2022 was a relentless year. Global markets had to navigate a land war, an inflation shock, unexpectedly steep monetary tightening, and heightened geopolitical tensions all while economies were still emerging from or dealing with the Covid crisis. These events resulted in poor US dollar returns from most asset classes, with many struggling to beat inflation or to deliver a positive performance. In US$ terms, the MSCI All Country World Index came in with a negative 18.4% return for the year, the MSCI Emerging Markets Index was down 20.1% and the World Government Bond Index was down 18.3%.

In South Africa (SA), investors fared slightly better, assisted by a 6.4% weakening of the rand against the US dollar. In rand terms, the domestic FTSE/JSE Capped Shareholder Weighted Index was up 4.4% for the year, followed closely by the FTSE/JSE All Bond Index (ALBI), up 4.3%. Listed property came in with marginally positive returns. Overall, no asset class delivered returns in excess of SA inflation, which is itself elevated at 7.1%, but below levels currently experienced in most developed markets. Against this backdrop, the Strategy delivered a marginally positive return for the year aided by a very strong 4th quarter.

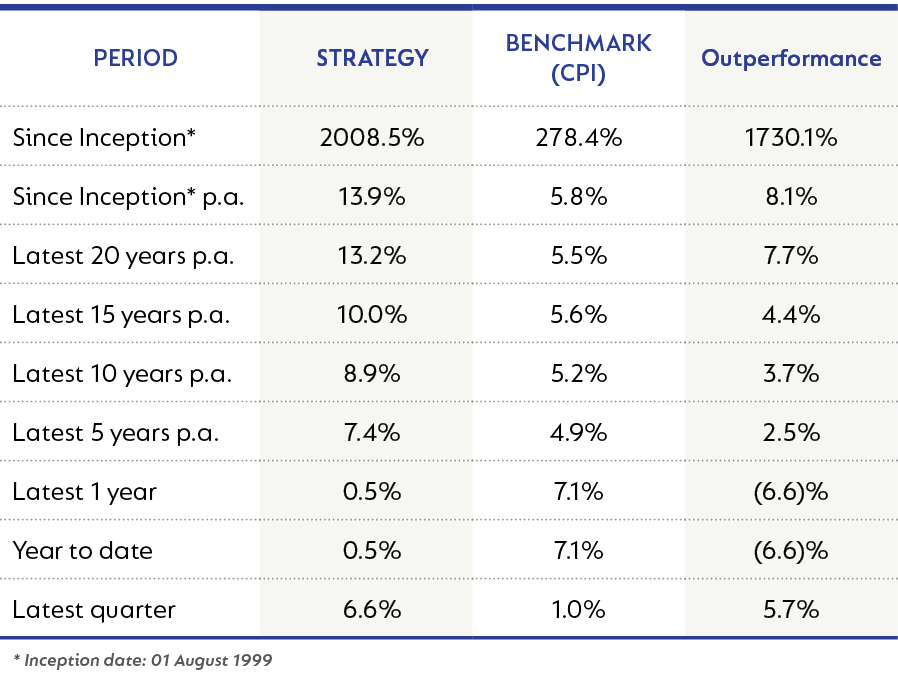

The Strategy’s performance as at 31 December 2022 is shown below:

The Strategy’s allocation to global assets was the largest detractor from performance over the past year. Given expensive starting valuations for global equities and bonds, the Strategy entered the year with offshore exposure deliberately limited to 25%. The Strategy also held put protection over a portion of its global equity allocation as a further risk mitigation tool. These actions could, however, only partly offset the negative performance of the Strategy’s developed and emerging market equity selection.

Domestic assets have contributed positively to Strategy performance over the past 12 months, with the exposure taken primarily through equities and bonds. Good equity and bond selection delivered returns ahead of their respective indices. Within domestic equities, defensive holdings in British American Tobacco; commodity holdings in Glencore, Exxaro and Anglo American; and domestic bank holdings (Nedbank, Standard Bank, FirstRand) were the largest contributors to returns, while holdings in Quilter, Anglo Gold, MTN and Spar detracted.

Naspers/Prosus bounced very nicely in Q4-22. While Prosus was “only” up 24% for the quarter, it is up 83% from its low in October to the time of writing. Extremely weak sentiment has been improving as Chinese President Xi Jinping spoke about the importance of a healthy Chinese tech sector. The Chinese government announcing the softening of their zero-Covid stance is also expected to buoy consumer demand and Chinese economic activity in general. Finally, Prosus/Naspers’s aggressive share buyback campaign is starting to benefit intrinsic value per share, as they buy back their shares at a discount to its underlying value.

Within domestic fixed income, the biggest contribution came from holdings in inflation-linked bonds. We continue to see real yields on offer from SA government bonds as attractive, notwithstanding the structural challenges faced by the domestic economy. Risk is managed by keeping the duration of the Strategy’s bond carve-out lower than that of the ALBI but at a real yield that remains compelling.

We responded to the volatility we saw last year with the following key portfolio actions:

1) We increased our exposure to global equities where we saw more reasonable valuations. The more generous Regulation 28 offshore allowance also allowed us to broaden our selection away from SA-listed global businesses into offshore-listed direct global peers. To this end, the Strategy initiated the buying of Heineken, St James Place and a basket of US oil and gas counters as alternatives to (and at times in addition to) ABI, Quilter, and Sasol.

Heineken entered the Strategy in the last quarter of the year as it had underperformed ABI. Like ABI, Heineken is a defensive beer company, but it has a more premium product mix and less exposure to the US market. We think the business will continue with its track record of respectable revenue growth, which together with an increased focus on cost control and productivity measures will deliver decent organic profit growth. Earnings are expected to compound strongly over the next five years as the business benefits from the aforementioned organic growth and synergies from its acquisition of Distell.

2) The Strategy also bought select global corporate bonds where spreads expanded to very attractive levels. These exposures were mainly taken in corporates we know well and where we felt the balance sheet risk was very manageable. The combination of de-rating global bond markets and widening spreads allowed us to take advantage of a good yielding investment opportunity in this space.

The above actions have meant that our offshore allocation has increased to approximately 33% by the end of the year.

Domestic stocks continue to offer attractive stock picking opportunities, with their low starting expectations and undemanding valuations. Many trade on high dividend yields too. Our emphasis within the portfolio has been on finding businesses that can prosper even in a low-growth economy. The banks feature here as their earnings have benefited from interest rate hikes, with higher interest earned on capital and lazy deposits. Strong capital positions leave them well placed to release provisions when the credit cycle turns. We increased the Absa exposure in the Strategy during the quarter. Absa has shown strong growth off its pre-Covid earnings base, driven by market share gains and good operating leverage. While the share price has risen, multiples remain low in absolute terms and versus the other banks. With board and management succession issues resolved, and the Barclays separation complete, we expect Absa to continue delivering against its long-term targets.

Looking forward, we expect the influence of some of the key drivers of markets in 2022 to continue into 2023:

- Although inflation remains elevated, a combination of loosening supply chains, lower energy prices and moderating household rents means that it is likely that inflation has peaked and will start rolling over. This implies that the interest rate response from central banks is nearing completion, although the timing of a potential “pause” and “pivot” remains uncertain.

- The key concern for the year ahead remains the growth outlook of key economies. Europe and the US will face a recession because of the adoption of more restrictive monetary policies. Emerging markets, however, are well placed to show relatively faster growth as they start to come out from a rate hiking cycle sooner than developed markets. China’s surprise emergence from stringent Covid lockdowns towards the end of the year means that their growth prospects have also brightened.

- Geopolitical risks will remain elevated as the war in Ukraine continues. This will impact investor positioning and sentiment, but the de-rating in global asset prices seen last year has resulted in more palatable starting valuations.

- An immediate impact of the war was felt last year through a spike in energy prices. Towards the end of the year, we saw these prices moderate due to warmer weather and the impact of demand destruction. We expect medium-term energy prices to be supported at relatively elevated levels as years of under-investment in oil and coal constrain growth in supply.

- Domestically, we continue to see muted economic growth as rapid deterioration in rail and power infrastructure presents real headwinds to our industrial, retail and export businesses. Lack of adequate fixed investment spend, and proper policy reform means that these problems will be difficult to address quickly. Low economic growth will impact the earnings power of domestic-facing businesses but also has implications for the government’s ability to manage its debt burden.

The above list is not comprehensive and shows that many of the issues faced last year remain unresolved as we enter the new year. The Strategy will continue to stick to its process of making asset allocation and instrument selection decisions based on valuations while being mindful of managing downside risks through diversification and purchasing protection. We continue to think a full equity allocation is appropriate, as we see significant value in our selection. A portion of our global and local equity remains under put protection. We have also balanced the risk asset exposure with a healthy fixed income allocation where we can still achieve attractive real yields.

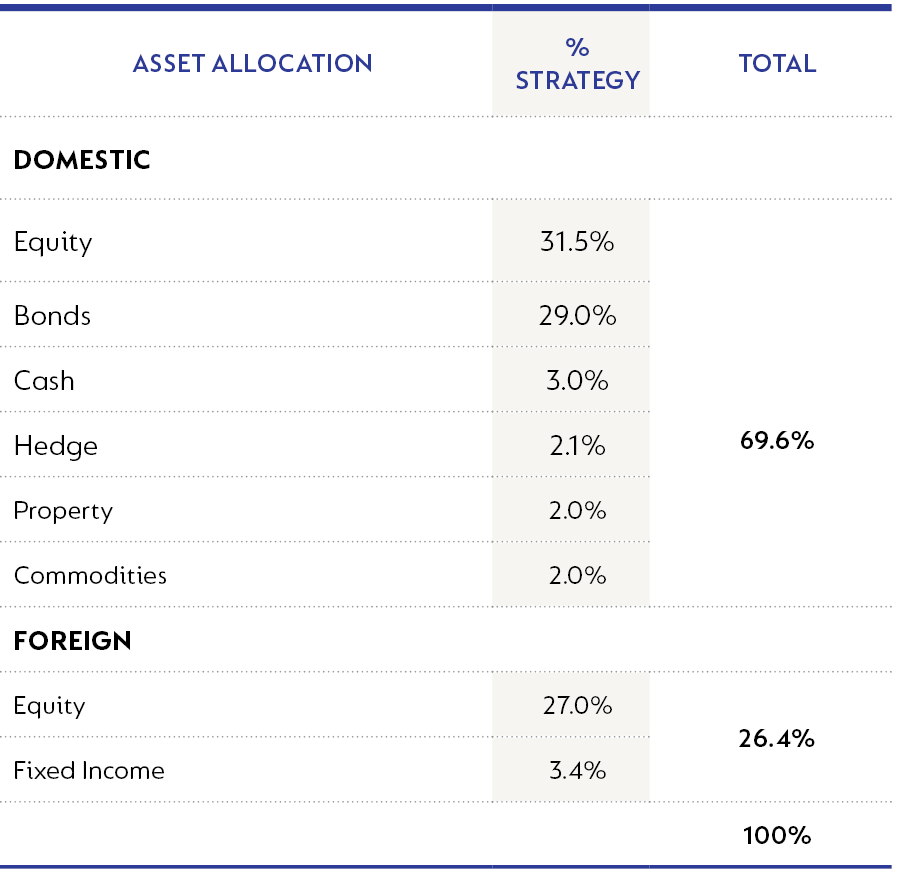

Our asset allocation and top 10 holdings as at 31 December 2022 are shown below:

While the past year was challenging to navigate, we have seen before that crisis periods throw out compelling investment opportunities. We have a proven investment philosophy and process that allows us to take advantage of these opportunities to generate long-term wealth for clients. We think the portfolio remains resilient despite a highly uncertain outlook and that the Strategy is also well set up to deliver on its targeted returns for clients.

Global (excl USA) - Institutional

Global (excl USA) - Institutional