag from weaker trade.

Similarly, growth in Japan was disrupted by weaker global trade, slowing growth in China, and a series of natural disasters. The latter interrupted supply chains and saw a meaningful slowdown in GDP growth during the second half of 2018. Some recovery and rebuilding activity should offset some of the headwinds created by the increase in VAT planned for October 2019, while more stable growth in China will likely provide support for net exports. Japan should also benefit from some ‘payback’ as disrupted export shipments normalise, even if the global environment is softer than in 2018.

Trade tensions and a long period of credit tightening has seen Chinese economic growth slow from 6.8% year on year (y/y) in the first quarter of 2018 to 6.5% y/y in the third quarter. The recent reprieve in the pace of escalation in tariff increases planned by the US after the G20 summit in December probably will not last, and we expect some increases in tariffs in early 2019. The implementation of policy support by the Chinese authorities has thus far been reasonably constrained and it remains to be seen if materially weaker growth triggers a more dramatic policy response. For now, it looks as though growth of about 6% is achievable under current policy settings. That said, a broader base and higher tariffs are the biggest threat to Chinese growth and would materially increase the risk of a more extreme policy response.

EMERGING MARKETS AT ROCK BOTTOM?

A number of emerging markets suffered market-related disruptions in mid-2018, which had material impacts on their real economies. Turkey saw its currency depreciate almost 40% between January and August as concerns over total foreign-denominated financing needs gave investors pause. The high oil price, excessive credit growth and a wide current account deficit, coupled with relatively high external corporate borrowing all contributed to the slide. Recent data suggest that the real economic fallout has been severe, with inflation surging to 24.7% y/y, interest rates at 24% and economic growth dwindling to 1.6% y/y.

Elsewhere, Argentina turned to the IMF, as liquidity dried up with the withdrawal of investment support. Inflation remains high and any economic adjustment is likely to be painful and slow. Nonetheless, both these economies are expected to stabilise, albeit at weak levels, in 2019. A modest recovery in South African GDP growth and a reasonably steady Russia should contribute to a resilient emerging complex.

NOT WITHOUT (CONSIDERABLE) RISK

There are always risks: probably the most obvious in this context is the heavy reliance on the US as the current driver of global growth. While we think that some stability in Europe, Japan and some emerging markets will buffer a slowing US through 2019, there is significant risk – either that the US slows faster than data currently suggest, or that the economy starts to overheat and the Fed hikes more aggressively into a restrictive policy stance. Longer term, the US faces fiscal challenges that could disrupt growth and confidence. An escalation in trade aggression would see China’s growth path under considerably more pressure, and the Brexit outcome is a clear unknown but looking increasingly chaotic. In Europe, peripheral economies still carry high government debt levels that could become strained should Italy’s fiscal position weaken.

Another challenge – especially in the case of a crisis – will be the much tenser and more polarised political positions of major economies. Brexit will isolate the UK from its European peers and affiliated policymakers, while the US is becoming increasingly insular. The consolidation of political power in Russia and China may also be increasingly disruptive and certainly, taken together, may make the coordination of a global policy response much less likely than that seen through the last financial crisis.

For now, we broadly expect a continuation of 2018 – relatively strong, if increasingly uneven and generally more moderate global growth – throughout 2019. In line, monetary policy should continue a slow path to normalisation in developed economies, while emerging market policy settings are likely to be more mixed. This is a reasonably supportive cyclical context for oversold asset classes, including emerging markets.

Global (excl USA) - Institutional

Global (excl USA) - Institutional