The Fund returned 16.6% in the second quarter of 2025 (Q2), 4.6% ahead of the return of the benchmark – the MSCI Emerging Markets Total (Net) Return Index, which returned 12.0%. This brings the total return for the year to date to 20.0%, 4.7% ahead of the benchmark. Besides good relative performance from the Fund, it is also encouraging that Emerging Markets (EM) as an asset class is now delivering strong absolute returns after not having done so for a number of years. In this regard, the Fund has produced a return of 18.0% over the past one-year period (outperforming the benchmark by 2.7%) and a return of 13.8% p.a. over three years (outperforming the benchmark by 4.1% p.a.). The five- and 10-year returns are clearly not yet where we want them to be, and we continue to work towards improving these outcomes. Since its inception 17 years ago in July 2008, the Fund has outperformed the market by 0.4% p.a.

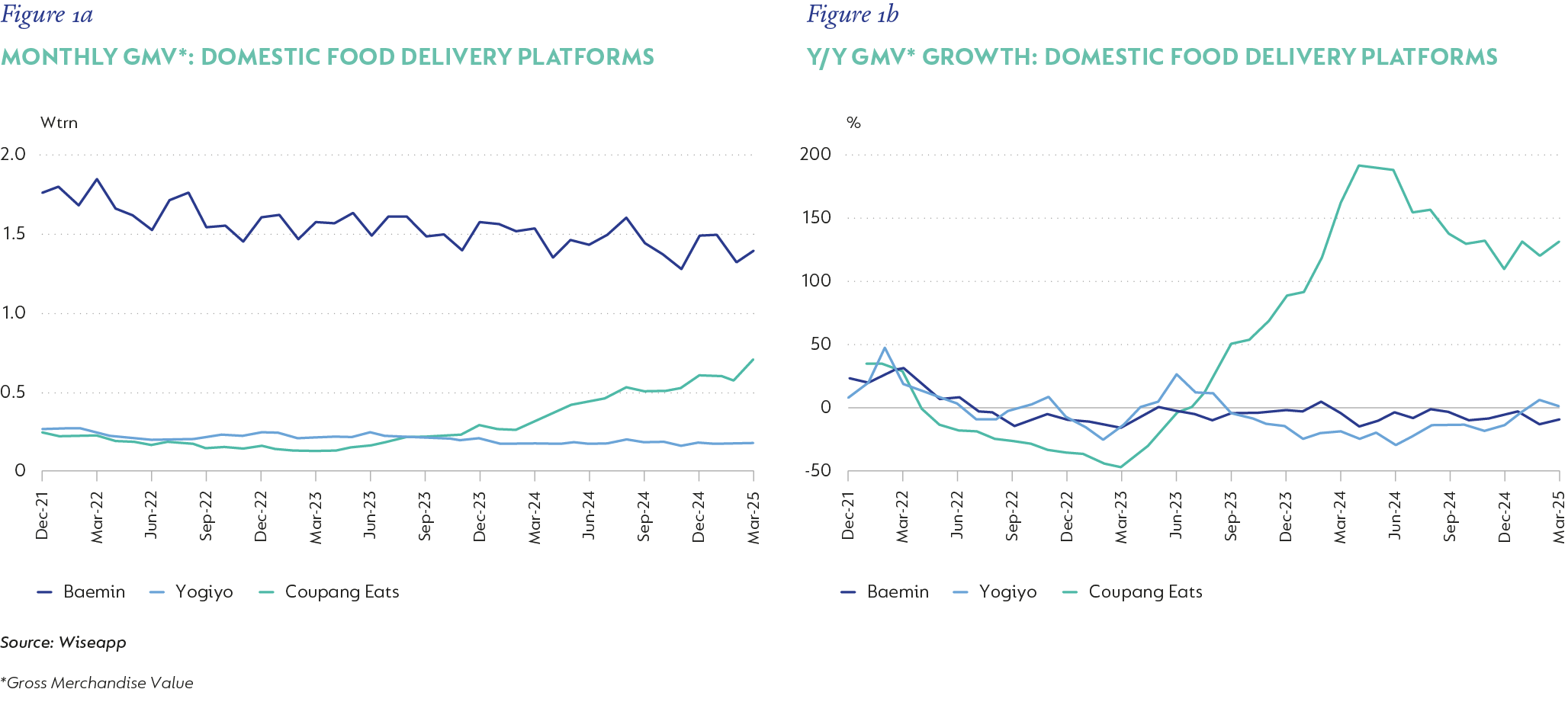

The biggest contributor to the Fund’s outperformance in the quarter was Coupang, a South Korean ecommerce retailer. Coupang returned 36% and contributed outperformance of 1.0%. The share price move was driven by the excellent results that it reported for the first quarter. Coupang’s core ecommerce offering in Korea, which makes up about 90% of total revenue, delivered revenue growth of 16% (in local currency) in the first quarter. With overall retail sales in Korea up by only a few percent, this was a stellar result and another indicator that Coupang continues to grow its market share, both within ecommerce and the retail sector as a whole. Coupang’s less mature offerings, such as food delivery in Korea and ecommerce in Taiwan, showed currency-neutral revenue growth of 78%, bringing overall revenue growth to 21% year on year (YoY). As these developing offerings ramp up, the losses they incur have narrowed (from -30% to -16% EBITDA margins YoY), and so the operating profit of the business at the group level (the core ecommerce business is very profitable) increased by 285%. Coupang Eats (its food delivery business) has grown monthly Gross Merchandise Value (GMV) to the detriment of the market leader Baemin (owned by Delivery Hero) and the number three player Yogiyo. This has largely been achieved by extending the benefits of Coupang’s ecommerce loyalty programme to food delivery, and, in our view, these strong market share gains are likely to continue.

Despite the strong share price performance, Coupang is still very attractively valued – its current operating margin is under 2% and we believe the business can ultimately be several percentage points higher. Together with double-digit revenue growth, this results in cumulative earnings growth in excess of 25% p.a. for several years ahead. Coupang is a 4.0% position in the Fund.

The second largest contributor to relative performance was NU Holdings (Nubank), the Latin American digital bank. Nubank returned 34% and also contributed 1.0% of outperformance. We have covered Nubank in detail in previous write-ups, but it is worth highlighting that the investment thesis continues to play out. In Brazil, Nubank already banks almost 60% of the adult population, and profitability continues to improve (the Return on Equity in Brazil is now 48%) as costs get diluted with scale. The Mexican and Colombian operations are growing steadily and are expected to make a material contribution in the years ahead. Nubank trades on 17x 2026 earnings and remains very attractive in our view.

After Nubank, the Fund’s zero weighting in Alibaba added 0.9% to outperformance as Alibaba is a 3% weight in the benchmark and returned -13%. This partially reversed the upward move of Alibaba in the first quarter, which had cost the Fund relative performance at the time.

The other noteworthy contributor was MercadoLibre (MELI, 3.5% of Fund at quarter end), the leading ecommerce and fintech platform in Latin America, with Brazil, Mexico, and Argentina accounting for around 95% of revenue and earnings. MELI returned 34% in the quarter and contributed 0.9% of outperformance. Like Coupang, this was driven by the most recent outstanding operating results: MELI’s GMV rose 17% YoY in its reporting currency (USD), but in constant currency terms, GMV was up 40%. Total revenue was up 37% YoY, with ecommerce revenue growing 32% YoY, and the fintech business growing revenue 43% YoY. Overall operating profits rose by 45% compared to last year’s first quarter. These exceptional results are due to historically heavy investment in the business ecosystem. MELI continues to offer a compelling proposition to customers, for example, by recently reducing the basket size threshold for free delivery in Brazil from R$79 to R$19 (roughly $14.50 to $3.50). Although this is likely to have a short-term impact on profitability, it will maintain their competitive positioning relative to other platforms like Shopee (owned by Sea Ltd – also a 3.7% Fund position that contributed positively in the quarter).

Naspers/Prosus returned 23% (0.7% outperformance) and, in a departure from the usual outcome, this was not offset at all by negative alpha from not owning Tencent (which is Naspers/Prosus’ main contributor to NAV). In fact, because Tencent was up only 1% in the quarter (vs the benchmark return of 12.0%, the zero weight in Tencent added 0.4% of outperformance.

The biggest detractor in the quarter was JD.com (JD), which declined 19% and cost 1.2% in relative performance. The core ecommerce business at JD is showing good signs of recovery after a tough couple of years post the Covid reopening in late 2022. The three main parts of ecommerce (electronics & appliances, general merchandise, and third-party marketplace & advertising) are all growing strongly (around 10%), and this led to operating profit in the retail business growing by 38% YoY. The main reason for the share price decline has been concerns about JD entering the food delivery business to compete with Meituan, which dominates the sector in China. For reasons similar to Coupang in Korea, JD believes that its investment in logistics and drivers gives it an opportunity to have a meaningful contribution from food delivery in the years ahead, but in the short term, it will require heavy investment to get customers and restaurants on board. The “new business” segment in which food delivery is measured saw operating losses of RMB1.3bn in the first quarter, and with food delivery having just launched in February, it is likely these losses will be larger in the quarters ahead as it ramps up. With markets being very short-term focused, this has weighed on the share price.

We believe that JD will be rational in its approach, and that these losses will moderate over time. They are also relatively small to the operating profit of RMB13bn that JD delivered in its retail operation. Very importantly, JD continues to prioritise capital allocation and, after having bought back $3.7bn in shares last year, they bought back another $1.5bn in the first quarter as well as paying a $1.5bn dividend in April. This combined shareholder return of $3bn so far this year is around 6% of the company’s market capitalisation. JD trades on just 7x 2026 earnings and we believe it is materially undervalued.

Only two other stocks detracted more than 0.5% each. Wizz Air (Wizz, 1.5% of Fund) returned -22% in the quarter and cost the Fund 0.8% of relative performance, while the underweight in TSMC, the largest stock in the index, and which returned 33% in the quarter, also cost 0.8%.

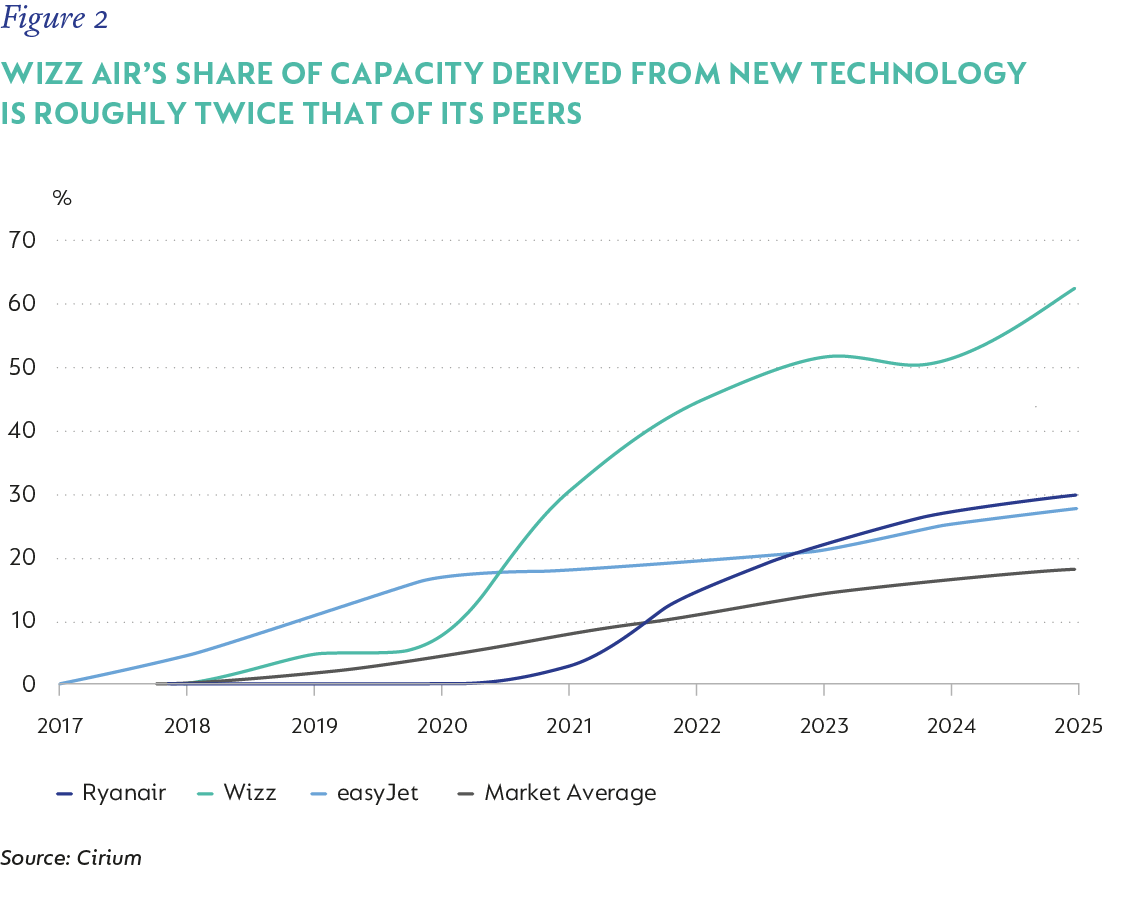

The move in Wizz was triggered by a full-year results’ expectations miss and exacerbated by an unexpectedly weak ex-fuel unitary cost outlook. Wizz is suffering from a disproportionate share of its fleet being grounded (one in five planes) due to Pratt & Whitney engine issues that need to be resolved by the engine manufacturer. These are affecting several cost lines and largely explain the weak cost performance.

The groundings will become less material over time as the fleet grows with unaffected new planes and as the grounded fleet is serviced and returns to operation. We believe that the fleet’s engine teething issues will eventually become an advantage due to superior fuel efficiency and capabilities offered by Wizz’s Airbus A321neo aircraft versus previous generation models as well as Boeing equivalents. Wizz is expected to operate one of the youngest and most efficient fleets of any major European airline over the next decade. Wizz now trades on less than 6x 2026 earnings.

The biggest news of the quarter was the announcement by the US of increased tariffs against pretty much every country in the world, with particularly heavy tariffs on countries with a trade surplus in goods with the US, and punitive tariffs on China in particular. This happened early in the quarter and was then rolled back as US equity markets declined, US government bond yields rose (making borrowing more expensive), and the US dollar weakened. The end result looks to be higher trading barriers for most countries with the US, but nowhere near the worst-case scenarios first announced, and the US stock market has returned close to its all-time highs.

The impact of this volatility was to create a few buying opportunities in high-conviction stocks held in the Fund. A good example was Sea Ltd (SEA), which we added to at lower levels. Although the share appreciated by 22% during the quarter, this masked some large intra-quarter moves. During the market sell-off initiated by the US tariff announcements, the share sold off heavily, falling from $135 (on the 2nd of April) to $106 (on the 8th of April). In our view, there was unlikely to be any material direct impact from US tariffs on Sea Ltd's business: structural growth (increasing ecommerce penetration in Southeast Asia) provides a buffer against any tariff-induced economic weakness in Southeast Asia, and the only US exposure is in their digital entertainment division (gaming) which was not subject to trade-related tariff risks.

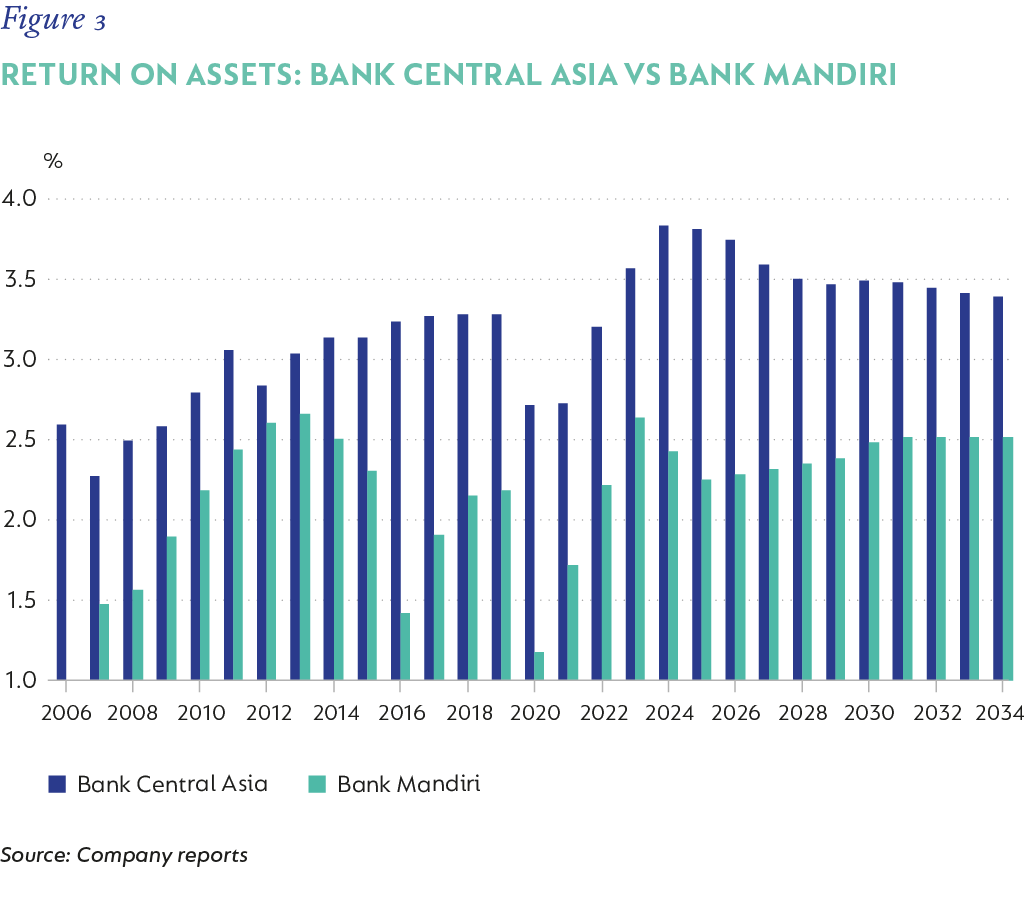

There were a few new buys in the quarter, the largest being Bank Central Asia (BCA) in Indonesia. This is a previous Fund holding, sold when it became too expensive, but having now de-rated along with much of the Indonesian market, it was bought back. As far as banking in EM goes, BCA is as close as one gets to the “gold standard” – excellent management and impeccable execution in a fast-growing market. This additional exposure to Indonesian banking (the Fund also owns Bank Mandiri) brings the combined total exposure to 3.5%. Although BCA trades at a premium to Mandiri, the absolute forward PE multiple of 16x is amongst the lowest it has been in the last decade, and the long-term outlook remains very attractive. BCA’s superior execution has seen it deliver Returns on Assets that are best in class.

The Fund also bought back into MakeMyTrip (0.8% position) and ICICI Bank (0.7%) in India. Other smaller new buys were luxury group Prada and Taiwanese technology firm Asia Vital Components (both being 0.7% positions). Asia Vital Components provides cooling systems for power-hungry data centres and is growing particularly strongly in liquid cooling technology, which is more effective for Artificial Intelligence data centres. This is a very high-return business (30%+ Return on Equity and 50%+ Return on Invested Capital) and on 16x 2026 earnings, in our view, the stock is not priced for our earnings per share forecasts of 25%+ growth p.a. for the next couple of years.

A few positions were sold to fund these new buys as well as some of the position size increases in existing stocks. The most material sales were AngloGold Ashanti and Pinduoduo Holdings (each a 1.7% position at the beginning of the quarter). In the case of AngloGold, the continued upward move in the share price provided insufficient upside (on any sort of normalised gold prices), particularly with the underlying gold price reaching all-time highs and being well above our assessment of normal. In the case of Pinduoduo, the sale was prompted by another re-evaluation of the investment case after yet more warning signs that culminated in very weak results in the first quarter. Although revenue was up 10% YoY, operating profit was down almost 40%. Disclosure of operating trends both domestically and in their international business (Temu) has been getting more opaque over time, and the refusal to countenance any form of capital return with their huge cash balance ($50bn net cash) has caused us to question the credibility of the management team.

We remain very excited about the prospects for the Fund and have been very actively travelling to meet current holdings and assess new prospects. During the quarter, our analysts were in India, China, Korea, and Taiwan, and we have a number of other trips planned for the remainder of the year.

Global (excl USA) - Institutional

Global (excl USA) - Institutional