PERFORMANCE AND FUND POSITIONING

The first quarter of 2025 (Q1) saw a reversal of recent trends: global equity markets declined 1%, and the US underperformed most other regions, with the S&P 500 declining 4%. In contrast, global bond markets posted solid gains, up 3%. Against the benchmark return of 0.3%, the Fund continued to perform well, gaining 2.6%. For the last 12 months, the Fund posted a 14.4% return compared to the benchmark return of 5.7%.

At quarter-end, the portfolio was positioned as follows:

- 64% effective equity

- 5% in real assets (listed infrastructure and property)

- 5% in high yield fixed income

- 6% in inflation-linked assets

- 16% in investment-grade fixed income instruments

- 4% in short-dated T-bills

Much has been written over the last two years about the narrowness of equity market returns. Returns in 2023 and 2024 were dominated by the US and, more specifically, by a narrow cohort of US-listed large capitalisation technology shares. Indeed, over 60% of US returns over these two years were generated by the Magnificent 7 group of companies consisting of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

While we owned and continue to own some of these names, the market’s seeming obsession with a small group of technology companies created significant opportunities for stock pickers in large parts of the market, both in the US and elsewhere, that were totally ignored by investors. As a result, our analysts uncovered many good ideas across geography and sector. These are high-quality companies with strong growth prospects trading on depressed valuation metrics.

Many of these names performed strongly for the Fund in the second half of 2024 and continued to do so in the first quarter of 2025. The first quarter of this year has also ushered in a very welcome and healthy broadening out of market returns. It is our strong belief, as long-term focused and patient stock pickers, that strong company fundamentals will be rewarded in time. It is thus pleasing to see the share prices of many of the abovementioned names responding strongly, with the gap between fundamentals and share price starting to close. This comes against the backdrop of weaker US equity market performance, with market participants beginning to cast their nets wider than a small group of large capitalisation US tech shares. We believe this remains a very attractive environment for bottom-up stock pickers willing to take the long view.

For the quarter, key contributors to relative returns included Auto1, Rolls-Royce, Just Eat Takeaway, Spotify, and not owing Nvidia. Flutter detracted. We discuss some of these below.

Auto1 is the largest fully digital used car platform in Europe. The company, under its localised ‘webuyyourcar’ brand, has grown to become the largest buyer of used vehicles directly from consumers across Europe, buying almost 700k vehicles in 2024. Auto1 has established a strong brand in each of its nine sourcing markets with over 500 drop-off locations. This unrivalled sourcing network is a powerful competitive advantage, providing a convenient network for consumers to have their vehicles inspected prior to purchase.

The Auto1 merchant platform is Auto1’s largest business, selling over 600k vehicles annually. Vehicles are auctioned to used car dealers via fully digital auctions, providing a convenient and seamless process for dealers to acquire the inventory their customers seek. Auto1 has the largest breadth and depth of inventory of any auction platform in Europe and has established itself as a key sourcing channel for over 40k dealers. This business is profitable and earning healthy margins with further room for upside as it continues to grow and leverage its fixed costs. The recently established and rapidly growing merchant financing solution has allowed Auto1 to accelerate the growth rate of this business. By providing hassle-free financing for dealers built into the checkout flow, Auto1 has made it easier than ever for dealers to buy vehicles on the Auto1 platform. This short-term lending product is driving increased demand across the platform and has significant room for further penetration gains.

Autohero is Auto1’s retail consumer brand, providing consumers with a convenient way to buy a car fully online. This business is Auto1’s newest venture and its most operationally intensive and fixed-cost heavy business. Autohero requires significant investment in operational capabilities, including building out a pan-European refurbishment network and significant logistics capabilities. Having spent 2023 and 2024 working to improve the unit economics of this business, it is now in a position where breakeven is imminent, and management has signalled their intention to accelerate the growth rate significantly. Whilst currently the much smaller of Auto1’s two businesses, we believe that Autohero can scale to multiples of its current size at attractive unit economics in the years ahead. As this business continues to scale, the company will leverage the significant fixed cost investments it has made to date. Autohero will also continue to expand and grow its consumer financing product to more markets and improve the penetration rate in existing markets, making an attractive contribution to gross margins.

With expanding margins in the already profitable merchant business and the curtailment of heavy losses in the retail business, group-level profitability has improved materially over the last 12 months, and the group is now profitable at the net income level and is free cash flow positive. The group’s balance sheet has EUR600m of cash and no debt with recourse to the parent.

The business, as it stands today, is increasingly hard to replicate, and as it continues to grow, Auto1’s competitive advantages will continue to compound. Auto1 has a 2.5% share of the European used car market today, and we believe this can more than double in the years ahead.

Shares of Rolls-Royce, the British aerospace and defence company, performed strongly in the quarter. Rolls-Royce is a high-quality company with its key product - aircraft engines for longer haul widebody planes - holding a 55% market share and operating in a stable duopoly with GE Aerospace. The company has significant pricing power, generates the majority of revenue in its key civil aerospace division from long-term services contracts, which ensures excellent earnings visibility, and has a strong multi-year growth runway underpinned by growth in global air travel.

But the business has also been historically under-managed, generating operating margins well below peers such as Safran and GE Aerospace. This changed in early 2023 with the appointment of Tufan Erginbilgic as CEO. He has wasted no time since joining, implementing a headcount reduction, renegotiating onerous contracts with airlines, refining servicing contracts and, most importantly, making significant improvements to engine efficiency. His appointment has been nothing short of revolutionary, improving customer satisfaction whilst also growing earnings strongly. Operating margins in the civil aerospace segment have increased from breakeven levels in 2021 to 17% today, but there is still scope to increase this further, with peers earning margins in the mid-20s range. After its strong run, Rolls-Royce trades on 23x forward earnings, a level we continue to find attractive considering its strong growth outlook and potential for further margin gains, driving robust earnings growth for many years to come.

Flutter detracted from returns in the quarter. Flutter is the leading online gambling and sports betting operator in the world, including the leading position in the large and fast-growing US market. Gambling stocks underperformed in the quarter after customer-friendly sports results, concerns of potential competition from prediction markets, and rising fears of a US recession. We believe these concerns to be temporary. In our view, Flutter’s scale and superior product offering is a formidable moat, and ongoing efforts to legalise online betting in multiple markets will provide a structural tailwind for the entire industry for years to come. The US is now Flutter’s largest market – here margins are still well below normal, and growth is likely to be supported by additional states legalising online betting, underpinning our expectation of more than 20% annual earnings growth for Flutter over the next few years. The stock trades on 26x forward P/E, which we consider attractive given the growth outlook.

In terms of fixed income, we continue to maintain our conservative positioning. The Fund’s duration of 3.4 years is three years shorter than the index, with a yield to maturity (YTM) of 4.9%, which compares to the YTM on the Global Aggregate Bond Index of 3.6%. With credit spreads in both the investment grade and high yield markets at very low levels, we believe now is not the time to be reaching for yield. Notably, this conservative positioning has not come at the expense of returns, with the fixed income portion of the Fund returning over 6% for the last year. This is well ahead of inflation and the global fixed income index, which returned 3%. Furthermore, it leaves the portfolio well positioned, with plenty of liquidity to take advantage of stresses in both equity and credit markets that have started to emerge in April.

DEVELOPMENTS POST QUARTER END

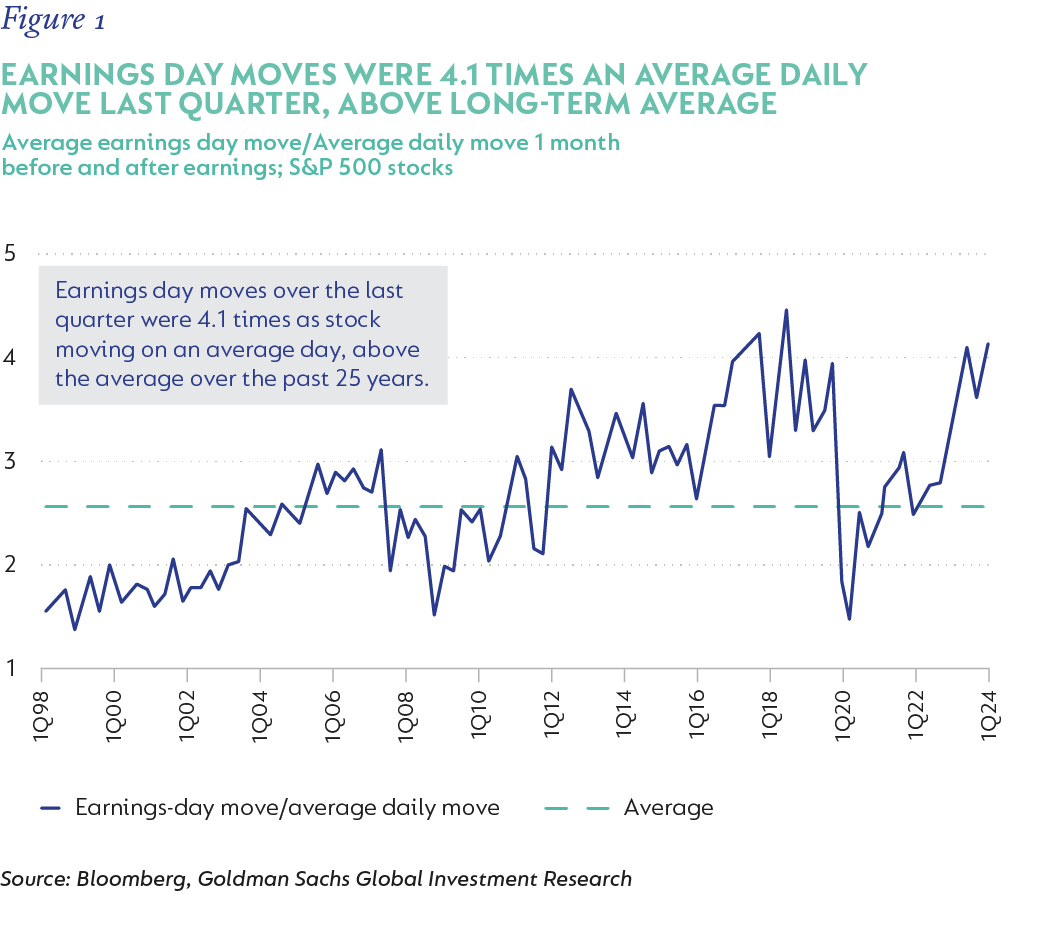

In early April, markets sold off heavily following the announcement of the Trump administration’s tariff plan. A negative reaction is understandable, considering the opening gambit is far worse than initial expectations. The sell-off has, in our view, been indiscriminate, reflecting widespread fear and de-risking, as opposed to a rational reassessment of specific company fundamentals. We have spoken before about increasing volatility in markets – the chart below illustrates this neatly.

For investors who allocate capital with a long-term horizon and who have a robust assessment of what a stock is worth, this volatility is an opportunity to be exploited. The volatility in recent days has been even more extreme, with the intraday range on a single day (9 April) matching that of entire years.

When re-examining the investment cases for every company we cover, our team has found that the earnings power of certain businesses is unscathed, others are likely to suffer only a temporary hit, for some, it is too hard to figure out, and, finally, there are those businesses with a high probability of impairment. We have followed our valuation discipline and responded to the changed opportunity set. This has caused portfolio turnover to be higher than usual, but the end result is a portfolio with a higher concentration of what we consider to be long-term winners at more attractive valuations (and, therefore, higher expected future returns). We have also sold some short-dated US T-bills to fund a higher allocation to equities. We would not be surprised to see continued market volatility and are prepared to take advantage of additional opportunities as they arise.

Global (excl USA) - Institutional

Global (excl USA) - Institutional